hapabapa

Seems like a strange recommendation. Why would one buy a stock BECAUSE of the overhangs?

Nonetheless, I like Chevron Corporation (NYSE:CVX) stock in the low-$140s; the overhangs are part of the investment thesis. It’s a corollary to one of my basic investment principles: seek to invest in premier companies when the Street dislikes it.

Investment Thesis

My thesis is broken into three parts.

First, Chevron Corporation meets my basic screens for a good, long-term investment:

-

It is well-managed.

-

The company owns a strong franchise.

-

The balance sheet is sound.

-

The business earns its profits in cash.

-

Management is shareholder-friendly.

Second, the stock appears to be inexpensive based upon basic valuation metrics.

Third, current events have created overhangs that, I believe, are transitory or overbaked. Embrace the doubt and worry.

Why Is Chevron a Good Long-Term Investment?

Let’s run down the bullet point list from the previous section.

Chevron Is Well-Managed

I believe management makes a difference. As a passive investor, evaluating management may be somewhat subjective; however, certain data points / benchmarks can help discern whether senior leadership in on par.

Here’s a few considerations regarding Chevron:

-

CEO Mike Wirth has spent his career with Chevron. He began with the company in 1982 as a Design Engineer, worked his way up through the organization, and was named the Chief Executive Office in 2018. For large businesses like Chevron, I favor promotions from within. Corporate culture is important; perhaps even critical. I contend that bringing in C-suite outsiders to run a company like Chevron is a yellow flag.

-

Only three of the twelve corporate directors have served more than ten years. I prefer to see orderly board rotation; no major overhauls, nor too many entrenched directors who’ve served for more than ten years.

-

In recent years, Chevron Corporation has not experienced major miscues entailing Health & Safety, environmental management, or public relations. Management seeks to run the business without undue fanfare.

-

Chevron Corporation return-on-capital-employed is highly competitive with super major energy peers and runs significantly higher than its weighted-average-cost-of-capital. For certain sectors/ industries, I believe this metric is a good barometer of overall management effectiveness.

-

Warren Buffett is a major stockholder. I believe Warren Buffett is mindful of management, especially when he holds a major position in a company. Currently, Mr. Buffett owns over 6 percent of CVX outstanding stock. He first acquired shares in 2020.

Chevron Owns a Strong Franchise

The Chevron franchise and logo is recognized worldwide. It is an international-integrated super major energy company. Chevron is a wide-moat business.

Chevron Has a Sound Balance Sheet

Chevron has an exceptionally strong balance sheet.

CVX capitalization (net debt plus equity) is about $178 billion. The net debt ratio (net debt as a function of capitalization) is just 10.7 percent. The debt ratio is so low, management seeks to lever up the business a bit. Remarks from CFO Eimear Bonner on the most recent earnings conference call:

…we are currently under-levered, and we expect (and are comfortable) to modestly re-lever over time, but to stay within historical ranges.

Among the super majors, Chevron’s 0.15 debt-to-equity ratio is best in class.

Currently, S&P indicates Chevron’s credit rating is AA-. This is on par with peer ExxonMobil (XOM) and superior to the ratings for Shell (SHEL), TotalEnergies (TTE) and BP (BP).

Chevron Earns Profits in Cash

I favor companies that generate strong, consistent cash flow. A solid benchmark is when a business generates more operating cash flow than profit. Chevron meets the mark.

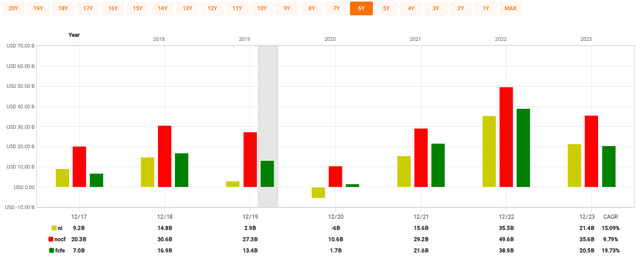

Please find a FAST Graph below comparing Chevron’s multi-year cash flow versus profit.

The red bar is operating cash flow. The yellow bar is net income (profit).

Historically, Chevron generates more cash flow than net income. Indeed, in most years, the company’s free cash flow (operating cash flow minus capital expenditures) is on par or higher than its profit.

2024 mid-year results continue to highlight Chevron’s operating cash flow is greater than net income.

Chevron is Shareholder-Friendly

What is shareholder-friendliness? It’s open to some discussion. I offer a start:

-

The company provides clear quarterly financial reports and presentation material: no confusing charts, opaque disclosures or adjustments.

-

Management has a strong, consistent dividend track record.

-

Management communicates straightforward, long-term strategies and intentions.

-

During earnings conference calls and investor sessions, company representatives offer balanced commentary; they answer questions directly.

Chevron management ticks these boxes.

Quarterly and annual financial information is presented clearly. “Adjustments” to earnings or cash flow is done in a consistent manner: reasonable and unambiguous.

Chevron is a Dividend Aristocrat. It is one of a small set of companies that have paid increasing annual dividends for over 25 years. CVX has increased the dividend for 37 consecutive years. Management states defending the dividend is their top priority for cash deployment.

Chevron’s overarching strategy is straightforward:

chevroncorp.gcs-web.com/static-files/382dd7f8-9f11-452c-bb41-b8c5cc5b0b10

The company also seeks to lower its carbon intensity.

In addition, Chevron management offers investors prioritized financial intentions:

-

Grow the dividend

-

Invest in the business for profitable growth and capital efficiency

-

Maintain a strong balance sheet

-

Return any remaining surplus cash to investors through share repurchase

Company management stakes their positions and offers commentary without stuttering, even if the topic is difficult. For example, when pressed, CEO Mike Wirth has gone on record stating, Chevron’s culture is “grounded in integrity and a deep belief in doing the right thing.” Wirth added, “We are not selling a product that is evil. We’re selling a product that’s good.”

CVX Stock Is Inexpensive

By several measures, Chevron common stock is inexpensive.

Let’s use some FAST Graphs to highlight valuation. I selected the time frame 2018-to-date since it aligns with current CEO Mike Wirth’s tenure and the past versus future growth rates.

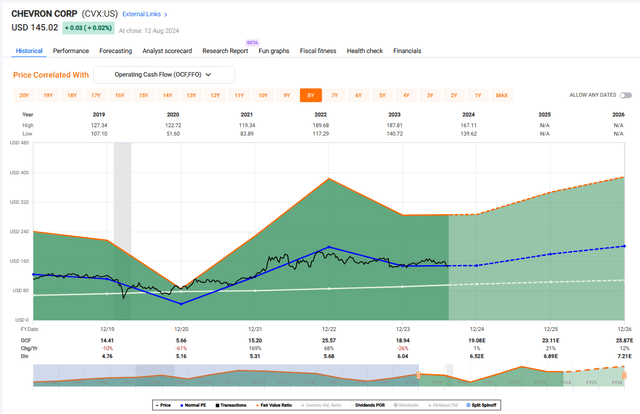

Price-to-Cashflow

Actual past OCF growth rate for the period was 6.2 percent. Two-year forward growth rate is greater.

Input 2025 operating cash flow at $23 per share and apply the historical 7.7x price-to-cash flow multiple: CVX is a $178 stock.

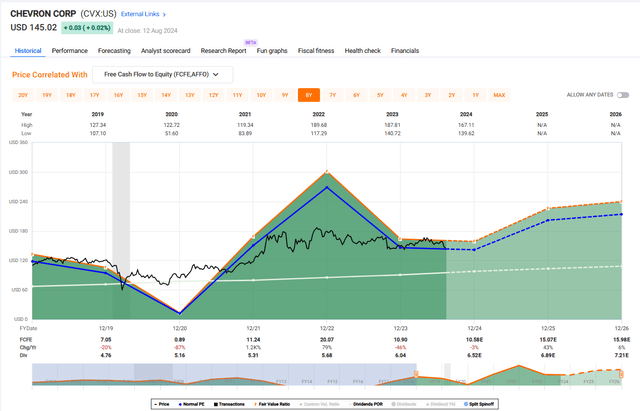

Price-to-Free Cash Flow

Actual previous FCF growth rate for the period was 7.7 percent. Two-year forward growth rate is greater.

Input 2025 free cash flow at $15.07 per share and apply the historical 13.4x price-to-free cash flow multiple: CVX is a $201 stock.

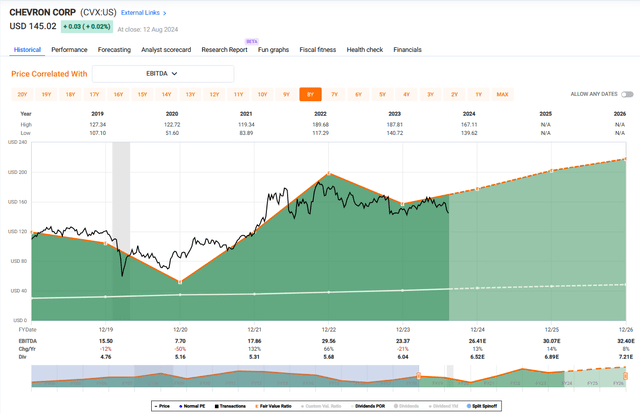

Price-to-EBITDA

Actual previous EBITDA growth rate for the period was 7.9 percent. The two-year forward growth rate is significantly greater.

Input 2025 EBITDA at $30 per share and apply the historical 6.7x price-to-EBITDA multiple: CVX is a $201 stock.

For those who prefer to consider EBITDA as a function of enterprise value, I input 2025 estimates and used a 6.5x EV / EBITDA ratio; in line with recent years’ performance. The resultant price target is $185 a share.

Summarizing, we have four valuation metrics all converging upon approximately the same FV price target. My current CVX Fair Value Estimate is ~$190. That’s a potential 34 percent upside with a 4.5 percent dividend yield to boot.

Additional supporting data:

Recent Street consensus envisions 2025 improvement in earnings and cash flow for the energy industry. However, to the point, CVX current valuation appears more compelling than peer Exxon Mobil. XOM stock trades above its current long-term valuation multiples, while CVX is at or below these marks. Among the super majors, I consider Exxon and Chevron the premier companies. If one is underperforming the other today, historically, it is likely the laggard will “play catch up” and outperform looking forward.

Risks to the Thesis and Valuation

After two relatively soft years, I concur with the Street and expect the energy industry to firm up in 2025. The sector is cyclical. However, a prolonged energy downturn caused by a global recession could bust the thesis.

Chevron management could fail to execute. Here are the major thrusts: large, deepwater production projects in Australia, the Eastern Mediterranean, and the GOM; the Permian Basin, and the TCO project (Tengiz) in western Kazakhstan.

While the Hess transaction is important, I do not believe Chevron’s future success is predicated upon the acquisition.

The Overhangs

My investment thesis includes two overhangs. I believe these overhangs have the probability to become springboard catalysts for the stock. As a contrarian, I see these potential threats as investment opportunities.

The Hess Acquisition / Guyana JV

The Hess acquisition remains in limbo after Exxon Mobil and CNOOC (China National Offshore Oil Company) contested the Chevron / Hess contract under a ROFR (Right of First Refusal) clause. What’s interesting is, the clause is found in a Guyana JV operating agreement. The joint venture partners are Exxon (45 percent owner and the facility operator), China (25 percent owner), and Hess (30 percent owner). Chevron is not part of the venture. The JV is located in the offshore Stabroek Block off the coast of Guyana and is one of the world’s most prolific production fields.

You can read about the basics about the situation here and here.

My take on the matter is straightforward:

I believe odds on Chevron will prevail. Exxon Mobil is likely to lose the arbitration decision.

Having worked my career in the energy business, and much of it specifically managing joint ventures, it is not clear to me why Exxon Mobil would have rights to get in between Chevron and Hess by virtue of its ownership in the Guyana joint venture.

Joint ventures are operated and governed by various contractual agreements. Typically, ROFR provisions are triggered by a change of control and a Bonafide offer. Without seeing all the documents, it is impossible to know for sure, but I have not seen JV documents that permit a partner to step “up” through to the corporate level to invoke rights. Chevron likely has no intent to change control of the Guyana JV to Chevron. The corporate entity Hess (HES) will remain an owner. Chevron is buying Hess Corp via an agreement, not the Guyana JV. To be clear: the Hess Corp entity will survive the merger, and it will simply become a legal Chevron subsidiary.

While we cannot see the Guyana JV documents, Hess and Chevron staff and attorneys most certainly did review these prior to entering into a merger agreement. Chevron and Hess are no strangers to joint venture governance and management.

Furthermore, at what price would a ROFR be triggered? ROFR documents I’ve seen require clear price and terms to be presented to the existing JV owners. Therefore, in turn, a JV owner may exercise their rights on the same price and terms as the potential acquiring party. However, in this case, Chevron did not make an offer for the Guyana JV. The merger documents are for the purchase of Hess Corp.

Exxon Mobil (perhaps conveniently) believes they can perform their own due diligence valuation exercise on the JV, then decide whether to invoke it on behalf of themselves. Curiously, such an approach makes it less than clear where this would leave CNOOC. Of course, if Exxon were to successfully win arbitration for Guyana ROFR rights, then China would have the same rights.

Bottom line: sans the documents, uncertainty remains. However, based upon experience, it seems unlikely a JV operating agreement permits one or more of the JV parties to reach up to the corporate level and inject itself into an overarching merger agreement. The mechanics of such a ROFR is also a bit puzzling.

I believe Hess and Chevron win.

The Green Movement

The other overhang on Chevron stock (and other energy companies) is one involving politics. Investors worry that a Democratic Party victory in November could hamstring the American energy business. While the headline seems plausible, I suspect the barking is a lot louder than the biting. I also believe mixing one’s personal politics with their investments is a recipe to destroy alpha.

Yes, it’s an election year. I know that.

Standard of California, once a pillar of the old John D. Rockefeller Standard Oil trust, is now known as Chevron. Currently, California (perhaps rivaled by New York) are the most hostile states in the U.S. towards energy production, refining, and transportation. Intuitively, hostility from the Federal and State level would appear to be a major threat to Chevron, historically based in California.

I contend it won’t.

Frankly, our friends in Washington have very little effect on global hydrocarbon prices.

But we will hear a lot of speeches since it’s an election year.

Let’s break it down.

First, Chevron management is waving their final goodbyes to California and moving to Texas. This isn’t big news. For years, the parts and pieces have been moving in this direction. Generally, California is an unfriendly place for a hydrocarbon company to do business.

Second, Washington politics can talk a good game about curtailing energy production and punishing hydrocarbon consumption, but it’s mostly throwing a bone to certain voters.

Here’s the reality: high-energy prices are a threat to politicians, and threatening to cut Americans’ standard of living is not a signature policy for garnering votes, either.

Oil and gas markets are global. The United States does not control it. If the U.S. doesn’t produce hydrocarbons, OPEC+ will fill the void. Indeed, since 2022, OPEC+ has voluntarily cut its production to maintain world energy prices and permit the United States to develop the Permian and other non-conventional fields. The Federal government cannot shut in existing private oil and gas facilities unilaterally.

Nor would they.

As we steam towards 2025, there will be no net reduction in global oil demand. To the contrary, demand is increasing, not decreasing.

If Washington politicians crimp domestic energy production, prices will rise, which politicians don’t really want. In the best case, other nations will pick up the slack. However, in that scenario, we start sending money to NOCs that don’t like the United States. We de-stabilize our own ability to meet domestic demand and must rely upon others. Despite all the big talk about alternative energy, global hydrocarbon demand rises about one percent a year, or about a million barrels a day.

Even worse for the politicians are policies discouraging oil refining and petrochemical manufacturing; if they start squeezing refinery output, pump prices are impacted. Refining margins blow out.

The politicians are pandering to the Greens, but their only real lever is trying to stunt supply through regulations. Without a corresponding reduction in demand, dampening supply simply drives up prices.

Want to quash gasoline demand? Raise gasoline taxes, so motorists pay $6 or $8 a gallon. Want to reduce electric consumption? Jack up monthly electric bills to $0.70 a KwH. Unfortunately, I suspect that won’t generate many votes… what do you think?

When pump prices, electric bills, heating oil invoices, etc. start rising, few voters seem to believe it’s their duty to cut back on hydrocarbons. They just want prices to go down. And we’re not just talking about gasoline, electric generation, and heating oil. Rising hydrocarbon costs cause price increases to ripple throughout the economy.

Well-heeled voters know China, India, Pakistan, Iran, Russia, and much of Southeast Asia continue to increase hydrocarbon consumption and have no (as in zero) intention of reducing it. Their increases overwhelm anything we could reasonably do here in the United States.

In the oil patch, there’s a saying: “Everyone likes the idea of using less hydrocarbons and switching to alternative fuels, so long as someone ELSE pays for it.”

Bottom line: I believe these two overhangs dissipate within a year or so: after the November elections and after the Exxon/Chevron/Hess arbitration hearing. Clearing these issues will turn these overhangs into catalysts for Chevron stock.

Please do your own careful due diligence before making any investment decision. This article is not a recommendation to buy or sell any stock. Good luck with all your 2024 investments.