MoMo Productions

Investment Thesis

I covered Upwork (NASDAQ:UPWK) back in March 2024, and since then, the stock has climbed by 8%. Before I dive into its earnings, let me quickly lay out my main investment thesis, and that is whether Upwork has shown clear signs of re-accelerating its growth while maintaining (or improving) profitability.

The rise in share price can be attributed to 2 factors – (1) management raising its adjusted EBITDA outlook for FY24, and (2) the company exceeding its estimates for both revenue and profitability in 1Q24. The main driver of its 1Q24 results was Upwork’s successful transition to a flat-fee pricing model which bolstered its marketplace take-rates and thus marketplace revenue, the strong growth from its ad and monetization products, and also its steady recovery in growth of active client base since 3Q23. Upwork progress indicates that it is on the right track of re-accelerating its growth rates and delivering profitable growth. Moreover, when compared to other marketplace businesses, UPWK seemed to be trading at a reasonable valuation.

Overall, I am pleased with Upwork’s 1Q24 results and have made positive progress with aligning with my thesis, and therefore, I have revised my rating from “hold” to a “buy”.

1Q24 Result Discussions and Thoughts

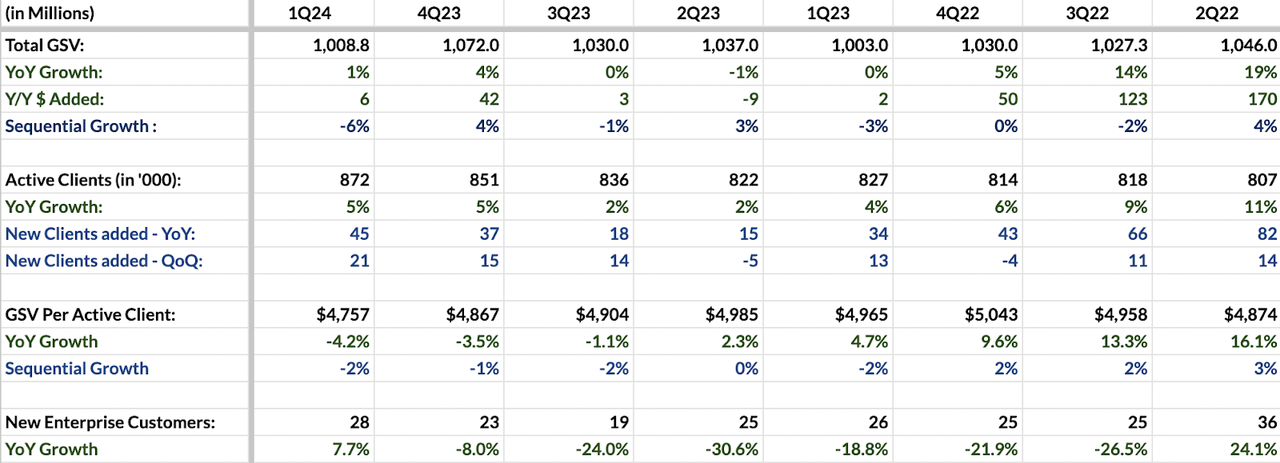

In 1Q24, Upwork added 21,000 new clients – the largest gain they have made in their past 8 quarters. This gain is inclusive of 28 new enterprise customers they have on boarded during the quarter, and that has resulted in a total active clients of 872,000 today. This represents a 5% YOY growth, which is a steady recovery. In the past, UPWK encountered sales execution issues, evident in quarters like 2Q23 where overall active clients declined. Additionally, UPWK was unprofitable at the time, raising investor uncertainty about its ability to achieve growth while reducing operating losses (a point I’ll address later). However, this quarter marks significant progress, with management implementing changes to its sales team and the company now operating profitably. Going forward, it’s crucial to assess how this momentum can be maintained in future quarters, as this is a good indicator to the long-term health of the platform.

Next, GSV per active client has been declining since 3Q23, and the management stated that this was due to the onboarding of new enterprise customers who need time to ramp up their activity, and thus, spendings on Upwork platform. Typically, the sales cycle for landing enterprises is longer, as they often have more complex needs compared to SMBs. Consequently, companies must make substantial upfront investments not only to convince and onboard these customers but also to address their specific requirements. However, the upside is that the opportunity to upsell and cross-sell are larger, and when executed effectively, enterprises make substantial contributions to revenue due to their larger financial resources.

Altogether, this contributed to a mere 1% growth in total GSV. However, according to the management, the transition to the new flat-fee pricing model last year had a temporary negative impact on the growth of GSV during the quarter, and excluding this headwind, Upwork estimates that GSV growth would have been approximately 3%. This headwind is likely to persist throughout FY24, and GSV growth is expected to resume in FY25. If UPWK is able to sustain its current sales momentum, I do think GSV can re-accelerate in FY25 to above 3%.

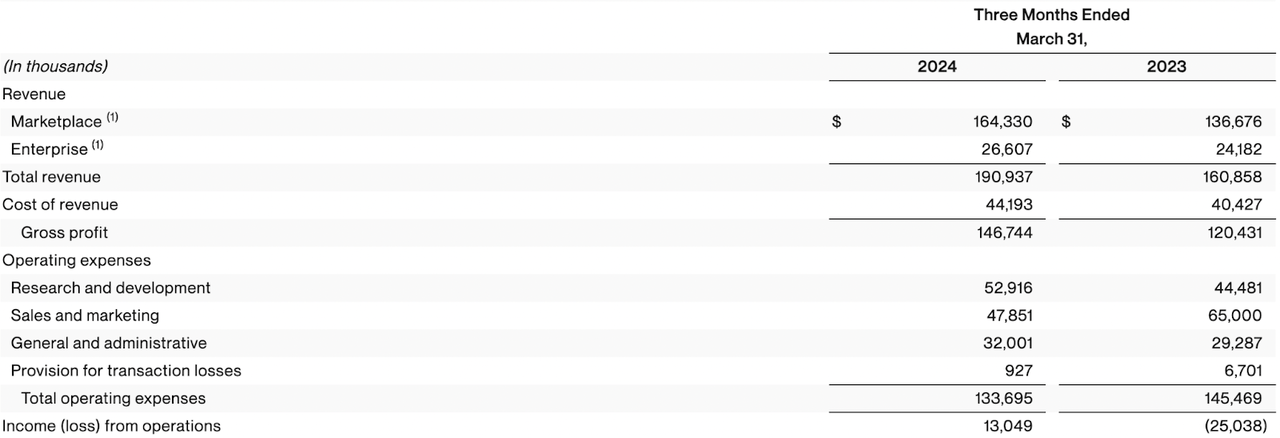

Marketplace revenue grew 20% YoY to $164 million, primarily fueled by the increase in take-rates from 15.9% in 4Q23 to 17.7% in 1Q24. This increase in take rates stems from its new pricing structure and the robust revenue growth in its advertising and monetization offerings, which surged by 93% YoY and is the platform’s fastest growing product. Like other marketplaces, ad and monetization products have high margins, which can be as high as 80%, and they have the ability to raise profitability and take-rates overtime. For instance, customers would pay additional fees to UPWK to boost or promote their services. I do anticipate this will be a crucial driver for Upwork in raising revenues and profitability, rather than relying on a new pricing structure which is not sustainable in the long run.

On the other hand, enterprise revenue delivered growth of 10% on a YOY basis, following a period of 0% growth in 3Q23 and 4Q23. Management attributes this to their strategic partnership with Vendor Management Systems (VMS) which aided them in landing multiple prominent enterprise clients including GoDaddy and Notion during the quarter. However, as mentioned earlier, as these clients gradually scale up their activities, there’s a temporary dip in Upwork’s GSV per active client metric.

Shifting to GAAP profitability, this quarter marked a significant milestone as Upwork achieved an operating income of $13 million, reflecting a notable 55% growth from 4Q23 and an impressive 152% surge from 1Q23. This marks the company’s third consecutive quarter of profitability, with an operating margin of 6.8%, compared to 4.6% in 4Q23 and -15.6% in 1Q23. This is a result of Upwork’s efforts in its cost-cutting initiatives, enhancing operational efficiency, and also resolving its sales execution issues.

In terms of non-GAAP profitability, Upwork surpassed its own projections in adjusted EBITDA, achieving $33.3 million compared to its initial forecast of $30.5 million, marking a 9.2% outperformance. As a result, management adjusted its FY24 forecast, raising the expected adjusted EBITDA range to $140 million to $150 million, up from the earlier estimate of $125 million to $135 million. Consequently, the stock rose by 8% after its 1Q24 results, reflecting investors’ growing confidence in Upwork’s ability to deliver profitable growth.

Valuation

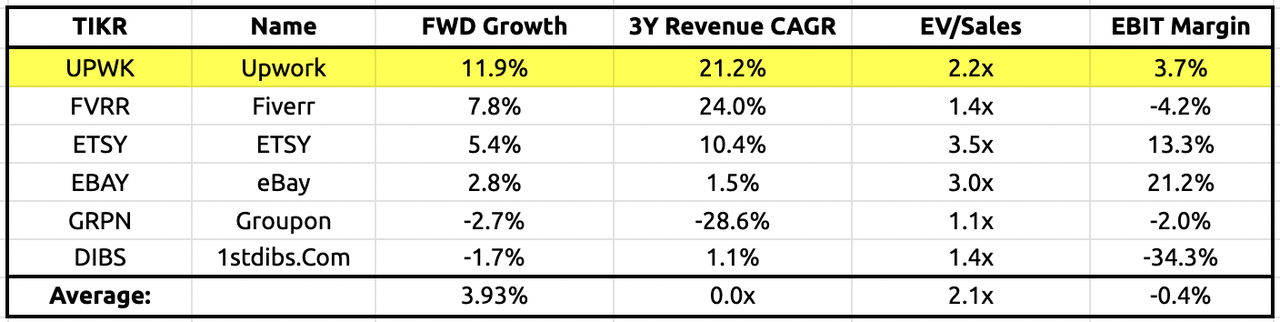

With a current EV/sales ratio of 2.2x, Upwork (UPWK) appears to be trading reasonably when compared to other marketplace businesses. This consideration takes into account its profitability and projected faster growth rate. Moreover, UPWK’s growth seems more resilient than its closest counterpart, Fiverr. Additionally, when comparing UPWK to mature marketplaces like Etsy, which share similar gross margins and asset-light business models, Upwork shows promise in attaining comparable EBIT margins over time as it matures.

Risks

Macroeconomic conditions: Despite sounding like a broken record, it remains a fact that Upwork’s business is still relatively sensitive to macroeconomic conditions. With high interest rates, businesses may continue to be cautious with their spending, presenting potential hurdles for Upwork in acquiring customers, especially in rising customer acquisition costs (CAC). Moreover, the ability to upsell or cross-sell to existing customers may prove challenging, and Upwork’s success to drive growth will be highly dependable on its ability to innovate new products and bundle offerings to deliver value to its customers.

Execution issues: Upwork has undeniably made good progress in this quarter, but execution issues may still persist. A longer time frame is still needed to assess if Upwork can continue this momentum in FY24 and beyond. Its success would depend on its ability to monetize its ad and monetization offerings, and drive customers to its platform

Final Thoughts

All in all, after reviewing its 1Q24 results, it appears that UPWK is making significant progress in aligning with my investment thesis. Upwork’s strategic initiatives, including transitioning to a flat-fee pricing model and experiencing robust growth in ad and monetization products, along with successful enterprise partnerships, have driven the company toward re-accelerating growth while maintaining profitability. However, it’s crucial to emphasize that the long-term driver relies on Upwork’s ability to monetize its ad and monetization products and expand its active client base, rather than solely increasing take-rates, which are unsustainable.

Upwork also achieved a significant milestone with its third consecutive quarter of profitability and exceeded adjusted EBITDA expectations, leading to an upward revision in FY24 forecasts. Considering its profitability and projected growth trajectory, Upwork’s valuation seems reasonable compared to industry peers. Consequently, I will be upgrading my rating on Upwork from “hold” to “buy,” as the company has demonstrated the ability to navigate challenges and deliver sustained profitable growth.