Scharfsinn86

Note:

I have covered Westport Fuel Systems Inc. or “Westport” (NASDAQ:WPRT) previously, so investors should view this as an update to my earlier articles on the company.

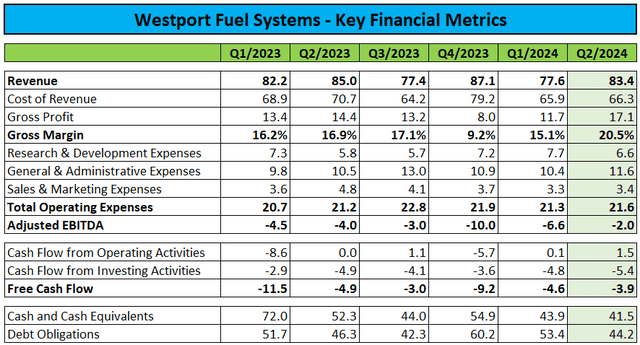

Last week, Westport Fuel Systems reported mixed Q2/2024 results with revenues coming in below and profitability ahead of consensus expectations mostly due to a $13.3 million gain resulting from the transfer of the company’s High Pressure Direct Injection (“HPDI”) operations to a recently established joint venture (“the Volvo joint venture”) with key customer AB Volvo or “Volvo” (OTCPK:VLVLY, OTCPK:VOLAF, OTCPK:VOLVF).

Company Press Releases / Regulatory Filings

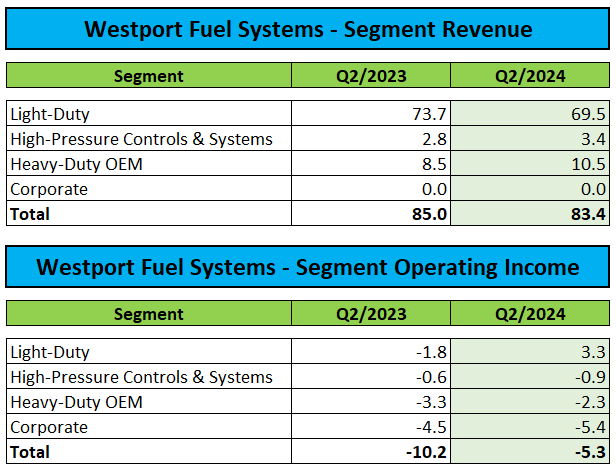

While revenues were pressured by decreased sales volumes in the company’s Light-Duty segment and the transfer of the HPDI operations to the Volvo joint venture in June, consolidated gross margin of 20.5% represented the highest level in recent years.

On the conference call, management attributed the improvement to tighter cost controls and early benefits from recent growth projects.

Operating cash flow and proceeds from the transfer of the HPDI business were consumed by initial joint venture funding requirements, capital expenditures and debt repayments.

Depending on the Volvo joint venture’s cash usage going forward, the company might be required to inject additional funds in the business over time.

Westport finished the quarter with $41.5 million in cash and cash equivalents, as well as $44.2 million in debt obligations.

Subsequent to quarter-end, the company received an additional $8.4 million in cash related to the transfer of the HPDI operations, thus increasing its pro-forma cash position to $49.9 million.

Starting with the third quarter, Westport will no longer recognize revenues from the former HPDI operations.

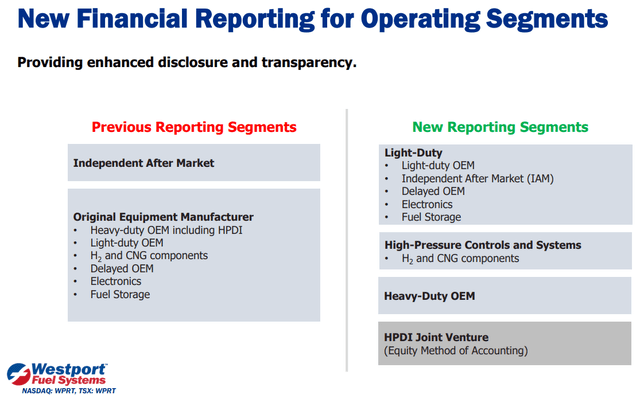

Following the transfer of the HPDI business, Westport has changed its segment reporting:

Please note that the company has introduced a new “High-Pressure Controls and Systems” segment, which includes Westport’s hydrogen and CNG component business.

Company Press Release

While growing nicely, the segment still represented only 4% of the company’s revenues in the second quarter.

On the conference call, management was optimistic regarding the prospects of the new segment:

Today, this segment has a pipeline of future business representing approximately $70 million in additional revenue to be generated in the latter part of the decade. Westport is excited to play a part in an innovative industry in which alternative fuels are seeing increased support and investments.

On July 8, the company sold its remaining ownership interest in the former Weichai Westport Inc. joint venture to Weichai Holding Group (“Weichai”) for approximately $1.4 million.

On the call, analysts were asking about additional color on the sale and potential implications for the company’s existing large-scale HPDI supply agreement with Weichai Westport Inc.:

Chris Dendrinos

I wanted to ask about – there was a comment, I think, it was in the financial disclosure of the MD&A, and it looks like you all exited the JV with Weichai. So if you could speak to that and what maybe the strategy shift was there and, I guess, thoughts going forward with them? Thanks.

Bill Larkin

Well, I mean it’s really two separate things. This is a JV that was formed a long time ago. And then more recently, we had a small ownership percentage, and they finally exited totally from the joint venture. However, that doesn’t change our relationship with Weichai and we continue to support their development activities.

Under the terms of the agreement, the company was expected to supply “proprietary components for no less than 25,000 12-liter engines operating on the HPDI 2.0 fuel system” to Weichai Westport Inc. by December 31, 2024.

However, with a commercial launch by Weichai in China nowhere in sight, I would expect the terms of the agreement to be amended again before the end of this year.

With the HPDI operations having been transferred to the new Volvo joint venture, operating expenses and cash usage should come down substantially starting in the current quarter, while gross margins should improve even further.

Consequently, I do not expect Westport to require new capital in the near- to medium-term, particularly not with a $10.5 million holdback receivable related to the 2022 sale of the company’s interest in a profitable joint venture with Cummins Inc. (CMI) expected to be paid in full next year.

Bottom Line

Westport Fuel Systems reported mixed second quarter results, with some revenue pressures more than offset by the strongest gross margin performance in recent years.

The recent transfer of the company’s HPDI operations to the new Volvo joint venture should boost gross margins even further while at the same time reducing operating expenses and cash usage quite meaningfully.

In combination with an anticipated $10.5 million payment from Cummins next year, Westport Fuel Systems is not likely to require additional capital anytime soon.

However, there’s still no visible path to sustained cash generation and profitability which could justify an upgrade of the company’s stock.

Consequently, I am reiterating my “Hold” rating on the shares.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.