John M Lund Photography Inc

GBTC loses its crown as the largest Bitcoin ETF: will Grayscale pivot?

Earlier this year, I covered the Grayscale Bitcoin Trust ETF (NYSEARCA:GBTC) as well as other Bitcoin ETFs. Back then, the GBTC ETF was the largest Bitcoin ETF by Asset Under Management (AUM), despite its uncompetitive 1.50% expense ratio, more than 5 times higher than competition.

The situation in terms of AUM has changed since April, and significant outflows from the Grayscale Bitcoin ETF (worth around 20% of the fund) have made GBTC lose its crown in favor of the iShares Bitcoin Trust ETF (IBIT). Grayscale’s GBTC ETF is still the second-largest Bitcoin fund at the time of writing, and now competes with Fidelity Wise Origin Bitcoin Fund ETF (FBTC) for the third place on the podium by AUM.

Prior to its conversion to an ETF in 2024, the Grayscale Bitcoin Trust was launched in 2013 and represented one of the first publicly listed products that investors could use to get exposed to Bitcoin (BTC-USD). At the time, a 1.50% expense ratio was justified, in my view, given the lack of competition and how exotic Bitcoin was as an asset class. Nowadays, investors who have held GBTC when it was trading at a discount against its Bitcoin holdings have better options to cash out and/or hold onto their Bitcoin.

Given its history, I am still keeping an eye on GBTC to see whether Grayscale will pivot by lowering its fees to make the fund more competitive. I expect Grayscale to seriously consider this pivot, given how radically the market for Bitcoin financial products has changed since 2013. Three Bitcoin ETFs have already lowered their expense ratio since their launch earlier this year – something I will cover in the next section.

However, at this point in time my recommendation concerning the GBTC ETF remains that of last time I covered this fund: I see no reason to invest in Bitcoin via GBTC, due to its very uncompetitive expense ratio. Investors who have it in their portfolio may opt to hold for a few more months, to see whether Grayscale will indeed review its expense ratio to promote the fund.

Bitcoin ETFs’ AUM growth: a signal of moderate retail interest

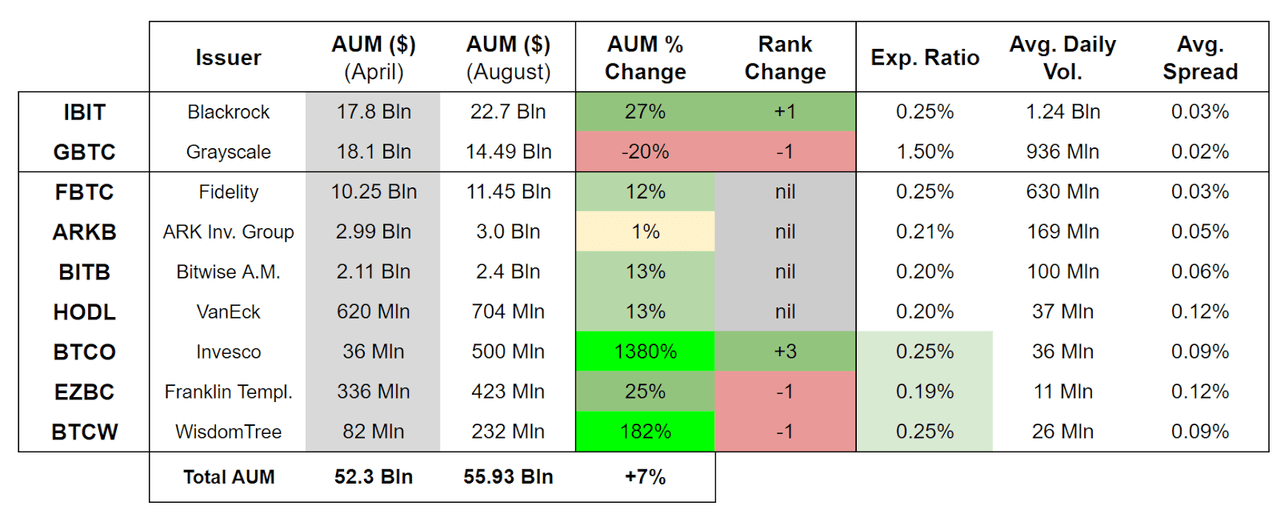

Bitcoin ETFs comparison, key metrics (Author’s elaboration of Seeking Alpha and Trading View data)

The above table shows the evolution of inflows and outflows for the largest 9 Bitcoin ETFs in the market since April this year (the time I first published this chart).

The loser of the Bitcoin ETF “battle” over the last 4 months has been – unsurprisingly – Grayscale’s GBTC ETF, with a loss of 20% in terms of AUM. The winner in my opinion is IBIT, which I continue to see as the best option to hold Bitcoin, partially because of BlackRock’s marketing and strategic focus on this fund.

I am also calling out the Invesco Galaxy Bitcoin ETF (BTCO) and its impressive performance, growing AUM by a factor of 13 in less than 4 months. I see this growth as a direct result of Invesco’s choice to lower BTCO’s expense ratio to 0.25%, matching that of IBIT.

Similarly to Invesco, WisdomTree also decided to lower the expense ratio of its BTCW fund to 0.25%. Franklin Templeton did similarly as well, with the expense ratio of the EZCB ETF now the lowest among the nine ETF in consideration, at 0.19%. I still do not consider either of these two ETFs as the best options for investors, given their somewhat limited liquidity.

Overall, I interpret the total inflows of around 7% in these ETFs as a sign of moderate interest from retail investors for Bitcoin. I also see the expense ratio competition among Bitcoin ETF issuers as moderately bullish for Bitcoin. I will cover in more details my thoughts on Bitcoin price action in the next section of the article.

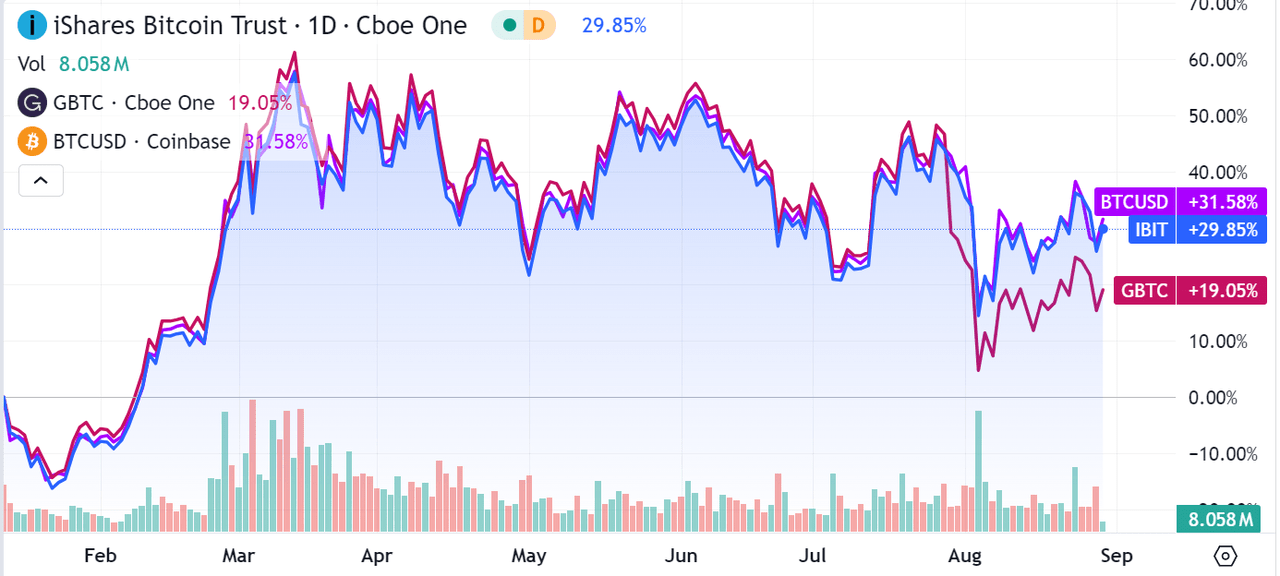

BTC, GBTC and IBIT performance, YTD (Seeking Alpha)

Going back to GBTC, I have already mentioned I do not see this fund as a viable tool to invest in Bitcoin. My recommendation is further confirmed by the Year-to-Date performance of Bitcoin against the IBIT and GBTC ETFs.

As displayed in the above chart, GBTC is underperforming its only underlying holding (Bitcoin) on an YTD basis due to its high management fees. The fund is also underperforming IBIT, which has been closely tracking Bitcoin’s performance thanks to its lower 0.25% expense ratio.

Entering Bitcoin now: retail interest won’t be enough, but I’m still optimistic

Moving beyond GBTC and into Bitcoin itself, I will spend the next few paragraphs to provide my thoughts on Bitcoin price action and whether I see the $ 60,000 per Bitcoin price level (Bitcoin’s price in USD at the time of writing) as an interesting entry point.

First, to take a step back: I see Bitcoin as an asymmetric bet on its potential to mature into a global reserve asset, partly replacing gold and reserve currencies currently held by central banks and governments.

Purely from a technical perspective, I think Bitcoin has all the characteristics needed to become a currency:

-

It’s durable, stored on the blockchain and resistant to physical degradation.

-

It’s divisible, with each Bitcoin able to be broken down into 100 million smaller units, called “Satoshis.”

-

It’s fungible, allowing any unit of Bitcoin to be exchanged for another.

-

It’s portable, enabling easy digital transfer across the globe.

-

It’s verifiable, with ownership and transaction history transparently recorded on the blockchain.

-

It’s scarce, with a maximum supply limit of 21 million Bitcoins.

However, from a political perspective, it still remains to be seen whether institutions such as governments, central banks, pension funds and retail banks will actually start adopting it as a reserve asset. Until that happens, Bitcoin remains a high risk asymmetric bet, in my opinion.

In this context, I see Bitcoin’s price action in the last few months as a time of accumulation from retail investors in wait for institutional adoption. In other words, I believe retail investors are holding Bitcoin (via ETFs, Exchanges or self custody), waiting for institutional investors to start buying and for the cryptocurrency to mature.

I base the above assessment on data about moderate ETF inflows (which I reviewed earlier in this article), as well as on-chain data. More specifically for on-chain data, I am considering the following two indicators:

- The number of Bitcoin active addresses, which saw a ~20% decline since the beginning of the year. This indicates, in my view, how retail investors are holding Bitcoin rather than trading or using it.

- The quantity of Bitcoin on exchanges, which is near 4 year lows. This indicates, in my view, retail investors moving their holdings in cold storage for long term holding.

Overall, I reiterate my bullishness on Bitcoin as an asymmetric bet and I see current price levels as a good entry point. My bullish case for Bitcoin sees it maturing to match the market capitalization of gold, at roughly $650,000 per Bitcoin. My bearish case sees the cryptocurrency staying stuck in a tug-of-war between bulls and bears, and Bitcoin trading in a range between $ 40,000 and $ 100,000 per coin. I covered in more detail my bullish and bearish scenarios for Bitcoin in a past article, that I invite readers to consult should they be interested in gaining exposure to Bitcoin.

Risks to my thesis

Bitcoin remains a highly risky asymmetric bet. Even if I believe Bitcoin has the technical properties needed to be a great global reserve asset, it does not mean it will actually be adopted as such on a global scale.

Whether or not Bitcoin will mature into a global reserve asset ultimately depends on geopolitics, political decisions and considerations from major global institutions. In other words, Bitcoin success ultimately depends on a human factor that is by definition very difficult to quantify and assess.

I recommend people not to be overexposed to Bitcoin, and carefully consider whether the level of volatility and risk of this bet is consistent with their investment objectives and risk tolerance.

In relation to GBTC, the main risk to my thesis is that Grayscale might pivot and lower the expense ratio of its fund to a very competitive level. If that were to happen, investors might eventually be better off holding GBTC rather than my current recommendation, IBIT.

Conclusion

I continue to see Bitcoin as an asymmetric bet on the cryptocurrency maturing into a global reserve asset. I do not believe Bitcoin will ever completely replace currencies in daily use, nor I think it will ever be used significantly in global commerce. However, I do see Bitcoin as a great (and better) alternative to gold and the US dollar in its capacity as global reserve currency. My bullish case sees Bitcoin maturing to match the market capitalization of gold, and reaching roughly $650,000 per Bitcoin.

For the last four months, Bitcoin price action has been disappointing for investors expecting the cryptocurrency to rapidly mature into a global reserve asset. Based on inflows into Bitcoin ETFs and on-chain data, I believe Bitcoin retail holders are indeed “HODL’ing” their Bitcoin for the time being, waiting for institutions to start adopting it.

As a result, I see the current price levels of Bitcoin as a good entry point to take this bet, given the potential upside in my bull case. However, investors should be wary of the risk in taking this bet. Bitcoin eventually reaching maturity depends on human factors, which is extremely difficult to predict and assess.

In this context, Bitcoin ETFs are in my view the best way for retail investors to gain exposure to Bitcoin. However, the GBTC ETF is not a good choice at the time of writing, due to its high expense ratio, at 1.50%. I do expect Grayscale to reconsider its fees and potentially pivot to make its Bitcoin fund competitive on the market. Should that happen, I will review once again GBTC and my “HOLD” recommendation.