Monty Rakusen

Identifying the difference between cycles and more secular trends is often difficult. While most markets have periods of weaker and stronger performance depending on the business cycle, sometimes there are multi-year changes that substantively change the dynamic of an industry over a longer timeframe.

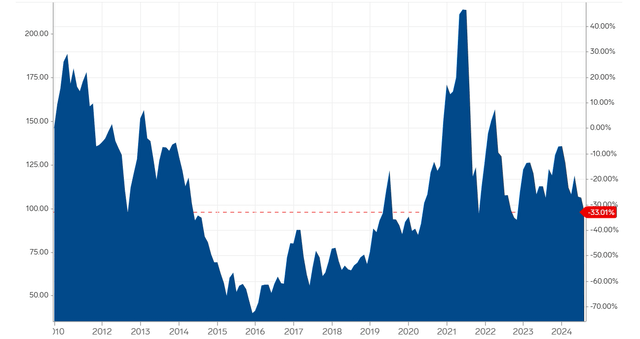

The iron ore industry has been one of the most volatile and cyclical markets for some time. The bulk commodity has seen multiple short-term price moves of over 50 percent in the last 14 years, but the prices of the key resource have generally been lower over the last 8 years, with the exception of a large short-term move up coming out of the pandemic in 2021.

A Chart of Iron Ore Prices (markets.businessinsider)

The largest iron ore producer in the world is Vale S.A. (NYSE:VALE). This British-Australian company produced 321 metric tons of iron ore in 2023. Vale S.A. gets nearly 65 percent of the company’s revenues from iron ore, while nickel and copper make up nearly 17 percent of revenues. The company also produces and exports manganese, ferroalloys, metallurgical and thermal coal, copper, platinum group metals, gold, silver, and cobalt.

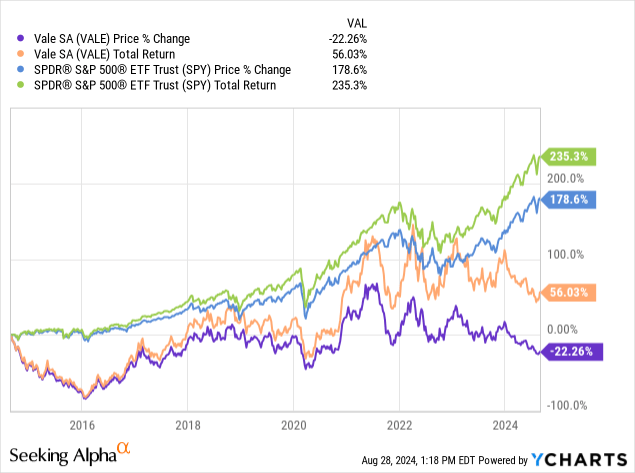

The British-Australian company has offered investors total returns of 56.03% over the last 10 years, while the S&P 500 has offered investors total returns of 235% during this same timeframe.

Today, I am updating my coverage of Vale S.A. I last wrote about the company in July of 2022, and I rated the company a sell. I am downgrading the company to a strong sell today. The company’s revenues peaked in 2011 and this leading iron ore producer is not likely to see earnings cycles at those levels against as China moves into a period of slower growth. The Chinese housing market also remains significantly overbuilt and increasing signs of a slowdown in China as well as globally. Vale S.A. looks overvalued using several metrics.

While Vale S.A. has modestly increased production levels of copper and nickel recently, the company is heavily levered to the iron ore markets. The main challenge for this industry is that there are no significant supply constraints on production since most of this bulk metal is mined in more stable countries Australia, Brazil, Russia, and China. The sanctions the US and Europe imposed have also not significantly impacted Russian exports or the Russian economy. Iron ore and most leading commodity prices remain below prewar levels.

The Chinese economy also appears to be entering a new lower growth phase, and the real estate and construction industries in the world’s second-largest economy remain overbuilt as well. China imported nearly 75 percent of all seaborne iron ore in 2023.

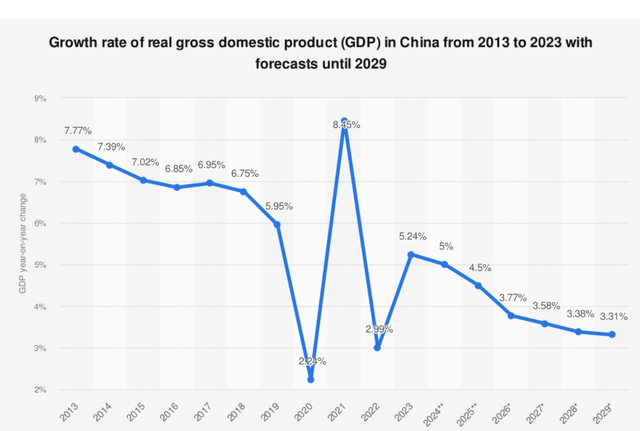

A Chart of China’s Expected Growth Rate (IMF)

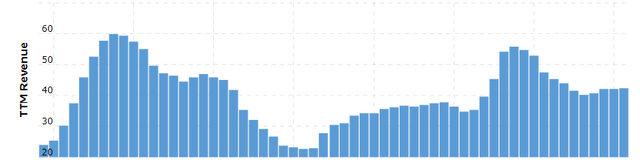

Vale S.A.’s revenues reached a 15-year high in September of 2011, and the company has not come close to hitting those levels for most of the last decade, outside of a brief and unsustainable move in iron prices coming out of the Pandemic in 2021.

A Chart of Vale S.A.’s Revenues (Macrotrends)

China’s growth rate has been in steady decline since 2013, with the exception of 2021, coming out of the pandemic, and the economic experts at institutions such as the IMF are only projecting the world’s second-largest economy to grow at 3-4% a year between 2025 and 2030. President Xi has recently signaled the country expects slower growth moving forward as well.

There are also multiple signs the Chinese property sector remains overbuilt, and the country’s weak housing market is beginning to negatively impact consumer spending in China as well. Housing prices in China in some submarkets have fallen by 40 percent in just the last 12 months, and experts see prices declining further in the property sector, with some analysts not expecting the market to stabilize until at least late 2025. There have also been recent signs the second largest economy in the world is slowing, with August’s industrial production and property investment data showing a weakening Chinese economy. Retailers in the US have also warned about slowing consumer spending as credit card debt has reached record highs in the United States, and growth expectations in Europe have come down as well.

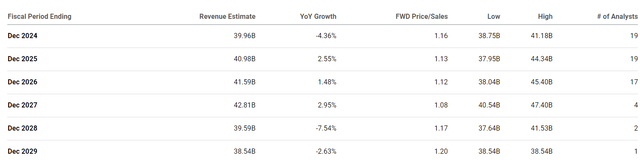

This is why Vale S.A. looks overvalued. Even though the company trades at 5.15x expected forward GAAP earnings and 4.27x projected forward cash flow, slightly below the miner’s 5-year average of 6.22x forecasted forward GAAP earnings and 4.67x predicted forward cash flow, Vale S.A. is likely entering a period of prolonged slower growth. Analysts are projecting negative earnings and revenue growth over the next 5 years, and the company’s core iron ore business also remains heavily cyclical.

A Chart of Analyst Expectations for Vale S.A.’s EPS (Seeking Alpha) A Chart of Expectations for Vale S.A.’s EPS (Seeking Alpha)

The iron market has been volatile for some time as China’s growth rate has fluctuated and the Chinese Central Government has spent massively in stimulus packages focusing on the country’s real estate and property sector after the 2008 recession and during the Pandemic in 2020. Today, the world’s second-largest economy faces significant short-term and long-term challenges, China’s iron ore imports should likely be at much lower levels for an extended period of time. While Vale S.A. has tried to increasingly diversify into the copper and nickel markets, this miner is still heavily dependent on a volatile market that is in a secular decline.