Matteo Colombo/DigitalVision via Getty Images

Introduction

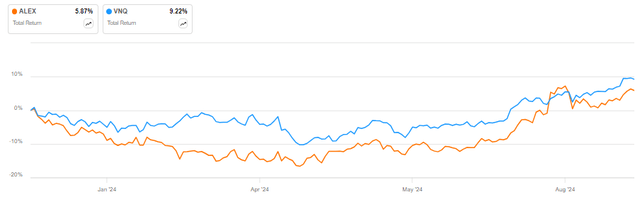

Alexander & Baldwin (NYSE:ALEX) has marginally underperformed the Vanguard Real Estate Index Fund ETF (VNQ) so far in 2024, delivering a ~6% total return against the 9% gain for the benchmark ETF:

ALEX vs VNQ in 2024 (Seeking Alpha)

I also covered the shares back in June, arguing they were undervalued on an enterprise-level basis. Taking into account the recent price rally, increased Fed rate cut expectations, and the REIT’s Q2 2024 earnings, I believe a Hold rating is now appropriate for the shares as I expect the company to trail peers that have more (floating rate) debt in their capital structure. Furthermore, the adjusted FFO multiple of 18.8x and market-implied cap rate of 6.7% are not indicative of a distressed valuation. The wild card for me remains how much extra value the company can extract from land sales.

Company Overview

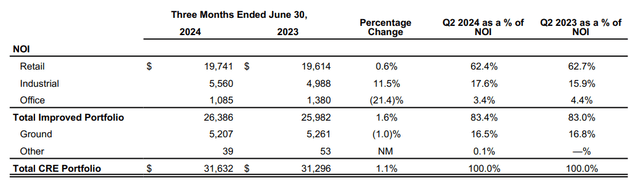

You can access all company results here. Alexander & Baldwin is a diversified REIT operating exclusively in Hawaii. The company derives 62.4% of its net operating income, or NOI, from retail properties, followed by a 17.6% contribution from industrial properties. Ground leases account for 16.5% of NOI:

NOI contribution by asset class (Alexander & Baldwin Q2 2024 Supplemental)

In addition to the leased real estate portfolio shown in the snippet above (referred to as the Commercial Real Estate segment in the REIT’s reporting), the company also has a legacy Land Operations segment, mainly involved in monetizing the remaining land real estate portfolio, as well as joint ventures.

Operational Overview

In Q2 2024 Alexander & Baldwin reported an adjusted FFO of $0.23/share, down 8% Y/Y, driven primarily by weaker performance in the company’s Land Operations segment.

Occupancy developments were mixed – leased occupancy was down 0.5% Y/Y to 93.9%, impacted by weakness in the retail portfolio. At the same time, economic occupancy, which is arguably more important as it looks at the lost potential rent from vacant units, improved by 0.4% Y/Y to 92.8%. Here the strength was concentrated in the REIT’s industrial portfolio.

Same-store NOI increased by 0.9% Y/Y, or 1.7% Y/Y excluding collections of prior year reserves.

Foot traffic grew by 3.3% Y/Y which is quite impressive considering visitor arrivals in Hawaii were down 4.1% in the May year-to-date period.

Increased 2024 Outlook

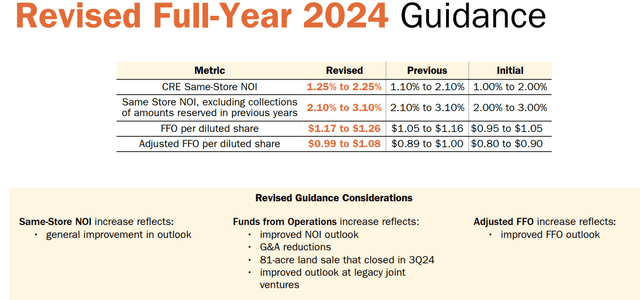

Despite the mixed performance in Q2 2024, the company expects stronger results in the remainder of the year, with the adjusted FFO outlook increased to $0.99-$1.08/share. Same-store NOI growth is also set to be marginally stronger, at 1.25-2.25%:

Increased 2024 Outlook (Alexander & Baldwin Q2 2024 Results Presentation)

The main driver behind the adjusted FFO increase will be improved results in the Land Operations segment as the company closed on a sale of 81 acres of non-core land for $10.5 million in July 2024. Cash proceeds will be $10.4 million, with the company realizing a $5.2 million profit on the sale.

I estimate that after the transaction the Land Operations segment will still have 3,324 acres available for sale, providing a source for further liquidity.

Debt Position

Alexander & Baldwin ended Q2 with net debt of $441 million, indicating that net debt accounts for just 24% of enterprise value following the recent stock price rally.

All of the debt is fixed-rate, indicating no immediate benefits from Fed rate cuts. The weighted average interest rate is 4.75%, with an average maturity of 3.1 years.

Market-implied cap rate

In 2024 I estimate Alexander & Baldwin will generate NOI of about $125 million, representing a 6.7% market-implied cap rate relative to the company’s $1.86 billion enterprise value, which is quite low for a commercial REIT even before we factor in management overhead. Selling, general and administrative expenses should total about $29 million in 2024, representing a 1.5% drag on enterprise value, in line with what we observe at other small REITs.

We should note NOI does not account for the occasional land sales in the Land Operations segment.

Valuation and prospects

If we take the ~$1.04/share midpoint of the company’s adjusted FFO guidance we observe the adjusted FFO multiple stands at 18.8x, quite high for a commercial REIT, but also indicative of the company’s low leverage and incremental cash generation potential from Land Operations.

The 6.7% market-implied cap rate is also generally at the lower end you would find for commercial REITs (especially smaller ones), hence both valuation indicators point to a relatively expensive valuation after the recent stock rally.

The company’s leverage, at just 24% of enterprise value, is also too low in my opinion. In essence, you would need a major real estate downturn for Alexander & Baldwin to outperform peers. Instead, I expect a sector–wide compression in real estate cap rates over the next few years, driven by Fed rate cuts. In such an environment, the company’s low gearing is likely to be a drag on performance.

All in all, I believe a Hold rating is appropriate for the shares. In such a situation, I would naturally recommend using a covered-call strategy to generate extra income but the spreads on the company’s options do not make it worthwhile in my opinion.

Risks

I think the main risk facing an investment in Alexander & Baldwin is the REIT’s geographic concentration in Hawaii, which makes the company’s results heavily dependent on the economy of a single state. Of course, as long as you hold the shares along with other REITs you can easily diversify the risk away.

The other risk to mention is that adjusted FFO is getting a temporary boost from land sales in the Land Operations segment. While the company still has more land available for sale eventually it will cycle through all its land holdings, resulting in a drop in adjusted FFO cash flows. This may be mitigated by the elimination of administrative expenses associated with the Land Operations segment, which the company highlighted at about $4-$5 million on its Q2 2024 conference call.

Since I am moving to a neutral rating on the shares, I would also like to mention an upside risk, namely that I have not included the value of the remaining land in the company’s enterprise-level cap rate. In essence, if the value of the land is material, let’s say $100 million (which may not be far off, as the carrying value stood at $72 million at the end of 2023 before year-to-date land sales, as visible on page 23 of the 10-K 2023 filing here), it would represent a 0.4% boost to the market-implied cap rate since it would directly reduce net debt without affecting cash flows. The gains on land sales are however included in adjusted FFO, hence this risk is mitigated to an extent.

Conclusion

Alexander & Baldwin reported mixed Q2 2024 results but increased its full-year outlook largely due to an 81-acre land sale that will boost results in the third quarter. While the company will continue to benefit from occasional incremental land sales in the future, I believe this is already priced into the shares, with the REIT trading at an adjusted FFO multiple of 18.8x.

Low gearing and no floating rate debt mean little immediate benefits from Fed rate cuts, potentially resulting in Alexander & Baldwin underperforming peers with a more debt-heavy capital structure.

Taking all of the above into consideration, I think it is appropriate to downgrade the shares to a Hold rating.

Thank you for reading.