malerapaso

Continuing my series of articles that pay due attention to intricately calibrated equity strategies at the intersection of factors, today I would like to discuss the JPMorgan Diversified Return U.S. Equity ETF (NYSEARCA:JPUS). According to its website, it is

Designed to provide domestic equity exposure with potential for better risk-adjusted returns than a market cap-weighted index.

This is an ambitious proposition. But the very essence of investing is to understand that expectations and reality diverge frequently. And alas, this is the case with JPUS.

Despite having a few robust periods since its launch in September 2015, JPUS was neither capable of outperforming the iShares Russell 1000 ETF (IWB), which is the fund that tracks its benchmark, on an annualized basis, nor delivering more comfortable risk-adjusted returns (my metrics of choice are the Sharpe, Sortino, and Treynor ratios). It is true that there is something to admire about its factor mix (i.e., a value tilt), but I would abstain from constructing a Buy thesis using this premise only.

Overall, while I believe JPUS is a vehicle capable of minimizing losses and taming volatility at times, it is tough to find a reason why I should initiate coverage with a Buy rating.

What is the basis for JPUS’ strategy?

Launched in 2015, JPUS is managed passively, with the basis for its strategy being the JP Morgan Diversified Factor US Equity Index. From page 1 of the summary prospectus, we know that its components “are selected primarily from the constituents of the Russell 1000 Index.” Regarding the factors considered in the process, the following details are provided:

The rules based proprietary multi-factor selection process utilizes the following characteristics: value, momentum, and quality. The Underlying Index is designed so that each of the individual characteristics is given equal input in security selection.

So in essence, it seems this is a mostly large-cap echelon-centered strategy with a factor trifecta at its core.

JPUS performance: a few bright spots, but mostly unimpressive

There is something to appreciate about JPUS’ performance, with its perhaps most significant achievement being the fact that it beat IWB and the iShares Core S&P 500 ETF (IVV) in 2021 and 2022. This implies that the ETF was not only capable of benefiting from the capital rotation to cyclicals but also offered some protection amid the gloomiest days of the monetary policy-driven bear market.

| Year | JPUS | IVV | IWB |

| 2021 | 29.08% | 28.76% | 26.32% |

| 2022 | -8.48% | -18.16% | -19.19% |

Data from Portfolio Visualizer

This is reflected in the downside capture ratio as well.

| Metric | JPUS | IVV | IWB |

| Downside Capture | 93.44% | 100% | 101.54% |

Data from Portfolio Visualizer. IVV was selected as a benchmark

However, neither its compound annual growth rate nor risk-adjusted returns measured using the Sharpe, Sortino, and Treynor ratios delivered over the October 2015-July 2024 period were appealing enough. That is to say, JPUS underperformed both IVV and IWB. Another problem is the maximum drawdown (delivered during the March 2020 pandemic-driven sell-off), which, surprisingly, appeared to be the deepest in the group.

| Metric | JPUS | IVV | IWB |

| Start Balance | $10,000 | $10,000 | $10,000 |

| End Balance | $26,712 | $33,661 | $32,598 |

| CAGR | 11.77% | 14.73% | 14.31% |

| Standard Deviation | 15.87% | 15.75% | 15.99% |

| Best Year | 29.08% | 31.25% | 31.06% |

| Worst Year | -8.48% | -18.16% | -19.19% |

| Maximum Drawdown | -25.95% | -23.93% | -24.57% |

| Benchmark Correlation | 0.95 | 1 | 1 |

| Sharpe Ratio | 0.67 | 0.84 | 0.81 |

| Sortino Ratio | 1.01 | 1.32 | 1.26 |

| Treynor Ratio | 11.21% | 13.3% | 12.8% |

Data from Portfolio Visualizer. IVV was selected as a benchmark

How does JPUS’ factor mix stack up against that of IVV?

Above, I have illustrated that JPUS’ historical performance was clearly insufficient for a Buy thesis. But returns are, of course, not the only parameter a thesis can theoretically be based on. A strategy centered on returns only is clearly a myopic and risky one. A much more important ingredient is the factor story, or, to be precise, the question of whether the factor proportions are adequate for the current market narrative. Here, there is definitely something to appreciate about JPUS, but these facts are still insufficient to justify a bullish stance.

Delving deeper, as of August 27, there were 362 common stocks and REITs in the JPUS portfolio, with the overlap with IVV being at around 72.1%. Though JPUS has exposure to almost all the trillion-dollar companies, except for Amazon (AMZN), its portfolio is much lighter in them. For example, Apple (AAPL) is IVV’s largest holding with a 6.9% weight. Meanwhile, JPUS has allocated just 0.37% to it. And its key holding, Kellanova (K), has just a 0.52% weight. And here comes its first relative advantage: a value tilt.

To corroborate, starting with the market cap, as of August 28, JPUS had a weighted average of $108.7 billion, as per my calculations, while the S&P 500 ETF had that figure 9x larger. And this is hardly a coincidence that its 5.1% adjusted earnings yield appeared to be much higher than IVV’s adjusted EY of 3.7%. Besides, there is a massive difference in allocations to stocks with a B- Quant Valuation grade or higher: 26.3% vs. 6.2%.

It is worth clarifying that when I say ‘relative,’ I mean that for most investors who believe the rally will continue for the foreseeable future, these characteristics likely mean little. However, for those contrarians who believe a good correction is long overdue, JPUS certainly offers something.

But a value tilt and solid growth exposure are antithetical in nature. So JPUS is significantly behind IVV when it comes to the growth indicators, like those presented in the table below.

| Metric | JPUS | IVV |

| EPS Fwd | 6.30% | 18.27% |

| Revenue Fwd | 3.97% | 12.20% |

| EBITDA Fwd | 4.84% | 20.11% |

Created by the author using data from Seeking Alpha, IVV, and JPUS

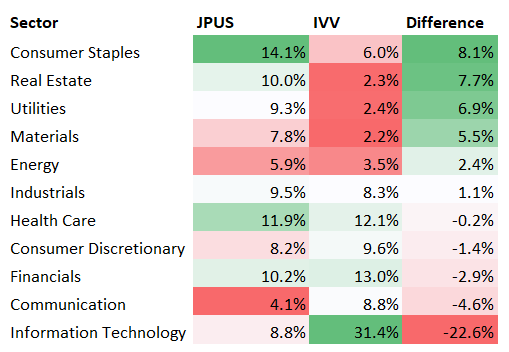

In part, this is driven by the sector proportions. For instance, compared to IVV (which has a sector mix close to that of the Russell 1000 ETF), JPUS is substantially underweight in IT and overweight in consumer staples. The table below, prepared using data from the ETFs and the iShares Core S&P Total U.S. Stock Market ETF (ITOT), shows other important differences.

Created by the author; data from ITOT, IWB, IVV, and JPUS

JPUS’ second relative advantage is its exposure to the low volatility factor, which is again the consequence of the sector mix.

| ETF | 24M Beta | 60M Beta | Quant Momentum B- or higher |

| JPUS | 0.81 | 0.99 | 70% |

| IVV | 1.07 | 1.06 | 71.3% |

Calculated by the author using data from Seeking Alpha and the ETFs

It might look a bit counterintuitive assuming the strategy is mindful of momentum, not low beta. However, on page 2 of the summary prospectus, it is clarified that the index

Targets equity securities which have higher risk-adjusted returns relative to those of their sector peers over a twelve month period. The twelve month returns are divided by the twelve month volatility of the returns to get the risk-adjusted returns.

So as volatility is also taken into account, low beta is explainable. Again, this should appeal to investors who are awaiting for the growth premia to become slimmer, or, another way of saying, the market to give up a sizable deal of gains. I personally do not view this as a base-case scenario.

However, in regards to quality, I would argue that JPUS is weaker than the S&P 500 ETF, with its weighting schema being the key reason. The data below are what I am basing my opinion on.

| Metric | JPUS | IVV |

| Net Income Margin | 14.6% | 21.5% |

| Return on Assets | 7.3% | 14.3% |

| Adjusted Return on Equity | 19.2% | 20.1% |

| Quant Profitability B- or higher | 87.9% | 94.8% |

Calculated by the author using data from Seeking Alpha and the ETFs

Final thoughts

JPUS is about applying the factor trifecta in a mostly mega- and large-cap universe, with the goal being to capture the “potential for better risk-adjusted returns than a market cap-weighted index.” And in fact, JPUS does a lot of things right. It offers a meaningful depth and breadth of exposure without over-reliance on just a handful of market darlings that have been rushing higher, a value tilt, and mostly fine quality. Importantly, its expense ratio of 18 bps looks razor-thin assuming the complex factor-driven methodology. However, neither its performance nor factor mix can persuade me that a Buy rating is justified.