FocusEye/E+ via Getty Images

Dear subscribers,

Sometimes you can’t help being thrilled about some of the drops you see on the market. This is one of those times. If you follow my work, you know that I’ve already established a large position (and growing) in the British company Diageo – a distiller/vintner with a world-leading position in certain key areas.

I have been expanding my Diageo (NYSE:DEO) position for a number of months at this point. I started investing when I believed the company to be cheap, but Diageo has declined more since – so I’ve added more (obviously after checking that it’s not anything fundamental that’s the issue for the company).

Diageo, to me, is more of a total return than an income investment. There’s plenty about the company to like. How about A-rated credit and a 3.2%+ yield from one of the world’s leading liquor producers and vendors? Because this is what the company offers.

Yes, during the fiscal 2024 and going into 2025E, we’re expected to actually see a bit of a decline for the business. Diageo troughing is expected to happen during the fiscal – after which we’re expecting to see a rebound back to growth.

This is a $70B market cap company despite the slight tumble it’s been taking, and I’m happy to invest here. Let me show you why I’m a big-time investor in Diageo.

What there is to like about Diageo

Even with the company seeing some pressure here, and Diageo itself calling this company a challenging year, there’s plenty to like about the way this company operates and what it has. First off, some annual results (for the 2024 period). Company organic volume was down 3.5%, organic net sales were down 60 bps, and operating margin declined by around 1.3%. However, FCF was up to $2.6B, and the company delivered yet another (expected) increase in its dividend.

Like other large and diversified liquor companies, part of Diageo’s strengths comes from its wide and diverse footprint. And in the last year, everywhere in the company’s operations with the exception of the US and South America actually did well, with Africa growing double digits.

Companies like Diageo are going to have “down” years. It’s the same with any business or sector – and that spirits have been struggling is clear, since some of my other investments in the sector, such as Pernod Ricard, are also down.

Does this worry me?

No, not really. There’s a degree of cyclicality to this business that does recur, and there are enough signs that the company is actually gaining momentum even as I am writing this article.

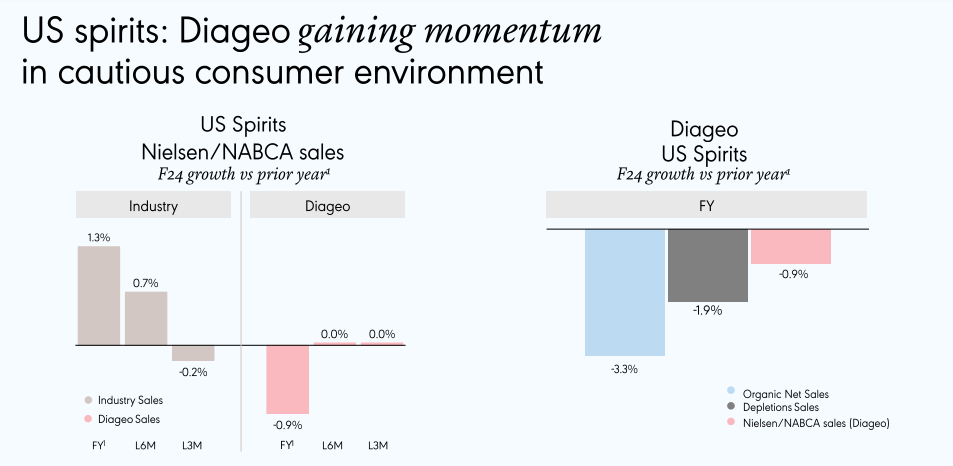

DEO IR (DEO IR)

Scotch, for instance, is gaining category share in 9 out of 10 of the largest scotch markets in the world. Tequila, for another example, is another solid segment strengthened by good brand building and very strong marketing. And Guinness is Guinness – this well-known brand is seeing double-digit growth for the 7th consecutive year.

So anyone saying that the company is in dire straits or in danger of a fundamental decline, well, I’d say you might have been drinking a bit too much of the company’s famous ale! I do not believe this to be the case. Is the company seeing a decline completely in line with the volatility for the rest of the sector? Yes, it is. Key performance metrics are showing a decline across the board for some of the companies here – but at the same time, Diageo is not exactly inactive. Reinvestments and positive cost control only mildly impacted by short-term challenges are in my view central to the company’s long-term upside here.

Let’s look exactly at what’s driving these negative trends or issues here.

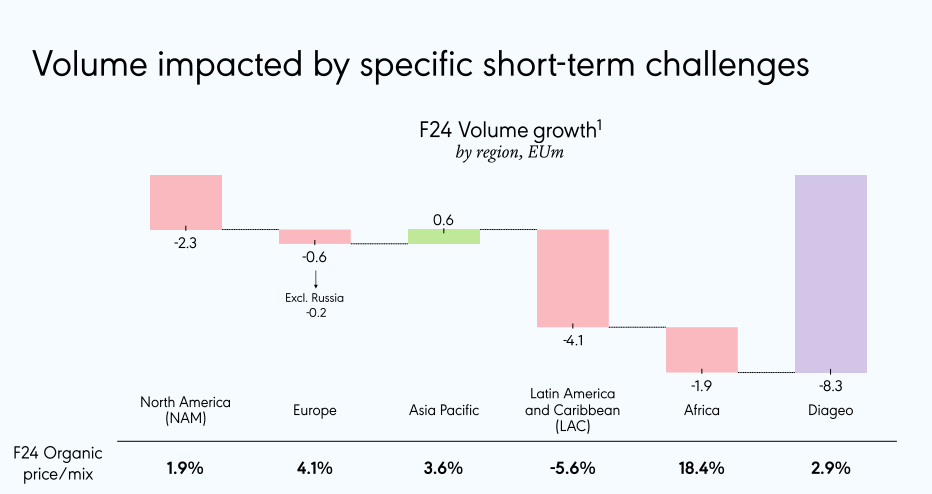

DEO IR (DEO IR)

As you can see, from a geographic perspective, the company’s volume challenges are broad-based. But once we start delving deeper into these numbers, we will start finding that the company’s current strategy is aimed at serving the company’s strengths here – including the docs on value, standard, and premium segments, which are driving sales. The company has continued confidence in the premiumization of its overall portfolio. This is a company with what I consider to be a wide moat. Its 2024 results came as recently as a month back – and they were not good, but it’s important to view this in context.

This marks the end of a superb growth streak where it grew 13.5% per annum over the last 3 years. When taking this into consideration, a sub-10% organic net sales decline is really nothing worrying or even surprising. Yes, there were some external impacts, such as consumer sentiment issues in LATAM and the like, but the price/mix for all regions, except LAC, was positive, with good premiumization of Guinness above all.

The bullish arguments here, which are those I follow and advocate, would say that the company has one of the strongest positions out there. Its support base, including its distribution networks, makes any sort of long-term downturn as long as people drink the company’s products unlikely. Premium distilled spirits is a so-called affordable luxury that most people continue to spend on, provided they like to drink the products. This translates into the potential for long-term demand, both from so-called want-to-be and already high-income customers.

There’s also something that you really need to know spirits to understand. Diageo owns a vast inventory of aging and aged spirits. It should not be in doubt that aged spirits are worth more than aging or freshly barrelled spirits – but as things are, these aged spirits are being held on the books at the cost of aging. This leads to a book value understatement that I have raised before, and that other analysts have raised as well. As things stand, I believe the company’s book value is worth at least £2.5-£.3.5B more, depending on how you evaluate these – and this further widens the valuation gap.

I started investing in other spirits companies prior to Diageo when the downturn in the sector started. However, as it became clear that Diageo too was being pulled down, I started allocating funds here. My position in Diageo is now at a respectable 1% size, both private and commercial, and I have no qualms about expanding here.

While I fully admit that there are risks to the business, and we’ll definitely look at those, it’s my view that the current valuation overstates these risks which results in a positive potential RoR – and I’ll show you what I expect from here on out.

Valuation for Diageo – Positive, even at just 15-17x P/E

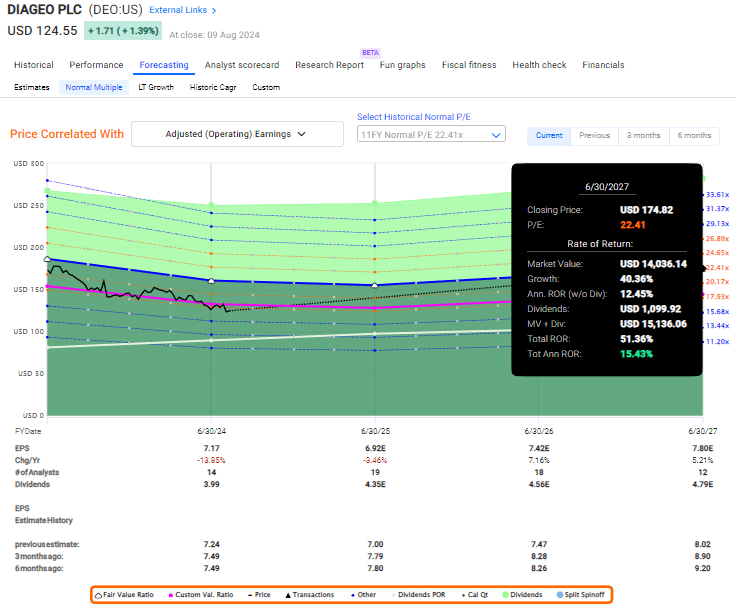

Diageo, here, is now trading at below 17.5x P/E normalized as of the time of writing this article. It’s an A-rated spirits business that typically warrants something like a 25x P/E. This is somewhat influenced by the last three years of growth, so let’s normalize that to somewhere along the lines of 22.5x P/E. Anything less than that would be unfair, but more than that could be argued to not be conservative enough.

The company is in the midst of an inarguable decline at this time, and it’s also a clear expectation that this decline will go on into the next fiscal. This is also the expectation for other spirits businesses, not just Diageo.

However, at this valuation it’s a likely development that we’ll see a 15% annualized RoR even at just a 22.4x P/E – and this is why I’m so positive on Diageo at below $125/share for the NYSE ticker (though I invest in the native).

F.A.S.T Graphs Diageo Upside (F.A.S.T Graphs Diageo Upside)

As you can see, Diageo is a company here where you on the basis of A-credit with a yield of over 3.2% can get a 15% annualized RoR for the next 2–3 years even in the case of what I consider to be a conservative performance or target.

And this is what I typically look for. My other “pick” this week was Realty Income. Realty Income, while having recovered markedly, is also still attractive on a conservative basis (albeit not as attractive as it once was). I try, when it comes to most of my portfolio, to avoid getting “fancy”. I just look for that 15% annualized, and I go from there.

A few reasons for it, but most of them have to do with 15% being enough for me at this stage, with the fact that excessive RoR typically implies excessive risk, and that I’m really interested in capital preservation above excessive capital appreciation, provided I get my “money” while I’m waiting.

This approach has served me well for the past 10 years, and I will continue to use it.

Even with the risk of continued declines included, I believe that Diageo’s share price at this time marks an attractive potential and an attractive entry point to this great business.

Some risks exist – and here is what I think they are.

Risks to Diageo – Cyclicality and trends

I’ve noted over the past few years as I invested in Spirits that the spirits business tends towards higher degrees of volatility than products like beer. This is especially true the more premium you go – and this is where Diageo is at “home”. It means that during a global slowdown of the economy, which is what we currently have, Diageo might hurt more than others because of how its products and segments are positioned. This is, what I believe that we’re seeing right now.

As with Pernod and other similar businesses, Diageo is also exposed to significant regulatory and political risks. Russia’s and Chinese moves to try and curb alcohol consumption are only the latest of these. It needs to be said clearly however that governments have been trying to do this for centuries without success and I do not believe it to be successful here either.

Because Diageo is such a mature business, the potential for organic growth is low. The company’s growth, as evidenced by the past few years, is mostly inorganic here. M&A growth comes with the risk of overpaying, and this is especially true for Diageo which is trying to move deeper into premium spirits and the like.

These are the main risks to a positive thesis for Diageo at this time – none of which, I believe, are significant enough to offset the potential for investment.

Thus, I say the company is a “BUY” here.

Thesis

-

This is one of the most quality beverage businesses on the planet, and it typically trades above 25X. The current company price for the native ticker DGE on the LSE implies a P/E of 17.6x, which is the lowest it’s been in some time and has pushed the yield to almost 3.3%.

-

Because of that, and because of the market, I believe it is time to shift my stance on DEO, which is what I am doing here.

-

I consider DEO a “BUY”, and the upside to that buy is at least 15+% annualized to a normalized 22-25x P/E, which I consider valid for the largest spirit and beer play in these categories.

-

I give Diageo a native PT of at least £38/share and an ADR PT of $180/share.

Remember, I’m all about:

-

Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

-

If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

-

If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

-

I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

The company also fulfills several of my investment criteria.

-

This company is overall qualitative.

-

This company is fundamentally safe/conservative & well-run.

-

This company pays a well-covered dividend.

-

This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

This means that the company fulfills all of my criteria, and I consider it a “BUY”.