Ton Photograph

Dividend compounding strategy is widely used among investors, who favor current income streams and value the optionality of deciding where to allocate the periodic proceeds stemming from the yield-bearing assets.

Usually, the focus on dividend compounders comes with financial characteristics that are necessary for enjoying de-risked income streams as in order to compound over the long-run (and this is where really the beauty of this strategy lies) the assets or companies have to be durable an supported by robust underlying cash generation. In other words, what we want to avoid is experiencing dividend cuts or notable equity dilution events that structurally impair the dividend prospects. Instead, the overall objective boils down to capturing as high dividend as possible without assuming speculative financial risk and / or completely sacrificing the dividend growth potential.

Apart from the pure financials, making reinvestments in a systematic fashion without having to pay taxes for each dividend received (but rather back-end loading the payment) are also critical constituencies of this particular strategy.

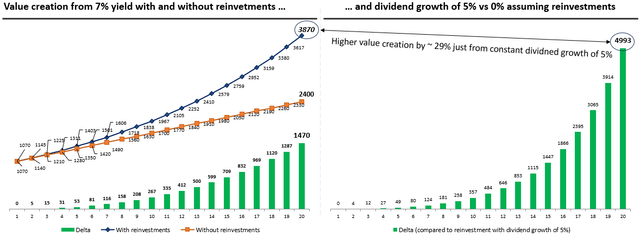

In the chart below, I have tried to depict the attractiveness that is associated with following the aforementioned criteria – i.e., sticking to businesses that provide enticing yields from the start in combination with tangible dividend growth potential (at low financial risk).

On the left hand side we can see the difference that dividend reinvestment process makes, where in one case the assumption is that 7% yield is extracted out from the portfolio, while in the other case the assumption is that the captured dividends are reinvested back in the position. Based on a starting principal of $1,000, dividend yield of 7% and no dividend growth or share price fluctuations, the difference lands at stunning $1,470 in year 20 (i.e., above the initial principal value).

On the right hand side we can observe the level of difference between a scenario in which 7% dividends are reinvested back in the position and a scenario in which the same process takes place with an additional nuance of enjoying 5% annual dividend growth each year. This nuance leads to a result in which the total (cumulative) that would be achieved by reinvesting the 7% dividend at 5% growth is higher by ~$5,000, where this delta or difference alone exceeds by ~ 30% the total wealth generated without capturing dividend growth component.

To put it simply, the compounding process is great and is made even more attractive if there is a presence of consistent dividend growth factor.

Let me now elaborate on two picks that, in my opinion, tick all of the checkboxes for being deemed as truly sustainable dividend compounders.

Pick #1 – Enterprise Products Partners (NYSE:EPD)

EPD is one of the largest MLPs out there with a market cap of over $63 billion and a dividend growth history of 25 years. Looking at the underlying fundamentals, we will see that all of the necessary elements are in place in order to facilitate attractive compounding process.

The current dividend yield stands at 7.1%, which warrants an enticing entry point by locking in dividend yield that will render income compounding tangible already from the start.

Besides the yield factor, EPD carries an upper-investment grade credit rating, which is not that common in the MLP or midstream infrastructure place. Typically, we will see credit ratings in investment grade territory, but not in the upper grade. This is obviously a clear indicative of fortress balance sheet and low financial risk. Speaking of the balance sheet, we have to also appreciate the benefits stemming from a well-laddered debt profile. Currently, EPD has below 1 billion of outstanding debt to roll over in 2024 and 2025, which explains less than 7% of the total borrowings.

Cash flow wise, EPD is also strongly positioned. For example in Q2, 2024 the adjusted EBITDA landed at $2.4 billion compared to $2.2 billion in the same quarter last year. Plus, the distributable cash flows came in at $1.8 billion, which translates to an increase of 4.5% relative to the same period last year. Now, based on the Q2, 2024 dividend and DCF figures, the distribution coverage lands at 1.6x, which leaves plenty of capital that could be directed towards funding new growth projects in a sustainable manner (i.e., without relying too much on external debt).

In a nutshell, EPD’s case is really attractive for dividend compounding strategy as the three most critical pre-conditions are met here: 1) the current dividend yield of 7% is attractive, 2) there is an inherent dividend growth potential since the distribution coverage is so high and there is no need to direct this surplus capital to further strengthen the balance sheet, and 3) the underlying capital structure is robust.

Pick #2 – Enbridge (NYSE:ENB)

ENB is another midstream business (albeit not an MLP) that has even larger market capitalization level than EPD. As of now, the market cap for ENB stands at $87 billion, which puts it among the Top 3 largest midstream players.

The dividend yield for ENB currently stands at 6.75%, which is slightly below that of EPD, but still attractive in absolute terms. The main difference between EPD and ENB from the risk and return perspective is related to the chosen strategy. As opposed to EPD, which is focused more on cash extraction and funding stable growth, ENB has ventured into more sizeable investments and has built $20 billion of CapEx project backlog. Namely, ENB has tilted its strategy towards meaningful growth.

For example, ENB has established (and is in the process of strengthening this vertical) a presence in the renewable energy segment, which introduces both a more favorable growth component and an element of diversification. Plus, the lion’s share of ENB’s CapEx program is linked to gas transmission utility segment, which inherently exhibits utility-like / de-risked cash generations levels.

From Q2, 2024 earnings results we could already notice the benefits of this. The year-over-year adjusted EBITDA level increased by 8%, which was mostly driven by several organic CapEx projects coming on line and previously conducted M&A moves.

As a result of sizeable investment activity, ENB’s leverage is higher than that of EPD. As of Q2, 2024 ENB had a leverage of 4.7x, which is certainly above the sector average. However, there are three important mitigants to consider here:

- Almost 98% of ENB’s EBITDA stems from cost of service like contracts, which in conjunction with a more diversified business model than what we can typically see in the MLP sector warrant stable cash flows.

- Each year starting from 2025 ENB plans to redirect circa $2 billion of internal cash generation mainly towards debt reduction activity. Together with growing EBITDA, the leverage profile should come down or remain stable.

- As a testament of a sound financial quality, in the most recent quarter credit rating agency DBRS upgraded ENB’s rating to A low and the S&P removed its negative outlook, leaving strong investment grade rating in place.

With Enbridge investors have a rather similar investment case to that of Enterprise Products Partners, where dividend yield, financials and further growth potential clearly support attractive and sustainable income compounding process.

The bottom line

To maximize full benefits of a dividend compounding process, investors have to cherry pick the right names that offer high yield at limited risk. On top of the high yield component, dividend growth potential has to also be there to enhance the value from the compounding process.

Both Enterprise Products Partners and Enbridge are great picks that fit nicely into such strategy, where investors can remain patient and consisting by reinvesting dividends and letting the snowball become larger and larger.