phakphum patjangkata/iStock via Getty Images

Key takeaways

- The fund declined for the quarter.

- REITs underperformed broader equity markets, with REIT sectors that are historically more vulnerable to high interest rates – timber, industrial and infrastructure – lagging.

- The fund aims to strike a balance between select structural growth opportunities and historically economically sensitive REITs at reasonable valuations.

- The fund is positioned for a positive, but below-trend, economic growth environment, which would favor positioning in REITs with visible potential growth opportunities.

- Prospects for falling interest rates and modest growth could mean good investment opportunities in real estate.

- We have observed that listed real estate has delivered strong returns relative to general equities following the final interest rate hike in a Federal Reserve tightening cycle.

Manager perspective and outlook

General equities delivered a positive return, while REITs had a negative return for the quarter. Property transaction activity has been limited in the past two years by tightened availability and elevated cost of capital, creating a wide gap between buyer and seller pricing expectations. Full normalization of the property transaction market may take time as interest rates and cost of capital have remained high for many property types.

Issuance of unsecured REIT debt has increased in recent months as bond market conditions appear to have improved. REITs with access to unsecured credit have an advantage compared to private real estate markets that historically rely heavily on secured financing. Listed real estate companies that have favorable cost of capital relative to private real estate investors and also have strong operating platforms are most likely to find attractive investment opportunities.

Portfolio positioning

With further economic growth acceleration unlikely and interest rate cuts expected in 2024, the fund added to select discounted valuation opportunities. We also added to the fund’s position in single family rentals, which should, in our view, continue to benefit from a structural undersupply of housing that has been exacerbated by continued high interest rates.

Recent additions to the fund include holdings in more historically interest rate sensitive sectors such as triple net, infrastructure and medical office health care REITs. During the quarter, we rotated exposure among data centers in an effort to take advantage of relative valuation opportunities.

The fund’s current overweights include life science, health care and single family rental REITs. The fund is underweight retail, multifamily and industrial REITs. We believe the retail and multifamily sectors have unattractive growth and valuation characteristics compared to other property types, while the industrial sector is experiencing decelerating fundamentals at a still- elevated valuation.

Looking ahead, changes in macroeconomic data, fundamental outlooks, interest rates and monetary policy outlooks may affect our views of relative value and the resulting fund positioning.

Top issuers (% of total net assets)

|

Fund |

Index |

|

|

American Tower Corp (AMT) |

9.84 |

7.26 |

|

Welltower Inc (WELL) |

8.27 |

4.93 |

|

Equinix Inc (EQIX) |

7.71 |

5.73 |

|

Extra Space Storage Inc (EXR) |

4.90 |

2.60 |

|

Equity Residential (EQR) |

4.83 |

2.09 |

|

Camden Property Trust (CPT) |

4.72 |

0.90 |

|

Healthpeak Properties Inc (DOC) |

4.11 |

1.11 |

|

Invitation Homes Inc (INVH) |

4.03 |

1.76 |

|

Alexandria Real Estate Equities Inc (ARE) |

4.00 |

1.62 |

|

Rexford Industrial Realty Inc (REXR) |

3.95 |

0.77 |

|

As of 06/30/24. Holdings are subject to change and are not buy/sell recommendations. |

||

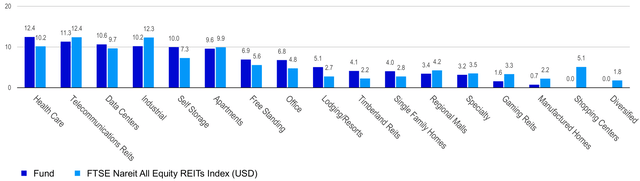

Sector breakdown (% of total net assets)

Performance highlights

Invesco Real Estate Fund (MUTF:IARCX) had a negative return and underperformed its benchmark.

Contributors to performance

During the quarter, the fund benefited from an overweight in the health care sector, which outperformed due to positive results from senior housing and select value opportunities. The positive effect of the fund’s health care overweight offset negative stock selection in the sector. Stock selection within the infrastructure and free-standing sectors also added to relative performance.

The fund was overweight in the multifamily sector for most of the quarter, which added to relative return as the sector outperformed, helped by a privatization and a still resilient labor market amid low expectations.

Detractors from performance

Both stock selection and sector allocations detracted from relative performance during the quarter. Overweight exposure to timber REITs was the largest detractor from relative return. Timber stocks underperformed as continued high interest rates have weighed on housing activity. An underweight in Iron Mountain (IRM) also detracted from relative performance.

Top contributors (%)

|

Issuer |

Return |

Contrib. to return |

|

Welltower Inc. |

12.26 |

1.00 |

|

Camden Property Trust |

11.77 |

0.58 |

|

Equity Residential |

9.72 |

0.47 |

|

Extra Space Storage Inc. |

6.80 |

0.32 |

|

Agree Realty Corporation (ADC) |

9.72 |

0.25 |

Top detractors (%)

|

Issuer |

Return |

Contrib. to return |

|

Weyerhaeuser Company (WY) |

-20.42 |

-0.87 |

|

Host Hotels & Resorts, Inc. (HST) |

-12.11 |

-0.64 |

|

Prologis, Inc. (PLD) |

-13.01 |

-0.54 |

|

Rexford Industrial Realty, Inc. |

-10.52 |

-0.50 |

|

Terreno Realty Corporation (TRNO) |

-10.23 |

-0.45 |

Standardized performance (%) as of June 30, 2024

|

Quarter |

YTD |

1 Year |

3 Years |

5 Years |

10 Years |

Since inception |

||

|

Class C shares inception: 05/01/95 |

NAV |

-1.73 |

-3.69 |

2.28 |

-3.57 |

0.51 |

3.79 |

8.74 |

|

Class A shares inception: 12/31/96 |

NAV |

-1.48 |

-3.36 |

3.06 |

-2.83 |

1.27 |

4.43 |

7.90 |

|

Max. Load 5.5% |

-6.90 |

-8.66 |

-2.58 |

-4.64 |

0.13 |

3.84 |

7.68 |

|

|

Class R6 shares inception: 09/24/12 |

NAV |

-1.43 |

-3.14 |

3.49 |

-2.43 |

1.73 |

4.90 |

5.80 |

|

Class Y shares inception: 10/03/08 |

NAV |

-1.48 |

-3.31 |

3.25 |

-2.62 |

1.51 |

4.68 |

6.62 |

|

FTSE Nareit All Equity REITs Index (‘USD’) |

-0.90 |

-2.19 |

5.78 |

-1.63 |

3.40 |

6.11 |

– |

|

|

Total return ranking vs. Morningstar Real Estate category (Class C shares at NAV) |

– |

– |

88% (218 of 235) |

88% (200 of 223) |

90% (188 of 204) |

86% (131 of 149) |

– |

|

|

Expense ratios per the current prospectus: Class C: Net: 2.00%, Total: 2.00%; Class A: Net: 1.25%, Total: 1.25%; Class R6: Net: 0.80%, Total: 0.80%; Class Y: Net: 1.00%, Total: 1.00%. Performance quoted is past performance and cannot guarantee comparable future results; current performance may be lower or higher. Visit invesco.com for the most recent month-end performance. Performance figures reflect reinvested distributions and changes in net asset value (NAV). Investment return and principal value will vary so that you may have a gain or a loss when you sell shares. Returns less than one year are cumulative; all others are annualized. Index source: RIMES Technologies Corp. Had fees not been waived and/or expenses reimbursed in the past, returns would have been lower. Performance shown at NAV does not include the applicable front-end sales charge, which would have reduced the performance. |

|

No contingent deferred sales charge (‘CDSC’) will be imposed on redemptions of Class C shares following one year from the date shares were purchased. Performance shown at NAV does not include sales charges, which would have reduced the performance. Class Y and R6 shares have no sales charge; therefore, performance is at NAV. Class Y shares are available only to certain investors. Class R6 shares are closed to most investors. Please see the prospectus for more details. |