Shahid Jamil

Investment Outlook

Jamf Holding Corp. (NASDAQ:JAMF) recently reported Q2 2024 financial results, meeting earnings expectations but beating revenue guidance.

I previously wrote about JAMF in October 2023 with a Sell outlook due to its heavy technology sector exposure in an environment of job shedding by tech firms.

The company is still suffering from those conditions but has made progress in reducing operating losses through cost controls.

I’m still concerned about slowing top-line revenue growth, but the stock may get a valuation bump on a lower cost of capital environment and a new Apple upgrade cycle ahead.

My current outlook on JAMF is an upgrade to Neutral.

Jamf’s Market And Approach

According to a 2023 report by SecureMac, macOS had a 23% market share in enterprise IT environments in 2021, up significantly from 17% in just 2019.

As a result of this enterprise penetration, Apple systems are increasingly the target of cyberattacks from various vectors.

For example, in 2023, a macOS malware called XCSSET was discovered to be targeting developers and was able to steal data, control the webcam and take screenshots.

Jamf sells its SaaS solutions primarily via a subscription revenue model and targets enterprise customers via its in-house direct sales force and smaller accounts via its self-serve online portal.

The firm’s services include:

-

Inventory & Device Management

-

Lifecycle Application Management

-

Threat Prevention & Remediation

-

Identity & Security Management

-

Visibility & Compliance.

Jamf also markets its IT services through channel partners, which even feature Apple itself.

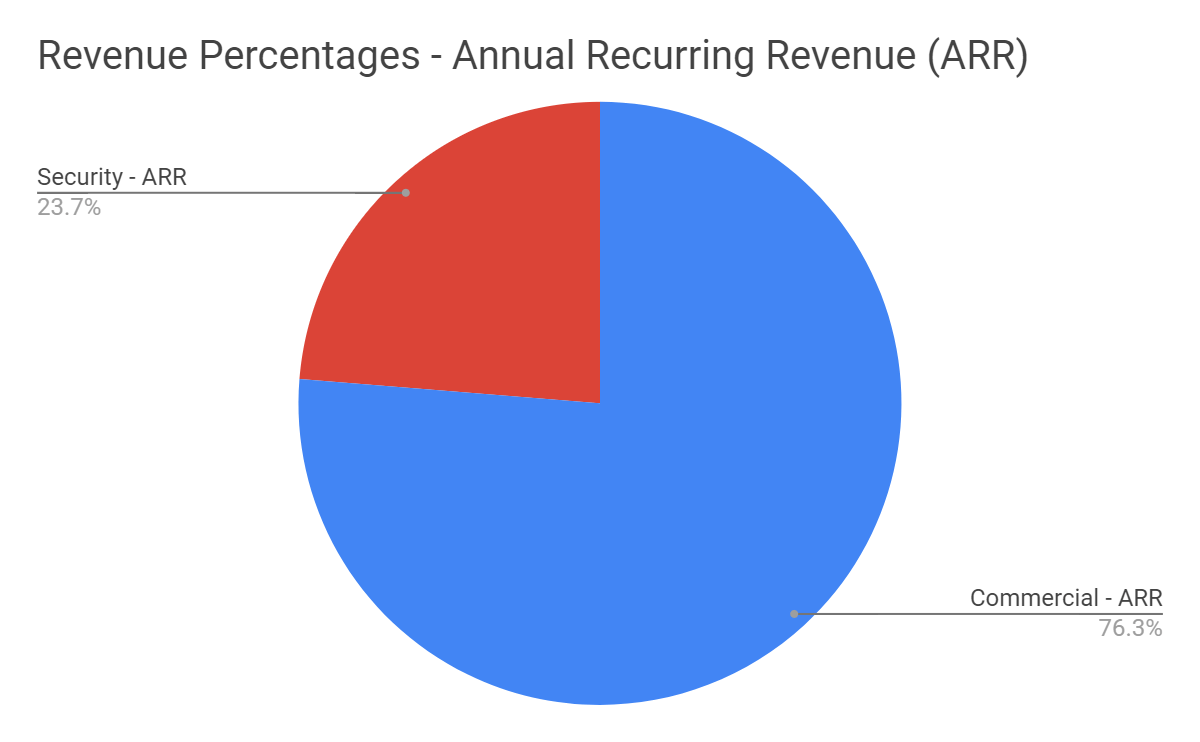

For Jamf’s annual recurring revenue segment, about three-quarters comes from its Commercial segment and one-quarter from its Security segment, as the pie chart shows here:

Seeking Alpha Data

Jamf’s competitors include the following companies:

-

Kandji — deployment, management, and compliance

-

Addigy — Apple device management

-

Mosyle — mobile device management

-

ManageEngine — unified endpoint security.

Recent Financial Trends

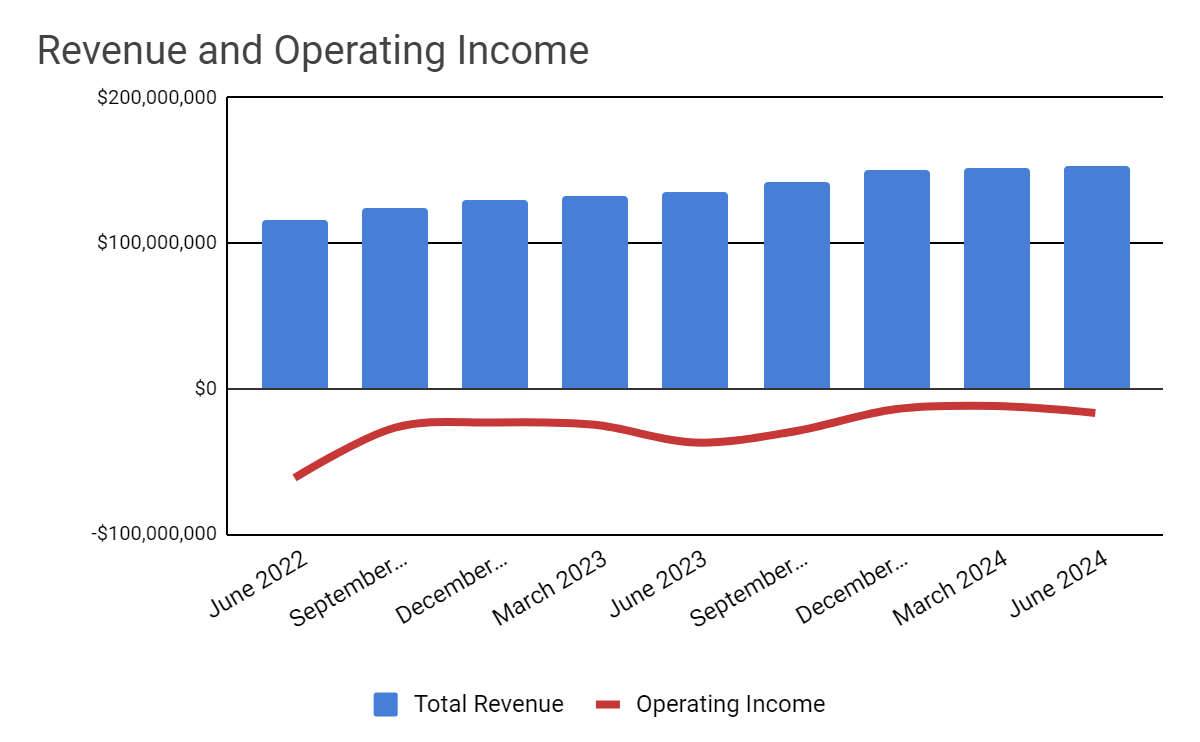

Total revenue by quarter (columns) has slowed its growth trajectory in recent quarters due to reduced technology hiring and increasing tech layoffs or attrition. Operating loss by quarter (red line) has dropped year-over-year because of ongoing cost reduction efforts.

Seeking Alpha Data

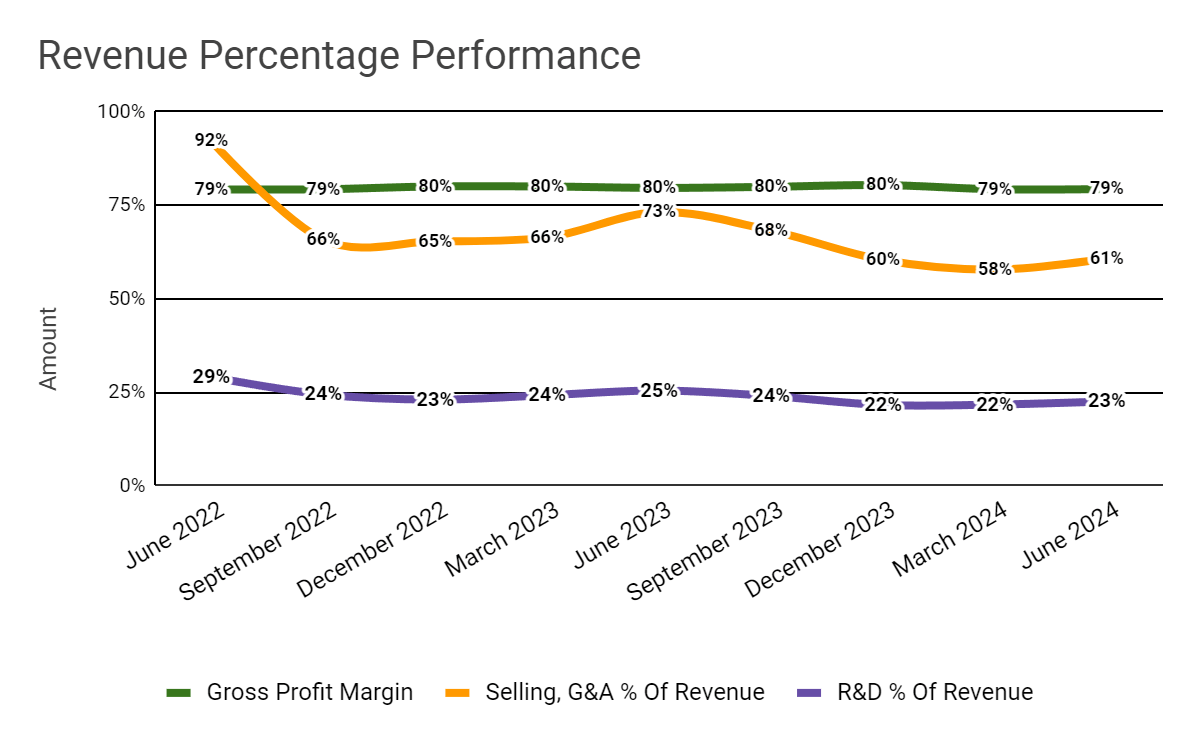

Gross profit margin by quarter (green line) has trended lower as a result of changing service mix. Selling and G&A expenses as a percentage of total revenue by quarter (orange line) have trended lower due to continued cost control focus. R&D expenses as a function of revenue (purple line) have also moved lower in recent quarters, indicating management is reducing R&D spend as revenue growth has slowed.

Seeking Alpha Data

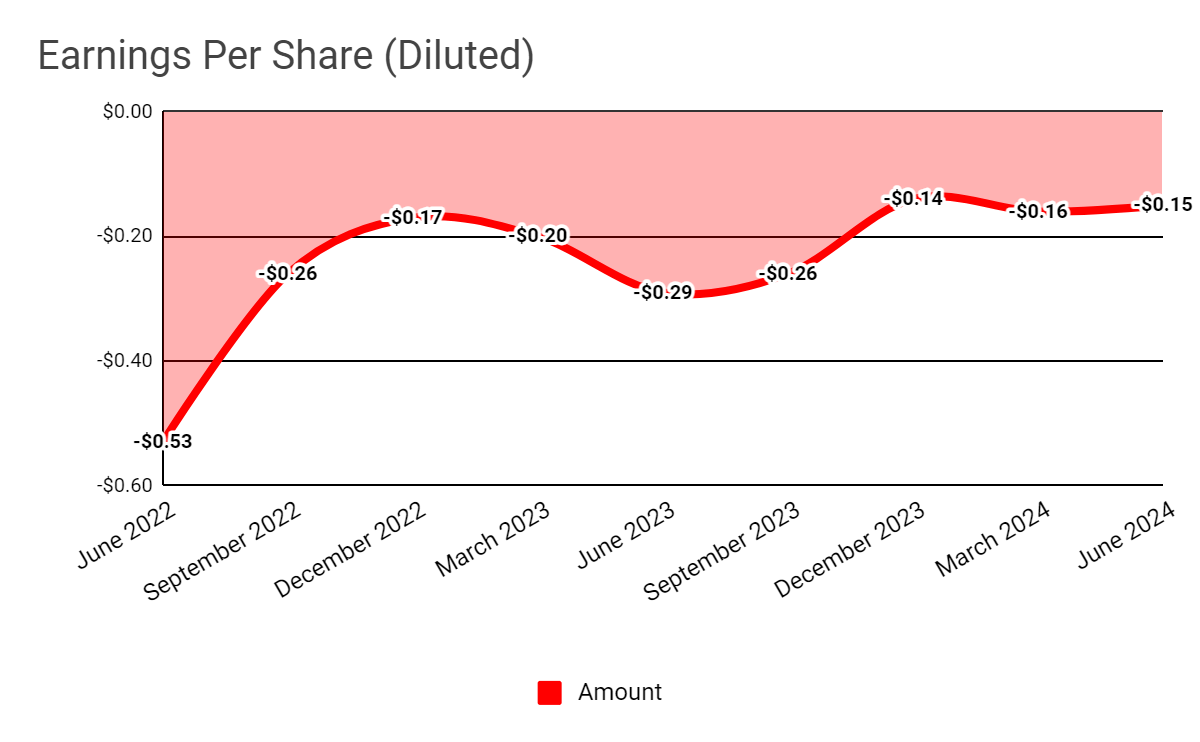

Earnings per share (Diluted) have remained negative but have stabilized in recent quarters on a lower cost structure.

Seeking Alpha Data

(All data in the above charts is GAAP.)

For balance sheet results, JAMF ended the quarter with $200.9 million in cash and equivalents and $368.2 million in total debt, all of which was long-term.

Over the trailing twelve months, free cash flow was $43.7 million, and capital expenditures were $3.9 million.

The company paid a hefty $98.1 million in stock-based compensation in the last four quarters, so free cash flow net of SBC was negative ($54.4 million).

The net dollar value of the decrease in stock outstanding for the last four quarters was valued at $30.6 million, so Jamf has been retiring its stock base over time.

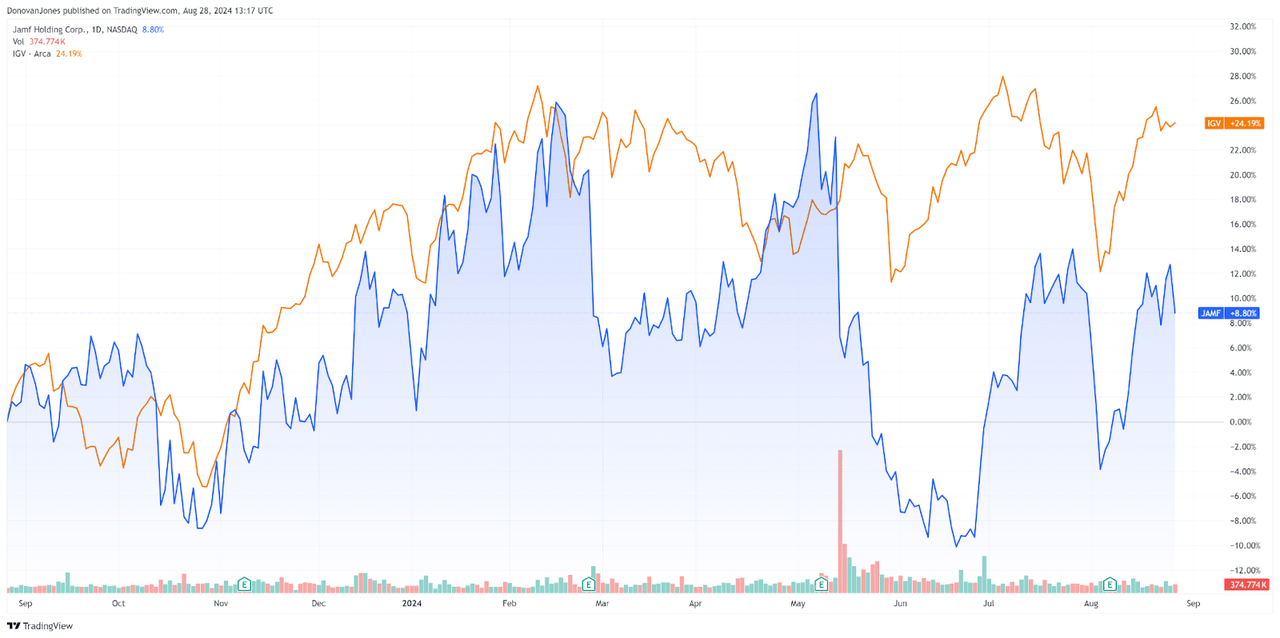

In the past 12 months, JAMF’s stock price has gained 8.8% vs. that of the benchmark iShares Expanded Technology-Software ETF’s (IGV) much more impressive rise of 24.2%, as the chart indicates below.

TradingView

Below is a handy major metrics table that highlights trailing twelve-month and forward results and expectations.

|

Metric |

Amount |

|

EV/Sales (“FWD”) |

4.1 |

|

EV/EBITDA (“FWD”) |

24.8 |

|

Price/Sales (“TTM”) |

3.9 |

|

Revenue Growth (“YoY”) |

14.6% |

|

Net Income Margin |

-15.0% |

|

EBITDA Margin |

-3.7% |

|

Market Capitalization |

$2,360,000,000 |

|

Enterprise Value |

$2,550,000,000 |

|

Operating Cash Flow |

$47,600,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.71 |

|

2024 FWD EPS Estimate |

$0.60 |

|

Rev. Growth Estimate (“FWD”) |

13.9% |

|

Free Cash Flow/Share (“TTM”) |

$0.34 |

|

Seeking Alpha Quant Score |

Buy — 4.28 |

(Source: Seeking Alpha)

The firm’s Rule of 40 performance has improved year-over-year, but that improvement has been due to reduced negative operating margin. Topline revenue growth has dropped significantly in the past year, as the table shows below:

|

Rule of 40 Performance (Unadjusted) |

Q2 2023 |

Q2 2024 |

|

Revenue Growth % |

23.4% |

14.6% |

|

Operating Margin |

-27.3% |

-10.8% |

|

Total |

-3.9% |

3.8% |

(Source: Seeking Alpha.)

Why I’m Neutral On Jamf Holdings

Overall, the customer demand environment that Jamf is facing can be described as “stable,” which is not likely to produce an upside catalyst any time soon.

As a result, management is focusing its attention on ramping up partner contributions in the back half of the current fiscal year and on controlling costs.

But, the company is suffering from a softness in device up-sell results.

In the most recent quarter, Jamf produced a net dollar retention rate [NRR] of 106%, which is an OK but not impressive result and a continuation of a steadily dropping retention rate recently, a negative trend.

NRR indicates how well the company is upselling or cross-selling its services within the same cohort of customers, i.e., how much it is growing revenue from its existing customer base. In this case, it grew revenue by 6%, which is a moderate result.

From this NRR information, it isn’t difficult to see that Jamf’s top-line revenue growth is dropping from 14.6% in the previous year to an expected 11% — 12% growth in the current fiscal year.

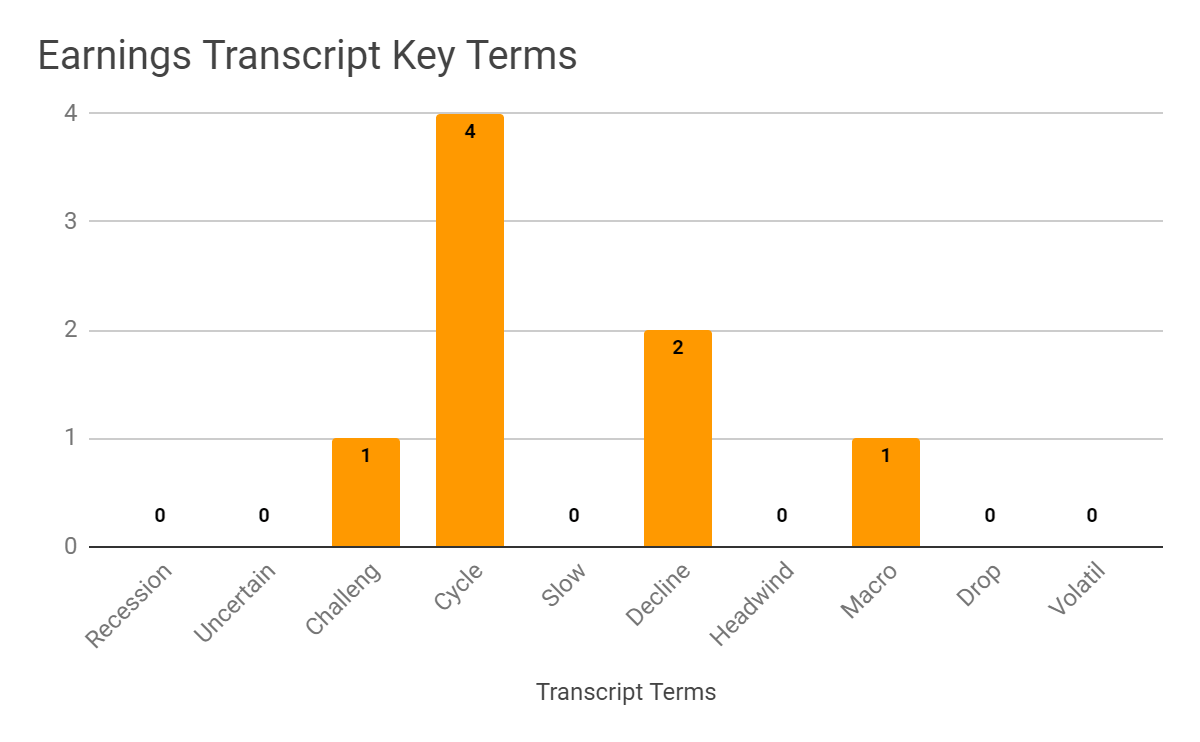

I track various sentiment indicators for negative keywords raised in the most recent conference call, as shown in the graphic below:

Seeking Alpha Data

The graphic suggests that the company is facing challenging client spending conditions in education and technology verticals.

Furthermore, its license, services and on-premise revenue streams continue to experience a decline, which acts as a drag on overall revenue growth.

As a result, the story on Jamf is that its top-line revenue growth is dropping, but its ability to reduce operating costs has resulted in reduced losses.

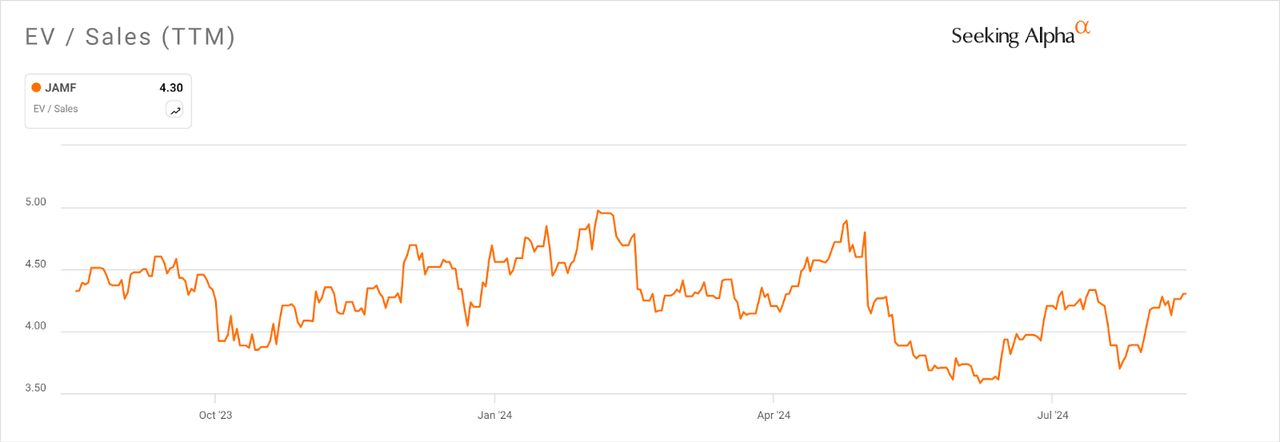

The market’s EV/Sales valuation multiple has moved around in the past twelve months, but essentially is currently where it began, at around 4.3x.

Seeking Alpha

The potential for a lower interest rate environment ahead may serve to increase valuations of operating loss-making companies like Jamf and Apple’s new iOS device rollout may provide impetus for a device upgrade for firms. However, I’m concerned about the firm’s lower revenue growth rate, retention rate and ability to squeeze out more operating costs to reach breakeven.

So, my near-term outlook on Jamf Holding Corp. is now Neutral on lower operating costs and improved but still negative earnings.