PM Images

Written by Nick Ackerman

Today, I wanted to give Gladstone Investment (NASDAQ:GAIN) an updated look, as it has been a while. Business development companies (“BDCs”) might have been performing strongly in a higher rate environment, but that doesn’t mean they still can’t deliver some strong yields when rates are cut. We aren’t expected to go back to a zero-rate environment, so that should help as well.

However, GAIN isn’t your usual BDC anyway, it is more of a unique BDC that never really benefited from a higher-rate environment. After their latest earnings showed some disappointment, shares slid lower, but this could be simply presenting an attractive time to consider investing in this name. This is more for a long-term investor who can handle the ups and downs that this BDC can take one on.

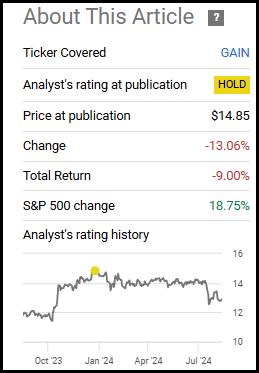

In our prior update, I went more neutral on this name with a ‘Hold’ rating. The valuation here just seemed too stretched. It seemed to be, at least partially, driven by euphoric feelings due to the several special dividends paid out last year, with the particularly large supplemental of $0.88 paid in December 2023. Results since then have been quite weak for GAIN, though we are already off from the lowest levels recently touched.

GAIN Performance Since Prior Update (Seeking Alpha)

A more tactical investor could have taken advantage of the highs it was reaching to sell out of the position and revisit at a lower price. That said, I do view GAIN as a long-term core portfolio position for me, so I’m not too keen on trading around it. Instead, I hold the position over the long term and look for opportunities to add, which I believe we are around now.

Latest Earnings Sour Price

Driving the price lower recently was the BDC’s latest earnings report; these results weren’t great, to say the least. We’ve seen some issues pop up in their portfolio and the net asset value per share declining primarily because of those issues. NAV declined from $13.43 to $13.01—though that is up from the $12.99 seen a year ago.

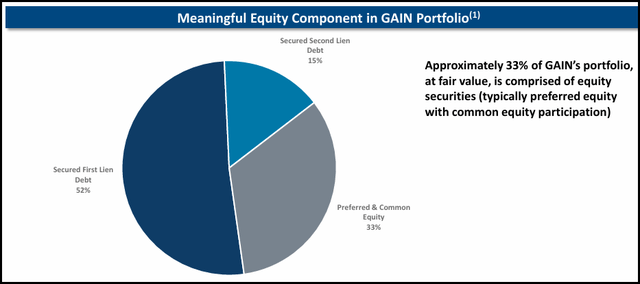

Before investing in GAIN, I think it is also important to understand that GAIN isn’t your usual BDC. It is a “buy-out” focused BDC with a rather narrowly focused portfolio of only 23 companies. They tend to provide all the financing for a borrower, which includes debt and equity, rather than being more focused on just secured first-lien loans.

GAIN Portfolio Breakdown (Gladstone Investment)

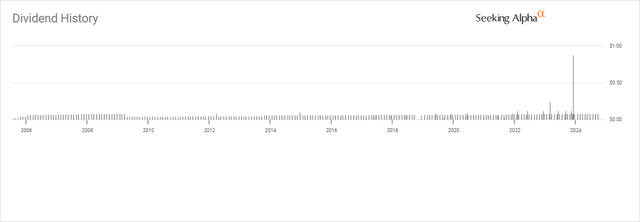

That allows for some more potential upside appreciation, which resulted in driving the larger supplemental seen last year. In total, GAIN paid an additional $1.48 in supplemental during calendar year 2023—which was in addition to the $0.96 in the regular monthly distribution paid at $0.08 per month.

GAIN Dividend History (Seeking Alpha)

In fact, for a few years, GAIN has been able to pay out some specials quite regularly. So not seeing any this year is giving some investors pause.

However, with this composition, it also tends to mean that NAV can be a bit more volatile, with greater overall risk to their operations. With only 23 total companies invested in, that means each one becomes more important to the success of the overall fund.

That can be compared to something like, for example, Blackstone Secured Lending (BXSL), which has 231 companies it is invested in. That makes each one become less important, where a few holdings can go on non-accrual, and it doesn’t provide for much disruption of BXSL overall.

With that being the case, we can see that a couple of new non-accruals have crept into GAIN’s portfolio and that resulted in a material increase in the total non-accrual percentage.

As of June 30, 2024, certain of our loans to B+T Group Acquisition, Inc., Diligent Delivery Systems, Edge Adhesives Holdings, Inc. (“Edge”), and J.R. Hobbs Co. – Atlanta, LLC (“J.R. Hobbs”), were on non-accrual status, with an aggregate debt cost basis of $86.1 million, or 13.1% of the cost basis of all debt investments in our portfolio, and an aggregate fair value of $46.8 million, or 7.8% of the fair value of all debt investments in our portfolio. As of March 31, 2024, our loans to Edge and J.R. Hobbs were on non-accrual status, with an aggregate debt cost basis of $59.1 million, or 9.0% of the cost basis of all debt investments in our portfolio, and an aggregate fair value of $29.7 million, or 4.8% of the fair value of all debt investments in our portfolio.

As we can see, two non-accruals going to four total in the latest earnings meant an increase from 9% to 13.1% of the cost basis. 9% is already quite high compared to other BDCs.

There is some positive news indicated by management, though. Of course, it is kind of their job to be optimistic; here is what they had to say in the latest earnings call:

Now, we currently have four companies on non-accrual, two of which we just put on non-accrual, which represent about 7.8% of the fair value of the debt investments in our portfolio. I really want to stress that this is not indicative of any portfolio-wide concerns. Two of these companies combine to represent approximately $32 million of the total amount of the debt. And both of these are now profitable. We anticipate returning these to accrual status sometime within the next year. We also have meaningful equity holdings in those two companies. So again, this will happen from time-to-time, but we work with these companies to get them back where they need to be. And again, I do want to stress that our portfolio is functioning at a very high level, and I’m not concerned about having these two companies just recently going on non-accrual status.

The main takeaways here are that they don’t see it being a portfolio-wide concern and that they expect these to be put back onto accrual before the next year is up.

Valuation Looking Better

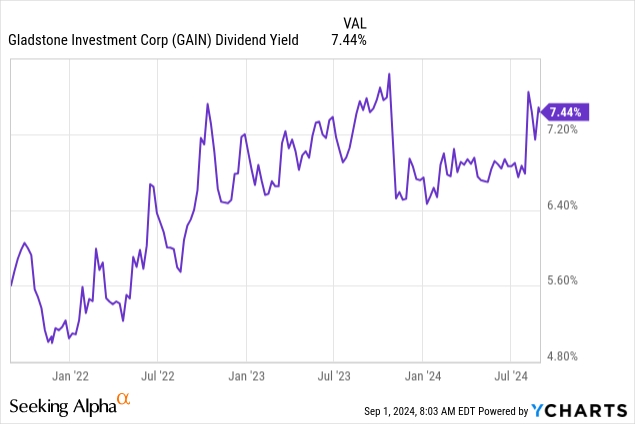

Another positive is that with the share price sliding based on these earnings, is that the price of GAIN has become a bit more attractive. First, the yield goes up due to the price going down. That is assuming they can maintain their current $0.08 monthly payout. Based on the latest $0.24 net investment income, it is just enough to be covered.

This narrow coverage really isn’t all that unusual, either. Last quarter, NII came in at $0.24. Last year, fiscal Q1 saw NII at $0.25, and fiscal Q1 2023’s NII was at $0.22. Going back to fiscal Q4 2022, which is actually calendar Q1 2023 – before the Fed began increasing interest rates – GAIN delivered NII of $0.26. So, for the most part, GAIN didn’t benefit materially from a higher rate environment as we saw with other BDCs.

Second, the discount/premium of the share price from the underlying NAV per share also moved closer to parity—specifically, it is trading at a -0.77% discount based on the latest closing price.

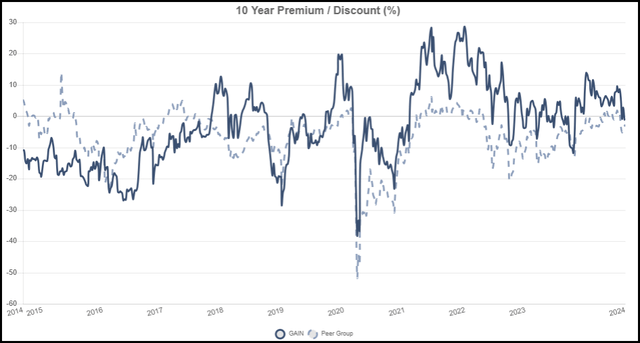

Historically speaking, besides the NAV itself being quite volatile, the discount/premium on this BDC can be quite volatile, too. However, the current level does reflect that GAIN could be a decent entry price because it has come down from some of the higher premium levels seen in the last five or so years.

GAIN 10-Year Discount/Premium (CEFData)

Of course, there is also the Covid pandemic period when the discount jumped materially. If one can predict a black swan event, one can simply wait for the next one before investing. While waiting, one is giving up all the potential dividends GAIN is paying.

Conclusion

GAIN is a unique BDC, but it may not be appropriate for everyone, given the higher allocation to equity positions. That can be compared to most other BDCs, which primarily focus on providing loans, often of the secured first-lien variety. That can lead to more volatility and risk from the underlying portfolio.

It was looking more expensive during our last update, but I feel more comfortable now that the price has retreated from the higher levels. GAIN dropped substantially on the back of a shaky earnings report. It started an initial recovery quite swiftly but has come back down again since. The current valuation provides an entry for long-term income investors.

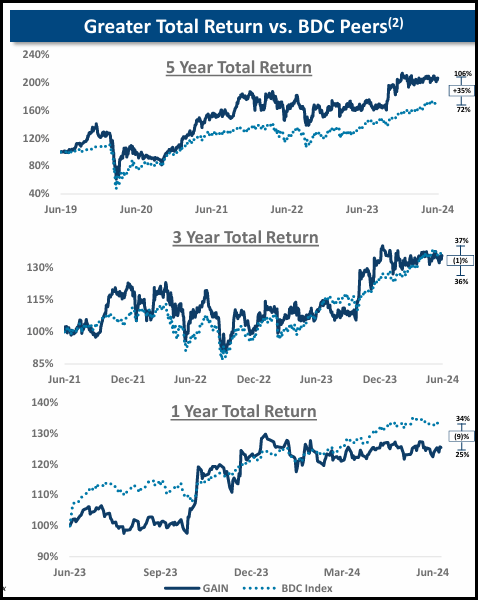

For investors who are willing to take the greater volatility, history has suggested that GAIN has delivered superior returns over the last five-year period.

GAIN Total Returns Vs. BDC Index (Gladstone Investment)

Of course, history is just that, history. There can be no guarantee this BDC can deliver the same results in the next five years that they did in the last. With a more concentrated portfolio, it does require management to be more prudent and to get much more right than they get wrong.