maybefalse/iStock Unreleased via Getty Images

Alibaba Group Holding (NYSE:BABA) is profiting from bullish investor sentiment following the eCommerce company’s earnings for the last quarter.

Alibaba benefited from growth in its eCommerce segment, while seeing encouraging momentum in cloud as well.

While Alibaba’s total sales performance was satisfactory, I think investors are undervaluing the eCommerce company’s eye-popping levels of free cash flow.

Alibaba is selling for a mere 8.3x profit multiple while the eCommerce company is anticipated expected to produce a handsome amount of profit growth next year.

The stock has a positively tilted risk/reward relationship and could be poised for a breakout as investor sentiment continues to recover.

My Rating History

My last stock classification on Alibaba Group Holdings, was primarily explained by the eCommerce company spending a boatload of money on share repurchases which, I thought, would stabilize the stock price.

Alibaba Group Holdings could also profit from strengthening consumer spending in China’s retail sector moving forward.

With earnings growing quickly, based on EBITDA, I think that Alibaba Group Holdings remains a compelling growth investment for investors.

Single Digit Sales Growth, But Strong Free Cash Flow

Alibaba Group Holdings produced 4% sales growth in 1Q25, compared to 7% in the prior quarter. The main explanation for Alibaba Group Holdings’ slowing sales growth is that the eCommerce industry in China is brutally competitive, leading to razor-thin margins and intense price competition.

As a consequence, Alibaba Group Holdings actually reported a decline in sales in the eCommerce segment which the company refers to, after last year’s reorganization, as Taobao and Tmall Group. This segment is reliant on consumer spending, the trend of which is improving in China.

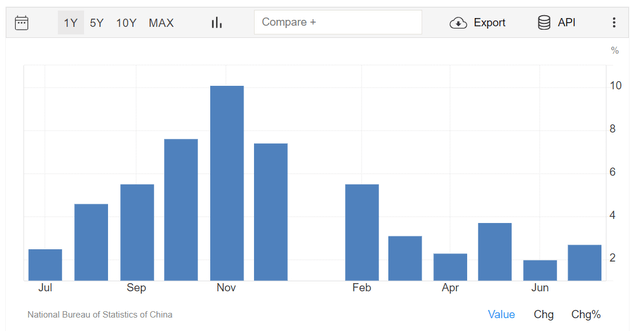

Chinese retail sales have seen a nice bounce in the month of July, with Chinese customers spending 2.7% more year-over-year on retail purchases. Since Alibaba is still quite dependent on the Chinese consumer, despite efforts to diversify, for instance via investments in a stand-alone cloud business, spending trends in the retail market are an important influence on the company’s financial performance.

Retail spending trends have been mixed in the last year, which has had a lot to do with Chinese weak economic growth. In the second quarter, China’s GDP grew at an annualized rate of 4.7% which is below the CCP’s long-term GDP growth rate target of 5.0%.

Moving forward, retail sector spending growth is a possible catalyst for Alibaba Group Holdings to see an acceleration in its sales growth.

China Retail Sales (National Bureau Of Statistics Of China)

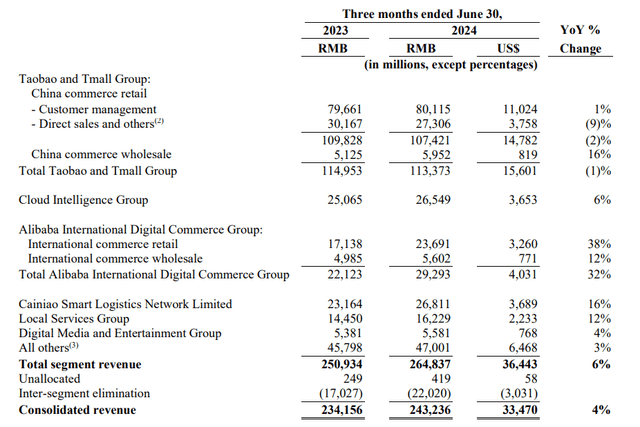

In 1Q25, Alibaba Group Holdings reported total sales of RMB243,236 million (US$33,470 million), plus 4% YoY, but Taobao and Tmall sales actually fell 1% YoY to RMB113,373 million ($US15,601 million).

Cloud did reasonably well, with sales growth of 6% YoY and total segment sales of RMB26,549 ($US3,653 million). Much more important than sales, however, is Alibaba Group Holdings’ free cash flow.

Consolidated Revenue (Alibaba Group Holding)

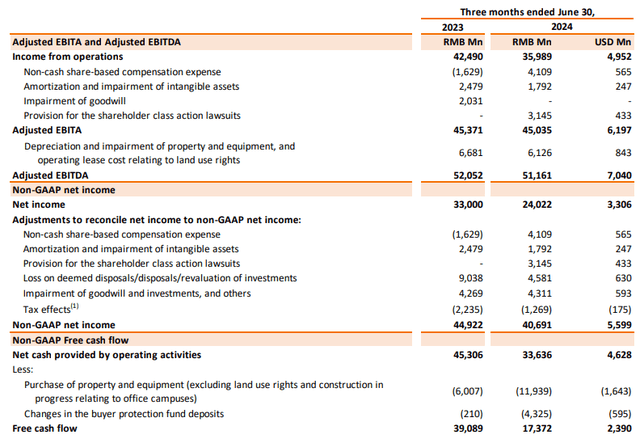

Alibaba Group Holdings produced RMB17,372 million in free cash flow (US$2,390 million) which is a formidable sum. Annualized, this 1Q25 level of free cash flow translates into something close to $9,560 million, a substantial amount that the company could use for share repurchases.

Already, Alibaba Group Holdings authorized a $25 billion in share repurchase, which means it could potentially see a substantial reduction in the company’s outstanding shares moving forward.

Free Cash Flow (Alibaba Group Holding)

Technical Setup

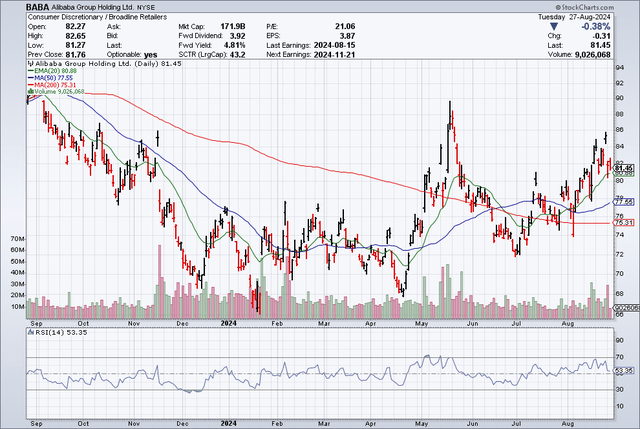

From a technical angle, Alibaba Group Holdings is in an increasingly bullish setup. After the eCommerce company reported earnings for its last quarter, the stock climbed into a short-term up-channel, and it stayed above the 20-day and 50-day moving average lines (short-term bullish indicators) as well as the 200-day moving average line (long-term bullish indicator).

The stock is technically in neutral territory, with the Relative Strength Index flashing a value of 53, but the recent stock uptrend is showing improving investor sentiment toward the eCommerce company.

Moving Averages (Stockcharts.com)

Alibaba Group Holdings Is A Steal

Investors have been worried about Alibaba Group Holdings and China’s maturing growth for a while now, but that didn’t prevent the eCommerce company from earning an outrageous amount of recurring free cash flow.

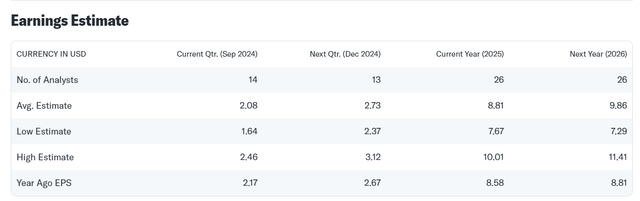

The market presently models $9.86 per share in profits for next year, reflecting a YoY growth rate of 12%. As Alibaba Group Holding’s stock is selling for $81.45 at the time of writing this piece, the profit projections imply a leading profit multiple of 8.3x. Obviously, with the stock being this cheap, Alibaba Group Holdings has a big incentive to spend as much of its free cash flow as it can on share repurchases.

In my view, Alibaba Group Holdings is undervalued here, and to a significant degree as well. I think BABA could sell for 12-13x leading profits fairly easily, particularly if China’s retail spending grows in the next couple of quarters. Valuing Alibaba’s stock at a leading profit multiple of 12-13x leads us to an intrinsic value of $118-128.

Earnings Estimate (Yahoo Finance)

Why The Investment Thesis Might Not Pan Out

Alibaba Group Holdings is a Chinese company and as such, subject to government regulation and period crackdowns.

In the last three years, the CCP appeared to have pulled back from implementing more stringent regulations for the tech sector, but this does not mean that the Chinese Communist Party could not change the tune to which Chinese companies will have to dance to.

Investment risk in China is real, and so is Alibaba Group Holdings’ exposure to the Chinese eCommerce industry. If the sector does not continue to recover, in terms of retail spending, Alibaba’s stock’s total return performance might disappoint investors moving forward.

My Conclusion

Alibaba Group Holdings is a well-managed and well-known eCommerce company in China with growth coming from a collection of businesses, some of which are not eCommerce-related, such as cloud.

What makes Alibaba Group Holdings compelling from an investment narrative angle is that the company produces a high amount of recurring profits and free cash flow.

Though Alibaba Group Holdings’ sales growth has slowed down in 1Q25, BABA is highly profitable and retains a lot of power to repurchase more shares in the future.

Furthermore, Alibaba Group Holdings is selling for a compelling 8.3x leading profit multiple while being expected to grow its profits 12% next year.

I think that the risk/reward relationship is positive here and that the stock remains a ‘Buy’ for investors. I am still buying Alibaba stock here, and I don’t plan on stopping any time soon.