Mihaela Rosu

SOFI Investment Thesis Remains Dirt Cheap At Current Levels

We previously covered SoFi Technologies (NASDAQ:NASDAQ:SOFI) in May 2024, discussing why we had maintained our Buy rating, due to the promising growth in its top/ bottom lines as the management executed the dual pronged growth as both an online bank and a fintech.

At the same time, investors must also temper their near-term expectations, with the stock likely to trade sideways until the company achieves substantial GAAP EPS profitability and the lending/ tech segment emerged as the top/ bottom line driver.

SOFI YTD Stock Price

Since then, SOFI has already rallied by +10.3%, well outperforming the wider market at +5.4%.

The same trend has also been observed in its fintech peers to varying degrees, thanks to their robust FQ2’24 performances – effectively reversing market sentiments surrounding fintechs after the painful meltdown after the November 2021 top.

SOFI’s Growing Financial Services/ Technology Platform Revenue Share

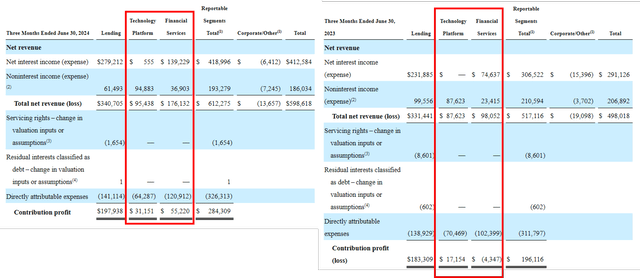

This is significantly aided by SOFI’s double beat FQ2’24 performance, with adj net revenues of $589.61M (-8.5% QoQ/ +18.3% YoY), adj EBITDA of $137.9M (-4.4% QoQ/ +79.5% YoY), and GAAP EPS of $0.01 (-50% QoQ/ +116.6% YoY).

Much of the growth tailwinds are attributed to the fintech’s growing Technology platform net revenues of $95.43M (+1.1% QoQ/ +8.9% YoY) and expanding contribution profit margins of 32.6% (+0.1 points QoQ/ +13.1 YoY).

The same has been observed in its Financial Services net revenues of $176.13M (+16.9% QoQ/ +79.6% YoY) and expanding contribution profit margins of 31.3% (+6.7 points QoQ/ +35.7 YoY).

Most importantly, SOFI Financial Services/ Technology Platform segment also comprises a growing portion of its net revenues at 45.3% in FQ2’24 (+3.3 points QoQ/ +8.1 YoY), naturally diversifying its revenue stream, with it “on track to finish 2024 with a revenue mix near 50:50.”

SOFI’s Performance Metrics

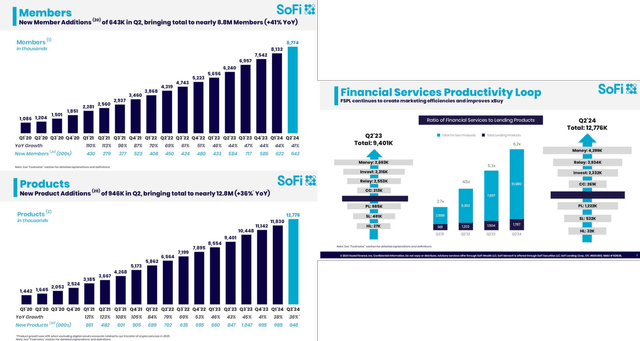

Its vertically integrated fintech platform continues to gain traction as well, with accelerating net member adds of 643K (+3.3% QoQ/ +10.1% YoY) and increased production adoption at 12.77M (+7.0% QoQ/ +35.8% YoY) – with the growing cross selling resulting in the much improved productivity loop at 6.2x in FQ2’24, compared to 5.3x in FQ2’23.

These developments highlight SOFI’s ability to generate growth as a well-diversified fintech platform across banking, personal/mortgage/student/auto loans, investments, insurance, and credit cards, as opposed to the online bank as discussed in our previous article here, allowing it to maintain its profitable growth trend despite the projected normalization in its interest incomes as the Fed pivots.

The Consensus Forward Estimates

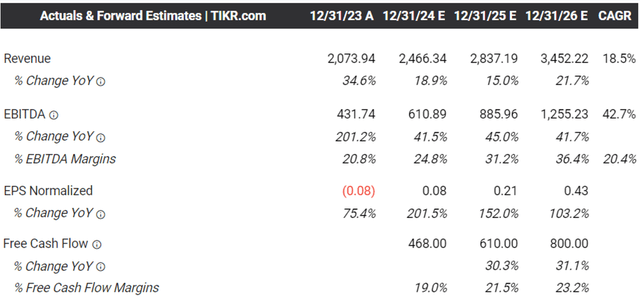

As a result, it is unsurprising that SOFI has already raised their FY2024 guidance with adj net revenues of $2.445B (+15.3% YoY), adj EBITDA of $610M (+41.2% YoY), and GAAP EPS of $0.095 (+126.3% YoY) at the midpoint.

This is up from the previous midpoint guidance of $2.41B (+13.6% YoY), $595M (+37.8% YoY), and GAAP EPS of $0.085 (+123.6% YoY), respectively, with it signaling the management’s confidence of bringing the fintech to a new level of profitable GAAP growth.

These developments are also why the consensus have moderately raised their forward estimates, with SOFI expected to generate an accelerated top/ bottom line growth at a CAGR of +18.3%/ +126.3% between FY2024 and FY2026, respectively.

This is compared to the top-line growth at +34.6% between FY2021 and FY2024, thanks to the vertically integrated fintech capabilities and the expansion in its lending/ credit card offerings.

On the other hand, it goes without saying that the market has priced in a 25 basis point cut in the upcoming FOMC meeting in September 2024, with it likely posing headwinds to SOFI’s Lending Segment net interest incomes – which currently comprise 46.6% of its overall net revenues (+0.1 points YoY), despite its ability to sustain robust growth in loan originations during an elevated interest rates environment.

At the same time, it is uncertain if SOFI may be able to sustain its 4.50% Annual Percentage Yield [APY] on its members’ savings balances, with any moderation potentially triggering the deceleration of its online bank growth.

Even so, as borrowing costs moderate, we may see the adoption of its Lending products grow, as the management expands into home equity products and small/ medium business loans segment, while building upon its existing BNPL and credit card offerings.

As a result, readers may want to pay attention to SOFI’s intermediate term execution, since it remains to be seen if it may be able to successfully tap into the potential housing market boom once borrowing costs moderate below the “magic mortgage rate” of 5%.

Lastly, the other metric readers may want to monitor may be the delinquency rate, one which has been gradually rising (or normalizing) to 0.47% by FQ2’24 (-0.3 points QoQ/ +0.16 YoY), one that we have similarly observed with numerous credit card lenders.

With the normalization of macroeconomic outlook likely to be prolonged, SOFI’s Provision for credit losses and Net charge-offs may also grow on a QoQ and YoY basis, potentially posing headwinds to its bottom-lines and balance sheet over the next two years.

So, Is SOFI Stock A Buy, Sell, or Hold?

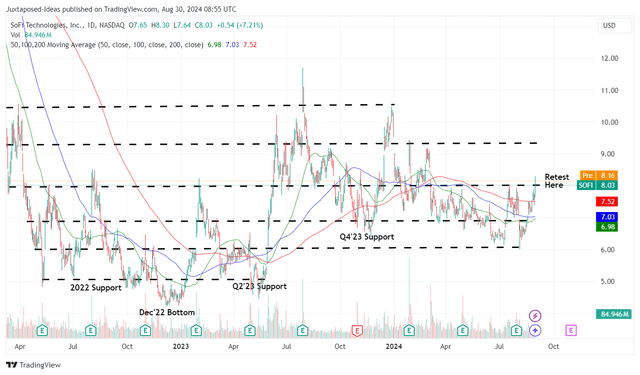

SOFI 2Y Stock Price

For now, SOFI has been charting a near vertical rally since early August 2024, while running away from its 50/ 100/ 200 day moving averages.

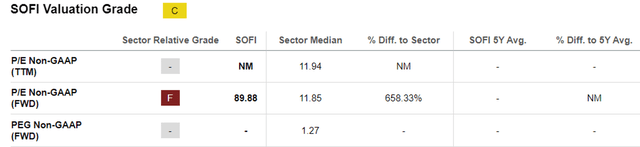

SOFI Valuations

Even so, we believe that SOFI at FWD P/E valuations of 89.88x is not overly expensive. This is especially when comparing its extremely cheap estimated PEG ratio of 0.0007x to the sector median of 1.27x, Block (SQ) at 0.44x, and PayPal (PYPL) at 1.33x.

This is based on the SOFI stock price of $8.03 at the time of writing, the FWD P/E of 89.88x, and the projected expansion in its adj EPS at a 2Y CAGR of +126.35%.

As a result of the overly discounted valuations and the prospects of profitable growth as the macroeconomic outlook normalizes over the next few years, we believe that SOFI continues to offer a highly compelling growth investment thesis for discerning investors.

We maintain our Buy rating here.