Morsa Images

A Quick Take On MBX Biosciences

MBX Biosciences, Inc. (MBX) has filed to raise $100 million in an IPO of its common stock, according to SEC S-1 registration information.

MBX is a clinical-stage biopharma firm developing a pipeline of treatments for various endocrine and metabolic disorders.

The firm’s lead drug has produced an initial ‘continuous, infusion-like’ delivery profile in Phase 1 trials and MBX is backed by top-tier life science venture capital firms.

I’ll provide a final opinion when we learn more details about the IPO.

MBX Biosciences Overview And Development Efforts

Carmel, Indiana-based MBX Biosciences, Inc. was founded to create precision peptide drug therapies [PEP] in Phase 2 and Phase 1 stage trials that aim to have reduced dosing frequency, possibly as low as once per month.

Hypoparathyroidism is an endocrine disorder that results in the inadequate production of parathyroid hormones by their related glands in the neck, changing the amount of calcium and phosphorus in the body and thereby altering the body’s natural operation of nerves, muscles and bone development.

MBX is led by co-founder, president and CEO P. Kent Hawryluk, who has been with the firm since April 2019 and was previously a partner at Twilight Venture Partners, a life science venture capital firm and was co-founder of Avidity Biosciences (RNA).

The company’s lead candidate, MBX 2109, is in Phase 2 trials as a possible long-acting hormone replacement therapy for patients suffering from chronic hypoparathyroidism [HP].

MBX is also in Phase 1 trials for its MBX 1416 program that seeks to treat post-bariatric hypoglycemia conditions.

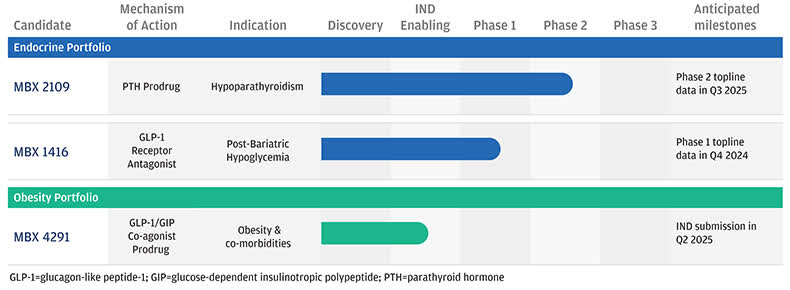

The current status of the firm’s development pipeline is shown here:

SEC

MBX Bio has booked fair market value investment of $158.3 million as of June 30, 2024, from investors, including Frazier Life Sciences, New Enterprise Associates, OrbiMed Advisors, Deep Track Biotechnology, Wellington Biomedical, Norwest Venture Partners, and RA Capital.

MBX Bio’s Markets & Competitors

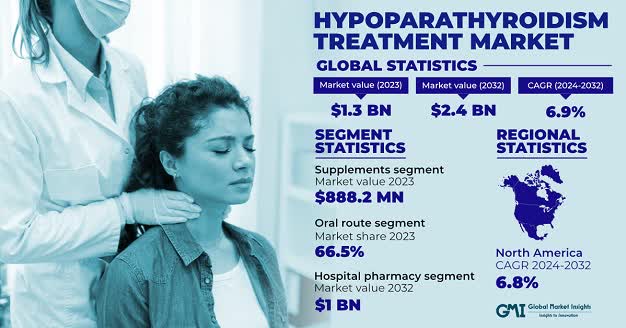

According to a 2024 market research report by Global Market Insights, the global market for hypoparathyroidism treatments was approximately $1.3 billion in 2023 and is expected to reach $2.4 billion by the end of 2032.

This represents a forecast CAGR (Compound Annual Growth Rate) of reasonably robust CAGR of 6.9% from 2024 to 2032.

The primary factors driving this expected growth are a growing number of diagnosed hypoparathyroid conditions, increasing thoracic surgeries and thyroid gland disorders and more thyroid cancer cases globally.

Also, the graphic below illustrates various aspects of the hypoparathyroidism market over the coming years:

Global Market Insights

Major competitive vendors that have developed or are developing similar treatments include the following firms:

-

Ascendis Pharma (ASND)

-

AstraZeneca (AZN)

-

Extend Biosciences

-

Xeris Biopharma Holdings, Inc. (XERS)

-

Vogenx

-

Amylyx Pharmaceuticals (AMLX)

-

Eli Lilly and Company (LLY)

-

Others

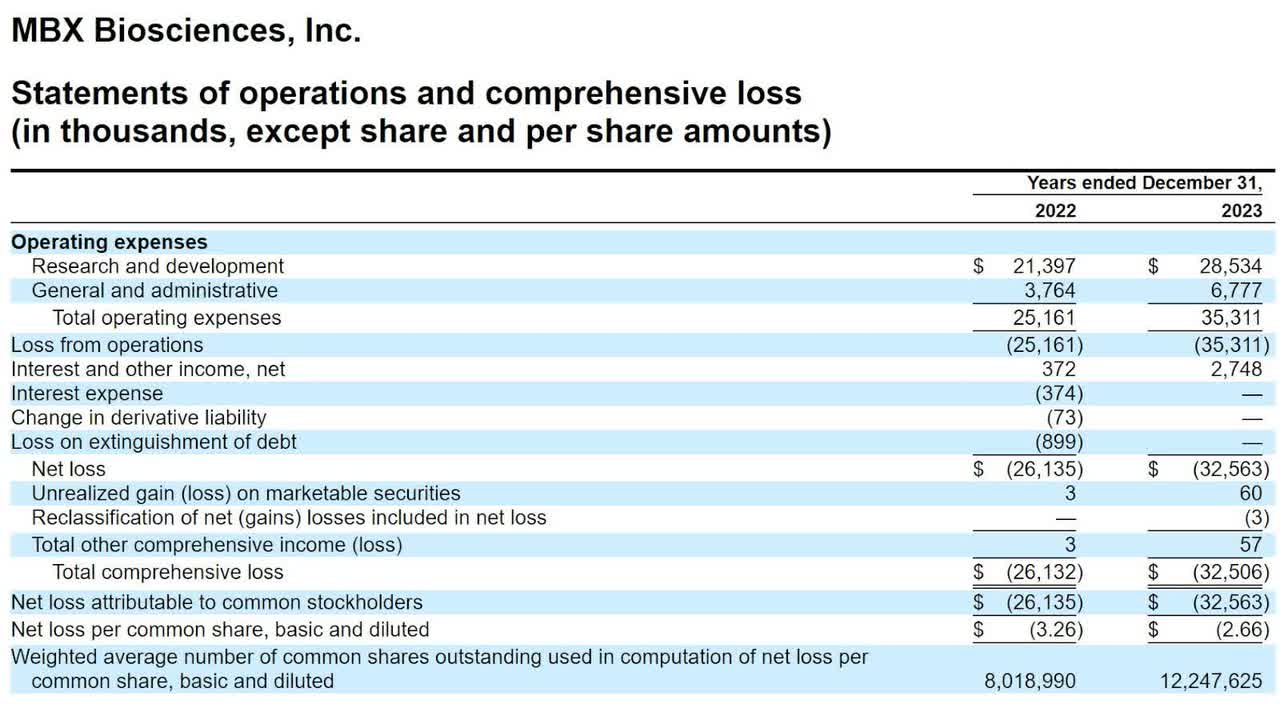

MBX Bio Financial Results

The company’s recent financial results are shown for the past two calendar years from its most recent IPO filing documents:

As of June 30, 2024, the company had $55.3 million in cash and $8.4 million in total liabilities.

MBX Bio IPO Details

MBX Bio intends to raise $100 million in total proceeds from an IPO of its ordinary shares, although the final amount may vary.

The company will be a ‘smaller reporting company’ and an ‘emerging growth company’, which means management will be able to disclose materially less information to shareholders.

I’ve prepared a summary of the various primary reporting aspects of these two designations.

Management said it plans to use the IPO net proceeds as detailed here:

to advance development of our two clinical-stage programs, MBX 2109 through Phase 2 topline data and into Phase 3 development, and MBX 1416 through Phase 1 topline data and into Phase 2 development;

to advance development of MBX 4291 through preclinical development and into clinical development;

the remainder to fund our discovery research and development activities and additional clinical development, and for general corporate purposes, working capital and capital expenditures.

(Source: SEC)

Leadership’s online company roadshow presentation is not currently available.

Pertaining to legal proceedings, management said in the filing that the company is not a party to litigation or other legal proceedings that would likely have a material adverse effect on its business.

Listed bookrunners of the IPO are J.P. Morgan, Jefferies, Stifel and Guggenheim Securities.

My Thoughts About MBX Bio’s IPO

MBX is seeking capital from public investors to advance its various clinical and pre-clinical programs through and into various trials.

The firm’s lead candidate, MBX 2109, is in Phase 2 trials as a possible long-acting hormone replacement therapy for patients suffering from chronic hypoparathyroidism [HP].

The drug delivery activity seeks to effect a ‘continuous, infusion-like’ profile and in the Phase 1 trials for MBX 2109, the results were positive in this regard.

If the drug is otherwise sufficiently efficacious, this feature will potentially enable the first once-per-week dosing regimen for patients suffering from hypoparathyroidism.

The firm expects Phase 2 topline data by Q3 2025 for MBX 2109.

MBX is also in Phase 1 trials for its MBX 1416 program that seeks to treat post-bariatric hypoglycemia conditions.

Management expects data from its varying dose Phase 1 trials for MBX 1416 by the end of 2024.

The market opportunity for treating hypoparathyroid disorders is moderately large and expected to grow at a fairly robust rate of growth in the coming years due to a global population that is getting older and the expected increasing incidence of the disease as a result of reduced immune system capabilities.

Leadership has not disclosed any major pharmaceutical company collaboration agreements or relationships.

The company’s investor syndicate includes a number of well-known and highly regarded life science venture capital firms and is reasonably well-capitalized.

I estimate the firm’s market capitalization at IPO to be in the range of $300 million to $400 million or more.

When we learn management’s expectations regarding pricing and valuation assumptions at IPO, I’ll provide an update.

Expected IPO Pricing Date: To be announced.