AlexSecret/iStock via Getty Images

Introduction

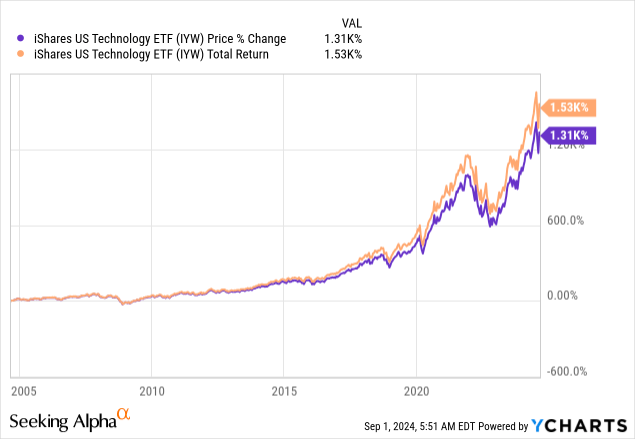

We last covered iShares U.S. Technology ETF (NYSEARCA:IYW) back in March 2023. At that time, we recommended investors to accumulate shares of IYW as we see good long-term opportunities especially after the significant correction in 2022. Since the publication of that article, IYW has delivered a total return north of 70%. Now that it has been about 1.5 years since we last covered this fund, it is time for us to take another look at IYW and provide our thoughts and recommendations again.

ETF Overview

IYW invests in a portfolio of about 140 mostly large-cap U.S. technology stocks. The fund has a high expense ratio of 0.39%. For example, The Technology Select Sector SPDR ETF (XLK) only charges an expense ratio of 0.09%. IYW should benefit from many secular technological growth trends. Its share price has increased significantly since the cyclical low reached in October 2022. The market’s AI hype was one of the primary reasons of this outperformance. However, its valuation is expensive now. Any weakening demand for AI may result in significant decline in its share price. Hence, we think investors may want to seek higher margin of safety and wait for a better entry point.

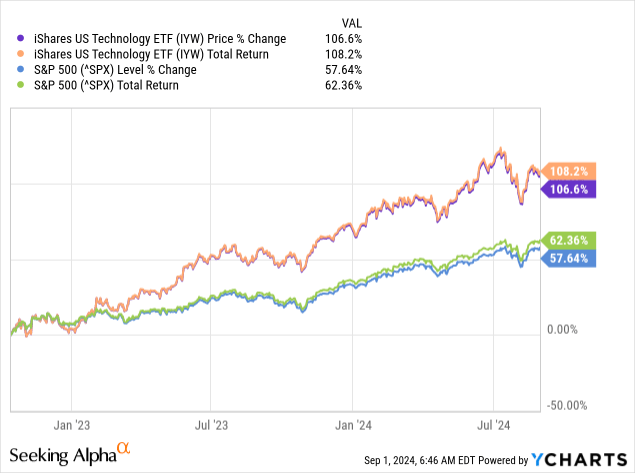

YCharts

Fund Analysis

IYW has done very well since the cyclical low in 2022

Let us quickly review IYW’s performance in the past few years. Following significant correction in the first ten months of 2022, IYW’s fortune turned positive. Since the cyclical low in October 2022, IYW saw its share price increased by 106.6%. Including dividends, IYW delivered a total return of 108.2%. This performance was much better than the S&P 500 index’s price return of 57.6% and total return of 62.4%. In the past 10 years, IYW also outperformed the S&P 500 index, registering a total return of 526.0%, much better than the S&P 500 index’s 238.8%.

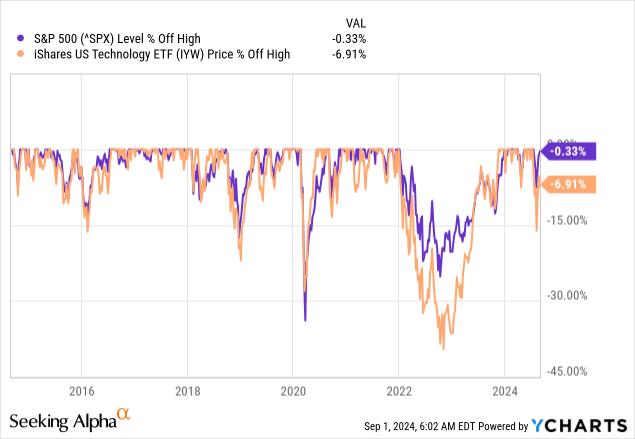

YCharts

AI hype is one of the primary driver to IYW’s outperformance

As we have highlighted in our previous article, stocks in IYW’s portfolio will continue to benefit from many secular growth trends such as electrification of automobiles, artificial intelligence, industrial automation, Internet of Things, cloud computing, etc. One of the primary drivers of IYW’s outperformance since early 2023 has been the AI hype. In order to provide AI models and services, many software and cloud services providers need state-of-the-art semiconductor chips, and semiconductor designers and manufacturers are benefiting from the surge in demand for these chips. For example, AI chip designer Nvidia (NVDA), which consists of about 13.7% of IYW’s portfolio, saw its share price increased by nearly 1,000% since October 2022. This is nearly 10 times the performance of IYW in the same period.

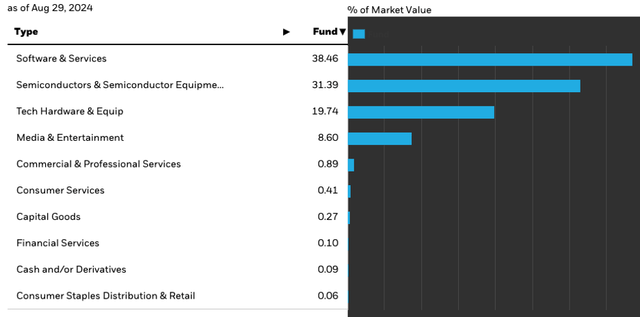

Other semiconductor stocks also saw their share price increased significantly, although not the same scale of performance as Nvidia. This is evident in the fact that back in March 2023 when we wrote our previous article, semiconductor and equipment subsector only represents about 24.4% of IYW’s total portfolio. Over the course of the past 1.5 years, this subsector now represents 31.4% of IYW’s total portfolio (see chart below). The market appears to be very optimistic that AI will result in significant transformation to many industries.

Valuation still expensive despite recent correction

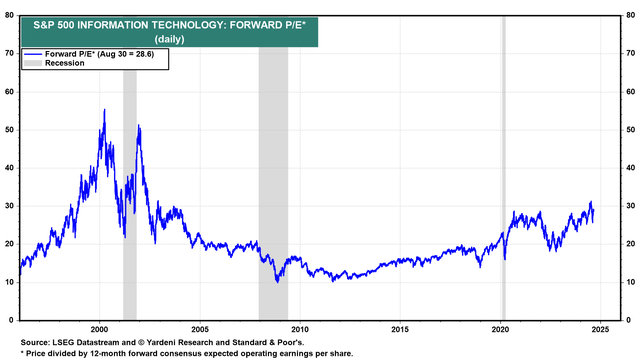

Let us now check IYW’s valuation. Below is a chart that shows the forward P/E ratio of information technology stocks in the S&P 500 index. Since there is significant overlap between stocks in IYW’s portfolio and information technology stocks in the S&P 500 index, the chart will help us gauge the change in valuation of technology sector in the past. In other words, the exact number is not that important. It is its current valuation relative to the historical valuation that we are comparing. As can be seen from the chart, the current forward P/E ratio of 28.6x is still higher than the peak reached during the pandemic even after the recent correction in July. In fact, as the chart suggests, we have not seen this high valuation since the burst of the Internet-dot-com bubble. Therefore, we think IYW is now quite expensive.

Source: Yardeni Research

Downside risk can be very high

As shown in the previous chart, technology sector’s valuation range can be very wide. In the significant market correction in 2022, technology sector’s forward P/E declined significantly from the peak of nearly 30x down to below 20x. As shown from the chart below, a combination of multiples compression and negative earnings growth caused IYW to decline by nearly 40% in 2022. This decline is much more significant than the S&P 500 index. This higher volatility is also evident in the fact that IYW has a much higher beta of 1.28 relative to the S&P 500 index. As the chart below shows, IYW typically declined much more than the S&P 500 index in past corrections such as in 2016, 2019, and 2022. The decline in 2020 is an exception as the technology sector is one of the sole beneficiary sector during COVID-19.

YCharts

Be cautious of declining AI server demand

As we have stated earlier, one of the primary drivers of many technology stocks’ strong performance in the past year is due to the AI hype. At the moment, many cloud solutions providers (CSPs) such as Alphabet (GOOGL), Microsoft (MSFT), and Amazon (AMZN) continue to allocate large chunks of their capital expenditures towards buying AI servers. Right now, there may be more demand than supply. However, things may reverse just like what happened towards the end of the pandemic. Could there be overbooking now? It is hard to tell. What if these CSPs realize that they do not need that many servers? Remember that we have experienced similar problem towards the end of COVID-19 as demand for many technology products dwindled quickly. Therefore, if demand for AI servers weakens, many semiconductor stocks may underperform. In such a scenario, market optimism towards technology stocks can decline quickly as well. If this happens, we think IYW’s fund price will likely experience significant decline.

Investor Takeaway

Although we like IYW’s strong long-term growth outlook, we think technology sector is now expensive based on our valuation analysis. Therefore, we think investors should be careful and patiently wait for a better entry point.

Additional Disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.