Eduard Lysenko

Qualcomm (NASDAQ:QCOM) was founded in 1985 by a bunch of super smart engineers led by Irwin Jacobs. They had a vision for a future where people connected and communicated through handheld devices; Qualcomm sits at the heart of the technologies of the phones we use today. The name is short for ‘quality communications.’ The company has pioneered the cutting-edge chip technology that allows phones to connect with towers over radio frequency (RF). Their technology has allowed 3G, and 4G and is currently supporting the 5G build-out.

Due to their long history, deep research expertise, and technical capability, Qualcomm is the best RF chip company in the world. However, the phone boom is somewhat in the past; in 2000 only some people had smartphones; today everyone and their dog have one. The phone-based business of Qualcomm will continue to grow, if more gradually. I think of it as a mature-stage company paying a dividend, rather than a growth company. However, Qualcomm has its hopes set on the Internet of Things, IoT, which has the potential to power a future boom in RF sales.

Radio Frequency Technology

To enable the magic of connectingphones,s there are four necessary components to the complete infrastructure. First, there needs to be the RF chips. Second, there need to be hand sets. Third, there needs to be towers and satellites. Fourth, there needs to be a common code that the phones talk to each other on. Qualcomm has two main business segments that correspond to the first and fourth of these components, which are probably the higher-margin businesses.

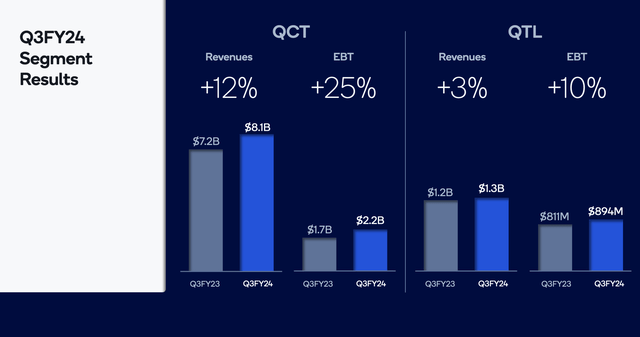

Qualcomm Q3 Segment Results (Qualcomm Presentation)

Their first segment is QCT, which makes the RF chips that go into phones, cars, and other places. Like NVIDIA (NVDA), this is a fabless chip business. Qualcomm designs the RF chips and sends them to a chip fab. This business is the largest business, making up 86% of Q3 revenue. This business has EBT margins of 27%.

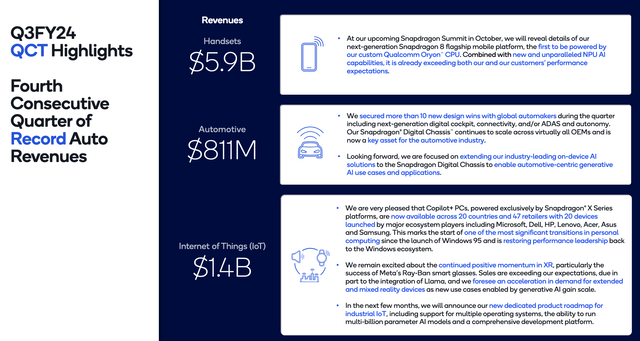

Qualcomm QCT Segment (Qualcomm Presentation)

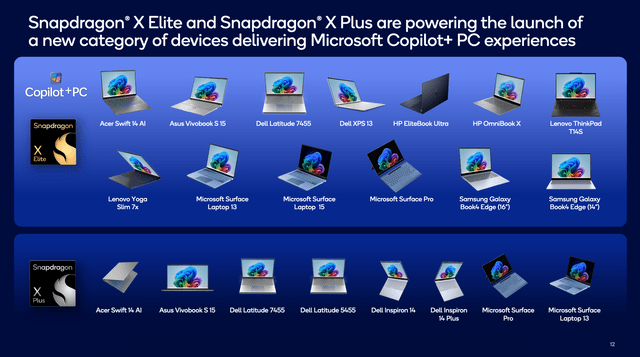

It is this segment that produces the System on a Chip brand Snapdragon.

Snapdragon (Qualcomm Presentation)

The second business segment is QTL, where Qualcomm owns and licenses the IP that makes phone networks work. The company’s original technology was called CDMA, which is the tech that undergirded 3G; LTE was 4G, and 5G is called NR (New Radio).

When a company wants to build a phone or a tower that uses any of these protocols, they need to pay various licensing fees to Qualcomm. The business is 14% of Q3 revenues and has a 70% EBT margin.

Qualcomm continues to research future technologies, investing in its IP portfolio. They also made a major acquisition of Nuvia in 2021, largely to boost their IP pipeline.

Qualcomm has a third segment, called QSI, which is about investing in future technologies.

Qualcomm Growth

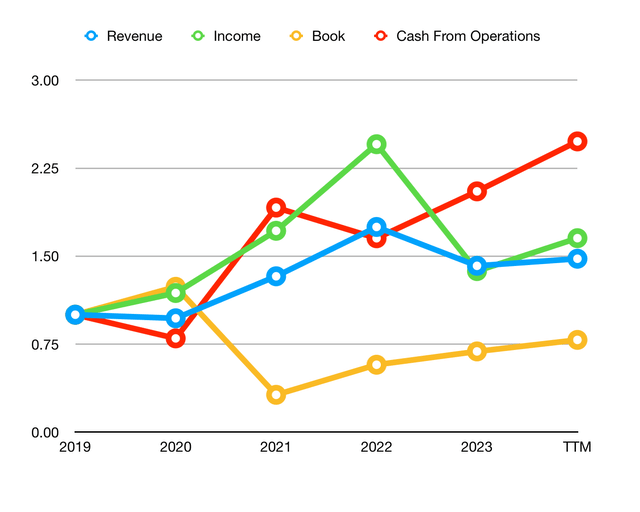

I like to look at the growth of four items to establish the long-term power of Their business: revenue, income, book value, and cash from operations.

Qualcomm Growth Numbers (Author)

There are a few things worth mentioning here. The revenue has had an 8.1% CAGR in the last five years. There was a phone boom around COVID that drew forward some of their revenue. Analysts estimate revenue will continue to grow 7–10%, which is reasonable given Qualcomm’s past.

Qualcomm Revenue Estimates (Seeking Alpha)

The income has a similar shape with a 10.5% CAGR over five years. Analysts estimate 19% growth in 2024, then ~11% going forward, which is also reasonable.

Qualcomm Income Estimates (Seeking Alpha)

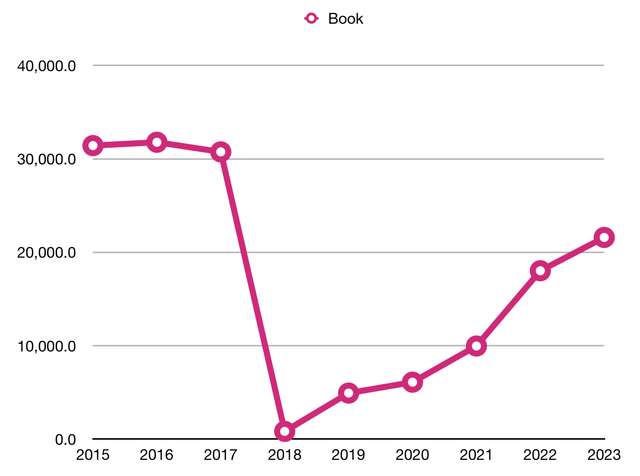

The book value took a concerning dip, back in 2018. In this year, they lost money on a few things, including the failed NXP Semiconductor (NXP) acquisition, as well as paying back $4 billion in debt. This means that looking at metrics like ROI is a little weird Since, 2019 Qualcomm has grown BV at 34.5% CAGR, but this has been a recovery.

Qualcomm Book Value (Author)

Qualcomm has grown its cash from operations at a five-year CAGR of 9.2%, which is in line with its income growth.

Overall, this is a business that should continue to grow revenue at a rate of around 8-9% and earnings at a rate of around 10-11%.

Capital Allocation

Normally, I look at ROE and ROIC to evaluate a business’s profitability, but their book value has been whacky.

Qualcomm currently has $13 billion of debt, with its debt/earnings ratio at 1.5. I’m always too happy to see this number less than three.

Qualcomm is currently paying an 85-cent quarterly dividend, which comes to $3.40, or a 1.97% annual yield at the current share price.

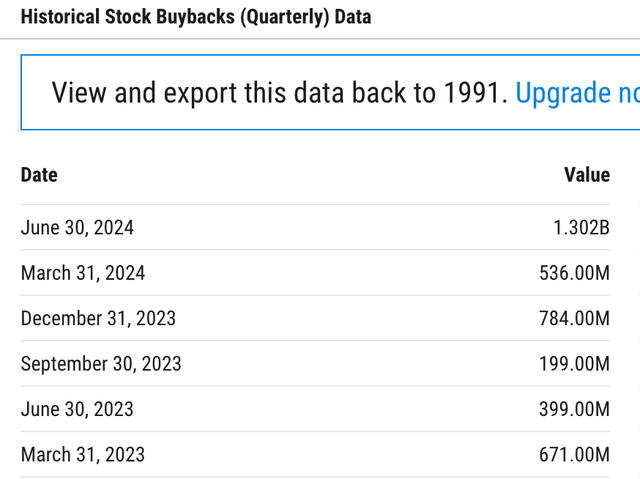

Qualcomm is also buying back shares. They have purchased $1.8 billion of shares, which is 0.95% of their current market cap.

Qualcomm Share Buybacks (YCharts)

Overall, it looks like the company is a great capital allocator.

The Bear Case

When evaluating the future of the business, we need to think about potential problems. There are three reasons to fear for the future of Qualcomm.

1. The Low End

There are various levels of RF chip quality. The newest iPhone has a more sophisticated RF chip than a cheap handset. The low end of RF chips are easier to make and are more like a commodity. A company like MediaTek can produce the low-end chips.

2. The High End

Currently, one of Qualcomm’s biggest customers is Apple. However, Apple is paying large fees and is seeking to design its own RF chips. They have not been successful and recently extended their contract from the end of 2025 to the end of 2027. This is good news, but Apple may get there and cease to be a customer of Qualcomm.

Qualcomm will not go out of business: they are the best RF chip maker in the world. They still have a moat, but it seems less strong than it was ten years ago.

3. IP Problems

Qualcomm is a company beset by legal attacks. It might be that they hold a monopoly on the IP for 4G and 5G. These patents represent a high-margin, low-cost business that makes Qualcomm very profitable. Their customers are not always happy about this. Apple has tried twice to challenge the Qualcomm monopoly in the courts. This challenge has not succeeded. But there exists the possibility of future challenges succeeding and killing the fat margins.

4. China Trade Tensions

Recently, there was a ban on some IP tech between Huawei and Qualcomm. It looks like this ban is not so severe. If, however, this ban is an indicator of a political culture that has more future bans, it could really hurt Qualcomm’s bottom line.

The Bull Case

Qualcomm will continue to be an amazing tech company that produces the RF chips that power our connectedness. However, the best days or growth for their handset-based business is behind us. Qualcomm is looking for a different business to power its future: the Internet-of-Things (IoT).

IoT is not a fully developed reality yet, but the basic idea is that our everyday lives will be filled with connected devices. The central example of IoT is smart cars, cars with sensors that can talk to each other. To achieve this vision will require massive amounts of RF connectivity and massive amounts of computing power. If this vision is made a reality, Qualcomm will be one of the key companies benefiting.

If there is a future for Qualcomm to exceed 10% earnings growth, it depends on IoT. My eagerness to invest in Qualcomm depends on my feeling about the future potential of IoT. My feeling about this is this question goes into the speculation bucket. The IoT certainly will happen, but I’m not sure how big it will be or how fast it will happen. I don’t feel confident in an investment case that depends on the best-case scenario for an IoT future. Therefore, for my evaluation model, I will take 11% for future earnings.

Evaluation

I use three evaluation methods, taught by Phil Town and RuleOne Investing.

Margin of Safety

The first method is about the earning power of a business. A business with a durable competitive advantage will be able to grow its earnings over time. You need to have a sense of what their earnings growth rate has been and what it will likely be in the future, which requires understanding the business. Once you can estimate the earnings growth rate, you can grow the earnings ten years out.

Qualcomm currently has an EPS of $7.71. If we grow this for one year by 19% and then for nine years at a compounded rate of 11%, the future EPS will be $23.47 in 2035. The share would be fairly valued then at $516.33, given a PE of 22 (double the growth rate).

Discounting this by a rate of 15% today gives a ‘fair value’ of $127.63. Phil Town seeks a 50% margin of safety, which gives a buy price of $63.81.

Payback Time

The second method is called Payback Time. This method looks at the free cash flow growth over time. Basically, you think of yourself as owning the business. If you owned it, how much FCF would you get per year? You add up the growing FCF over the years. Town argues that eight years is considered a ‘fair’ amount of time to get your investment returned. If an investment can ‘pay you back’ in eight years in FCF, then it’s a good investment.

Qualcomm currently produces $11.35 FCF/share. If we grow this by 19% in the first year and then by 11%, and add up this cash, each share will produce $161.23 in eight years, which is the ‘buy price’ for PBT. The fair value in this view is $322.46.

Ten Cap

The third method is called the Ten Cap. In this lens, we imagine the business is like a rental property that we own. Each year there is cash coming off the property, which may not be growing, but is a dependable stream of income. However, we need to pay for maintenance fees. This is like Warren Buffett’s concept of Owner Earnings. Phil Town does a similar calculation to FCF, but he takes cash from operations and subtracts only the maintenance Capex, which is a proxy for depreciation, and adds back to the tax benefit. This is the annual owner earnings. If a property pays 10% of its invested capital back a year, it is called a ten cap. Anything that is a ten cap or higher is a good investment.

(In billions) the operating cash flow of Qualcomm is $13.6; the depreciation is $1.3; the tax benefit is $3.1. These numbers yield owner earnings of $18.1 billion, or $16.41 per share. If you held these shares for ten years, they would throw off $164.10, which would be a ‘good deal.’ This evaluation implies a fair value of $328.20.

Summary of Evaluation

As the three methods do not look at the company in the same way, they do not always agree. When two agree together, this is often enough for a

The ten-cap method is often the most conservative, but this says Qualcomm is a great deal. The shares are $172, which implies an almost 100% upside; so does the PBT method. This situation makes sense as Qualcomm is a cash-generative business. These two methods together say the company is definitely on sale, down from $227.

The MOS indicates that the shares are slightly overvalued, which makes me cautious. What gives me confidence in making a buy rating is that they are also paying a dividend and making share buy-backs.

Conclusion

Qualcomm is a wonderful business that will be a central part of our technological future. There are some threats to their business, but I think these threats are not dire threats.

For our evaluation, we used a conservative growth rate and found that Qualcomm seems to be on sale, even if there are some bear-case concerns. If the IoT future is brighter then I think there is a lot of upside in the stock. However, I’m happy with a buy rating, even with the conservative future.