Tony Anderson/DigitalVision via Getty Images

Over the past several decades, the average home has only gotten larger in size. That increase in size has actually been one of the primary drivers behind home affordability issues in this country. As an example, the median square footage of a single-family home that was built sometime in the 1960s would be around 1,500 square feet today. This is significantly greater than the 750 square feet that the original Levittown home was. By 2009, the average single-family home had swelled to around 2,200 square feet. And by 2015, the average home had increased even further to 2,467 square feet. Due to home affordability issues, that picture is changing and homes are finally starting to shrink. But for some buyers, this won’t do the trick.

Whether due to affordability issues, or just a desire to live a more minimalist lifestyle, many home buyers in recent years have focused on manufactured homes and ‘tiny houses.’ These are homes that can be as small as a few hundred square feet. Because of this, they tend to be significantly cheaper. And for the companies that produce some, they can be quite profitable. One example of a firm in this market that is doing quite well for itself is Legacy Housing Corporation (NASDAQ:LEGH). Recently, financial performance achieved by the business has been under pressure because of a drop in demand for these houses. And I wouldn’t exactly call shares cheap on an absolute basis. But relative to similar companies, the stock looks decently priced, at least enough to warrant a soft ‘buy’ rating from yours truly.

Making big by getting small

According to the management team at Legacy Housing Corporation, the company operates as the 6th largest producer of manufactured homes in the US. Founded back in 2005, the company is a fairly young firm. But despite its age, it has been successful in establishing itself as a specialist in manufactured and ‘tiny’ homes. For context, management does build homes for customers that are up to 2,667 square feet in size and that are up to five bedrooms with as many as three-and-a-half baths. But many of its homes are on the smaller side, with some as little as 395 square feet and consisting of only one bedroom and one bathroom. Given this wide range that we have to work with, some of the company’s homes can be as pricey as $180,000. Some of them though can be as cheap as $33,000.

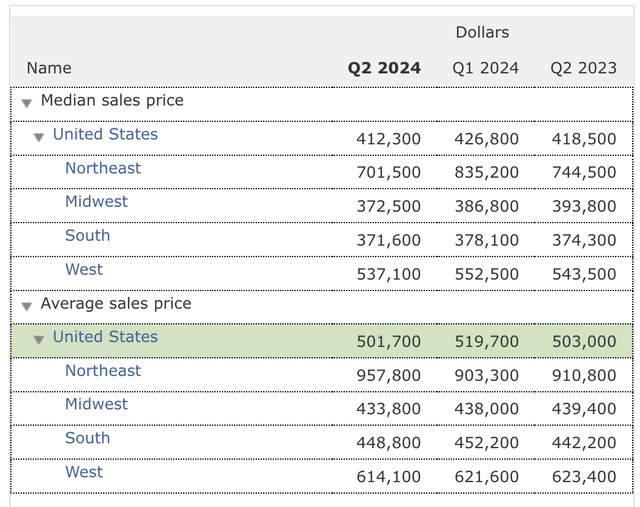

Even at the high end of the scale, these homes are significantly cheaper than most of what else is out there. I am blessed in the sense that, in my own home state of Ohio, you can buy a perfectly nice home in a perfectly decent neighborhood for $200,000 or less. But this is not the case nationwide. The average home price as of the second quarter of this year was $501,700. And in the northeastern portion of the country, where homes are most expensive, the average price is a whopping $957,800.

Naturally, this price disparity makes the homes that Legacy Housing Corporation sells attractive to a particular type of client. Its customers usually have annual household incomes of less than $75,000. Management describes most of them as younger and working-class families. However, they did say that some older individuals also purchase their homes. Considering that there are nearly 66 million households in the country with annual household incomes of less than $75,000, this creates a pretty big market opportunity for a company like this.

To sell its homes, the business uses 13 company-owned retail locations. But it also has a network of over 150 independent retail locations spread across 15 states that it sells its properties to. Even though the company is geographically diverse, most of its revenue, 53% in all, comes from Texas. The only other state that accounts for more than 10% of sales is Georgia at 12%. To generate additional income, the enterprise also offers up different types of financing solutions for customers. This includes solutions to end users, as well as other parties in its supply chain.

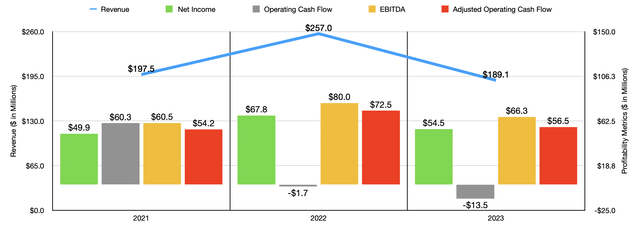

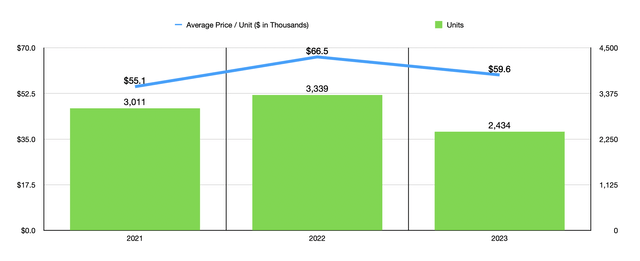

Over the past few years, financial performance achieved by the business has been a bit mixed. After seeing revenue jump from $197.5 million in 2021 to $257 million in 2022, sales pulled back to $189.1 million last year. Most of this has been driven by changes in the number of units sold. The company went from selling 3,011 homes back in 2021 to selling 3,339 one year later. But then, in 2023, the business sold only 2,434 homes. Inflationary pressures and high ownership costs, in part driven by high interest rates, were responsible for this weakness, according to management. The company even accepted lower prices of its homes, dropping the price from $66,500 on average in 2022 to $59,600 on average last year.

With revenue fluctuating, profits and cash flows have also jumped around. The company went from $49.9 million in net income in 2021 to $67.8 million in 2022. Then, in 2023, net profits declined to $54.5 million. Operating cash flow has been on a consistent decline, dropping from $60.3 million in 2021 to negative $13.5 million last year. But if we adjust for changes in working capital, the trend looks very similar to net income. The same thing holds true of EBITDA.

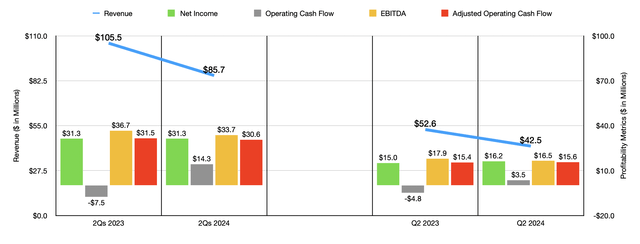

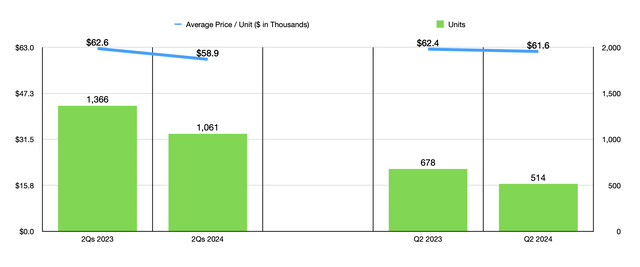

For the 2024 fiscal year, we have seen continued weakness. In the chart above, you can see what I mean. That chart covers the second quarter of 2024 compared to the same time last year. It also looks at the first half of 2024 in its entirety compared to the first half of 2023. As the chart below illustrates, the number of units sold by the company has dropped rather materially. However, pricing has been a bit more resilient. This was especially true in the second quarter of 2024, with an average price per home sold of $61,600 compared to the $62,400 reported one year ago.

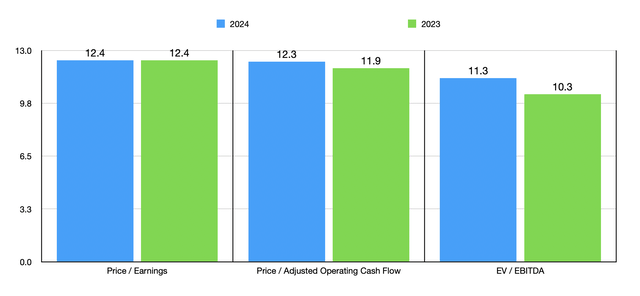

Unfortunately, we don’t really know what to expect when it comes to the rest of this year. If we simply annualize the results generated for the first half of this year, we would expect net profits for 2024 of $54.5 million. Following the same approach for the other profitability metrics would imply adjusted operating cash flow of $54.9 million and EBITDA of $60.9 million. In the chart below, you can see what this means for the valuation of the business. With trading multiples in the low double-digit range, the company falls a bit outside of the undervalued category for me. However, the firm does earn bonus points from hefty profit margins. Even with results depressed for 2023, the firm achieved a net profit margin of 28.8%. Its adjusted operating cash flow margin was 29.9%, while its EBITDA margin was 35.1%. Another great thing going for it is that the company has only $11.8 million in net debt on its books. Considering the firm’s size and cash flows, this is nearly debt-free.

When compared to other housing-oriented businesses, shares are also a bit toward the cheap end of the spectrum. In the table below, you can see what I mean. On a price to earnings basis, two of the five companies I compared Legacy Housing Corporation to are cheaper than it is. This number drops to one of the five when using both the price to operating cash flow approach and the EV to EBITDA approach.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Legacy Housing Corporation | 12.4 | 12.3 | 11.3 |

| Landsea Homes Corporation (LSEA) | 19.4 | 11.8 | 26.1 |

| Beazer Homes USA (BZH) | 7.0 | 25.8 | 12.5 |

| LGI Homes (LGIH) | 13.7 | 117.6 | 17.3 |

| Dream Finders Homes (DFH) | 11.0 | 16.5 | 9.7 |

| Cavco Industries (CVCO) | 23.8 | 18.3 | 14.8 |

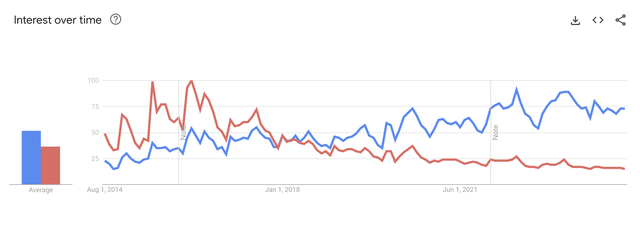

The level of interest in these types of properties is also quite elevated at this point in time, which suggests to me that sales very well could increase once interest rates start to fall. In the chart below, you can see the past 10 years of Internet interest according to Google Trends. While ‘tiny houses’ have been trending down rather significantly over the past several years, the general trend for ‘tiny homes’ has been rising. Admittedly, we aren’t at the level that we were at during peak interest in July of 2022. But we are still well above pre-pandemic levels.

Key risks

As with almost any company, there are certain risks that investors should be paying attention to. As the data shows, unit sales have been down. Even though these homes are more affordable than traditional homes, the buyers of them tend to be financially less stable and less capable of buying a home than traditional home buyers would be. Because of this, a steep decline in the economy could put pressure on potential buyers. The Federal Reserve is doing its best to manage matters, but its track record is far from perfect. We are likely to see our first interest rate cut this month. That will likely be one of many. And if that does go well, and it starts a trend of additional cuts, the end result could be bullish for investors. By considering that jobs data was recently revised substantially lower, with 818,000 fewer jobs created in the 12 months ending in March of this year than what was previously estimated, it is possible that we could be in for a hard landing.

There could also be some political risk here. If Kamala Harris wins the election, one of her plans is to provide $25,000 worth of support for first time homebuyers. Should this come to pass, it could prove to be either really positive or really negative for a company like this. I say that because there is uncertainty over whether or not this support would apply to any home. If it does, I would expect a surge in demand for tiny homes and manufactured houses. But if these happen to be excluded from the mix, either because of their price points or some other reason, it could make more traditional homes more affordable to home buyers relative to what these homes are priced at. Until more details come out, that does create some uncertainty.

Another risk involves a potential change in consumer behavior. The fact of the matter is that a home should be viewed as an asset that should appreciate over time. However, the data on tiny homes and manufactured homes is clear. Those that are set up on wheels to be transported almost always depreciate over time. Those on foundations usually appreciate. But because of how they are constructed and the smaller market that exists for them, this appreciation rate tends to lag the appreciation rate of more traditional homes. Should this realization become a major sticking point for buyers, that would bode poorly for a company like Legacy Housing Corporation.

Takeaway

Fundamentally speaking, I understand that things have been a bit rough for Legacy Housing Corporation as of late. Having said that, the company is a solid operator with strong margins. The stock is not exactly cheap on an absolute basis, but it is attractively priced compared to similar businesses. Net debt is also very low. Considering home affordability issues and interest in tiny homes, not to mention the benefit the company should receive when its interest rates start to decline, I do think that rating the company a soft ‘buy’ is logical right now.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.