Carlos Duarte/E+ via Getty Images

Following our initiation of coverage of Intercorp Financial Services (IFS), today we deep-dive into another South American bank: Credicorp (NYSE:BAP). Credicorp is a Peruvian financial holding company with a presence also in Colombia, Chile, and Bolivia. The bank’s largest subsidiary is Banco de Crédito del Perú, with a significant share of deposits in the country and a leading market position. Aside from its solid commercial banking activities, the group has pension fund operations and insurance solutions that serve all population segments.

Q2 Earnings

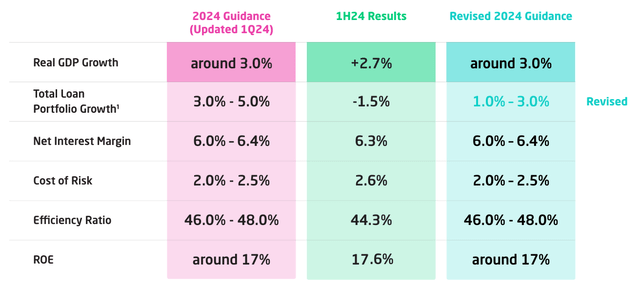

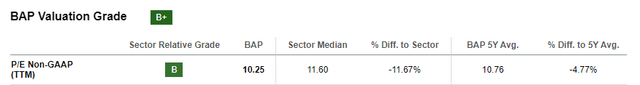

Credicorp released its numbers on 09/08/2024; however, four days later, it corrected specific H1 financial ratios and reaffirmed its 2024 outlook. On a positive note, the adjusted figures are better than the one communicated initially.

Fig 1

Credicorp Corrected Indicators (Credicorp Corporate Website)

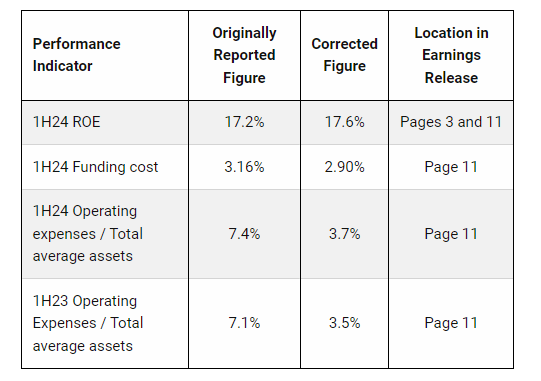

Starting with the bottom line, Credicorp’s net profit reached approximately S/1.4 billion and was down by 7.7% compared to consensus estimates. On a quarterly basis, we see an 11% contraction, yielding an ROAE of 21.7% versus 23.4% in Q1 2024. This lower quarterly performance was due to a spike in provision charges. Even if we anticipated some hike considering the IFRS release, this also came 20% above Wall Street estimates. If we had excluded the provision reversal in the first quarter, the loan loss expenses would have increased sequentially by only a tiny single digit. This came in at a plus 34.2%. Looking at the details, Credicorp’s asset quality deterioration was pressured by Mibanco, with a higher cost of risks. Still related to the Mibanco division, the bank reported a contraction in the loans by 3.2% quarter-on-quarter. This was mainly due to more restricted credit policies. Another critical financial ratio to report is the cost of risk evolution. The CoR was 80 basis points higher quarter-on-quarter and reached 3% (Fig 2). This was due to Mibanco loan portfolio deterioration in old vintage and higher-than-expected write-off.

On a positive note, looking at the aggregate group, the bank loan portfolio posted a recovery, with a 4.4% acceleration on a quarterly basis. The wholesale division mainly supported this. In addition, the net interest income increased by +1.2%, with a NIM stable at 6.1%. Regarding the holding group asset quality, the NPL ratio decreased to -363 basis points to 95% on a yearly basis. This performance was based on the contraction of Mibanco’s NPL. On the CET 1 financial ratio, BCP, and Mibanco reached 12.1% and 16.7%, respectively. Both are above the regulatory capital requirements.

The guidance for 2024 remained almost unchanged (Fig 3), thanks to a resilient net interest margin evolution and higher efficiency in the group segments. The only positive difference is a higher pace of recovery in the portfolio loan growth. In addition, Credicorp also aims to reach an ROE of 18% by 2025.

Fig 2

Credicorp Q2 Financials in a Snap (Credicorp Q2 Results Presentation)

Fig 3

Why are we positive?

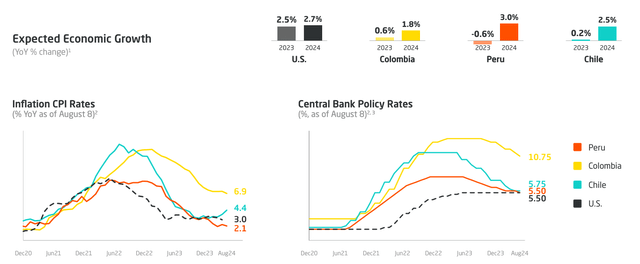

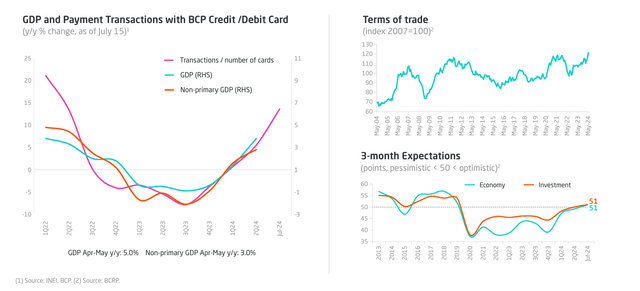

Firstly, the chances of an intense El Niño event have significantly dropped. In addition, the Peruvian economy has been sluggish due to the negative civic protests at the beginning of 2023. For this reason, we forecast a gradual decrease in the provision charge for the group. In detail, for this year, we anticipate a provision for loan losses at 3.6 in S/. in billion, with a forecast of 3.5 and 3.4 in S/. in billion for 2025 and 2026, respectively. On a macroeconomic impact, this will translate into a more benign economic scenario in Peru. Here at the Lab, we believe Peru’s financial outlook is favorable. This is supported by low inflation, as evident in Fig 4, and a transaction recovery (and GDP) – Fig 5. Even if the company ROE slightly deteriorated from Q1 to Q2, we already see signs of a recovery path. The evolution of total loan growth demonstrates this and will be supported by the acceleration of earnings at BCP. With safe estimates on NIM evolution and considering BCP earnings contribution as a standalone division (almost 80% of the total Credicorp results), we implied a turnover growth rate of 2% for the two years ahead. This implied a margin of safety given the current outlook of 2.6% and 2.3% growth in 2025 and 2026. For this reason, we arrive at a yearly 2024 Net Interest of 13.9 in S/. in billion.

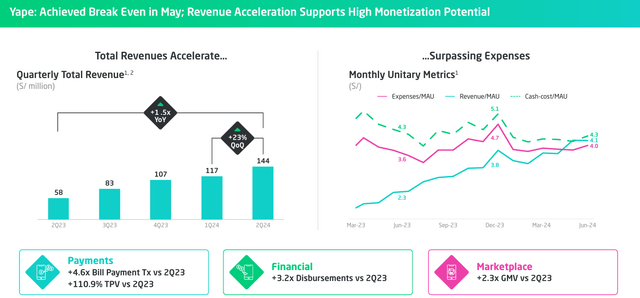

Secondly, and more importantly, the bank has been negatively impacted by higher OPEX costs. This was related to Credicorp’s heavy investment in its digital transformation strategy, which has led to lower ROAE results. Finally, Yape reached its breakeven in May (Fig 6). Yape is the “leading Peruvian payment method, offering a localized and innovative solution to facilitate seamless digital transactions.” In Q2, Yape reached a Monthly Active User base of 12.3 million. Yape is incorporated in the BPC segment, but we see the sales evolution. In numbers, Yape’s success represents approximately 40% of BPC fee growth for the quarter. This online division represents 7% of the total banking fee. Looking ahead, we anticipate this positive trend will continue. Yape is not modeled separately from the investor relations presentation, though we recognize that Credicorp’s disclosure has improved significantly. In our estimates, given that Yape’s fees are up 3.6x year-on-year, we believe it will continue to gain market share penetration. In numbers, Yape fees represent 58% of the segment’s revenue. Therefore, Yape NII currently represents only 2% of Credicorp’s margin. However, given the efficiency ratio and the solid growth, this might be the key takeaway for the year ahead. Therefore, our adjusted operating profit before tax increased more than GDP conservative estimates. In our numbers, we arrive at an adj. PBT of 7.7 in S/. in billion and 8.6 in S/. in billion. This also considers lower provisions.

Fig 4

Fig 5

Fig 6

Valuation

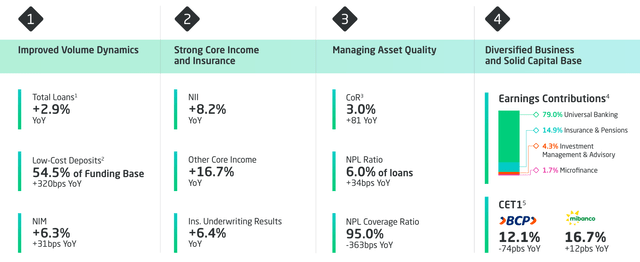

On the valuation part, here at the Lab, we estimate a corporate tax of 26%. Credicorp’s effective tax rate stood at 27.5% in Q1 and 25.5% in Q1 2024. At this current rate, including Yape, and assuming sales continue to double, we would expect this division to arrive at approximately 10% of Credicorp’s profit before tax in 2025. In our calculation, given our model forecast, we arrive at a 2025 net profit of 6.36 in S/. in billion and an EPS of 79.5 soles. The company trades at 7.9x P/E. Considering the current FX rate, our US dollar EPS is $21.26. Valuing the company with its five-year historical average of 10x (Fig 7), we arrive at a $212.6 per share valuation. A ROE valuation of 17.5% also backs this.

Fig 7

Risks

Credicorp’s downside risks include 1) local economic conditions and changes in rates (this might impact the bank NIM evolution and the company’s net profit), 2) natural catastrophe events such as El Niño, 3) asset quality deterioration with higher delinquency rate due to weaker economic conditions, 4) changed in regulatory frameworks such as higher reserve requirements or higher tax, and 5) an increased cost of risks. LatAm’s financial performance is also linked to political risks, as happened in early 2023 in Peru. Another downside risk associated with our target price is related to Yape’s business development. Here at the Lab, we assume a consistent x2 growth rate in 2025.

Conclusion

We like the bank’s dominant market position, low population penetration, and structurally high system ROE. Additionally, the company has a tailwind in Yape’s evolution of digital initiatives. Yape is now breakeven. Hence, this feature and an attractive valuation drive our buy rating recommendation.