Jacobs Stock Photography Ltd

In our last coverage, Daiwa Industries (OTCPK:DAWIF) had just rounded out a phenomenal year of strong sales and profit growth. Since then, performance has moderated as some deals see delays in coming through, but the strong underlying model is still present. We think mean reversion in inspection is more likely than not and that forecasts look reasonable. But more importantly, as time passes, the likelihood that some sort of capital plan announcement becomes more likely. Though, key members of management probably feel less of a sense of urgency since they only really answer to themselves, as also the controlling shareholders in the business. The upside is still significant, and the business quality is high, but on the realities of being a family owned and controlled business, we temper our rating to just “buy”.

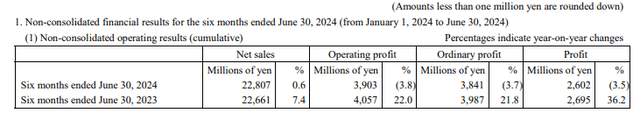

Earnings

This company builds mainly refrigeration equipment, but also vertical showcases, for Japanese convenience stores and small restaurants. Their clients are mom-and-pop businesses, not large clients. Their business is attractive because of recurring economics. The equipment doesn’t sell at high margins, but the maintenance and inspection revenue comes in twice every year, particularly around summer, and has significant margins. Due to the mission-critical nature of refrigeration for restaurants and stores, particularly in summertime, these inspection revenues are not volatile and weren’t even during COVID-19.

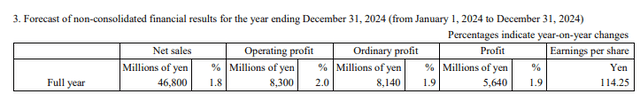

While they manufacture the refrigeration equipment (products segment, growing 3.2%), they also distribute other products that are used in convenience stores, like convection ovens to heat noodles (merchandise segment). Water purifiers as well were products that launched well during COVID-19 and are seeing some sales declines. Inspection is also in some slight decline, which is a little unusual considering the sales growth last year should have increased the base. This could reflect the muted consumer environment, possible churn in the asset base, or some shutdown restaurant customers. Nonetheless, the sales picture is very solid, and the company expects things to improve as a delayed project gets closed later in the year. Moreover, expecting a reversion in inspection revenue should support margins, since those are significantly higher margin businesses than the product business. In fact, the data indicates that products are sold at negligible margins compared to the stream of inspection revenue that comes after. The merchandise and inspection revenues are dictating the negative direction of the profits.

As of the June results, rates had not risen at all in Japan, and that was reflected in the flat YoY interest income developments. Interest income as it currently stands reflects the low rates on deposits. Interest income should double, but the low absolute rates make it still an irrelevant income line despite the large cash balances.

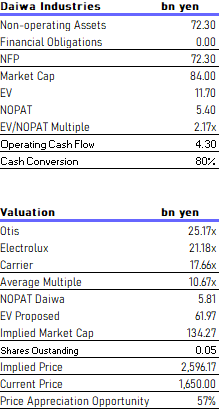

Valuation And Final Remarks

The most important aspect of the company is the valuation appeal. The cash and time deposits of the company are almost as large as the market capitalisation! In other words, the value of the stock is covered by assets that have nothing to do with operations, and therefore the operations are basically not included in the price. They come for free. It is clear that the valuation of the business can only be justified if you remove the cash from the equation, which is perhaps what markets are doing as this family controlled business has been accumulating and not investing cash for some years. There is absolutely nothing concerning about the operation of selling and inspecting refrigeration that would worry us. We think there is 57% theoretical upside, even after using half the multiple of possible comparables.

Valuation (VTS)

We think the reason this extreme discount exists is that the business is family controlled, with the majority of the public stock in family members’ hands, and that they have just been sitting on the cash so far. However, TSE companies are being asked to make some statements about their capital allocation plans in line with the general PBR-related corporate governance reforms, so Daiwa which has yet to announce a capital plan, will likely release something at some point regarding the cash balance. As the cash is currently not being considered as available by markets, any announcement that the company makes in which they will detail significant capital investment or M&A, will be received extremely favourably by markets and will likely catalyse some of the upside theoretically available. They don’t even have to make a great investment, as long as it’s better than nothing, there will be value to gain from that, as currently the cash is being treated as if it doesn’t exist. The margin of safety remains high, although there are of course some risks to the business associated with a more major recession, which would impact the mom-and-pop restaurants that are their customers, whose businesses are probably not very robust and sophisticated. Major impacts on the restaurant industry in Japan is a risk factor.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.