eyewave

American Express (NYSE:AXP) is one of the oldest and most well-known companies on the NYSE. Founded in 1850 as a valuables transportation company, it transitioned into financial services, with the creation of the traveler’s check in 1891, something similar to what we know today as a check, until the issuance of its first credit card in 1958. I find American Express to be one of the most unique and special companies in existence, as it combines an aura of aspiration and status with a versatile business model that has been improving since the 2008 crisis.

Business Model

The business of American Express is relatively simple to understand, although its accounting and financial statements can be a bit tricky, especially if you’re not used to analyzing financial companies like banks. I’ll try to explain it in a simple way, as I prefer to focus on the future that AXP has ahead.

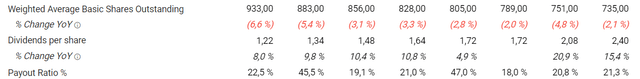

Source: 2023 annual report, page 45

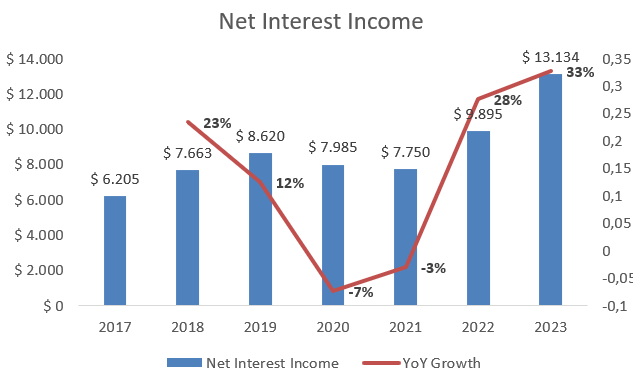

Within American Express’s revenues, we find two main types, which are further divided into subcategories. On the one hand, we have net interest income, which is the money AMEX earns from the difference between what it charges on loans versus what it pays for the deposits that its customers have with the company. The larger this differential, the more money AXP will earn.

It’s interesting that AMEX has an increasing amount of deposits, as this allows it to earn more money in terms of volume and provides cash that it can use for investments or to lend to other customers at higher interest rates than it pays on deposits, just like banks do.

Since the regional bank crisis in the USA in 2022, American Express has emerged with a much stronger image in the eyes of customers, who, as we will see later, tend to be of much higher quality compared to its competitors. The bank panicked and made deposit withdrawals from that year, seeking refuge in brands with stronger brand power and customer trust. This is easy to see when looking at the YoY growth of this business segment over the past few years. While it must be noted that this is the most cyclical branch of the company and the one that tends to suffer the most, its customer quality is on par with major banks like JPMorgan (JPM).

Source: Author’s Representation

The rest of the revenues are unrelated to interest and are divided into several sub-segments, as shown in the image at the beginning of this section. Here, it’s important to highlight two key aspects: the American Express closed-loop system and the fees it charges for holding its various cards.

The largest sub-segment is “Discount Revenue,” which is the percentage of each transaction that AXP retains and charges to merchants. This percentage varies by region, type, and size of business, but it ranges between 3% and 5% of each transaction, compared to the 1.5%-2% charged by Visa and Mastercard, which must then be shared with the payer’s and acquirer’s banks. However, the figures vary by merchant and geography, so there is no standardized number as such. Thanks to its closed-loop system, American Express does not have to do this.

In the closed-loop system, AMEX controls everything from the issuance of the card to the connection with the merchant, with no intermediaries involved. This creates a continuous stream of proprietary data, which is then used to offer better deals to customers and merchants, internal delinquency reports, personalized rewards, and more.

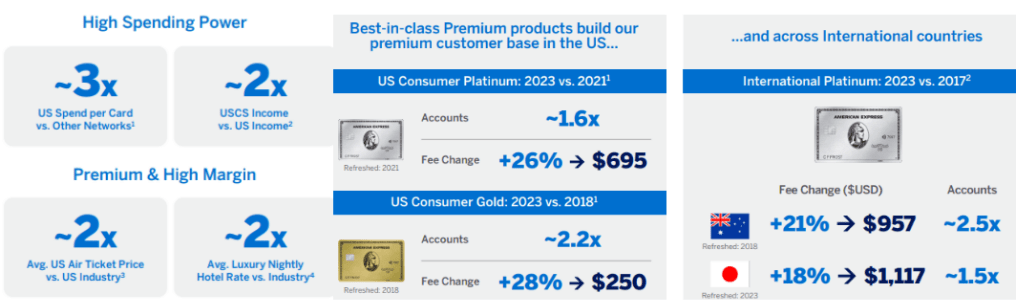

The second major revenue source in this segment comes from membership fees charged depending on the card. Everyone is familiar with the AMEX Centurion card, which has an initial fee of $10,000, an annual fee of $5,000, and requires a series of minimum spending requirements as well as an invitation for obtaining it. There is also the Platinum card ($695 per year), which is primarily aimed at travelers, and the Gold card ($250), which is more focused on everyday spending. Additionally, there are free credit cards, such as the Green card, but these are less interesting.

You can find all the benefits and fees of the cards at this link.

Source: American Express

These fees automatically place the type of customer in a high social tier, with significant purchasing power and higher spending frequency and amounts. In fact, this propensity to spend more and on more expensive items is what attracts more merchants. Despite losing a higher percentage per transaction compared to Visa Inc. (NYSE:V) or Mastercard (NYSE:MA), the overall volume makes it worthwhile for them.

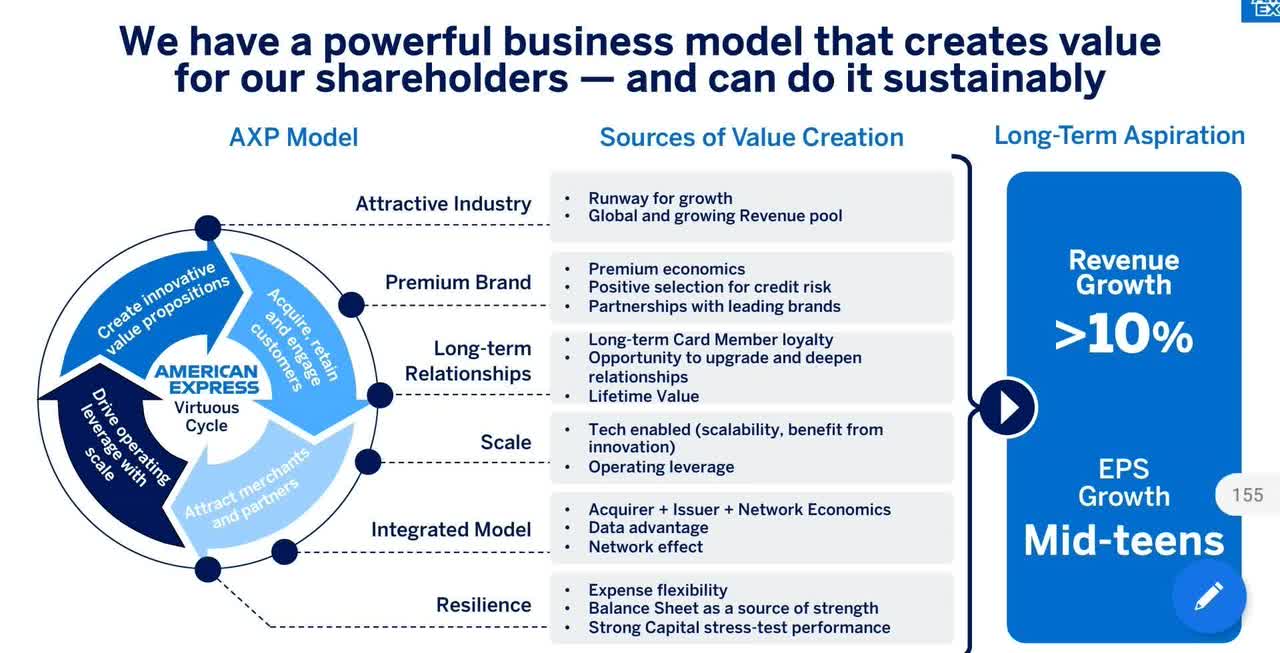

This creates a very interesting virtuous circle and has helped achieve parity (the number of merchants accepting all types of cards) in the USA. Internationally, we are still a bit away from this, but it is undoubtedly one of the driving forces behind this growth thesis. In fact, this Investor Day image might be useful to justify and summarize the American Express thesis. I recommend a thorough review, as it essentially explains the thesis and its virtuous circle in a single slide.

Source: Investors Day Slide 155

In addition to all the mentioned sources, AMEX also earns money from: “service fees charged to merchants and other customers, travel commissions and fees, card member delinquency fees, foreign currency-related fees charged to card members, and income (or losses) from investments where it has significant influence. Additionally, processed revenue primarily represents revenues related to network partnership agreements, including royalties, fees, and amounts earned from facilitating transactions on cards issued by network partners.” AMEX Annual Report.

Nevertheless, I find this aspect to be somewhat less interesting and more generic. Apart from the proprietary data generated by the closed-loop system, I don’t believe AMEX has significant competitive advantages in these areas, unlike the other segments.

Growth Drivers

Once we have understood American Express’s business model, it is time to discuss the company’s future growth drivers.

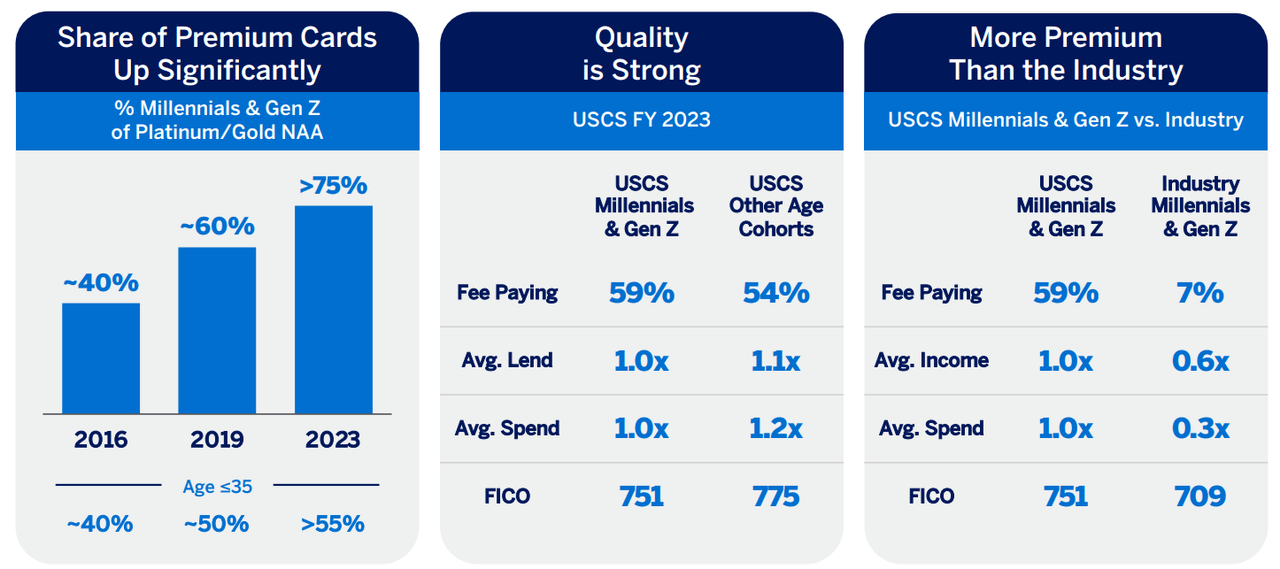

We’ve already discussed the importance of focusing on premium clients, with all the benefits they bring. However, AMEX also targets other customer niches that can provide longer life cycles and further increase their terminal value. I’m talking about Millennials and Generation Z.

Currently, they represent 75% of new Gold and Platinum cardholders. This demographic is interesting, and clearly, American Express has attracted the premium segment of this generational niche: They pay fees 8 times higher than those of competitors, earn almost double, spend three times more, and have a better FICO score.

Moreover, as is obvious, the lifetime of these customers is much longer, and it is expected that as they continue to age, their purchasing power will increase.

Source: Investors Day Slide 26

Payments from small merchants:

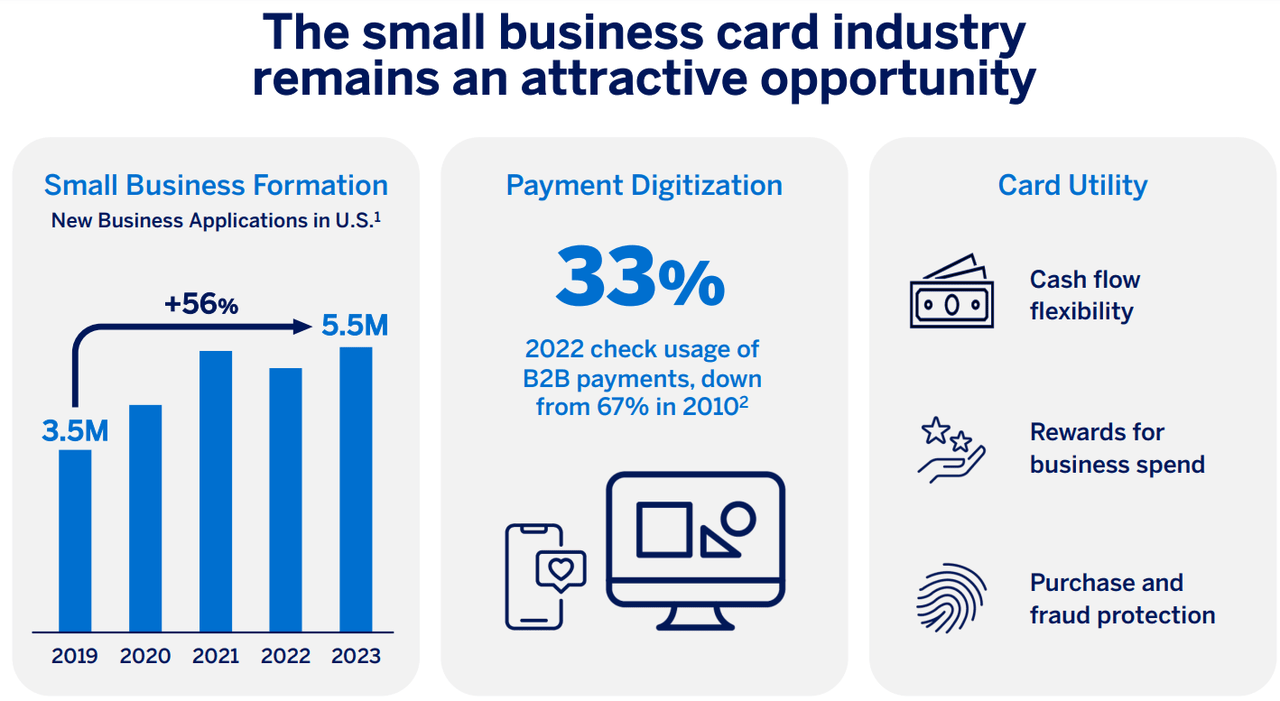

Visa and Mastercard have also been focusing on this and trying to attract B2B payments for some time. Nevertheless, AMEX has gained market share since 2019, increasing from 45.8% to the current 47.1%, although it still faces volatility.

This is a highly attractive industry with a 98% retention rate. Some of these features are shown in the photo.

Source: Investors Day Slide 48

Solutions include B2B payments, loans and deposits, marketing offers, partner cards similar to Delta, and other solutions like fraud management, accounting, and general business finance. It’s a quite multidisciplinary range and directly in the backbone of the company, similar to ADP or Intuit.

International Market Segments:

This segment has been growing at 17% over the past few years. The five largest countries, excluding the USA, are Mexico (11% market share), Australia (7%), the UK (6%), Japan (6%), and Canada (4%). In the USA, AMEX has a 5% market share, but in absolute terms, it is the largest.

In all these countries, AMEX is growing faster than the competition. For example, its customers in Japan spend 8 times more than the average. In fact, most of the international sales come from sales commissions and fees (89%), with only 11% from the differential between loans and deposits. These five countries alone account for 33% of international sales.

AMEX has tripled the number of locations where it is accepted since 2017, although it is still far from achieving parity with the USA, with levels varying by market niche.

Internationally, it should be noted that the number of cards issued directly by AMEX is lower, and the company has to leverage partnerships with entities such as:

Source: Investors Day Slide 101

Everything explained so far places AMEX in a unique position within its industry, enjoying premium partners and customers to whom it can increase card fees while still growing its customer base. You have the combination of price and volume growth that I like to see in any company.

Source: Author’s elaboration with slides 17 and 18 from the Investor Day

AMEX also benefits from partnering with top companies like Hilton or Delta Air Lines to continue attracting customers. These customers, by the way, have higher FICO scores than those of competitors and, as expected, also have lower delinquency and default rates. All this enhances confidence in AMEX’s financial position, which in turn attracts more deposits and generates more revenue for the company. These are all virtuous circles continuously feeding into and boosting each other, powered by proprietary data and technologies.

Capital Allocation

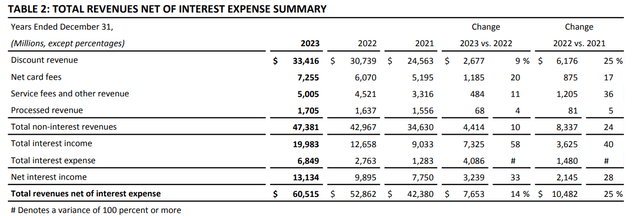

It’s time to discuss another point that, I believe, will bring joy to AMEX investors in the coming years. AMEX is very adept at capital management, and this is an area they continue to improve. Between stock buybacks (which have ranged from 2% in some years to 6% in others) and has reduced the number of shares outstanding by 17% over the past 7 years, along with a dividend yield of just over 1%, a payout ratio averaging 20%, and a 6-year CAGR of 9%, we are seeing an annual return to shareholders of around 4%-5% as capital yield.

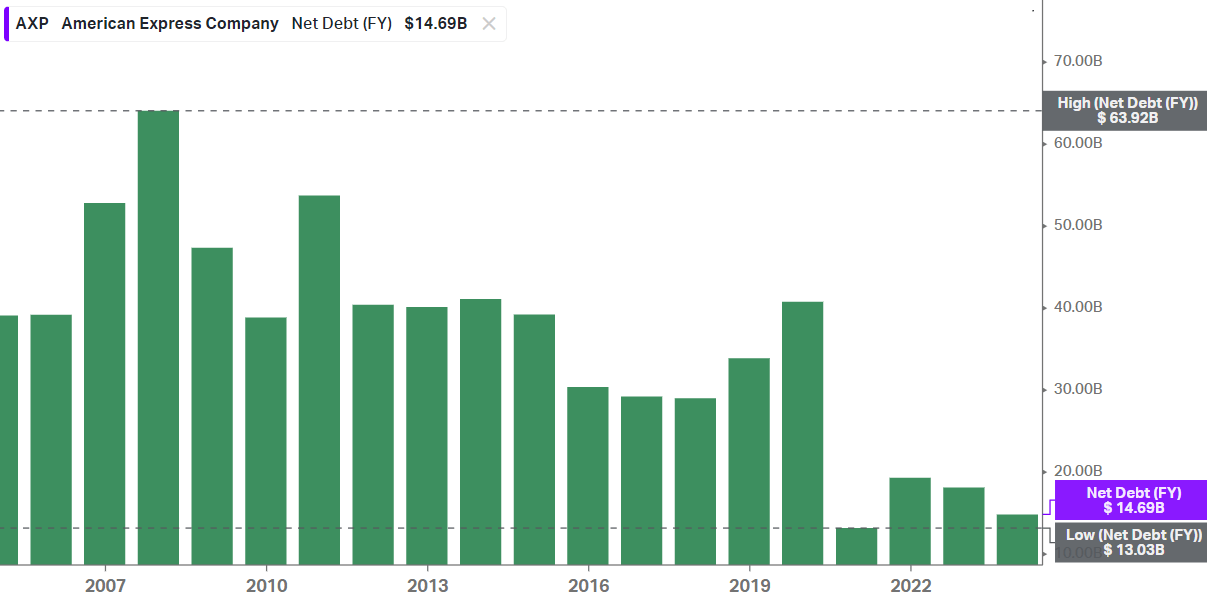

On one hand, there’s also the significant work the company has done in deleveraging since 2008. From having nearly $64 billion in net debt, AMEX has reduced this to $14.4 billion today. For a business like AMEX, this has many positive aspects. It reduces operational risks, lowers exposure to economic cycles, increases returns for shareholders, provides flexibility during tough times, enhances terminal value, and ensures greater overall security for both new and existing customers.

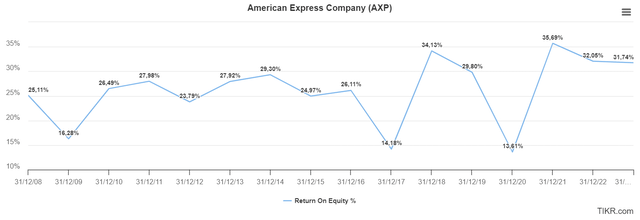

Source: Koyfin

Moreover, despite this deleveraging, AMEX’s ROE continues to grow. In financial companies, ROE is often inflated by high leverage on the balance sheet; however, in AMEX’s case, it has increased even though the company has reduced its debt.

The decline in 2017 was due to the expiration of its contract with Costco, which represented 10% of the cards. Since then, a new strategy has been implemented, focusing on earning fees from card usage, increasing the number of cards in circulation through agreements with merchants and partners, and boosting overall marketing expenditures. Both margins and profitability, as well as the company’s status image, have been positively affected. The decline in 2020 was due to COVID. Although it remains a volatile metric, it seems likely to stabilize around the 30% range.

Valuation

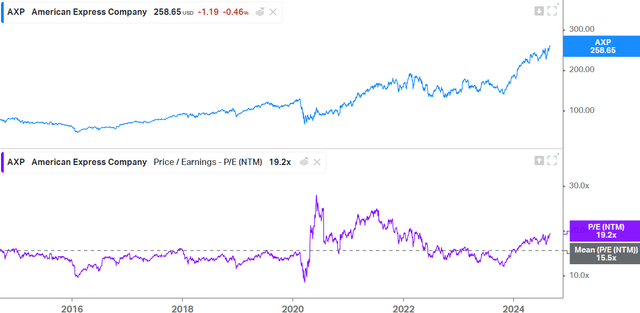

In this section, I’ll keep it simple, as the volatility in AMEX’s results makes it challenging to make precise estimates. According to the company, its underlying market grows at a rate of 7%, but due to all the advantages of the business model mentioned in this article, it expects to grow at 10% in sales and anticipate margin improvements. Ultimately, AMEX is a business that doesn’t require much capital to grow, and parts of the business, such as card fees, have very high margins. If we believe this, we might think that AMEX’s profits could grow at 10%-12%, and depending on the share buybacks the company undertakes, EPS could even see growth of 15%.

On paper, this sounds very promising, but we need to consider its current valuation. With a 19x P/E ratio, it’s one of the highest in recent years. Depending on its future performance, I believe AMEX could warrant a multiple in the 16x-18x range. Therefore, to have some margin of safety, I would aim to buy it at 15x-16x. At current prices, I think you would achieve results similar to the market, but with slightly more risk compared to buying an index.

For all these reasons, I rate the stock as a hold.

Risks

Although the changes implemented since 2017 have reduced its operational risks, AXP is still a company that tends to be punished during market panics. Declines of 30% are quite significant for this stock, and depending on how much interest rates drop, it could suffer in that revenue segment.

A real risk, but one that, I believe, is less likely to materialize due to the more premium nature of Delta’s business compared to Costco, is a scenario similar to the one with Costco in 2017.

“Delta is our largest strategic partner. Our relationships with, and revenues and expenses related to, Delta are significant and represent an important source of value for our Card Members. We issue cards under cobrand arrangements with Delta, and the Delta cobrand portfolio represented approximately 10 percent of worldwide network volumes and approximately 21 percent of worldwide Card Member loans as of December 31, 2023. The current Delta cobrand agreement runs through the end of 2029, and we expect to continue to make significant investments in this partnership.” Annual report page 4.

Conclusion

I believe AMEX is a fantastic business that is currently priced fairly. It has unique characteristics that create virtuous circles among top-tier clients and merchants. It’s a company with a strong brand image and many growth drivers still ahead. Without a doubt, it will always be on my watchlist.