ALEAIMAGE/E+ via Getty Images

Universal Corporation (NYSE:UVV) engages in sourcing, processing, and supplying leaf tobacco and plant-based ingredients worldwide. We have started covering the firm back in July 2022 with an initial “buy” rating, due to its attractive dividend- and dividend growth, which we have reiterated in September 2022.

The aim of our article today is to give an updated view on the valuation of UVV, using a dividend discount model, just like before, and a set of traditional price multiple to further validate our results.

To conclude our article, we will also summarize the key takeaways from UVV’s most recent quarterly earnings report and discuss the current status of the tobacco market, including potential growth prospects and the state of the macroeconomic environment.

Valuation update

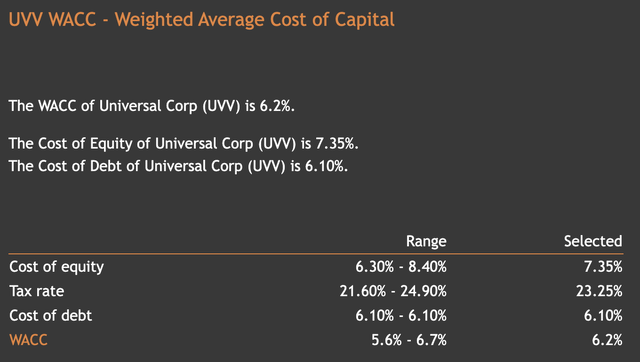

In our first article, we have estimated UVV’s fair value to be in the range of $45 to $65 per share. To get these results, we have used a required rate of return equivalent to the weighted average cost of capital (WACC) of the company, 8.5% and a dividend growth rate in the range of 1% to 3%, based on UVV’s historic dividend growth figures.

To have a fresher look on this company, we will be primarily focusing on the changes of these parameters to come up with a more accurate estimate.

Dividend discount model

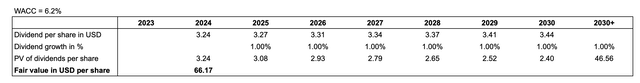

The following table shows the latest estimates for the company’s WACC. The current value of 6.2% is significantly lower than what we have been using before, and for this reason we expect the estimated fair value to be shifted upwards.

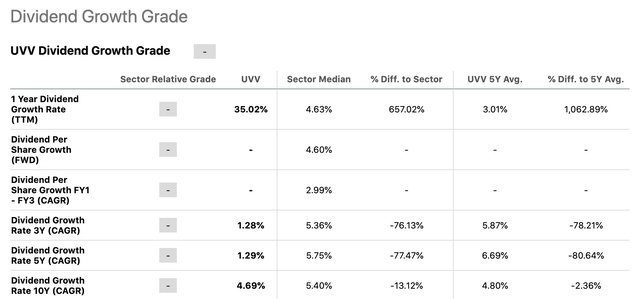

When talking about the dividend growth rate, there have not been any significant changes, we believe that a growth rate of roughly 1% in perpetuity still looks realistic, achievable and reasonable. Especially, when we consider that normally a perpetual growth rate for the economy is assumed to be 2.5%.

If we use these updated input parameters, we get a fair value of $66 per share.

As UVV’s stock is currently selling for $52, it represents an upside potential of roughly 20%.

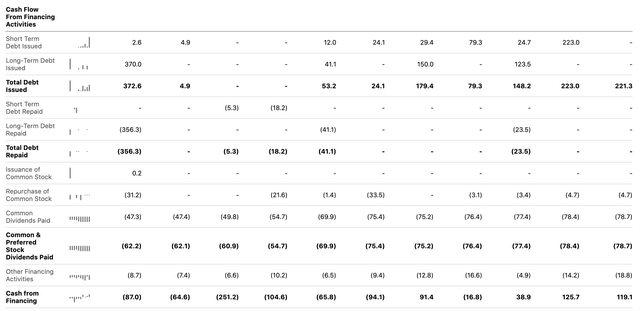

Also keep in mind that UVV has been regularly buying back its shares. Although the amount spent on buybacks is significantly less than the amount spent on dividends, it still contributes to the overall shareholder return, and it is ignored by our dividend discount model.

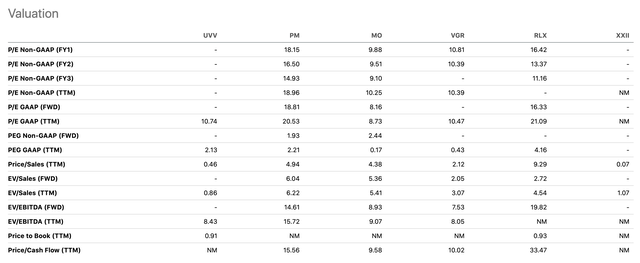

Price multiples

Let us now look at the valuation from a different point of view. The following table presents a set of price multiples and compares UVV’s figures with those of its industry peers.

While UVV appears to be more attractive than most, the undervaluation from this perspective is not as apparent as based on the dividend discount model.

All in all, we believe that UVV offers an attractive risk-return profile at the current valuation. But before setting any rating, we have to see how the firm has been performing in the most recent quarter, and prove that there is a justification from a fundamental point of view, for any bullish rating. Otherwise, we could very easily fall into a value trap.

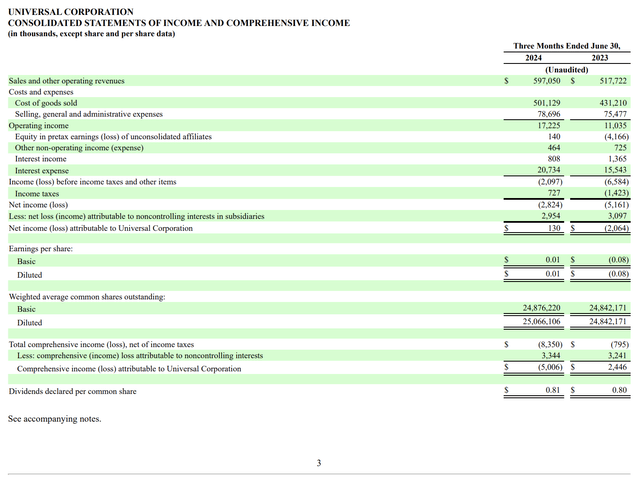

Quarterly highlights

In the most recent quarter, UVV has managed to achieve revenues of $597 million, an impressive 15% increase year-over-year. Its earnings have also came in in the positive territory, reaching $0.01 per share compared to the $0.08 loss in the prior year. The improved results were driven by both of UVV’s segments, namely the Tobacco and Ingredients Operations segments. The company’s operating income was $17.2 million, 56% higher than last year.

Sales

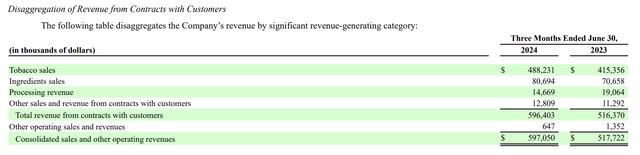

UVV sales increase has been driven by both higher sales volume and also higher prices. In their press release they have highlighted the continued strong demand for their products, as well as the undersupply of the global leaf tobacco. These factors are also assumed to play a major role in the company’s financial performance in the coming quarters.

When breaking down the drivers by segment, we can summarise that in the Tobacco Operations segment the improvement was primarily due to higher carryover crop shipments and higher earnings from UVV’s oriental tobacco joint ventures. At the same time, in the Ingredients segment increased sales volumes which included higher sales of new products and numerous increases in sales of core products drove the performance improvement.

Looking forward, we believe that the demand for tobacco products is going to remain strong. Although the reputation of tobacco products in the society remains poor, we believe that with improving consumer sentiment – which we expect as a result of Fed rate cuts – the demand for tobacco products is going to be even higher. However, keep in mind that the tobacco industry is subject to continuous changes in regulations, which can significantly impact the company’s financial performance. This is a major risk factor that always needs to be remembered, when someone plans to invest in this industry.

Dividends

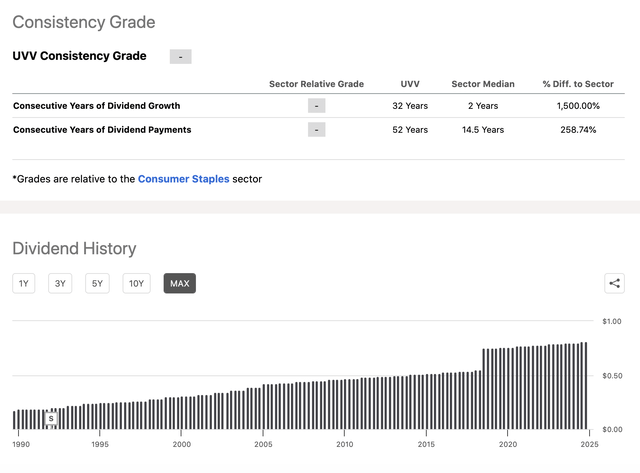

UVV has also declared a quarterly dividend of $0.81 per share. This is a key moment as our valuation method was based on continuous dividend payments and their increases in the future. With this dividend UVV continuous its tradition of returning value to shareholders this way, just like they have been doing so for the past half a century.

Key takeaways

UVV has managed to grow its revenues by more than 15% year-over-year. Both the Tobacco and Ingredients Operations segments have contributed to this growth.

The firm has also managed to achieve positive earnings in the most recent quarter, in contract to a year ago, when EPS was negative $0.08.

According to our updated dividend discount model, the fair value for UVV’s stock is estimated to be $66, which represents a roughly 20% upside compared to the current share price. The assumptions behind this results are a dividend growth rate of 1% in perpetuity and a required rate of return of 6.2%.

All in all, we believe that the current share price presents an attractive investment opportunity for dividend- and dividend growth investors.

For these reasons, we maintain our “buy” rating.