MOZCO Mateusz Szymanski

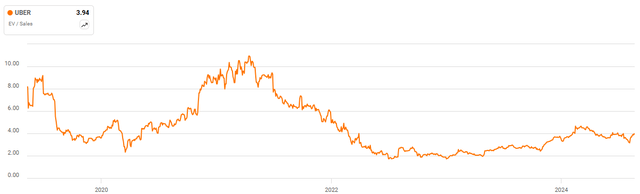

Uber’s (NYSE:UBER) business continues to progress, with growth remaining stable and margins continuing to trend higher. Against this backdrop, Uber’s share price has been fairly range-bound over the past seven months, possibly due to macro uncertainty and the growing threat of robotaxis. The scaling of robotaxi services now looks more like a question of timing than a possibility, and this finally seems to be impacting how investors think about Uber.

I previously suggested that autonomous vehicles were an overlooked threat, as larger autonomous vehicle companies are likely to try and disintermediate Uber. While this remains a fairly distant threat, it is gaining investor mindshare as AV companies begin to scale their services. Given Uber’s success in delivery and its growing advertising business, I now think there is a greater probability that Uber will remain relevant long term. This will still likely depend on robotaxi supplier dynamics, though. Regardless, given the pricing headwinds that autonomous vehicles will create, and the potential impact on Uber’s take rate, the outcome is likely to still be fairly negative.

In the near term, I continue to believe that Uber’s share price will be dictated by its ability to continue to drive profit margins higher. The current macro backdrop appears favorable from this perspective, but this could rapidly change.

Market Conditions

Uber has faced a highly variable demand environment over the past few years, with post-pandemic normalization leading to increased demand for mobility services, partially offset by a softening of demand for delivery. I tend to think that macro conditions have been highly favorable for Uber though, as employment has generally continued to grow and there has been an increased push for workers to return to the office. High immigration rates in countries like the UK, Canada, Australia, and the US have also likely benefited gig economy companies like Uber.

Despite this, there is growing uncertainty about whether current conditions will hold up, or if the economy will slip into a recession. Uber believes that consumers are still in good shape based on usage trends on its platform. While its user base skews toward higher-income individuals, Uber hasn’t seen weakness across any income cohort.

Even if a recession were to occur, Uber believes that it is well positioned due to the countercyclical nature of its platform. This means that the increase in driver supply that would occur during a recession, and subsequent lower pricing, would help to offset any demand weakness. The business may only be countercyclical to a limited extent, though. If a severe recession occurs, demand and pricing will both likely decline, leading to a drop in revenue and margins.

Uber Business Updates

Uber continues to drive growth by positioning itself as a transportation super app and by introducing products across a range of price points. This is increasing user loyalty and spend, which is highly positive for the company’s unit economics. Uber also continues to have a large amount of success in advertising, which is supporting both growth and margins.

Growth in Uber’s core transportation business remains solid, with the company likely still having a sizeable growth runway ahead of it. Uber believes that its consumer penetration rate is still below 20% across its top 10 countries. Assuming an urbanization rate of around 60% globally, Uber is probably a lot closer to market saturation in many of its markets than it believes, though. Even with a decline in user growth, frequency could help ensure growth remains solid in the medium to long term. A decline in cost per ride is probably necessary for this to occur, though, which will likely only come from robotaxis.

Uber’s delivery business also continues to expand, although growth is fairly modest at the moment. The pandemic accelerated the adoption of delivery, and the shift in behavior appears to be permanent. Delivery is also proving to be more habitual than many assumed, supported by memberships, with Uber One membership now covering 50% of gross delivery bookings.

Uber faces stiff competition in the delivery category from companies like DoorDash (DASH) and Instacart (CART). Uber recently partnered with Instacart to extend its food delivery footprint into the Instacart app. This is not necessarily surprising, despite the two companies competing in grocery delivery, as food and grocery delivery are quite different businesses. Instacart is focused on the grocery vertical and lacks the logistics scale of some of its peers.

Uber’s grocery business continues to expand, supporting the company’s margins and the growth of its advertising business. 15% of Uber Eats customers are now using grocery and retention is improving. Grocery represents a large opportunity, as the grocery and retail TAM is actually bigger than the online food delivery TAM. Instacart has a dominant position in this part of the market, though, underpinned by its tight integration with grocers.

Advertising is another growth area for Uber, which is contributing to profitability gains. Ad spend on grocery and retail has more than tripled YoY, and Uber also continues to expand its CPG product into new countries. Slightly over 1% of delivery gross bookings now come from advertising, compared to Uber’s 2+% target.

Autonomous Vehicles

Uber believes that autonomous vehicles will be good for the industry as they potentially increase supply, provide safer rides, and lower prices. There is a question of whether this will undermine Uber’s value proposition, though. The difficulty of scaling a multi-sided marketplace (drivers and riders) is one of the main barriers to entry that limits competition. A robotaxi would only need to attract riders, a fairly simple proposition given the likely cost advantage of robotaxis.

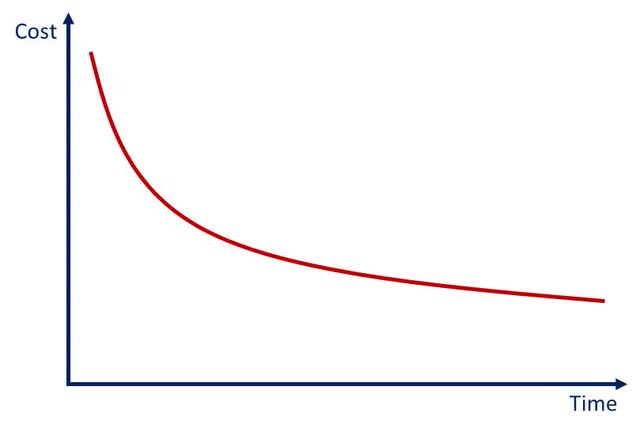

Costs are also likely to be an important driver of robotaxi growth, both because it will determine how much the service appeals to consumers and capital investment requirements for service providers. While uncertainty is currently high, estimates put the likely price decline at around 80%, driven by higher utilization and lower labor costs.

Google’s driverless test cars contained around $150,000 worth of equipment in 2012, with the LiDAR system dominating costs. It seems likely that upfront costs will decline over time as the industry scales, though. Even at a $100,000 price point, close to a $500 billion investment in robotaxis would be required to replicate Uber’s current driver supply.

Figure 1: Potential Impact of AVs on Ride-Sharing Costs (Created by Author)

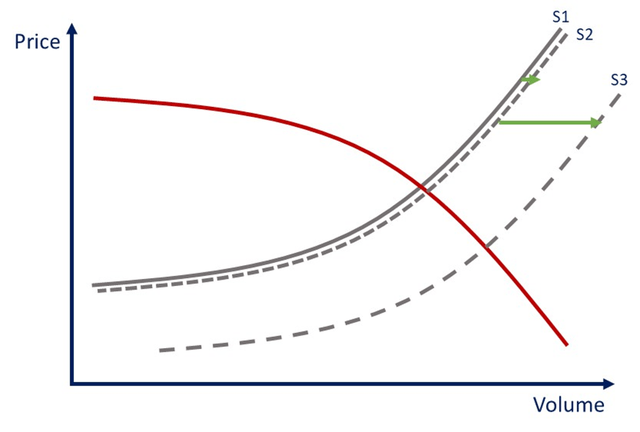

While AVs promise significantly lower costs, the initial impact on the market should be small, as the increase in supply will be limited. As AVs begin to scale, the impact is likely to become quite large, though. Based on information from Uber’s Head of Economic Research, the price elasticity of demand for ride-sharing is around 1.35, meaning a drop in prices should stimulate the growth of the market. Beyond a certain point, demand is likely to prove to be fairly inelastic, though, potentially causing a significant contraction of the overall market. For example, it has been estimated that robotaxis could triple the number of rides, which would see the market shrink significantly if prices decline by 80%.

At some point, traffic congestion, and hence service quality, is also likely to limit demand. This is a complex issue, though, as autonomous vehicles are also expected to improve the flow of traffic and would reduce the number of trips in personal vehicles.

Figure 2: Potential Impact of AVs on Ride-Sharing Pricing (Created by Author)

While the proliferation of autonomous vehicles is likely still years away, Uber’s business could be negatively impacted relatively early on. The company’s revenue likely follows a power law distribution across cities, meaning that only a relatively small number of important locations need to be disrupted by robotaxis for Uber’s mobility business to begin to struggle. For example, over 20% of Uber’s orders come from just five cities (New York City, Los Angeles, Chicago, London, and São Paulo).

Uber believes that it is well positioned to manage the introduction of robotaxis, as it can help suppliers deploy their technology at scale. While Uber’s ~20% take rate (excluding insurance costs) is a large cost, a 25% increase in utilization would offset this. I think this is a reasonable way of thinking about the market initially, as robotaxi vendors will be focused on developing the technology and scaling supply, not maximizing profitability.

It is naive to think that initial developments are reflective of how the market will evolve in the longer term, though. At a granular level, robotaxis should dominate the market in areas where they are deployed, meaning Uber will not be able to drive meaningful incremental demand. Dedicated autonomous fleets likely won’t cover all demand, though, due to the significant peaks that occur during rush hour. Uber’s model allows it to efficiently scale supply to meet this demand, whereas robotaxi vendors will face poor utilization if they try to meet all of this demand. This could eventually go the other way though, where an AV company offers ride-sharing through its app.

Someone will also need to provide fleet management (maintenance, cleaning, refueling, dealing with stuck vehicles, etc.), which will be an enormous task at scale. It is unclear how these types of services will be delivered at this stage, but it could be an opportunity for Uber to strengthen its competitive positioning by coordinating resources through its platform.

Regardless, Uber is downplaying the near-term importance, suggesting that it is not expecting to make substantial profits from robotaxis in the next five to 10 years.

Prominent autonomous vehicle companies include:

- Tesla

- Waymo

- Amazon’s Zoox

- Baidu’s Apollo

- General Motors’ Cruise

Investors appear to be placing a large value on Tesla’s self-driving technology, as its approach could result in a more generalized solution. This approach will take longer though, and a generalized solution may not be that much more valuable than a specialized solution that works in large markets.

Tesla plans on allowing drivers to rent out their personal vehicles on its platform, presenting a direct threat to Uber. It is questionable how many individuals will be willing to do this, though, due to both the risk to the vehicle and the fact that ride-sharing demand peaks are likely to overlap with vehicle owner demand peaks. Cruise, Waymo, and Zoox are also lobbying for higher safety standards, which could be a problem for Tesla. Tesla has a robotaxi event scheduled for October 10 which may shed more light onto the company’s progress and strategy.

Uber currently has partnerships with BYD, Waymo, and Cruise. BYD plans to invest $13.8 billion in developing autonomous vehicles and is targeting deployment in Europe. BYD has also received government licenses to drive its autonomous vehicles in seven Chinese cities.

Uber plans on launching its Cruise partnership next year, with a dedicated number of Chevy Bolt-based autonomous vehicles. After pausing operations in October 2023, Cruise reportedly plans on resuming autonomous rides later this year.

Waymo’s business continues to scale, with the company recently passing 100,000 trips per week. The trip volume is double what Waymo reported in May.

While Uber is partnering with autonomy companies, I find it hard to believe that suppliers will willingly give up a meaningful proportion of their revenue to an intermediary. The expansion of Uber’s platform across a growing range of services is probably the best defensive move the company can make at this point, as it helps to make Uber’s platform sticky from a consumer perspective.

Autonomous Delivery

While robotaxis represent a significant threat, autonomous delivery is a large opportunity that should be less of a risk. Even with autonomous delivery, platforms will still need to maintain a multi-sided marketplace (consumers and restaurants). Given lower technology and capital requirements, the autonomous delivery technology market is also more likely to be fragmented. Many of the leading vendors also do not have the necessary resources to forward integrate and launch their own platform.

Autonomy could massively expand the delivery market by dramatically reducing delivery costs (in excess of 80%). This could provide up to a $900 billion opportunity by 2030, although the more realistic near-term opportunity is likely to be under $250 billion, with food delivery constituting around a third of this.

Uber was working on its own aerial drones for food delivery. The drone would have been used to deliver from the restaurant to an intermediate drop-off location, with a driver taking the meal to the final location. DoorDash is working with Wing to implement drone delivery, although this is currently only at the pilot stage.

Autonomous Freight

Uber is also positioning itself to benefit from the commercialization of autonomous trucks. While this market is still nascent, it could be a growth driver in coming years, as highway driving is a more tractable and well-defined problem than urban driving.

Autonomous trucks are expected to reduce total operating costs between 30% and 45%, although this is highly dependent on the route, with feasibility improving on longer routes. In addition to cost advantages, autonomous trucks can also help to address looming labor shortages caused by an aging trucking workforce. Humans will remain important in trucking for many years to come, though, with humans and autonomous systems are expected to complement each other on long haul and local delivery.

Surface freight transportation is a trillion-dollar market in the US, with trucking constituting around 64% (by tonnage) of this market. Uber believes that the trucking market opportunity is close to $800 billion in the US and $4 trillion globally. Eleven to 19 billion miles is the realistic near-term opportunity in the US, which probably means something more like a $50 billion opportunity in the near term.

Uber is also taking a partnership approach to the freight market by making autonomous providers available on the Uber Freight platform. Partners include:

- Aurora

- Waabi

- Volvo Autonomous Solutions

- Torc Robotics

Uber Freight has also laid the groundwork for seamless trailer handoffs between autonomous trucks and human drivers with Powerloop, a drop-and-hook trailer solution.

Financial Analysis

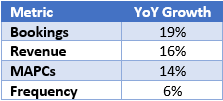

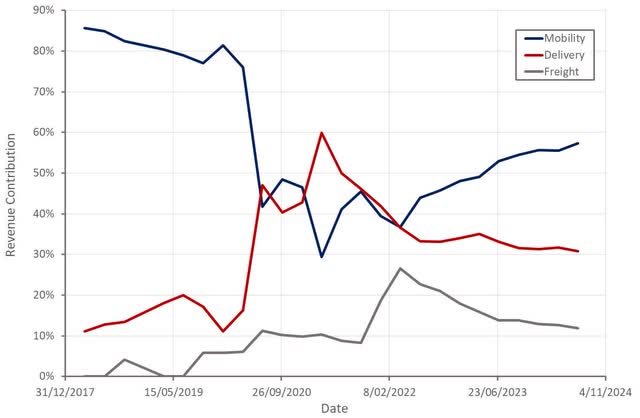

Uber saw solid growth across its business in the second quarter, with more users and more trips per user. This was somewhat offset by decreased revenue per trip, though. Mobility revenue was up roughly 25% YoY in Q2, while Delivery grew 8%.

Table 1: Uber Q2 2024 Growth Metrics (Created by Author using data from Uber)

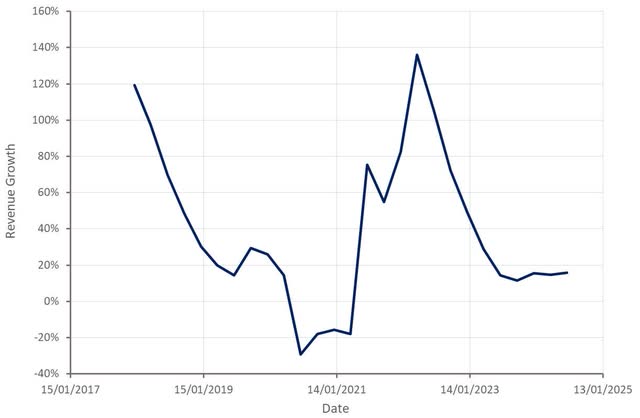

Gross bookings growth is expected to be 18-23% in the third quarter on a constant currency basis. Currency is expected to present roughly a 4% headwind, though. Mobility growth is expected to be in the mid-20s range again on a constant currency basis. This likely means that growth will remain fairly steady in the third quarter compared to the second. Uber is targeting mid-to-high teens gross bookings growth longer term.

Figure 3: Uber Revenue Growth (Created by Author using data from Uber)

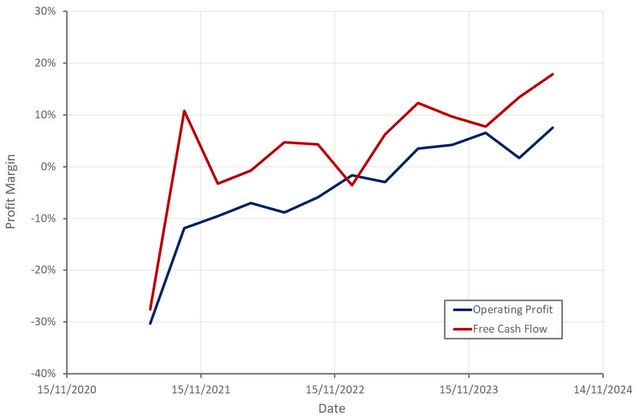

Uber’s margins continue to trend higher, supported by revenue mix and efficiency initiatives. The Mobility business has higher margins than the Delivery or Freight businesses and continues to have a higher growth rate. Advertising revenue is also now in excess of $1 billion on an annual run rate basis, with over a 50% growth rate. Despite these positives, there are headwinds. Newer products are generally growing at a higher rate than the rest of the business, and these products tend to have substantially lower margins.

Uber is also making gains in areas like efficiency and consumer loyalty. Tech improvements are also driving margin gains on the Delivery side of the business, lowering cost per transaction. The company is also targeting further improvements in areas like refunds and appeasements, which are still a drag on the Delivery segment.

Uber is targeting a 30-40% EBITDA margin within the next three years. This is a large step up from the 15% margin achieved in the second quarter, though. While margins should continue to trend higher, further margin gains will likely be harder to come by, particularly if the demand environment softens or Mobility growth weakens.

Figure 4: Uber Revenue Contribution by Segment (Created by Author using data from Uber) Figure 5: Uber Profit Margins (Created by Author using data from Uber)

Conclusion

Uber’s business has achieved solid growth and steadily improving margins in recent quarters, supporting the company’s share price. The business is likely to remain fairly robust in the near term, unless there are large white-collar job losses. Uber’s revenue multiple is still in line with its historical average, despite the share price moving significantly higher over the past year. The valuation also appears reasonable given Uber’s steady growth and recent transition to consistent GAAP profitability. As a result, I tend to think that Uber’s share price will continue to trend higher, absent a deterioration in the macro environment.

Longer term, there are serious threats to the business that are gaining investor mindshare. While autonomy could positively impact Uber’s Delivery and Freight businesses, Robotaxis are likely to have a fairly negative impact on the Mobility business longer term. As a result of the risk that technology presents to Uber’s terminal value, I continue to think the company could be a poor long-term investment.