wombatzaa/iStock via Getty Images

Investment Thesis

In my view, Life Time Group Holdings (NYSE:LTH) has a lot of tailwinds ahead as it is expanding its business to target high-end consumers and diversify its offerings. The company has also performed very well in recent years, with solid financial growth across important metrics. Furthermore, based on my own DCF analysis, I find that the stock is undervalued by the market. Thus, I recommend a buy rating on LTH.

Company Overview

Life Time is an American fitness company that started on June 1, 1992, with the goal of helping individuals’ health through friendly experiences that do not compromise on the quality of fitness. Life Time is in a competitive category with other fitness centers such as 24HR Fitness, LA Fitness, Equinox Fitness, and many others. Life Time provides a wide range of services, including yoga, swim, spa, sports, and many other services. Currently, Life Time only operates in Canada and the USA, but the company is planning to go international.

Business Drivers

One of the main business drivers in the near term is the company’s bet on Pickleball and their investments in expanding their pickleball facilities. Life Time has dedicated pickleball courts and facilities in many of their flagship locations. These facilities may seem to be a waste of valuable real estate resources to some, but it seems to be quite the opposite in our view. Due to the rising popularity of pickleball, I believe this is quite a smart decision that will expand the fitness brand’s reach to people of various age groups and backgrounds. If the sport continues to grow in popularity, Life Time would capitalize on the rise of a new sport through free and extensive marketing and have a synergistic impact on pickleball’s growing pro scene.

Life Time is also trying to target individuals in higher economic groups. Using this strategy, I believe that Life Time is going to benefit from going after the lucrative segment which will increase revenue per customer and improve retention, leading to a more predictable and constant cash flow. Life Time now has quite a high membership price, compared to their low-cost competitors, and is now directly competing with the luxury fitness chain, Equinox. Their high-cost membership system seems to be working in their favor, as they are growing in membership, class size, and overall engagement. This strategic focus on targeting a higher spend audience will propel the business forward as they increase engagement and revenue.

Financial Analysis

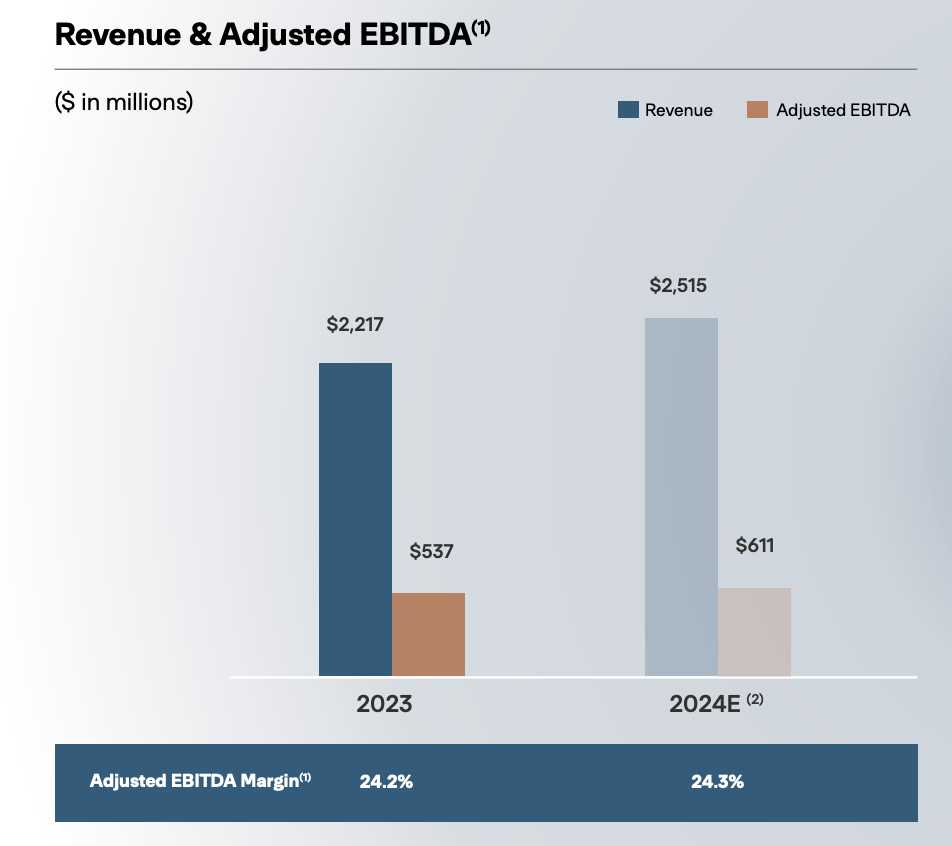

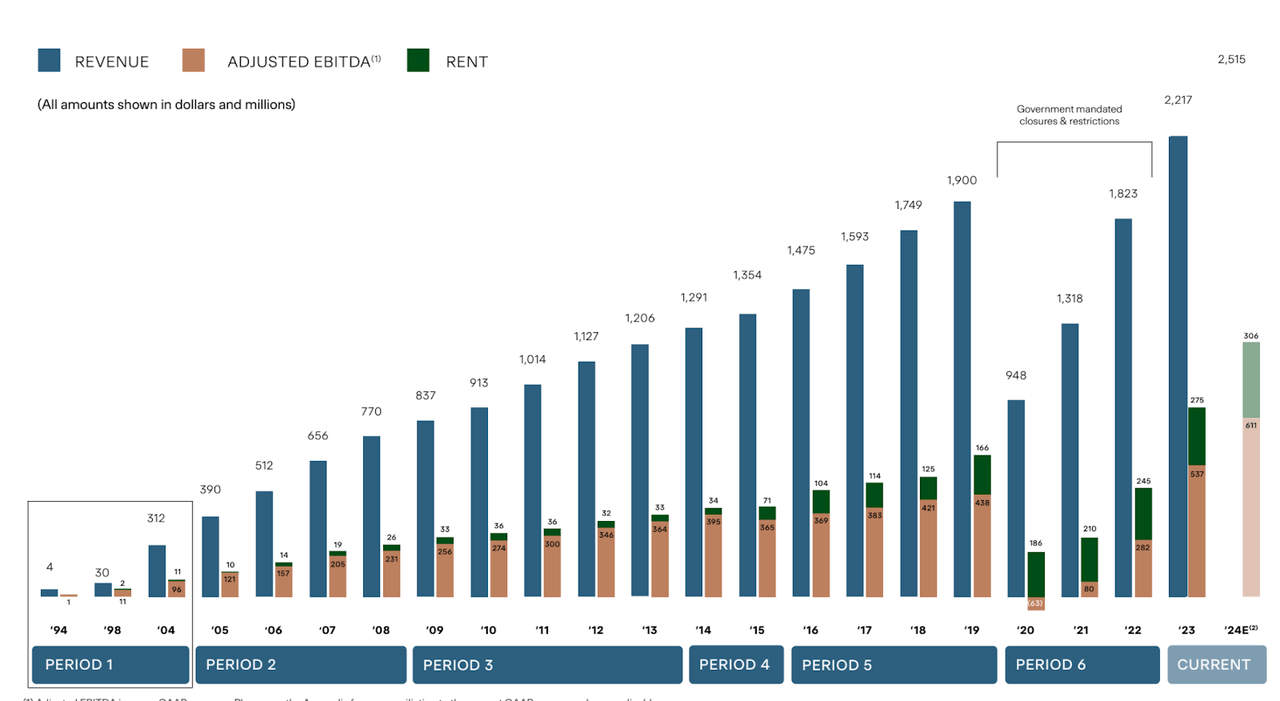

Life Time Investor Presentation 2024

Looking at the Investor Day Presentation Life Time Fitness pushed out in May 2024, the company’s financial performance has been great, being able to show improvement on a year-over-year basis and through the past decade. Comparing 5-year revenue CAGR from 2019 to 2023, the top line grew an impressive 16.68% on average; more impressively, the company’s EBITDA growth saw an 84.33% jump from 2019 to 2023. Life Time Fitness’s projected EBITDA and revenue for 2024 show their continued expectations for growth, as they are projected to grow 13.44% in revenue and 13.78% in EBITDA on a year-over-year basis.

Life Time Investor Presentation 2024

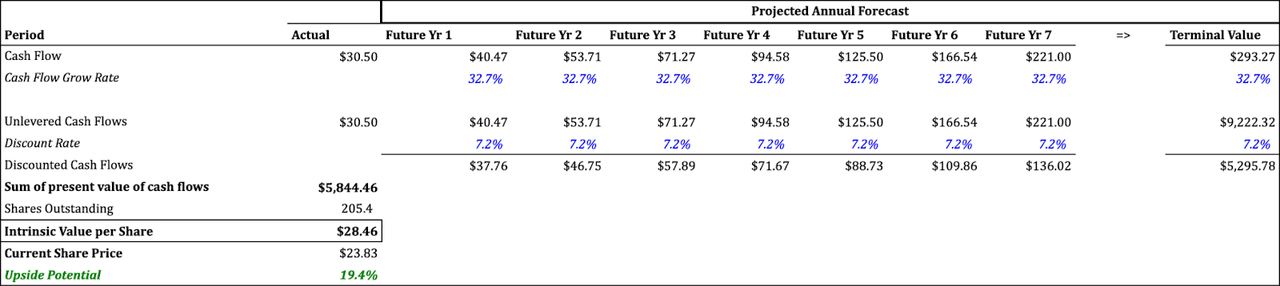

Valuation

I conducted a DCF on Life Time Fitness to determine the value of the stock. For 2024, management expects that the year’s Free Cash Flow will be between $28 million to $33 million, which would be the company’s first annual positive Free Cash Flow. The midpoint of this forecast was used in my analysis. For the growth assumptions in my prediction period, I assumed that the Free Cash Flow would grow on average at 32.7%, as the company’s revenue CAGR over the past 3 years was 32.7%. This growth seems reasonable as Life Time Fitness is expanding their facilities across the US, and has many tailwinds, such as the rise of pickleball. The terminal growth rate of 4.0% was chosen based on a belief that the company still has more room to grow even after the prediction window.

Risks

Competition

A risk Life Time fitness may face is a threat from competition, from other gyms, mainly Equinox and 24 Hour Fitness. All of these gyms provide monthly memberships, classes, and different facilities such as lifting, pool, yoga, cardio, and more. All of which have locations across the states, specifically 24 Hour Fitness having 300 clubs and Equinox’s 108 clubs worldwide – compared to Life Time’s 160 clubs in the US. It is clear Life Time is in the middle of the pack out of the three. I believe that this risk can largely be mitigated by the fact that Life Time Fitness is planning to create 12 more locations all across the USA, between 2024 and 2026, increasing its national brand awareness in the United States. Such expansion shows the company’s growth prospects despite the heavy competition.

Economic Recession

Another risk Life Time Fitness may face is the risk of a recession happening in the near future, which may lead to its customers/members canceling their memberships in droves. Recently, the July job report was unveiled, and the result was much less than expected with a job growth creation of 114,000 in July. This was a remarkable decrease from the 179,000 in June. Additionally, the unemployment rate has been at an all-time low since October 2021, having risen from 4.1% to 4.3%. Though an economic recession may happen, I believe the risk is largely reduced due to Life Time’s target demographic, with the company targeting the wealthier portion of the market. This demographic is historically more resilient to a recession. Due to this, Life Time Fitness should stay strong even in an economic downturn, and may even benefit from lower interest rates in the event of a recession.

Recommendation/Conclusion

With strong tailwinds, I recommend a Buy on Life Time Group Holdings as the valuation analysis indicates that the stock has an upside potential of 19.4% from current levels. I am of the view that the risks Life Time faces can be negated with time. Additionally, many of Life Time’s business drivers are strong, capitalizing on untapped industries. I believe, just like in previous years, Life Time has substantial potential to grow. I will continue to follow any new developments regarding Life Time and will update readers accordingly.