SHansche

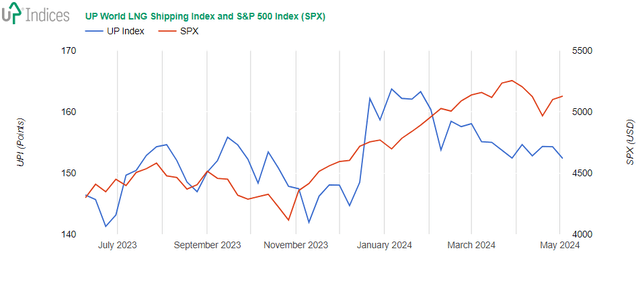

The UP World LNG Shipping Index (UPI) lost 1.92 points or 1.24% last week, reaching a closing value of 152.38 points. This index monitors the stocks of companies that specialise in LNG shipping. In contrast, the S&P 500 (SPX) index, representing US stocks, gained 0.55%. The image below displays both indices.

Week 19-2024: Chart of the UP World LNG Shipping Index with S&P 500 (Source: UP-Indices) (UP-Indices.com)

The UPI underwent its regular rebalance, with no changes in its constituents. However, the weight of all constituents was adjusted due to the free float of stocks and the Reduction Gas Ratio. Notably, the weight of Golar LNG (GLNG) was limited to a maximum of 20%, reflecting the index’s methodology.

The UPI’s movement within the top bracket of the 2023 range is a significant observation. This suggests that while the overall index is relatively stable, many of its constituents are showing signs of preparing for a bullish move, with some already in action.

Last week, two companies saw double-digit rises, a unique occurrence this year. Despite being minor constituents, Dynagas LNG Partners (DLNG) gained a remarkable 17.9% and closed at $4.14, while Awilco LNG (OTCPK:AWLNF)[ALNG] rose by 12.5%. Dynagas is being propelled by the imminent end of the distribution moratorium, although the announcement of new refinancing is still pending. On the other hand, Awilco closed a price gap after the ex-dividend day in March.

Several companies turned the sellers’ push into gains, with most of the gains below 3%. These companies displayed resilience and formed a hammer TA pattern again. Malaysian Misc (KLSE: 3816) was the only exception, surpassing 3%. The group of companies that demonstrated this resilience includes FLEX LNG (FLNG), Cool Company (CLCO), Excelerate Energy (EE), and Capital Product Partners (CPLP).

Flex LNG has gained 1.7% and closed at $26.6, with an aim to slowly return to its 2023 resistance above $28. During the last earnings call, management expected its TCE for Q1 to be 75-80kpds, which could result in a $0.75 dividend. Only one vessel was on variable rates during Q1, and two other charters were extended by option exercise. The main reasons for FLNG’s decline were the redelivery of Flex Constellation and falling spot and charter rates, which persist.

The other group averted the sellers’ activity but still closed lower, forming a red-body hammer: Golar LNG, New Fortress Energy (NFE), or Shell (SHEL).

Shell and Golar are better positioned to rise than New Fortress Energy, which is on a downtrend. On the other hand, NFE achieved a support level based on the second part of last year at about $26.2. On this level, NFE should at least hinder its decline.

The Japanese trio mixed, as “K” Line (TSE: 9107) and NYK Line (TSE: 9101) rose and MOL (TSE: 9104) dropped. “K” Line and NYK Line gained 2.4% and 1.9%, respectively; MOL lost 1.1%.

Nakilat (QSE: QGTS) gained 2.6%, which was hidden in the previous moves. Its price is still above the gap but below the resistance at 4 Rial.

Chevron (CVX) and BP (BP) declined, losing 3.4% and 2%.

In summary, UPI and its constituents prevail to rise, indicating the start of the early season.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.