Maria Tebryaeva/iStock via Getty Images

ULVM strategy

VictoryShares US Value Momentum ETF (NASDAQ:ULVM) started investing operations on 10/24/2017 and tracks the Nasdaq Victory US Value Momentum Index. It has a portfolio of 124 stocks, a net expense ratio of 0.20%, and a 30-day SEC yield of 1.63%. Distributions are paid monthly.

As described in the prospectus by Victory Capital, the fund selects companies of the Nasdaq US Large Cap 500 Index that have higher exposure to value and momentum factors. A value score is calculated based on price-to-earnings, share price-to-book value and price-to-operating cash flow ratios. A momentum score is calculated based on price returns adjusted for volatility over the last 6 and 12 months (excluding the previous month).

The Index Provider ranks each stock of the Parent Index based on its value and momentum scores, relative to their sector classification, and creates a composite score for each stock by equally weighting the stock’s value and momentum score. The Index Provider then selects the top 25% of the ranked stocks of the Parent index based on their composite scores for inclusion in the Index. The constituents are weighted such that securities with lower realized volatility are given higher Index weights.

The index is reconstituted quarterly and the portfolio turnover rate in the most recent fiscal year was 101%. Due to the focus on large companies, this article will use as a benchmark the S&P 500 Index, represented by SPDR S&P 500 ETF Trust (SPY).

ULVM portfolio

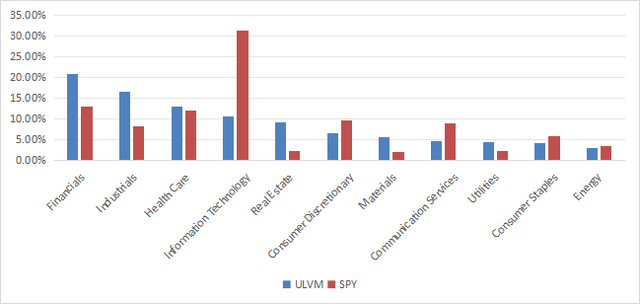

ULVM invests exclusively in U.S. companies. The heaviest sector in the portfolio is financials (20.8% of assets), followed by industrials (16.7%) and healthcare (13.1%). Other sectors are below 11%. Compared to the S&P 500, ULVM overweights financials, industrials, real estate, materials, and utilities. It massively underweights technology and to a lesser extent communication, consumer discretionary, and consumer staples.

ULVM sector breakdown (Chart: author; data: Victory Capital, SSGA)

The top 10 holdings, listed in the next table with valuation ratios, represent 13.1% of asset value. Risks related to individual companies are low, and the portfolio is more diversified than the benchmark, where the top 3 names (Apple, Microsoft, and NVIDIA) weigh between 6% and 7%.

|

Ticker |

Name |

Weight (%) |

P/E TTM |

P/E fwd |

P/Sales TTM |

P/Book |

P/Net Free Cash Flow |

Yield (%) |

|

Berkshire Hathaway, Inc. |

1.70 |

14.28 |

22.28 |

2.61 |

1.61 |

29.96 |

0 |

|

|

Loews Corporation |

1.39 |

11.65 |

N/A |

1.06 |

1.07 |

6.30 |

0.31 |

|

|

Regeneron Pharmaceuticals, Inc. |

1.37 |

31.45 |

26.36 |

10.16 |

4.86 |

43.04 |

0 |

|

|

Cencora, Inc. |

1.27 |

26.12 |

17.70 |

0.17 |

52.02 |

14.08 |

0.85 |

|

|

Fiserv, Inc. |

1.26 |

29.27 |

19.32 |

5.00 |

3.51 |

25.05 |

0 |

|

|

SS&C Technologies Holdings, Inc. |

1.25 |

26.57 |

14.21 |

3.27 |

2.88 |

25.19 |

1.36 |

|

|

The Hartford Financial Services Group, Inc. |

1.25 |

11.74 |

11.04 |

1.31 |

2.18 |

6.74 |

1.68 |

|

|

Duke Energy Corporation |

1.25 |

20.15 |

18.76 |

2.88 |

1.81 |

N/A |

3.73 |

|

|

The Bank of New York Mellon Corporation |

1.22 |

15.14 |

11.73 |

1.31 |

1.35 |

N/A |

2.87 |

|

|

JPMorgan Chase & Co. |

1.18 |

12.08 |

12.20 |

2.34 |

1.98 |

6.19 |

2.12 |

Ratios: Portfolio123

ULVM fundamentals

In accordance with the strategy description, ULVM is cheaper than the S&P 500 regarding valuation ratios, as reported in the next table. Growth rates are a bit lower, except for sales growth. Usually, value funds have significantly lower growth rates (there are some exceptions, though).

|

ULVM |

SPY |

|

|

Price/Earnings TTM |

17.55 |

26.44 |

|

Price/Book |

2.15 |

4.62 |

|

Price/Sales |

1.13 |

3.03 |

|

Price/Cash Flow |

11.35 |

18.15 |

|

Earnings growth |

18.99% |

22.62% |

|

Sales growth |

9.23% |

8.79% |

|

Cash flow growth |

6.92% |

8.99% |

Source: Fidelity

Performance

Since 11/1/2017, ULVM has underperformed the S&P 500 by 5.3% in annualized return. Maximum drawdown and volatility (measured as the standard deviation of monthly returns) point to a slightly higher risk, despite the strategy favoring low-volatility stocks.

|

Total Return |

Annual.Return |

Drawdown |

Sharpe ratio |

Volatility |

|

|

ULVM |

74.72% |

8.54% |

-40.71% |

0.4 |

18.26% |

|

SPY |

141.60% |

13.83% |

-33.72% |

0.69 |

17.48% |

Data calculated with Portfolio123

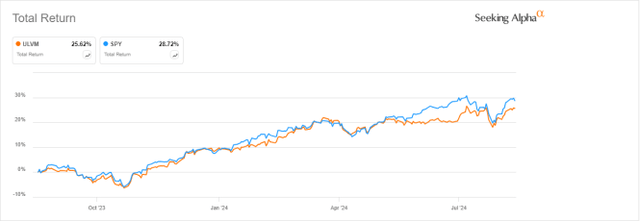

ULVM is lagging the benchmark by about 3% over the last 12 months:

ULVM vs SPY, 12-month return (Seeking Alpha)

ULVM vs. value and momentum ETFs

The next table compares the characteristics of ULVM, two large-cap value ETFs, and two large-cap momentum ETFs:

- Fidelity Value Factor ETF (FVAL).

- Vanguard Value Index Fund ETF Shares (VTV).

- iShares MSCI USA Momentum Factor ETF (MTUM).

- Invesco S&P 500® Momentum ETF (SPMO).

|

ULVM |

FVAL |

VTV |

MTUM |

SPMO |

|

|

Inception |

10/24/2017 |

9/12/2016 |

1/26/2004 |

4/16/2013 |

10/9/2015 |

|

Expense Ratio |

0.20% |

0.15% |

0.04% |

0.15% |

0.13% |

|

AUM |

$159.88M |

$823.56M |

$177.06B |

$9.91B |

$2.29B |

|

Avg Daily Volume |

$45.14K |

$3.30M |

$298.95M |

$132.39M |

$85.79M |

|

Holdings |

124 |

131 |

345 |

128 |

102 |

|

Top 10 |

13.07% |

37.98% |

22.47% |

44.39% |

65.28% |

|

Turnover |

101.00% |

43.00% |

10.00% |

111.00% |

81.00% |

Data: Seeking Alpha

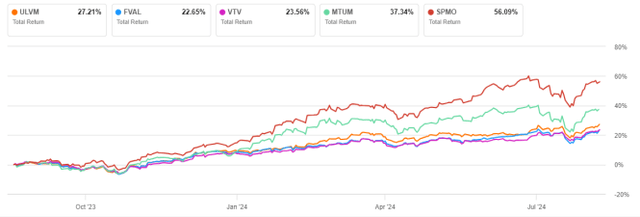

ULVM is the smallest fund on this list in assets under management, and the least liquid in dollar volume. It has the highest fee and turnover, but the lowest concentration in the top 10 holdings. The next chart plots total returns since ULVM’s inception in October 2017. ULVM is lagging by a significant margin.

ULVM vs competitors, since 10/25/2017 (Seeking Alpha)

Over the last 12 months, ULVM is shortly ahead of the value funds, but far behind the momentum funds.

ULVM vs competitors, 12-month return (Seeking Alpha)

Takeaway

VictoryShares US Value Momentum ETF selects large caps using value and momentum scores and weighs them favoring low-volatility stocks. ULVM is well-diversified across holdings and sectors, with a focus on financials and industrials. As expected, valuation ratios look better than for the benchmark, while growth metrics are only slightly inferior. However, past performance is underwhelming: ULVM has underperformed the S&P 500 by a significant margin, as well as some ETFs in value and momentum styles. In particular, ULVM has lagged value-only funds, despite an environment driven by momentum. Additionally, the low-volatility tilt of the strategy description is unconvincing: ULVM shows deeper drawdowns and a higher standard deviation of return than the benchmark. A strategy rebalancing SPMO and FVAL in equal weight every year since 11/1/2017 would have returned 14.5% in annualized return, vs. 8.5% for ULVM. Therefore, I think investors willing to mix value and momentum in their portfolio may split the allocated capital into a value ETF and a momentum ETF and rebalance them periodically rather than buying a fund trying to combine both styles like ULVM.