SimonSkafar

As a dividend investor, I have always been attracted to profitable utility companies trading at high valuations. I am invested in Entergy Corporation (ETR) with an annual dividend yield of 3.86% and Edison International (NYSE:EIX) offering a forward yield of 3.75%. These two companies operate on three macro factors; clean energy, electrification, and technology. In this article, I will explain why EIX is a buy owing to the management’s plan to grow its load in line with the increased roll-out of new technologies and increased base-revenue application to regulator.

Edison International registered a 9.5% increase in its Q2 2024 revenue at $4.324 billion and a net income of $572 million, a surge of +27.4% (YoY). Of importance is that the company through its Q2 2024 transcript affirmed its guidance of 2% to 3% of its load growth through 2028 with an additional forecast of 35% over the next 10 years. Through its main subsidiary, Southern California Edison (SCE) Edison has provided electricity to California for more than 100 years. It serves about “15 million people in a 50,000-square-mile area of Central, Coastal and Southern California.” The other investor-owned electric companies in California regulated by the California Public Utilities Company (CPUC) include Pacific Gas and Electric (PG&E) and San Diego Gas and Electric (SDG&E).

Growing electricity demand

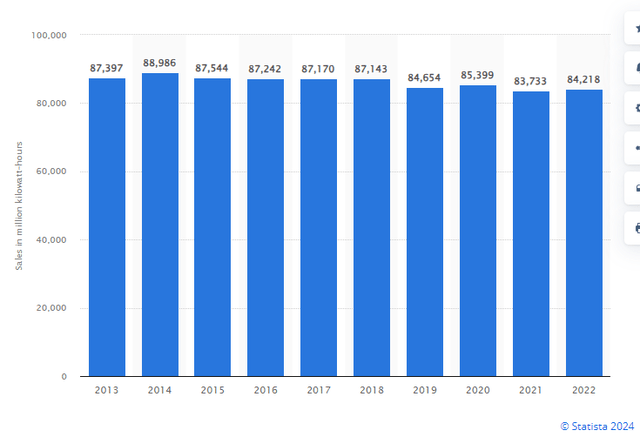

As of 2015, the demand for electricity in this service area (from SCE) stood at 106,080 GWh and it was then predicted to grow by 13.86% to 120,780 GWh by 2028. Still, records indicate that the company has been falling short of this demand by more than 17.5%.

Statista

By 2022, the main electricity sources for SCE included: renewable power- (solar, wind, and geothermal) at 33.2%, hydropower at 3.4%, natural gas at 24.7%, nuclear at 8.3% while the remaining 30.3% was from unspecified sources at the time. Renewable power has been the critical source of electricity for SCE over the years. The company affirmed its 2045 100% carbon-free power distribution target which is also a long-term plan by the State of California.

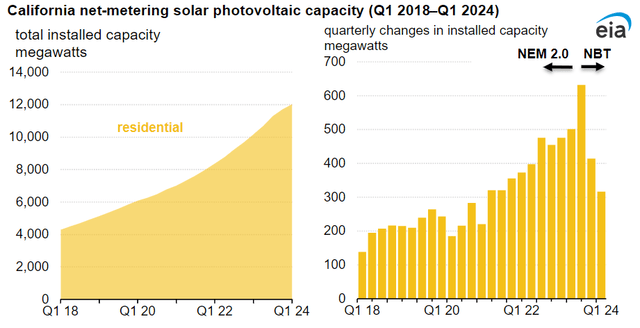

SCE began using net energy metering (NEM) in June 2016 after it was introduced by the California Public Utilities Commission (CPUC) in the same year to encourage the use of solar energy. Under the NEM, solar energy users are allowed to send excess energy after generation back to the grid in return earn credits. California recorded a 22% increase in net metering capacity among solar residents in Q3 2023 (YoY) with the State having more than 12,000 MW (12 GW) by Q1 2024.

EIA

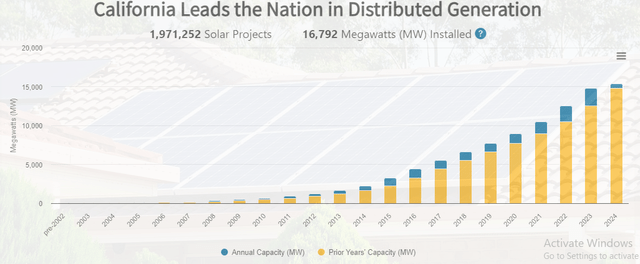

The CPUC upgraded the NEM billing system from NEM 2.0 to the net billing tariff (NBT) system as of April 2023. Under the NBT, the rate of compensation for exported power or credits is “applied to the customer’s bill at a rate reflecting the value of this generation to the grid.” Further statistics reveal that California had approximately 1,971,252 solar projects and installed 16.792 GW of power by May 2024 with a significant increase in annual capacity since 2016.

California AD Stats (solar projects)

The demand for power in California has been consistently growing over the years necessitating SCE to increase its load commensurate to this demand.

Load growth Determinants

I have considered various determinants of load growth by EIX based on emerging sectors in California. Other than the growing numbers of solar users, and by extension renewable energy customers, California will continue to advance industrial growth that needs electric power. Annual manufacturing output in California was estimated at $300 billion accounting for about 10% of the State’s GDP in 2023. Other aspects such as growing transport needs will also necessitate this growth. For instance, all cars sold in California must comply with the zero-emission policy by 2045 as indicated by “the Advanced Clean Cars II regulations.”

Another load growth area is in data centers. I had earlier indicated the similarity between EIX and ETR with the latter growing its data centers considerably. In its Q2 2024 earnings transcript, ETR’s CEO Andrew Marsh stated,

“At Analyst Day, we identified 5 to 10 gigawatts of new hyperscale data center potential in our service areas, which was informed by customer discussions. We continue to have very active customer and other stakeholder engagement on this front and the growth potential for all our stakeholders from this driver remains strong.”

The idea of installing data centers is not new to Entergy and EIX, but the companies have been slow in advancing these facilities as integral systems to the company’s electricity generation/ transmission process. Back in 2007, ETR announced a $41 million investment in a 76,000 sq. foot facility to “convert it into a data center.” It had only 1 data center at the time of this conversion located across the River Mississippi. In Texas, Entergy has 600 data centers employing 16,000 people out of its 50,000 workforce in the state.

Technological advancements have continued to be the hallmark of utility companies’ success with aspects such as the deployment of artificial intelligence (AI) to increase reliability. In July 2024, ETR stated that the use of AI in its metering infrastructure had in a year “hindered 536 unplanned outages and avoided more than 48,000 outage minutes.” Entergy’s Senior VP for Power Delivery, Charles Long elaborated by stating the following,

“Our advanced metering infrastructure is more than just a network of smart meters; it’s a data storage house. The smart meters generate vast amounts of performance data and provide real-time insights into the grid’s performance. By applying AI to this data, Entergy can predict when distribution transformers are likely to fail.”

California has the largest number of data centers in the US at 279. With data centers forming part of the State’s critical infrastructure, it will be imperative for EIX to extend its load growth based on the application of AI in such ecosystems. As seen earlier on, AI has proven effective in providing models and predicting power loads which can be used to forecast overall growth.

Earnings growth to consider

EIX reported in its Q2 2024 SEC Filings that the CPUC is expected to authorize SCE’s base revenue of $10.27 billion (from $8.4 billion in 2024), an increase of 23% or $1.9 billion. The outcome of this General Rate Case (GRC) application is expected in Q1 2025 with SCE looking to increase revenues in the years 2025 through to 2028. The CPUC approves the revenue as well as the cost instruments of these utility companies. I expect the regulatory body to approve this revenue increase since the company is preparing to grow its load to meet rising demand.

Risk

Wildfires continue to pose a significant risk to the growth in electric loads in California. An Insurance report states that the risk of wildfire is 70% more prominent in the western area of the US that comprises “California, Colorado and Texas.” EIX estimated that it accrued losses amounting to $9.9 billion through June 30, 2024, against retained earnings of $7.33 billion. The fire incident report of 2024 reveals that about 820,160 acres of land had been burnt in California with 5,195 wildfires reported.

Valuation

EIX has a forward price-to-sales ratio of 1.88 against the industry average of 2.19 representing a difference of -13.95%. This metric shows the stock has been slightly undervalued. It is also trading 20.20% (YoY) and just 0.7% shy of its 52-week high of $83.80. The company’s gross profit margin is also at 59.33% with a return on equity of 5.40%.

Bottom Line

I have explained that Edison International’s plan to grow its load makes it a buy. The company made a GRC application to the CPUC to increase its base revenue to $10.5 billion from 2025 through 2028 in anticipation of a surge in its clientele. I believe the regulator will approve this application as it coincides with the company’s strategic growth expectations.