Hans Hansen

The Thesis

Since my last neutral article on Boise Cascade Company (NYSE: NYSE:BCC), the stock is down in single digits against a 6% rise in the S&P500. After a decent start to 2024, the second quarter reported a consolidated topline decline of 1% as the weak demand environment continued primarily due to elevated mortgage rates. I am expecting the company’s topline to remain under pressure in the remainder of 2024 due to the expected volume decline across most of the business and price decrease in EWP (Engineered Wood Products) and a few parts of the business, which should further result in lower sales in the quarter ahead. Longer term on the other hand remains favorable due to tailwinds from demographic trends and the company’s market position to benefit from this in the coming years. The company’s stock is available at a cheap valuation, however, due to persisting challenges in the near term, I would avoid BCC’s stock for now.

Last Quarter Performance and Outlook

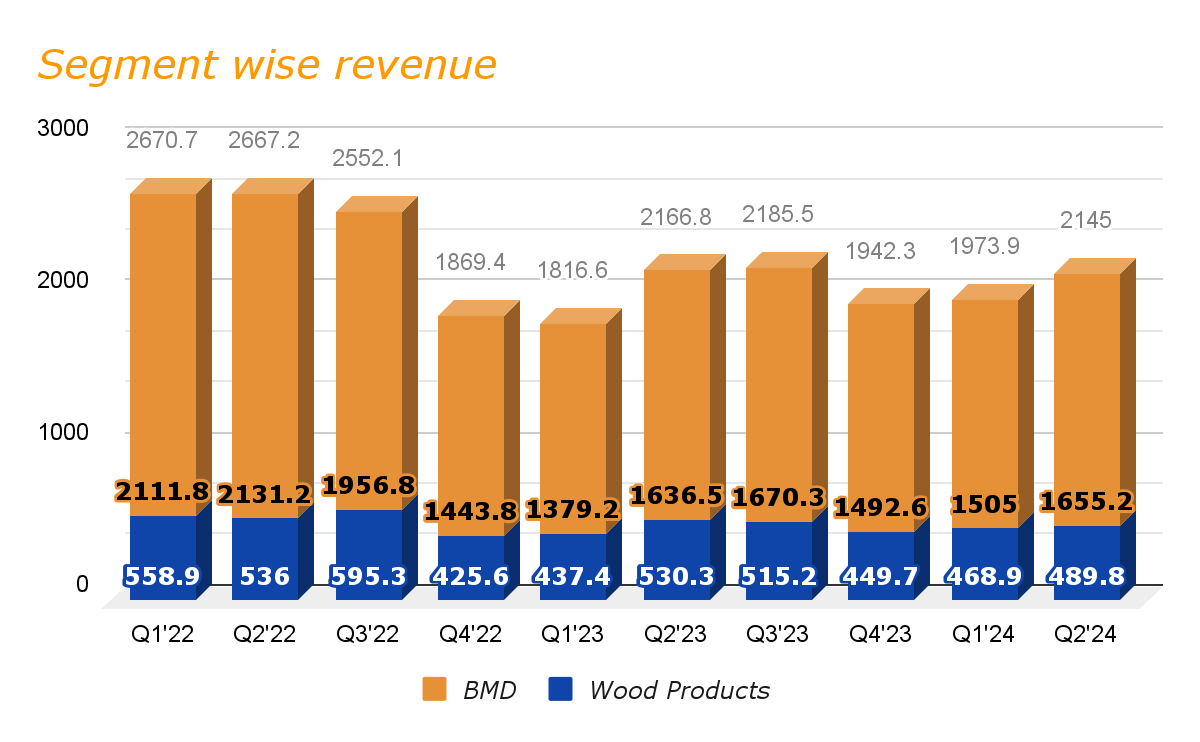

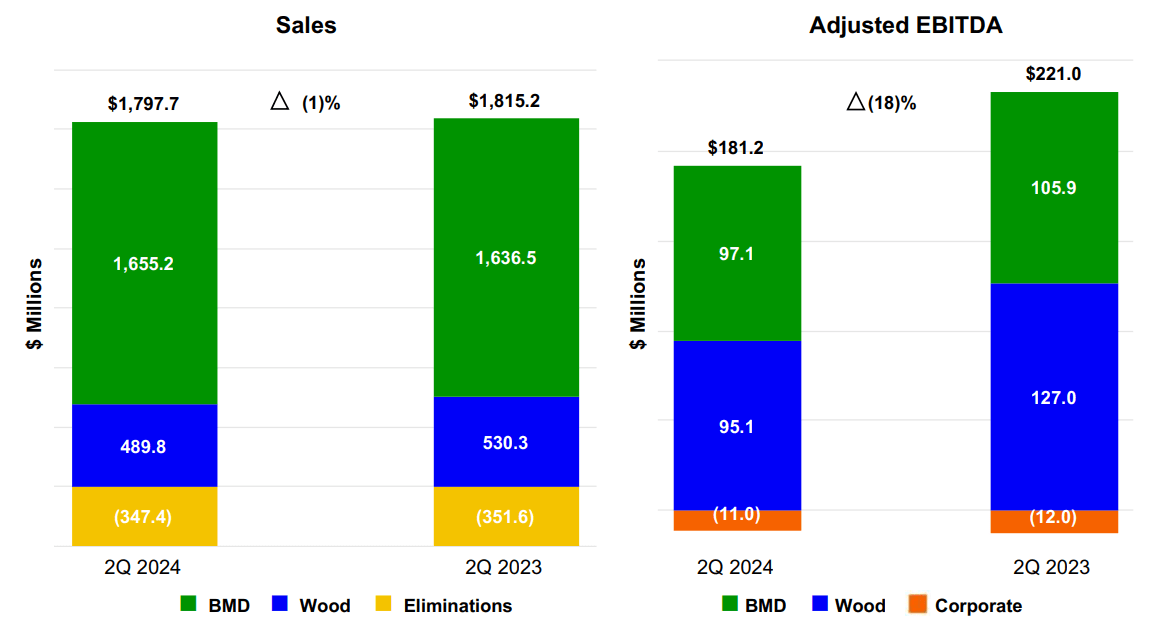

Moving into the second quarter of 2024, volume growth across general line products in the BMD segment continued to support the company’s top line in the weak pricing environment. EWP volumes in this segment were down 1%, however, continued to be supported by resilience and single-family starts, leading to a 1% growth in the segment sales to $1.7 billion more than offsetting the impact from price declines during the last quarter. Wood products segment on the other hand was down 7.6% year on year, as continued pricing pressure across I-joist and LVL more than offset the benefit from volume growth during the quarter. Overall, the company’s consolidated sales were almost flat with a year-on-year decline of 1% during the second quarter of 2024.

BCC segment-wise sales (Research Wise)

While the company saw volume growth across most parts of its business, the continued impact of pricing declines and higher wood fiber and conversion costs resulted in a 210 bps year-on-year decline in its consolidated EBITDA margin to 10.1% during the last quarter. Selling and distribution expenses also increased by approximately $11 million in the BMD segment which also negatively impacted the company’s margin during the last quarter. As expected, the decline in EBITDA also impacted the company’s bottom line which dropped to $2.84 during Q2 2024 from $3.67 a year ago, however, managed to beat the consensus estimates by $0.15.

Q2’24 result comparison (Company presentation)

The company saw a significant topline and margin contraction in FY 2023 as the demand environment across both segments remains influenced by the elevated mortgage rate and economic uncertainties. I expect these factors to continue to influence the end user’s purchasing decision in the quarters ahead until the economy cools down. In the last few quarters, BCC has seen a significant price decline across most of its business. In addition to this, a decline in the builder sentiment and weakening family starts and permit data due to ongoing affordability constraints for homebuyers, has slowed EWP order intake significantly. As a result, the company is expecting further price decline in the mid-single digits in the coming quarters, which should further impact the company’s topline in 2024.

The near-term challenges as I also mentioned in my previous articles on BCC still persist as the company is entering into the second half of 2024. However, not to forget, longer-term prospects remain strong primarily due to favorable housing fundamentals like underbuilt housing stock and rising homeowner equity. And, in my view, these tailwinds position the company strongly to capitalize in the future due to its significant local presence and nationwide scale. The company also continues to enhance its revenue potential by leveraging its extensive wholesale distribution network as well as focusing on longer-term capacity growth in the key markets including Kansas City and South Florida. To enhance its market position further, BCC also continues to explore underserved regions including South Central Texas and Carolina Coast, which should further support the company’s revenue growth in the coming years.

Overall, the near-term outlook remains challenging for the company due to the high-interest rate environment and unaffordability constraints among buyers, which along with further price decreases should continue to put pressure on the company’s topline growth in 2024. However, the longer term continues to be favorable for the company due to tailwinds associated with demographic trends and the company’s ability to capitalize on that in the coming years.

Valuation

I last wrote a neutral article on BCC in May’24 and since then, the stock has been down approximately 2%, while the S&P500 grew over 6.4% during this time. Currently, the company’s stock is trading at a Non-GAAP forward P/E ratio of 13.95, based on FY24 EPS estimates of $9.60, which represent a year on year decline of about 20% as we can see in the chart below. In comparison with its sector median average P/E, the stock appears to be priced at a significant discount.

BCC’s EPS estimates (Seeking Alpha)

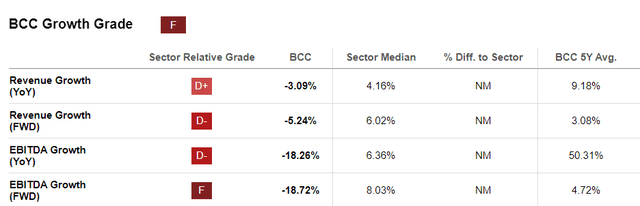

While the stock looks attractively priced but is still expensive considering poor growth prospects in the near term. I expect, the company’s topline growth to continue to struggle moving forward due to an unfavorable demand environment followed by elevated mortgage rates and reduced builder confidence. This should lead to lower volume in the quarters ahead, which along with the impact of reduced prices should lead to margin contraction in the coming quarter. This should result in the bottom line contraction, which should deteriorate the company’s stock valuation in the quarters.

BCC Growth grade (Seeking Alpha)

Conclusion

As discussed above, the company’s stock is currently trading at a decent discount versus its peers. In my view, the headwinds should continue as the company enters the second half of the year due to the weak demand environment across the business due to the high mortgage rate. Price also remains weak, and as the company is expected to implement further price decreases, the company’s margin should also remain under pressure going ahead. While the company’s stock is valued attractively, poor growth prospects in the near term suggest avoiding this stock despite its promising long-term. hence, I am staying with the HOLD rating on BCC’s stock.