FiledIMAGE/iStock Editorial via Getty Images

Union Pacific Once Again Appealing

Union Pacific (NYSE:UNP) is heading north and its ATHs are not far away. After a couple of rough years with investors fearing the high-interest environment and the rail traffic decrease (especially due to intermodal), the company seems to be switching gears thanks to Mr. Jim Vena, the new CEO ranked among the best executives in the industry. Thanks to the weekly update on rail traffic, we can follow these stocks with thorough attention without needing to wait from one quarter to the next without any update. So, let’s see how things are evolving for railroads and Union Pacific. Spoiler alert: investors may be happy.

Thanks to its last report, I finally turned once again bullish on the company and its stock. In the past, in fact, I was on one side bullish on railroads and Union Pacific’s exposure to the richest states in the U.S. and to intermodal traffic coming from Asia; on the other, I could not help but express my disappointment for low efficiency-metrics and uncautious buybacks which were expanding Union Pacific’s debt beyond sustainability. Not by chance, the company had to suspend its buybacks once interest rates rose.

But before we move on, allow me to quickly explain my specific view on railroads.

Investing In Railoards After Warren Buffett

One of the most extensive research studies I have done on my journey toward becoming a successful investor deals with North American Class 1 railroads. In particular, I was inspired by Warren Buffett’s investment in BNSF. This has been the case study where I learned the criteria the Oracle of Omaha used back in 2009 to invest in this capital-intensive business. As I reversed-engineered Buffett’s moves and thoughts to better grasp what made him step in and buy the largest Class 1 railroad, I found the following metrics. As we will see, they don’t always match the standard KPIs we normally use for this industry. The core idea hinges on why a capital-intensive business can be a good investment: it has to yield a decent return on capital employed.

Railroads are indeed regulated, but the regulators allow them to have a return above 10%. Buffett is known for investing in business with a moat. Railroads have a rather strong one: their physical assets (tracks, hubs, fleets) are hard to replicate without a massive use of capital. Since these companies use a lot of capital for maintenance and equipment enhancement or replacement, they take on debt. What matters here is their earning power, calculated as pre-tax earnings on interest expenses. As long as interest expenses are well-covered (railroads usually score a 6 or more), we can be sure railroads will be able to meet their obligations and refinance the debt that has come to maturity with no real risk of going bankrupt.

Railroads can’t really expand their top line by building new tracks and routes. They do, of course, but to a very minor extent given the maturity of the industry. So, they grow revenue by taking more market share and by flexing their pricing power. Fuel surcharges can boost revenues, but they can also impact it negatively when prices go down. So, when the available data allows us to do so, we only look at revenues net of the fuel surcharge programs each railroad implements. This explains why efficiency is particularly in focus when considering railroads. Buffett usually looks at fuel efficiency as an overall proxy for the efficiency of operations. Last, but strictly related to what we have just summarized, Buffett wants to know the overall use of capital the company wants to have. First and foremost, a railroad needs to take care of its assets. Dividends and share repurchases should be done only with excess cash. Of course, we have then seen how, in reality, Buffett made BNSF take a lot of debt from 2009 to 2015 to fund high distributions towards Berkshire. In this way, BNSF’s parent company made quickly back its initial investment. But this makes sense because Berkshire can deploy its capital at a higher rate of return, so moving some of Berkshire’s debt away from its balance sheet into BNSF’s was a strategic choice.

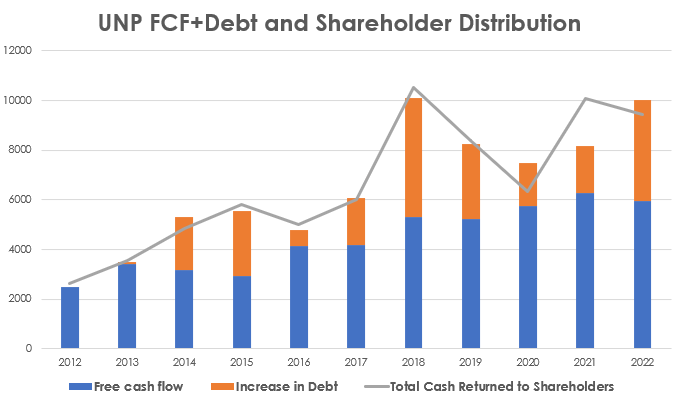

In Union Pacific’s case, however, I showed how from 2012 to 2022, the company regularly increased its debt to fund shareholder distributions.

Author, with data from UNP Sec Filings

While this surely helped the stock’s performance, it left the company and its shareholders aghast once the Fed increased interest rates.

In Q1 2024, Union Pacific reported an +1% increase in volumes, which was particularly meaningful as it was a countertrend result versus the industry. Moreover, the company’s operating income grew by 3%, and we saw the company making great strides toward enhanced profitability. The balance sheet had improved to an adj. debt/EBITDA ratio finally below 3x, although new properties were not purchased, hinting that a pull-backward effect may take place because of a delay in property purchases.

Union Pacific’s Recent Developments

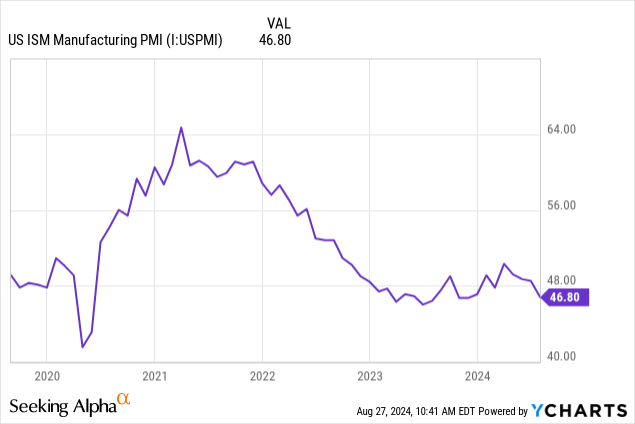

Manufacturing activity has not been great, and we are actually in a manufacturing recession since late 2022.

This creates a difficult environment for railroads, since they move across North America many commodities required by manufacturing and industrial activities. However, several strategists believe the industrial sector has become once again attractive as manufacturing activity seems to have found a bottom, and easing interest rates may drive new demand for machinery, equipment, and industrial products.

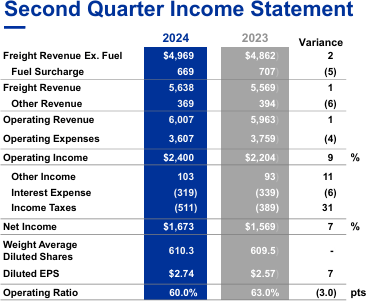

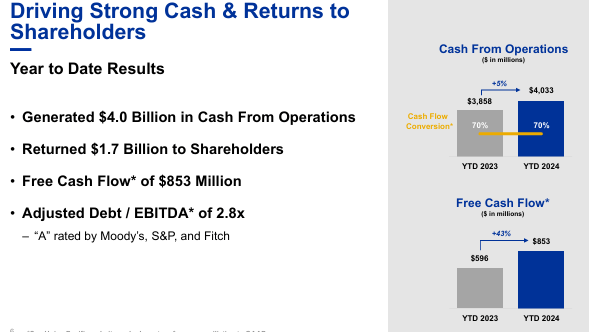

Now, Union Pacific’s Q2 report was mixed, with operating revenues of $6B, missing estimates by just $60M, and quarterly EPS of $2.74 beating consensus estimate by $0.03. Debt declined by 2.1% and the adj. debt/EBITDA ratio was reduced to 2.8x, confirming the deleveraging path Mr. Vena wants to undertake. Surprisingly, the company resumed buybacks, with $100M spent in the quarter.

Union Pacific was able to report a revenue increase thanks to pricing gains and increased volume, although the business mix was partially negative. But revenue carloads were up, too, which is a good sign. Most importantly, the company achieved a 60% operating ratio, which, in this environment with high input costs and soft demand, is incredible. Usually, 60% is the target every railroad wants to achieve. Right now, no one is close. As a result, operating income increased 9% to $2.4 billion. Now, this is something we want to see from a railroad: revenue up low-single digits and OI up in the high-single digits.

UNP Q2 2024 Earnings Presentation

Fuel efficiency improved by 1% to 1.08 fuel per 1,000 GTMs.

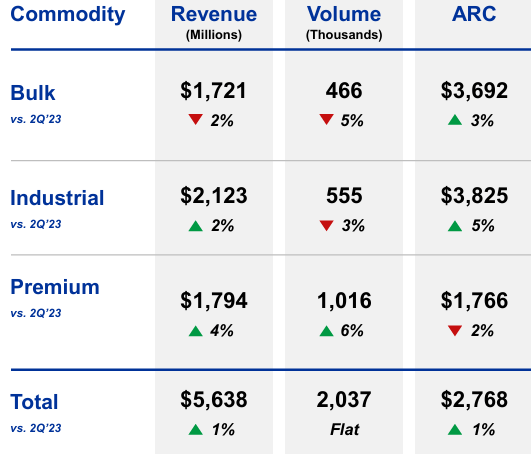

Let’s look a bit more in detail at the revenue mix.

UNP Q2 2024 Earnings Presentation

Bulk, which comprises grain, fertilizers, foods, and coal, saw revenue and volume decrease, though this was mainly due to coal being down 21% YoY. Fertilizers, for example, are up 9%, food is up 9% and grain is up 1% YoY. Overall, we see a segment in good shape. Coal, after all, saw a big demand surge because of high gas prices in 2022 and 2023. But with gas now being cheap once again, coal is returning to more normalized levels. Personally, I would never invest in a railroad expecting coal volumes to increase in the long term. However, the average revenue per car (ARC) was up 2% for coal, while fertilizers saw a 14% decrease. This helps us understand why Union Pacific still talks about a mixed environment with low visibility. Demand is not as strong as the company would need to assure investors about its pricing gains down the road.

Industrial was up 2%, thanks to chemicals and plastics contributing with a 9% increase, while metals and minerals were down 6%. Now, pay close attention. Chemicals is usually the commodity many economists consider understanding when the economic cycle is picking up strength once again. When demand for chemicals increases, it means that we will soon see more industrial output down the manufacturing supply chain. So, this is a particularly important number to consider, which surely bodes well for the next manufacturing cycle to start soon.

Union Pacific’s premium segment is made up of automotive and intermodal. Well, both are up 5% and 3% respectively. Now, automotive is slowly decelerating, and I don’t expect it to increase in 2025 vs. 2024 as automakers are now struggling with volumes. Intermodal, on the other hand, shows some renewed strength which could keep gaining traction as international traffic increases. However, the ARC was down 3% QoQ which still shows some difficulty in exercising pricing power.

Looking at the company’s quarterly income statement, we see more evidence of enhanced performance. Operating expenses decreased 4% YoY. This is net of wage increases and other input costs, which put pressure on margins. There is only one way to look at this result: Mr. Vena is taking action and the company is quickly getting rid of unnecessary costs.

UNP Q2 2024 Earnings Presentation

Union Pacific’s outlook was somewhat mixed, which is reasonable given the current situation. Second-half volume is seen as uncertain, even though the company expects to increase its profitability up to the point it committed to a $1.5B share repurchase program to be ended by 2024 (1% of the current market cap). True, its earnings power is still low around 5x, but by paying down debt we should soon see interest expense going down while pre-tax earnings should improve.

UNP Q2 2024 Earnings Presentation

Since Union Pacific released its Q2 earnings, however, more positive news about rail traffic has been released. At the end of July, the Association of American Railroads (AAR) reported U.S. rail traffic up 5.3% YoY, with intermodal volume rising 10.5%. Grain, farm products, forest products, and food all were up across the board, while coal kept decreasing as well as minerals and metals.

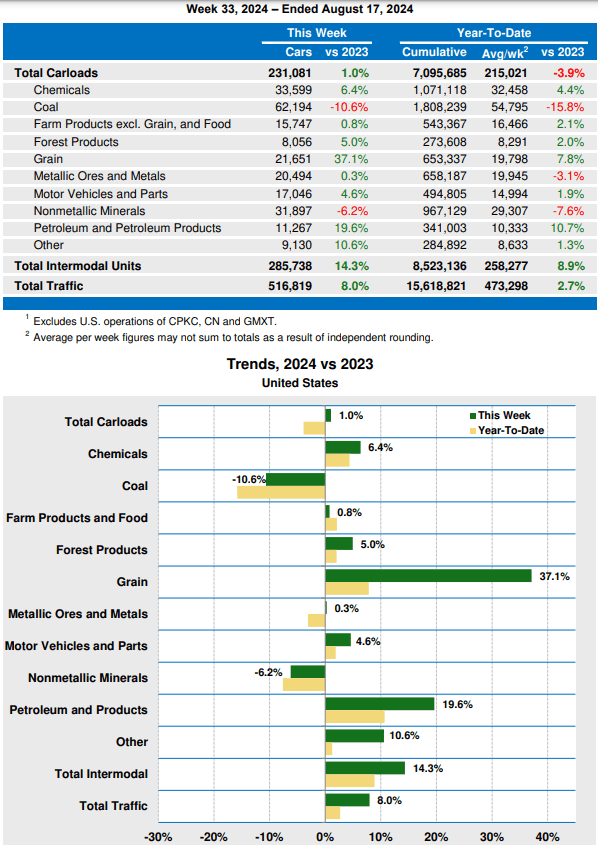

The last available report for the week ending August 17th, 2024, shows weekly traffic up 8% YoY, with 8 out of 10 commodity groups reporting YoY increases. YTD, volume is still down 3.9%, but intermodal is up 8.9%, which means that overall, traffic is up 2.7% YoY.

Looking at the report below, we see the breakdown by commodity. What matters, once again, is the convincing performance of chemicals (up 4.4% YTD), petroleum (up 10.7% YTD) and intermodal units. This makes me think industrials in general can be a good bet for 2025.

AAR

Union Pacific’s Valuation

Is Union Pacific a buy? Yes. Let me show you why. The company trades at a fwd PE of 22.2. Currently, the S&P 500 trades at a PE close to 27.5. Using consensus earnings estimates, the stock is trading at a fwd 2025 PE of 19.7, and a fwd 2026 PE of 17.9. However, though these estimates expect Union Pacific to grow EPS by 10-12% per year, they still don’t factor in the impact of buybacks or an improvement of economic conditions due to lower interest rates.

So, Union Pacific is undervalued compared to the rest of the market, which may be a bit stretched in its valuation.

But what matters more is that Union Pacific – under Vena’s tenure – may be able to grow its bottom line by 10-12% per year. If this goes along with a dividend yield of 2.2% (supported by a FCF yield of 3.9%) and share buybacks that return 1% or more, we have the recipe for a 15+% annual return, which will probably be reflected in the stock price. This means we should see Union Pacific trade above $310 by 2026. I think Union Pacific will be above that in two years.

All of this goes along with a stock scoring an A+ as its profitability metric.

So, a very interesting setup is coming up. We have a reasonable valuation for a business that won’t go away anytime soon. Its internal operations are improving, leaving ample room for expense moderation and profitability improvement. A manufacturing recession seems to be close to its trough, with signs of new economic activity being already identifiable.