jetcityimage

Earlier this week, an article I wrote on why I believe Winnebago Industries, Inc. (WGO) is a sell was published here on Seeking Alpha. After looking at that company, it is clear that demand for RVs has dissipated greatly in short order, but the stock’s valuation was still considerably higher than the historical average. That historical average includes three of the best years in Winnebago’s history.

Peer Thor Industries Inc. (NYSE:THO) has had a slightly better performance.

THO Year-To-Date Returns (Seeking Alpha)

The stock’s year-to-date loss is about half of that of Winnebago’s, with Thor even eking out a 2% gain over the last year.

I find that Thor is the superior company to that of the rival, but it still operates in a highly discretionary environment where the typical purchase price starts in the $140,000 range.

This article will examine why I believe that the crux of my investment thesis for selling shares of Winnebago can also apply to Thor Industries Inc. (THO).

Takeaways from Recent Earnings Results

Thor reported third quarter earnings results for fiscal year 2024 on June 5th, 2024. While the report is several months old, there are several insights that can be ascertained by looking at the business.

Thor’s revenue for the quarter declined 4.4% to $2.8 billion, but did come in $74 million above estimates. Earnings-per-share of $2.13 was down slightly from the $2.24 that the company generated in the prior year, but this was $0.30 higher than expected.

Revenue for the North American Towable RV segment fell 4.7% to $1.071 billion. Volume improved 15.1%, but this was more than offset by a nearly 20% decline in average selling price. The company stated that the shift in pricing was mostly due to consumers electing to choose the lower-cost and more moderately-priced units.

Gross profit margin held up well and expanded 10 basis points to 12.9%. The backlog did decline 2.1% to $741 million.

North American Motorized RVs had a sales decline of 18.7% to $647 million. Product mix and net pricing was a positive 1.3% for the period, which, while low, was better than what competitor Winnebago was able to produce. The flip side was the volume suffered a steep decline, with units shipped falling almost 19%.

This caused gross margins to contract 60 basis points to 11.1%. The backlog was down almost 27% to $926 million.

European RVs was the best performer within the company as revenue grew 7.4% to $931 million. Shipments did fall 1.5%, but net selling prices improved 8.9% per unit. Gross margin held steady at 17.5%. The bad news is that this segment’s backlog was down more than 44% to $1.94 billion.

Thor revised its guidance for FY 2024 as well. The company now expects revenue in a range of $9.8 to $10.1 billion, down from $10 billion to $10.5 billion previously. Earnings-per-share are expected in a range of $4.50 to $4.75 compared to $5.00 to $5.50 previously. Both midpoints of the updated guidance are well below what consensus had projected. At the new midpoint, earnings-per-share would decline 34% from the prior fiscal year.

This is also the second quarter that the company has lowered its forecast for the FY, never a good sign. This type of downward guidance tells me that even management is not exactly sure what the near-term holds as their visibility is limited.

Valuation is Extremely Rich

And yet, the stock trades with a premium multiple. The new midpoint of guidance gives Thor a forward price-to-earnings ratio of 23. Lets look at how that valuation compares to the stock’s historical figures and to that of the company’s peers.

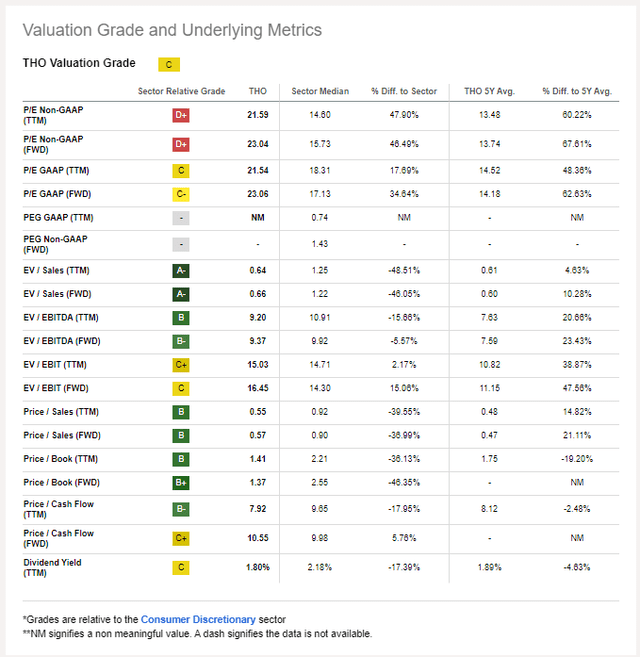

THO Valuation Metrics (Seeking Alpha)

The valuation is at a steep premium of 35% to the sector, but the gap is even wider when looking at Thor’s historical average. The stock has a five-year average multiple of 14.2 times earnings, which places today’s multiple at a nearly 63% premium to this average. In my opinion, this is wildly overvalued for a company that is expected to post a large decline in earnings-per-share this year.

For additional context, lets consider Thor’s valuation when business was booming coming out of the pandemic. From FY 2020 to FY 2022, Thor’s earnings-per-share grew from $4.02 to $20.59, which was one of the best growth rates in the entire market place during this period.

Even so, the average price-to-earnings ratio for that time period was 18.1, 7.3, and 4.0, respectively. Despite the surge in growth, the market was unwilling to pay up for the stock.

If that was the case during one of the best three year runs in the market, I fail to see why investors would be willing to pay a 63% premium to five-year average multiple today when earnings-per-share are expected to drop by a third this fiscal year.

Dividend Analysis

Thor does have a solid dividend track record, having raised its dividend for 14 consecutive years. Over the last decade, the annual growth rate has been a solid 7.2%, though that growth rate has slowed to 3.6% over the last five years. Given the weakness the company is experiencing, slowing dividend growth is unsurprising.

The dividend does look safe. The payout ratio for FY 2024 should be around 40%, which is higher than the long-term average of 23%, but not to a worrisome level.

Over the last year, Thor has distributed $101 million of dividends while generating free cash flow of $551 million. The free cash flow payout ratio is very reasonable at 18% and not too far off the average payout ratio of 16% for the prior four fiscal years.

Neither payout ratio looks to be in a dangerous range and the free cash flow payout ratio is extremely low so the dividend should be safe. Dividend growth, however, will likely continue to be on the lower side until business is able to grow. The stock yields 1.8% presently, but this is above the 1.3% average yield for the S&P 500 Index.

Risks to Investment Thesis

Looking at both Winnebago and Thor, I believe that the latter is the superior company. Thor performed much better in its most recent quarter than its top competitor. The company did see declines on the top- and bottom-lines, but it was not as painful as what Winnebago experienced. Thor also managed to top estimates for both figures.

Thor’s individual segments also faced less pressure, with the European business actually posting solid growth. With a slightly better performance, the margins did not fall off a cliff either.

These factors could prove my thesis incorrect, because Thor is, in my opinion, the best house on a terrible block.

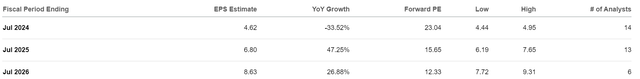

Analysts are expecting a return to growth over the next few years.

THO Earnings Estimates (Seeking Alpha)

While earnings growth of this magnitude would be a welcome sign, revenue is only projected to grow by a mid-single-digit percentage over this same period. Much of this expected earnings growth would have to come from margin improvements. This is one area that separates Thor from its rivals as it was able to protect its margins in the most recent quarter. If Thor can continue to do so, or even make some incremental gains, then earnings estimates could be as expected.

What does concern me about Thor is that, just like Winnebago, the backlog has been shredded. All three segments suffered drops in the size of the backlog. All told, Thor’s backlog decreased 34% from the prior year. This is an incredible drop in such a short time and demonstrates that demand for RVs just is not what it was.

Yes, higher interest rates have likely capped some of that demand. Interest rates are likely to begin to be cut as the Fed has indicated, but the timing and steepness of such cuts is not yet determined or at least not public knowledge.

Purchasing an RV is much like purchasing a second home for most people, so I remain skeptical that lowering interest rates alone will drive higher demand for a purchase that can be several hundred thousand dollars.

Final Thoughts

As solid as Thor’s business performed under the circumstances, it is going to be very hard for the company to overcome the demand issue.

Additionally, the company noted that consumers trended towards the lower cost models, providing some evidence that those who are in the market for a RV are trading down for cheaper versions. This combined with lower demand likely means that Thor, and the RV market as a whole, will continue to face substantial pressure to its business.

At the same time, investors are paying a significant premium for the stock while the fundamentals are deteriorating.

Therefore, I rate shares of Thor as a sell due to market pressures, weaker demand, and valuation.