Toronto cityscape with baseball stadium at dusk mbbirdy/E+ via Getty Images

Note: All amounts discussed are in Canadian Dollars.

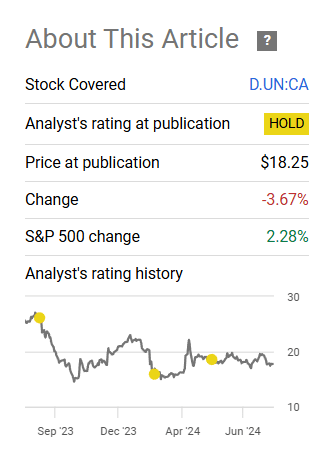

In our previous coverage of Dream Office REIT (TSX:D.UN:CA) we continued to emphasize caution as there was no real clear path to using the NAV discount to one’s advantage.

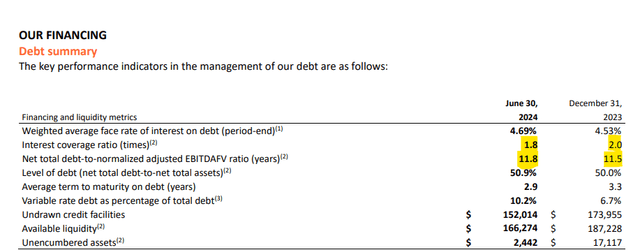

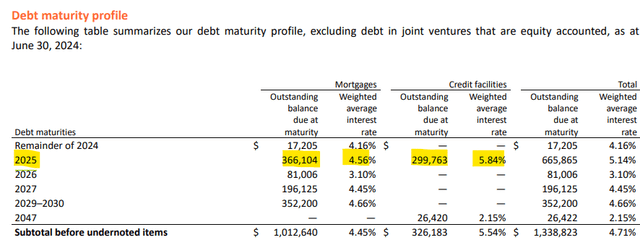

On the debt side, the challenges are mild for 2024 but they will get wild when we enter 2025. The debt to EBITDA is now approaching 12.0X and history is littered with companies that started a terminal velocity ride from far lower levels.

This is a pure wait and watch situation with the best trades being to buy for an oversold bounce. The longer term trend remains down and as we mentioned previously, H&R REIT (HR.UN:CA) with its internalized management and high exposure to alternate asset classes, provides the best way to get office exposure.

Source: Deterioration In Key Metrics

Refusing to buy the stock continues to be the best idea we keep putting out for readers, and this was no different.

Seeking Alpha

We go over the Q2-2024 results and update our thesis.

Q2-2024

The profound disappointment for investors likely came from no major sales being announced. They did announce one sale, which did take place after the end of the quarter, but it was completely immaterial.

In July, we completed a sale of a small asset in Saskatchewan for $8.6 million. The cap rate for the asset was approximately 2.8% as the committed occupancy was only 53%.

Source: Dream Office Q2-2024 Conference Call Transcript

That was the area where analysts honed in on the conference call.

Sam Damiani

I guess, first question just on dispositions. You talked about it a bit and you had a question from Mark there. But I mean, there was a couple of buildings listed for sale earlier this year. Just wondering, if you could provide an update on those specifically, if those are still intended to proceed or how that’s going?

Michael J. Cooper

I know you think that’s an easy question, but the answer is hard. As I mentioned, we definitely have been making great progress in one, but it’s a slow process. On the other one, we actually don’t have an update. One thing I had to mentioned is, I think that another source of capital for us, we have some buildings whose loans mature. And while everybody expects that there’s going to be paydowns on loans, we have a few that are under leveraged and they’ll be a great source of capital for the company.

Source: Dream Office Q2-2024 Conference Call Transcript

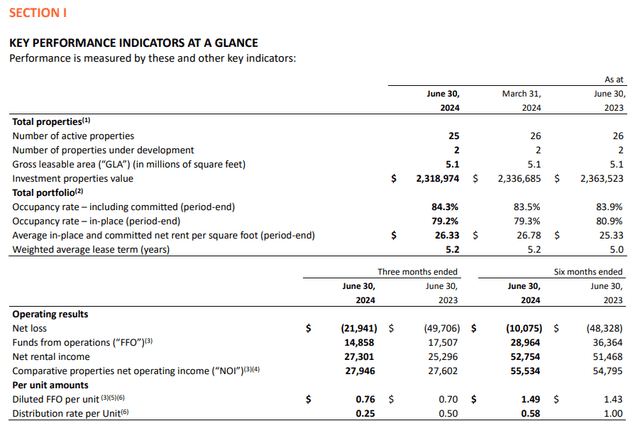

With no major sales, the attention was on the occupancy levels and funds from operations. In place occupancy moved along the bottom, declining slightly from 79.3% to 79.2%. Committed occupancy moved up by 0.8% to 84.3%.

Dream Office Q2-2024 Financials

Despite the decline in FFO from $17.5 million to $14.8 million, FFO per unit moved up from 70 cents to 76 cents. For those that forgot, this is thanks to Dream Office dialing up the leverage with the substantial buyback. That of course brings us to the leverage. The salient features, including a sub 2.0X interest coverage and a sub 3.0 year term (on a weighted basis) are below. More importantly, you can see the debt to EBIDTA ratio, which creeped up once more to 11.8X.

Dream Office Q2-2024 Financials

So 11.5X last December, 11.6X last quarter and 11.8X now. Dream Office has to refinance a lot in the next 18 months.

Dream Office Q2-2024 Financials

But a major portion of that is the $225 million mortgage on Adelaide Place. That looks close to being done.

We are also making good progress on our mortgage maturities in 2025, most notably, the 225 million mortgage at Adelaide Place. We believe we are close to receiving credit approval from the lenders and we’ll look to complete the closing before the end of this year. With this mortgage addressed, we will have 141 million of mortgages remaining for next year, of which we have already received credit approval for 44 million. Our CAD 375 million revolving credit facility also matures in September 2025 and we will look to start the renewal process starting this fall.

Source: Dream Office Q2-2024 Conference Call Transcript

While the debt to EBITDA is scary, the available liquidity and refinancing progress makes it impossible for bears to press hard, yet. But unless the occupancy levels move materially higher or that debt number drops under 10.0X, there will be some heavy cost down the line.

Outlook

There are some bull arguments to be made. We think a trough for office occupancy levels could be close. It is just the sheer dynamics of supply demand and the large immigration influx that Canada has got over the past two years. We have also selectively taken off some supply via residential conversions. We will also see some reversal of the work from home culture, especially in a recession, where employers may be back in the driver’s seat. So we are warming up a bit on office fundamentals, but are still not ready for Dream Office level of commitment.

The real win will only come if Dream Office proves everyone wrong and actually sells a good deal of their asset base anywhere near their stated NAV. It does not have to be exact. Their NAV is still being shown as over $62.00 and the stock is racing to trade at a 75% discount. So realistically, even selling at a modest discount and buying back shares (once debt is reduced) can get the NAV per share back up over $62.00. So far, it has been a slow grind and even the two buildings they are trying to sell appear to be the equivalent of pulling teeth.

Most analysts are slapping 7.00-7.50% cap rates, which equates to a $20.00 ballpark NAV. Fascinatingly, of the two buildings it is trying to sell, it has apparently found a buyer at a 7.25% cap rate.

Dream Office REIT has selected a buyer for 438 University Avenue in downtown Toronto, Green Street News can reveal.

Infrastructure Ontario is in the process of acquiring the Class-A office tower for just under $105m. That price translates to a 7.25% capitalization rate. Dream initially sought offers from $105m to $110m in March but upped its goal to $115m after receiving multiple bids in that area.

TD Cornerstone Commercial Realty and CBRE had the assignment.

The agency is an anchor tenant and occupies over 191,000 sq ft. The department recently executed a five-year renewal and told Green Street News it was “aware the property was listed for sale.”

Source: Green Street News

We are not sure that news is accurate as it has been one and half months since that story broke and Dream Office has not confirmed the sale. But if that price and cap rate are confirmed, you can expect some increased downside pressure. The stock also looks fairly expensive once you take into account the adjusted FFO (AFFO). This metric is significantly lower than FFO, thanks to very high tenant incentives. Dream Office is trading around 11X-12X AFFO for 2025, something we would not label as cheap. One final news piece we want to leave for the bulls. Artis REIT (AX.UN:CA) is certainly on the same page as them.

Sumayya Hussain

Okay. Got it. And lastly, probably a question for Michael. You now have shareholder, holders that own more than 20% of the REIT. Just wondering, what’s the dialogue like with them? And what you can share with us about their intentions?

Michael J. Cooper

The 20% holder runs Artis REIT and they have conference calls. I think you should ask them.

Source: Dream Office Q2-2024 Conference Call Transcript

Yeah Sumayya. Ask Artis. Dream Office cannot provide you with the answer.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.