Alvin Man/iStock Editorial via Getty Images

Since I last wrote about International Consolidated Airlines Group (OTCPK:ICAGY) (OTCPK:BABWF) or IAG in August last year, its price has risen by just 8.7%. By comparison, the S&P 500 (SP500) has risen by almost 15% since, indicating the stock’s appreciable lag.

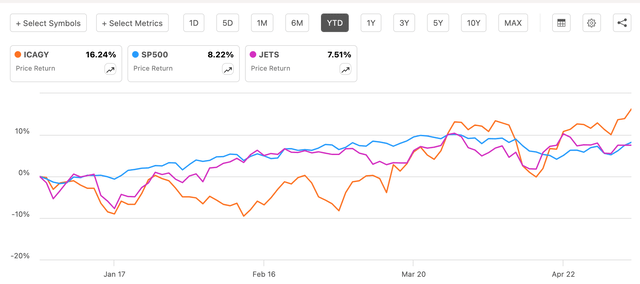

But here’s an interesting price trend more recently. Year-to-date [YTD], not only has its rise outstripped the S&P 500, but also the aviation ETF, the U.S. Global Jets ETF (JETS) (see chart below). With IAG’s first quarter (Q1 2024) results due on May 10, the question now is whether the stock can maintain its lead.

YTD Returns – IAG, S&P 500 and JETS (Source: Seeking Alpha)

Strong growth possible in Q1 2024

The company’s outlook is certainly encouraging. Along with the release of its full-year results in February, it mentioned that it is 92% booked for Q1 2024. In 2023, the company’s seat factor and the passenger load factor were at 83.7% and 83.5% respectively, by comparison.

This is a positive for the upcoming results. To estimate the revenues for the quarter, here I’ve assumed the following:

- The booking levels mentioned in the results are a reflection of the seat factor expected in Q1 2024, which is the proportion of revenue passenger kilometre [RPK] in the available seat kilometres [ASK].

- The passenger revenue per RPK is assumed to be at 8.6 cents, the same as in Q1 2023, keeping in mind seasonality in pricing.

- The ASK is expected to remain constant from Q4 2023, at 80.8 billion, just to stay conservative even as IAG expects capacity expansion this year.

- The ratio of cargo and other revenues to passenger revenues remains constant from 2023 at 14.1%.

These assumptions indicate that the company can report revenues of EUR 7,322 million, a 24.3% year-on-year (YoY) increase. This is a small drop from the 27.7% rise seen for the full year 2023 and a much bigger 71.4% seen in Q1 2023. But considering that the company, and the airline sector as such, was still normalising from the post-pandemic last year, it’s more instructive to look at the Q4 2023 revenue growth instead, which had slowed down to 13.1%. So the number is a significant uptick from that time.

Next, assuming that the operating margins and net margins remain constant at 2023 levels of 11.9% and 9%, respectively, IAG would report an operating profit of EUR 872 million and a net profit of EUR 660 million. By comparison, in Q1 2023, the company’s operating profit was a small EUR 9 million and it had reported a net loss.

I would like to mention, though, that my projections are rather bullish compared to analysts’ estimates on Seeking Alpha. On average, they assume just 5.5% revenue growth. Even the top end of the revenue projection puts the growth at 19%, which is also slightly lower than my estimates.

Outlook for 2024 and market multiples

Even with my bullish forecasts, though, the upshot from the market multiples remains exactly the same as that with analysts’ forecasts. I have assumed that the revenue growth projections for Q1 2024 are seen through 2024 as well. Also, the net income margin is kept constant, with the reported margin at 9% and the adjusted margin at 9.1%.

This results in EUR 3301 million or USD 3565 million of reported net income and a marginally higher EUR 3320 million or USD 3585 million adjusted net income. The resulting forward GAAP price-to-earnings (P/E) ratio of 3.09x and the forward non-GAAP P/E is at 3.08x.

The estimates on Seeking Alpha expectedly put the non-GAAP forward ratio at 4.62x. However, even this is the lowest among the top five airline stocks by market capitalisation. The average of these stocks’ forward ratio is at 11.1x, far higher than IAG’s ratio indicating that the stock has the potential to rise by 2.5x even as per analysts’ estimates. It can rise even more, by 3x, based on my estimates.

If the extent of increase indicated by the forward ratio appears to be a stretch, it’s instructive to consider the trailing twelve months [TTM] P/E as well, at 3.89x. This too, is much lower than the ten-year median of 8.05x, indicating that the price can at least double.

The risks

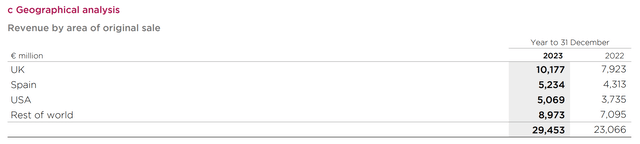

However, the stock isn’t without its risks. In my recent article on Delta Air Lines (DAL), I mentioned the risk of a demand slowdown in the US. The US isn’t IAG’s biggest market, but it does have a notable 17% share of revenues as of 2023. Moreover, its biggest market, the UK with a ~35% contribution to revenues isn’t any better. The Office of Budget Responsibility expects just 0.8% GDP growth for the economy this year, before accelerating to 1.9% in 2025.

Source: IAG

Next, the IMF has recently warned of the risk of higher oil prices, with geo-political stresses in the Middle East. So far crude prices are contained at sub-USD 80 per barrel levels, but these prices are worth watching considering that fuel, oil and emission costs accounted for 29% of the company’s total operating expenses. IAG hedges against volatility in commodity prices up to 60% of its requirements for a year ahead, which can soften the blow if prices go out of whack. To that extent, it’s a contained risk, though.

What next?

Despite the risks, IAG is still a Buy. Its numbers have only improved in 2023 and my projections point to the potential for continued strength in its upcoming results as well. The full year 2024 also looks positive for IAG. Yet, its price doesn’t reflect its value yet. Both the TTM and forward P/Es are trading at muted levels and indicate the possibility of even tripling in price.

Even if the company’s performance were to be affected if the risks play out to the detriment of demand or increase costs, there’s still plenty of room to make a buy case for it. The upside might take time to materialise though, going by the stock’s past momentum.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.