Richard Drury

Written by Sam Kovacs

Introduction

Real estate has been the worst performing sector year to date, with the SPDR Select Real Estate Fund (XLRE) declining 7.5% while the S&P 500 has increased 7.5%.

At the beginning of the year, I proclaimed that “2024 would be the year of the REIT“. 5 months in, and I’m starting to look like the class clown. But I do not fear, as there are things I know which mean I can sleep well at night buying the highest quality REITs.

What things do I know, you may ask? I know that in the stock market, if you’re right too early, you’re effectively wrong. And we’ve been wrong in this respect, as we’ve been building up our REIT positions since the second half of last year.

But I also know that in the stock market, if you can afford to be wrong for long enough, you can end up being very right. What do I mean by this? There are two reasons an asset class can underperform: The first is erosion of value, the second is erosion of perception. In the case of erosion of value, you’re effectively the class clown for holding, as for every passing day your position will be worth less. This is when you hold a poor asset, like say Office Properties Income Trust (OPI), which has destroyed shareholder value and continued to slash the dividend, again and again.

OPI stock price (Dividend Freedom Tribe)

The second reason for underperformance, is the erosion of perception. This, I can live with, because perception is fleeting. Negativity abounded around REITs in 2023, only to see a renewed bullishness in Q4 of last year, which returned to bearishness as it became apparent that many (including myself) were too optimistic on the timing of rate cuts. John Keynes said that “the markets can remain irrational longer than we can remain solvent”. But is that true? After all, I don’t use margin. I buy high quality dividend stocks, which means I get paid to wait. In fact, I think I can remain solvent longer than the market can remain irrational.

In this article, I will demonstrate that the underperformance of REITs is due to an erosion of perception, not of value, as the highest quality assets continue to generate superior results despite elevated rates, and that therefore the gaps in valuation become a source of value which will be unlocked not if, but when the Fed goes through with rate cuts.

Reviewing the top 10 REITs earnings

We’re in the middle of earnings season, which always keeps me particularly active as I cover 120 stocks and make it my mission to stay on top of every single one of them.

I have fun going through all the quarterly memos that my assistant prepares for me on these stocks. My assistant doesn’t seem to have such fun, but well, that was never in the job description. But I digress…

If we look at the top 10 holdings of the XLRE, we’ll notice that they constitute 60% of the index. As such their results will be a sufficient proxy for the results of the XLRE fund at large, which is often used as a proxy for real estate stock market performance.

XLRE top 10 (Seeking Alpha)

Let’s take a quick look stock by stock at their results, to prove that the top real estate stocks are doing just fine.

Prologis

Prologis (PLD), the industrial warehousing giant, beat analyst estimates on both top and bottom lines. This was dampened somewhat by softening full year guidance as leasing activity remains somewhat below historical levels as clients wait out for a lower rate environment. The CEO said: “While operating conditions are healthy in the majority of our markets, customers remain focused on controlling costs, which is weighing on decision making and the pace of leasing“.

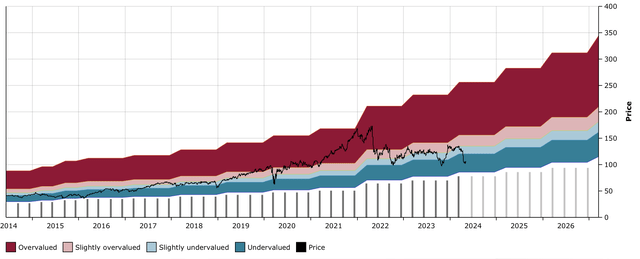

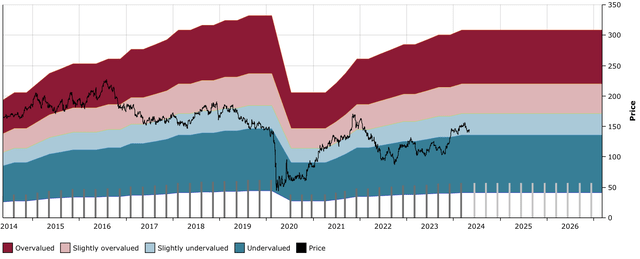

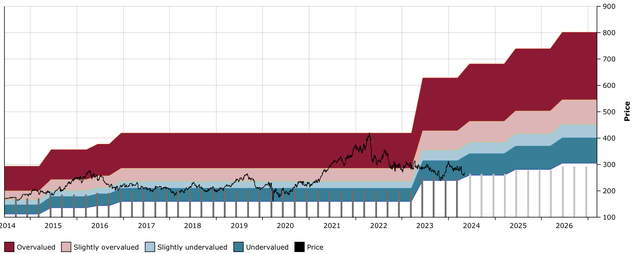

PLD DFT Chart (Dividend Freedom Tribe)

The stock price fell dramatically on the news, despite the fact that occupancy is at 97%, results came in above guidance, and the REIT continues to do well in the environment.

PLD isn’t our favorite industrial REIT, but there is no denying they are doing well.

American Tower Corp

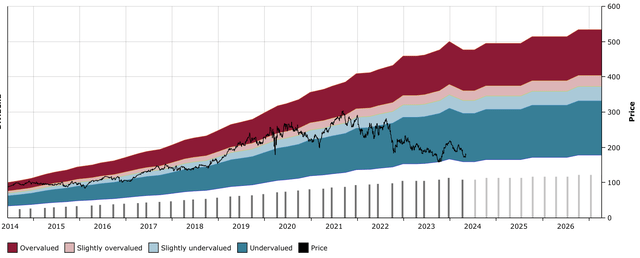

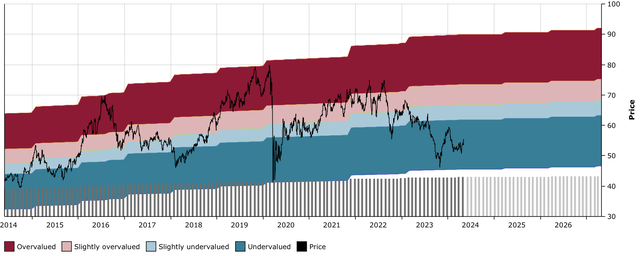

American Tower Corp (AMT) the cell tower REIT, beat both top and bottom line estimates, and lifted its estimates for the full year, as strong demand propelled AFFO up 10% YOY. After a period of sluggish results, this quarter came out better than expected, showing that the REIT can continue to operate very well even in a higher rate environment.

AMT DFT Chart (Dividend Freedom Tribe)

Equinix

Equinix (EQIX) hasn’t yet reported, nor have they communicated a date to report earnings. I wonder if this has anything to do with the short report which came out a month ago, as they usually report earnings by now. Unfortunately, they can’t be included in this analysis because of this.

EQIX DFT Chart (Dividend Freedom Tribe)

Welltower:

Welltower (WELL) beat on earnings, and boosted its full year guidance as the senior housing business exceeded expectations. Like the CEO said in the earnings call:

the demand supply backdrop for Senior Housing gets better with each passing day.

FFO was up 19% YoY. The higher interest rates are limiting new supply coming onto the markets, which is playing in the firm’s favor.

WELL DFT Chart (Dividend Freedom Tribe)

The stock is trading near ATHs and looking to breakout.

Simon Property Group:

Simon Property Group (SPG), the premium mall REIT, beat on both bottom and top lines, and raised guidance for the year. David Simon, CEO, pointed out that leasing growth and cashflow momentum continued to increase in 2024.

SPG DFT Chart (Dividend Freedom Tribe)

David Simon was upbeat throughout the earnings call:

Needless to say, I’m very pleased with our first quarter results and our business and tenant demand continues to remain strong despite a cloudy macro-environment. Occupancy is increasing. Property NOI is growing. We made a significant profit on our ABG investment and everything is kind of moving in all the right directions.

Realty Income:

Realty Income (O), the quintessential dividend stock, beat on both earnings and revenues and reaffirmed its full year guidance.

O DFT Chart (Dividend Freedom Tribe)

The CEO commented:

Underpinning the health of our balance sheet is continued stability in our high-quality portfolio. In the first quarter, occupancy remains stable at 98.6%, we delivered a rent recapture rate of 104.3% on properties re-leased, and we generated same store rental revenue growth of 0.8%. We believe our diversified portfolio of investments generates consistent recurring cash flow to support dependable monthly dividends that grow over time. In March, we announced our 124th common stock monthly dividend increase since Realty Income’s listing on the NYSE in 1994

Digital Realty:

Digital Realty (DLR), the data center REIT, saw FFO top consensus, had a record quarter in terms of leasing, saw cash spreads of 11% and raised its guidance, thanks to strong AI demand.

DLR DFT Chart (Dividend Freedom Tribe)

Crown Castle:

Crown Castle (CCI), AMT’s main competitor, beat estimates on both bottom and top lines, and reaffirmed their guidance.

CCI DFT Chart (Dividend Freedom Tribe)

Public Storage:

Public Storage (PSA), the self storage company, is an exception on this list, as FFO declined sequentially and year over year as the company missed analyst estimates amid rising costs and deteriorating margins.

PSA DFT Chart (Dividend Freedom Tribe)

Note this isn’t massive underperformance, and its close peer Extra Storage Space (EXR), beat on both top and bottom lines, and both firms pointed towards improved sequential occupancy as we move towards the busy season.

Costar Group:

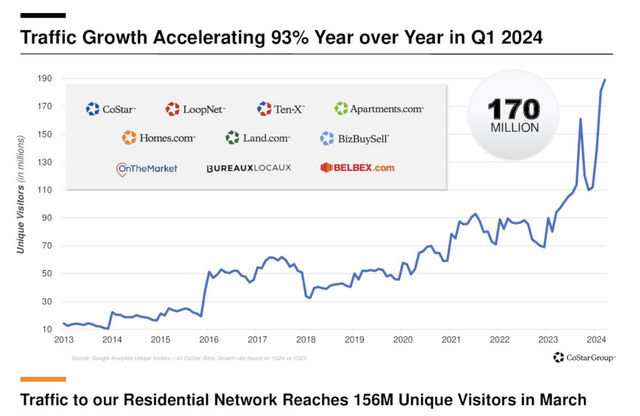

Costar group (CSGP), the real estate information and analysis platform (not technically a REIT), beat on both top and bottom lines, with traffic to its group of residential websites accelerating 93% year over year.

CSGP Investor Presentation

Piecing it all together:

Out of the 10 largest constituents of the XLRE, 9 have reported earnings, 8 have beaten estimates, and just 1 has adjusted guidance lower.

The argument we have been making for a long time, is that there are many industries that make up the real estate sector, and they have very different fundamentals. In just this list alone, there are industrial REITs, data center REITs, cell tower REITs, retail REITs, mall REITs and self storage REITs.

I have written extensively about the need to avoid office REITs as the demise of the US office is going to be a slow-motion trainwreck. The belief however, that higher rates compromises all REITs is just plain wrong. Many REITs have low interest rates locked in for many years, and are seeing a strong, resilient economy continue to lead to business growth.

I know this is a lot of information to come to this conclusion, but I believe it is necessary. Now for the good stuff! Below are 2 REITs which I believe are bargain buys, and I’m buying hand over fist after the recent sell-off.

Buy #1: Alexandria Real Estate

Do you remember last year, when Jonathan Litt, the CIO of Land & Buildings, showed his lack of understanding of the life sciences business model on CNBC’s Fast Money?

He said that Alexandria Real Estate (ARE) was no different than any other office REIT and should be valued as such.

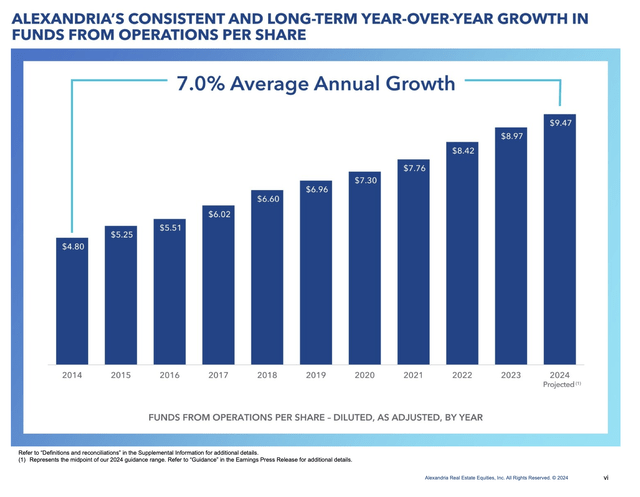

Well, ARE just reported its 1st quarter earnings, and revenues have increased by 9.7% year over year, and FFO by 7.3%. Rent collection stands at 99.8%.

ARE Investor Presentation

FFO has continued to increase like clockwork at a 7% CAGR for the past decade.

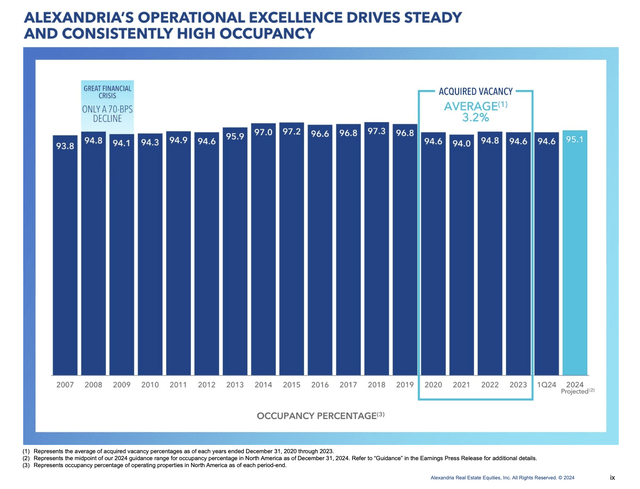

And its occupancy remains in line with the past 15 years, at 95%.

ARE Investor Presentation

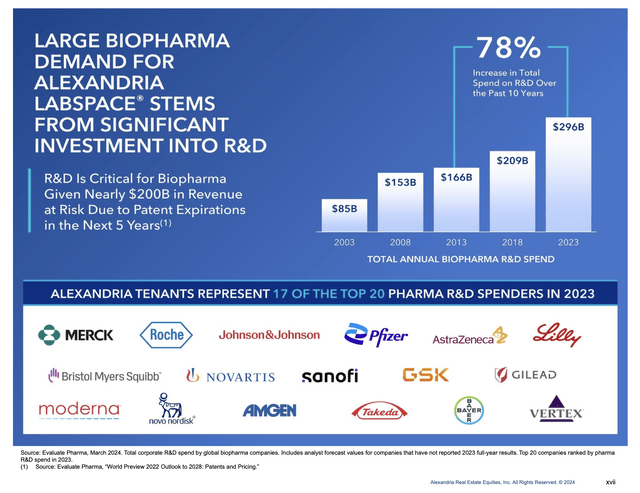

I’ve been making the case that demand for ARE’s properties is evergreen and ever growing, due to the wonderful feedback loop that exists in BioPharma:

- Pharma company spends money in R&D, finds a cool drug.

- Cool drug makes bags of money.

- Pharma company wants more bags of money, it reinvests profits in R&D.

- R&D increases, so does the lab space required.

It’s as simple as that, but the spend on R&D has increased by 78% in the past 10 years, and has tripled in the past 20 years.

ARE Investor Presentation

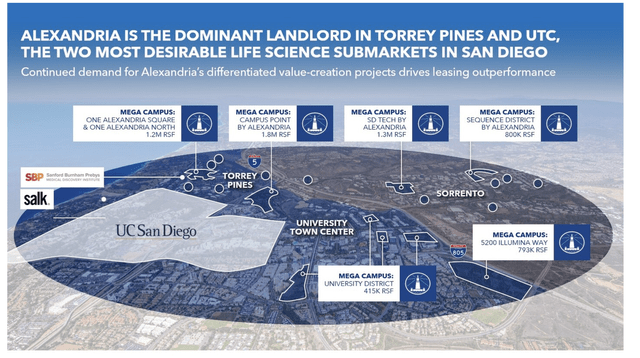

There is no reason this is going to stop anytime soon. Alexandria has some of the best life science labs located within walking distance from the best universities in the US, which makes them prime locations.

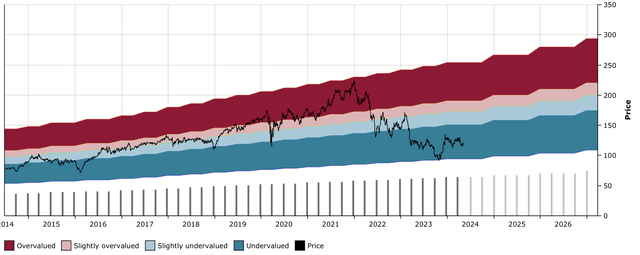

Yet ARE trades at $119 and yields 4.2%. This year the dividend increased by a satisfactory 5%.

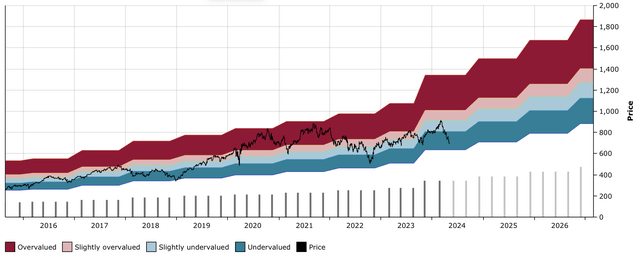

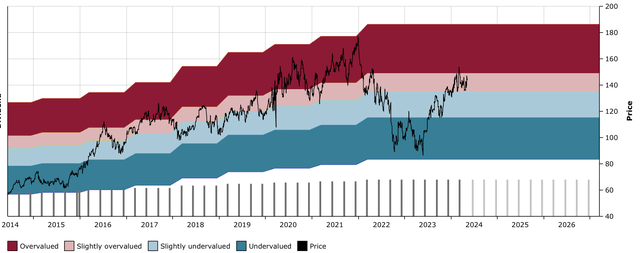

ARE DFT Chart (Dividend Freedom Tribe)

The concerns that life sciences buildings would see a glut failed to understand the dynamics surrounding such buildings. ARE’s buildings are for the most part very close to universities like I said before, and the pharma companies want to be close to these campuses.

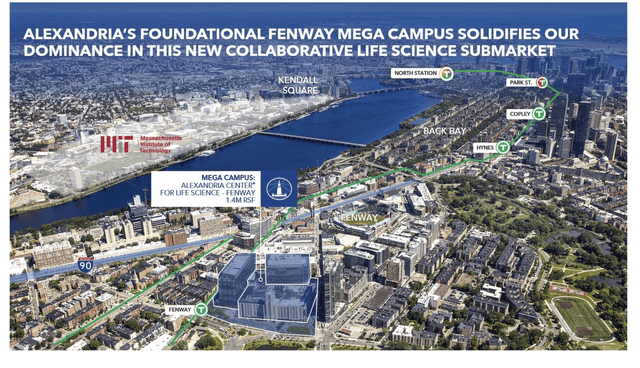

The pictures below highlight this:

ARE Investor Presentation

ARE Investor Presentation

ARE Investor Presentation

Assets such as these give ARE a large moat, a first movers advantage, and the scale to continue to dominate in their market. The Fenway asset was 17% occupied before ARE acquired it, stuck their brand on it, stabilized it, and made it a fully leased out space.

Its just a matter of time before ARE returns to its 10 year median yield of 3%, which would suggest a $175 price target. In the mean time you get paid a good amount to wait.

Buy #2: Omega Healthcare Investors

Omega Healthcare Investors (OHI) has gone from being a dividend investing darling at Seeking Alpha to a bit of a laggard.

The “silver wave” or “silver tsunami” argument that the ageing population would create lots of demand for OHI’s skilled nursing facilities, seems to have not played out as fast as you would have imagined.

The biggest question around OHI has been its dividend sustainability. Since the pandemic, it hasn’t increased its dividend once.

This past quarter the firm generated $0.68 in AFFO, or $0.65 in FAD (funds available for distribution), which left the FAD payout ratio at 103%. This is all management had to say about this:

Our dividend payout ratio, of 103%, remains slightly elevated, but should drop into the mid-90% range in the upcoming quarters.

Let’s look back at what management have said about the dividend in the previous 4 quarters:

- Q4 2023: “Full year FAD was $2.62 per share, slightly below our full year dividend of $2.68 per share, resulting in a payout ratio of 102%.”

- Q3 2023: “The third quarter FAD, funds available for distribution of $0.68 per share was better than expected, modestly exceeding our $0.67 per share dividend. The FAD dividend payout ratio is 99%.”

- Q2 2023: “The FAD dividend payout ratio is 96%. The large increase in FAD is primarily due to the resumption or increase in rent from cash basis operators”

- Q1 2023: “As expected, our first quarter per share FAD, Funds Available for Distribution of $0.60 per share was less than our quarterly dividend of $0. 67 per share, resulting in a dividend payout ratio of 112%. We expect that the dividend payout ratio will rapidly improve as Agemo resumed paying quarterly rent” “I’m not building in any of the pipeline to get below the 100% by the end of the year”.

It is the first time in a while that management has stated that they now expect the FAD to exceed the dividend in upcoming quarters.

With revenue up, key tenant occupancy continuing to improve, it seems OHI might be just about ready to turn the corner regarding the safety of its dividend.

Management has been committed to keeping the dividend as long as they could afford to pay it, even when FAD came up a little short. I see more confidence now than ever that this will work out for them.

Occupancy is nearly back to pre-pandemic levels:

Occupancy for our overall core portfolio has continued to recover from a low of 74.6% in January of 2022 to 80.8% as of mid-April of 2024, based upon preliminary reporting from our operators. For comparative purposes, occupancy for our core portfolio was 83.2% for the fourth quarter of 2019, just prior to the onset of the COVID pandemic.

Management’s character is truly shown in hard times. OHI has had its fair deal of troubled tenants and then some, but management has proven its skill and expertise in dealing with these tenants, and working out arrangements which would lead to the REIT managing to keep going, and keep paying the dividend.

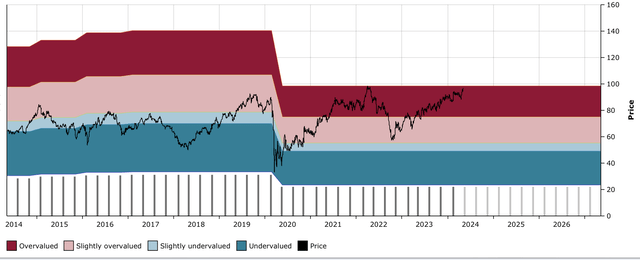

OHI yields 8.6%, which is just above the 10 year median of 7.8%, and exactly at the 5 year median yield.

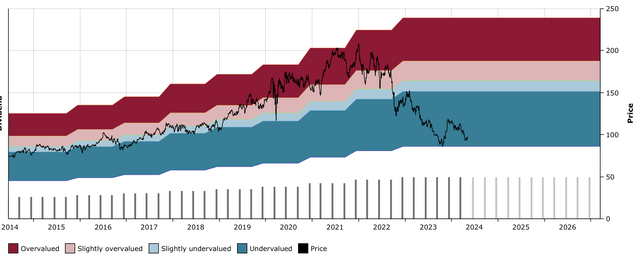

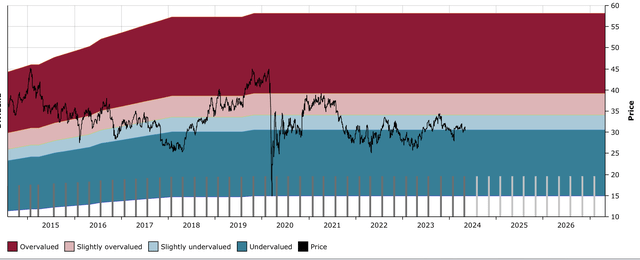

OHI DFT Chart (Dividend Freedom Tribe)

The market is not pricing the probability of a dividend cut higher than it has in the past 5 years. But it should be pricing the reduced probability of a cut, now that the numbers are on the verge of getting better.

OHI is likely not going anywhere until rates are going down, but in the meantime you get to get paid 8.6% to wait. I’m happy to bank on that, and know that when rates eventually come down, and real estate stocks inevitably go up, OHI will likely return to a 6.5% to 7% yield, providing some capital appreciation to top off all the dividends.

Conclusion

In October 2023 we reached peak bearishness for REITs. I believe that this might have been reached once again in 2024. Rate cut expectations have been decimated, and we’ve integrated a hawkish Fed into market views.

It is very likely that this marks a great entry point into REITs. If you can buy low, and get paid to wait, does it really matter if you have to wait for a while before selling high?