DamianKuzdak/E+ via Getty Images

Nearly a full year has passed since I last covered Bitdeer Technologies (NASDAQ:BTDR) for Seeking Alpha. It’s a name that I’ve written about a few times and I’ve consistently rated it a ‘hold’ in each piece going back to April of last year.

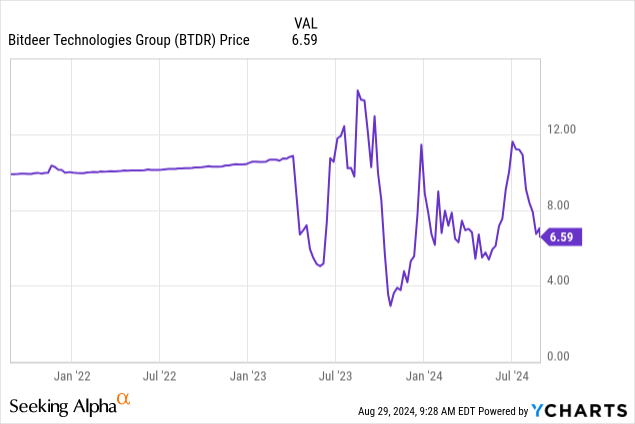

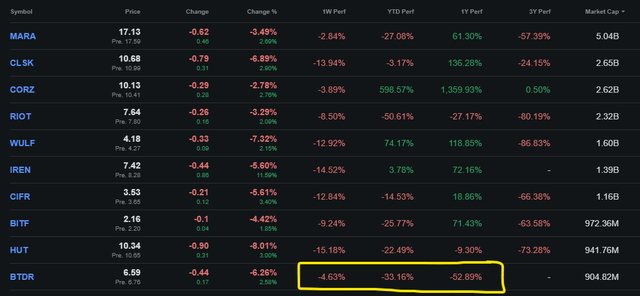

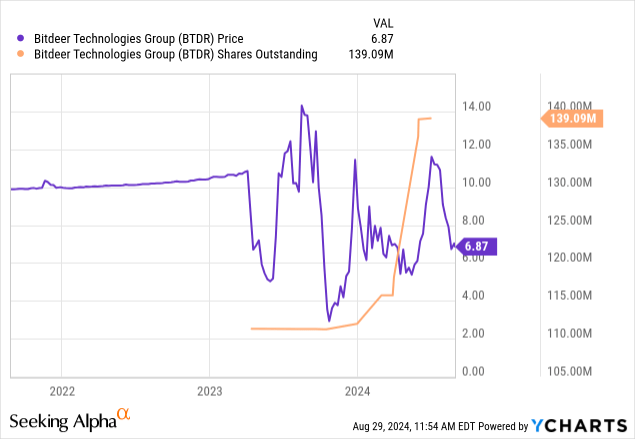

BTDR shares have doubled or tripled over a period of just a few weeks, three distinctly different times going back the last 15 months. It’s a volatile stock – we’ll get into why in a later section. At one point, Bitdeer was the third largest publicly traded Bitcoin (BTC-USD) mining company by market capitalization. It’s currently ranked 10th:

Bitcoin Miners By MC (Seeking Alpha)

Given the company’s decline in market cap rank against peers, it’s perhaps unsurprising to see BTDR having the 2nd worst YTD performance and the worst 12 month performance among top 10 miners. In this update, we’ll look at the company’s second quarter earnings, AI pivot, July production, balance sheet position, and institutional holdings.

Second Quarter Earnings

In Q2-24, Bitdeer reported $99.2 million in total revenue. This was up 5.8% over Q2-23, but down by 17% sequentially. Interestingly, most of the company’s individual business lines were down year over, with one notable exception; self-mining.

| Segment | Q2-23 | Q1-24 | Q2-23 | YoY | QoQ |

|---|---|---|---|---|---|

| Self-mining | $21.6 | $48.4 | $41.6 | 92.9% | -14.0% |

| Cloud Hash Rate | $18.0 | $18.1 | $12.2 | -32.3% | -32.6% |

| General Hosting | $27.8 | $29.0 | $20.6 | -25.8% | -29.0% |

| Membership Hosting | $23.9 | $19.5 | $22.1 | -7.7% | 13.3% |

| Other | $2.5 | $4.5 | $0.0 | -100.0% | -100.0% |

| Total revenue | $93.8 | $119.5 | $99.2 | 5.8% | -17.0% |

Source: Bitdeer, Author’s Calculations, dollars in millions

Self-mining revenue surge nearly 93% year over year. According to Bitdeer, the drop in cloud hash revenue was due to poor margins for clients following the block reward halving in April. General hosting revenue declines were attributed to temporary rig shutdowns – again due to the halving. This would appear to indicate that hosting machines are battling efficiency issues with less BTC to mine per block.

| Segment | Q2-24 Rev | EH/s | Rev per EH/s |

|---|---|---|---|

| Self-mining | $41.6 | 7.3 | $5.7 |

| Cloud Hash Rate | $12.2 | 1.2 | $10.2 |

| General/Member Hosting | $20.6 | 13.8 | $1.5 |

Source: Bitdeer, Author’s Calculations, dollars in millions

As I’ve pointed out in previous articles, the cloud hash segment is by far the company’s most profitable line of business, judging by revenue per EH/s. Given the continued erosion of that revenue segment, I would expect that the company needs a drastically different Bitcoin price to entice new customers to attempt cloud mining once again if that segment is ever going to return to the revenue figures it from just a couple of years ago.

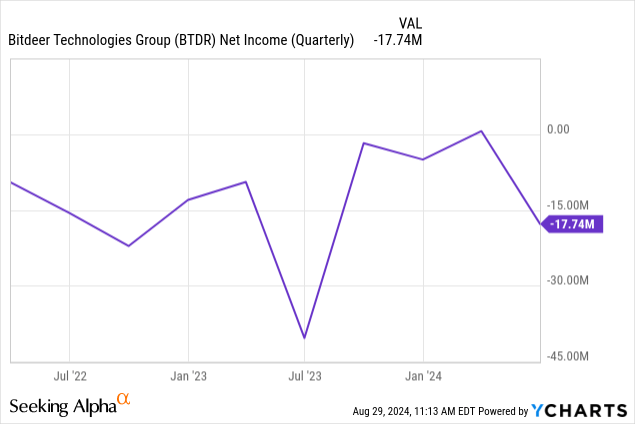

From a net income standpoint, Bitdeer reported a $17.7 million quarterly loss. This was the largest quarterly loss since Q2-23. $15.5 million of that loss was due to a “fair value change for Tether warrants” per Bitdeer.

AI & July Production

Stop me if you’ve heard this one before, but we have yet another Bitcoin miner that is entering the AI space. I’m making light of the situation, but there is theoretically an overlay between BTC mining and AI compute services. Although they require completely different chips, experience in datacenters and energy infrastructure are skills that are shared by both BTC miners and HPC builders. However, unlike the GPU-based mining that Ethereum (ETH-USD) previously allowed pre-merge, building out an AI solution as a Bitcoin miner requires H100s rather than ASICs.

Nevertheless, Bitdeer recently announced its AI training platform that will utilize NVIDIA (NVDA) H100 GPUS as well as InfiniBand Networks. The company worked with TLM Group to consult Bitdeer regarding its datacenter strategy. In the July production update, Bitdeer noted 100% utilization of its NVIDIA DGX SuperPOD system and said it will expand AI operations carefully to avoid “over investment.”

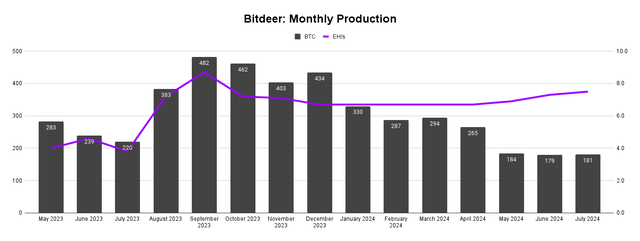

BTC Production (Bitdeer, Author’s Chart)

From a BTC production standpoint, EH/s growth in the self-mining segment has been generally up, but slow for the last 8 months. At 7.5 EH/s in July 2024, Bitdeer’s monthly EH/s is about double what it was in July 2023, but still under the peak from last November. We can see in this chart the clear impact of April’s halving. EH/s is double what it was a year ago, yet BTC production is actually down. In my view, it’s obvious, Bitdeer either needs a much higher BTC price to earn more dollars off less BTC production and to resuscitate its cloud hash rate business, or it needs its new AI initiative to be a big success.

Balance Sheet

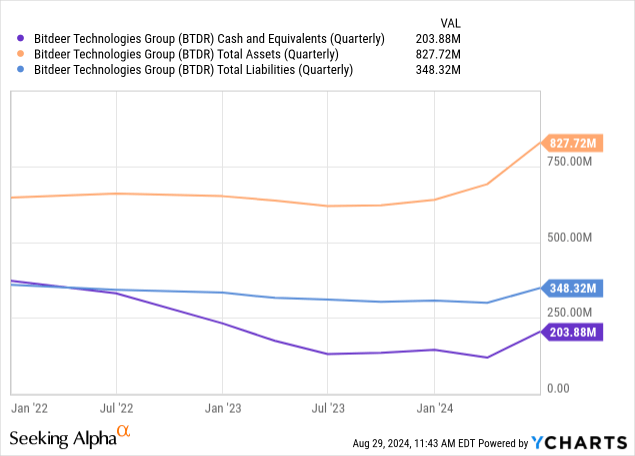

The good news is the company does have some time. As of the quarter ended June, Bitdeer has nearly $204 million in cash and $827.7 million in total assets against just $348 million in total liabilities. At about $41.5 million in combined intangibles and goodwill, Bitdeer’s balance sheet isn’t overly reliant on extrinsic value for the company’s $905 million market capitalization. Of course, this could certainly change if the price of Bitcoin were to crash. The result of which would surely be a re-rating of the value of Bitdeer’s mining equipment.

That said, at 1.7x book and 1.8x sales, BTDR is on the “cheaper” end of the Bitcoin miner industry. As part of Bitdeer’s datacenter growth strategy, the company is raising roughly $144.5 million from a convertible senior note offering at 8.5% that is due in 2029.

‘Tutes’ & The Low Float

Earlier in the article, I made note of the volatility in the name. In my view, this has been attributable to what has been a low float compared to BTC mining peers.

| BTDR | CLSK | HUT | BITF | CIFR | |

| Shares Outstanding | 137.30M | 248.12M | 91.08M | 451.98M | 328.94M |

| Float % | 24.56% | 97.42% | 78.51% | 78.18% | 64.44% |

| Insider Shares | 83.00M | 6.38M | 10.42M | 8.83M | 57.63M |

| Insider % | 60.45% | 2.57% | 11.45% | 1.95% | 17.52% |

| Institutional Shares | 10.00M | 107.64M | 42.62M | 100.74M | 96.70M |

| Institutional % | 7.28% | 43.38% | 46.79% | 22.29% | 29.40% |

Source: Seeking Alpha

At just 24.5% of shares outstanding, BTDR is a very low-float stock compared to other Bitcoin mining equities. And at 60% insider holdings, this is not what I’d call a liquid stock. The recent surge in shares outstanding will theoretically help alleviate that, but any potential investors who want to take a shot on BTDR stock would be wise to only us limit orders so they don’t get beat up by slippage.

Closing Thoughts

The most profitable segment the company currently has continues to erode. September is a weak month for Bitcoin historically. And the Federal Reserve appears poised to begin cutting rates in September. As I detailed in a pervious article for Seeking Alpha, Bitcoin’s performance following the beginning of rate cuts is not great. It wasn’t until after the Fed stopped cutting that BTC begin its surge higher back in 2020. I don’t actually hate the idea of BTDR as a possible swing trade, but I’m still going to rate BTDR a hold today as a long term investment.