flytosky11/iStock via Getty Images

PDI CEF: rating upgrade to HOL

My last article on PIMCO Dynamic Income Fund (NYSE:PDI) recommended a SELL rating for this closed-end fund, or CEF. More specifics of the article are provided in the screenshot below. As seen, the article is entitled “PDI: 14% Dividend Is Not Enough” and was published on April 12, 2024, by Seeking Alpha. My sell rating was based on the following considerations:

PIMCO Dynamic Income Fund currently has a dividend yield close to 14%, which is very attractive for income investors. However, the PDI closed-end fund’s yield is not enough to: A) make it competitive in terms of total returns; or B) compensate for the risk exposure of its underlying holdings. When comparing PDI’s total return to other benchmarks over a reasonably long period, it significantly underperforms. PDI’s large exposure to mortgage-backed securities poses a significant risk, especially in the current conditions with high rates and narrow yield spread.

Against this background, the goal of this follow-up article is to argue for a rating upgrade to HOLD given the shifted probability curve of interest rates since my last writing. As to the detailed next, such a shift has drastically reduced the risk premium of PDI relative to risk-free rates and improved its return/risk profile.

PDI CEF: fund introduction

To better prime the subsequent discussion, I need to first briefly introduce the fund and its holdings. PID primarily invests in debt, as detailed by its fund description below (the emphases were added by me):

The fund normally invests worldwide in a portfolio of debt obligations and other income-producing securities of any type and credit quality, with varying maturities and related derivative instruments. The fund’s investment universe includes mortgage-backed securities, investment grade, and high-yield corporates, developed and emerging markets corporate and sovereign bonds, other income-producing securities and related derivative instruments.

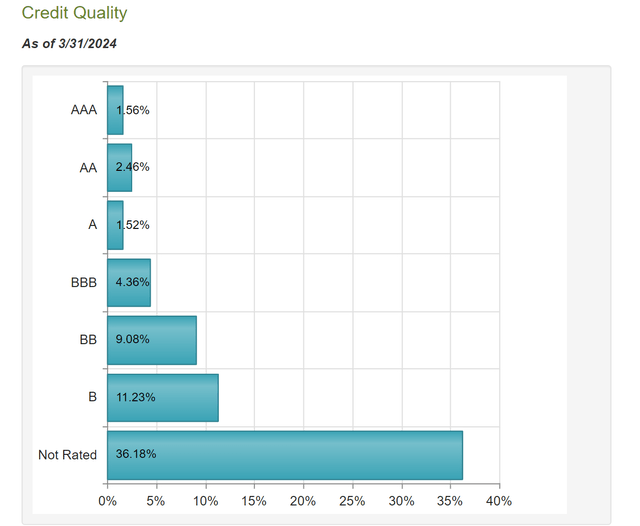

As seen, the fund focuses on high-yield debts, and as a result, the majority of its holdings have a credit quality below investment grades. More specifically, the chart below shows the credit quality distribution of PDI CEF. As of March 31, 2024, the majority of PDI’s holdings are not rated, accounting for more than 36% of the fund’s portfolio. The second-largest holdings are rated B (11.23%), followed by BB (9.08%). Holdings with credit quality at or above investment grades (BBB is the common threshold) are only a minor portion of the portfolio. Holdings with a BBB rating represent about 4.36% of the portfolio, followed by AA (2.46%), A (1.52%), and AAA (1.56%).

Next, I will examine the return/risk profile of such a high-risk credit profile under different interest rate scenarios.

PDI CEF: risk premium has improved

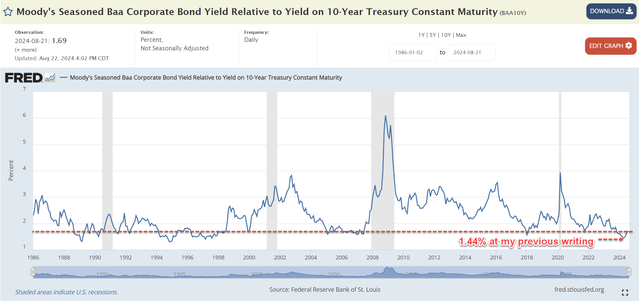

In my last article, I argued that it was among the worst times to invest in non-investment grade debts in more than 3 decades. This strong assertion was based on the risk premium of non-investment grade bonds relative to risk-free treasury rates, displayed in the next figure below. Quote:

This figure shows the yield spread between BAA bonds and 10-year treasury rates (US10Y) (which I use to represent risk-free rates). The yield spread is currently at 1.44% only as seen in the chart. Historically, the spread has been in the range of ~2% to 3.5% most of the time. The current spread is among the thinnest levels in the past 3 decades.

In the past few months since my last article, there has been a material decline in the treasury rates. As a result, the yield spread between BAA bonds and 10-year treasure rates has widened noticeably to the current level of 1.69%. Admittedly, it is still below its historical average. But it is not alarmingly thin, as I saw at the time of my previous article.

More importantly, as to be elaborated on next, the rate cut outlook should further reduce the risk premium.

Other risks and final thoughts

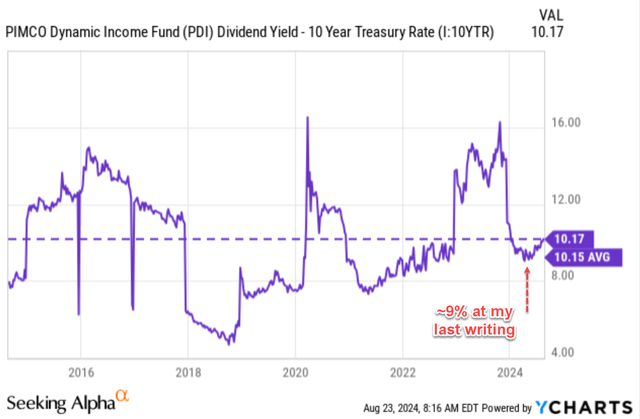

As another reflection of PDI’s improved risk profile, the following chart shows its dividend yield spread relative to 10-year treasury rates. As you can see from this chart, the yield spread has been on average 10.15% in the long term. At the time of my last writing, the spread was only about 9%, below the average by a good margin and indicating a heightened risk premium. As of this writing, the yield spread has widened to 10.17% to be slightly thicker than the long-term average, indicating a much better risk profile.

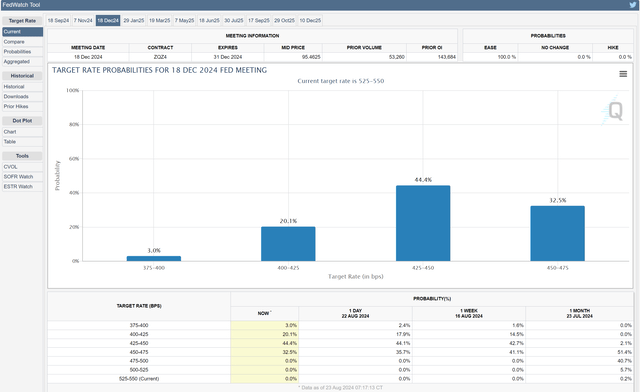

Looking ahead, PDI’s risk premium becomes even more attractive given the rate cut outlook. More specifically, the next chart shows the probability distribution of rate cuts by December 2024 based on federal fund contracts monitored by the CME Group FedWatch Tool. As seen, the current contracts suggest AT LEAST 2 interest cuts by December 2024. In contrast, at the time of my last writing, the market was not sure IF there would be a cut at all.

With the current outlook, the yield spread between PDI and the 10-year treasury yield would further widen. As an illustration, assuming A) there are two cuts by 2024 totaling 0.5% and B) long-term rates drop by the same amount as short-term rates, the yield spread would widen to about 10.7% under PDI’s current price and payout to be comfortably above the long-term average.

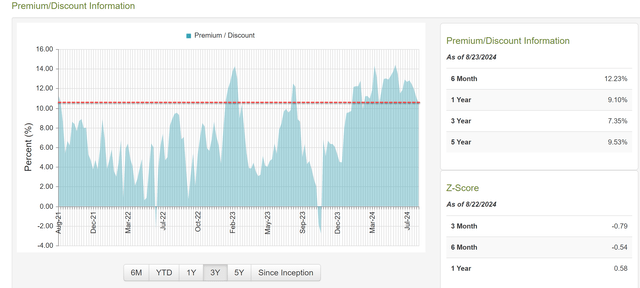

In terms of downside risks, the fund is currently trading at a substantial premium of around 12% above its net asset value (NAV). To better contextualize things, the chart below shows the premium/discount and Z-score information for PDI in the past. As you can see from the data shown here, PDI’s premium/discount has fluctuated significantly over the past. As an example, the Z-score varied substantially depending on the timeframe you choose. It is a negative -0.79 based on the statistics from the past month, but is a positive 0.58 based on the statistics from the past 1 year. If we widen our timeframe to the past 3 years, the current premium is among the highest levels as seen.

All told, my thesis is that the risk premium relative to treasury rates will be the dominant force in the near future. Thanks to the decline of risk-free rates in the past few months and the likelihood of multiple interest rate cuts by 2024, I see a much better return/risk profile from PDI. Thus, I upgraded its rating to HOLD from my previous SELL rating.