Dragon Claws

Introduction

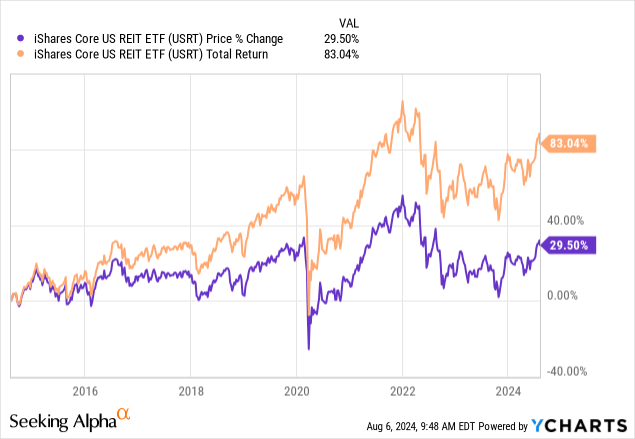

We wrote an article on iShares Core U.S. REIT ETF (NYSEARCA:USRT) back in February last year. At that time, we noted that the elevated rate environment will weigh on USRT’s fund price and the impact of a potential weakening of the economy can have on the fund. Since our last article, the rate has remained elevated and the economy appeared to be resilient through the first half of 2024. However, the macroeconomic environment is now much different than last year. It is time for us to analyze USRT again and provide our insights and recommendations.

Investment Thesis

USRT invests in a portfolio of U.S. REITs. It has a reasonable expense ratio of 0.08%. This is lower than the expense ratio of 0.13% of Vanguard Real Estate ETF (VNQ). USRT has underperformed the broader market in the past few years. USRT’s fund price is typically inversely correlated to the rate. However, it is also sensitive to different economic cycles. The fund has historically declined harder than the broader market in economic recessions. Given the rising unemployment rate, and declining services ISM data, we think investors should remain cautious and stay on the sidelines.

YCharts

Fund Analysis

A balanced portfolio

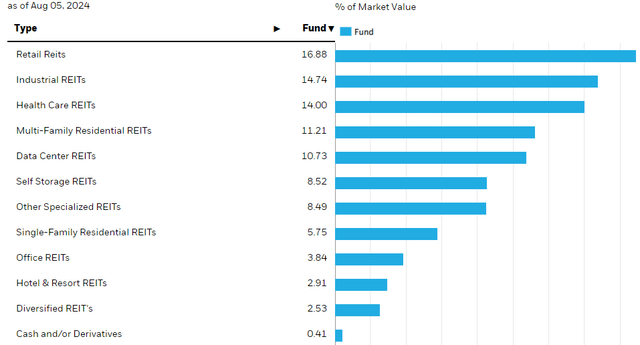

USRT has a balanced portfolio, with no single REIT representing over 10% of its portfolio. The fund also has a balanced portfolio, with no single subsector representing over 20% of its portfolio. As can be seen from the chart below, USRT has little exposure to troubling office REITs as this subsector only represents about 3.8% of the portfolio. In contrast, it has good exposures to higher growth sectors such as industrial, and data center REITs. As the chart below shows, industrial and data center REITs represent about 14.7% and 10.7% of USRT’s total portfolio. As we know, industrial REITs continue to benefit from the growth in e-commerce. Similarly, data center REITs benefit from growing demand in cloud computing and artificial intelligence. Therefore, this portfolio mix appears to be favorable.

USRT has gone nowhere in the past 3 years

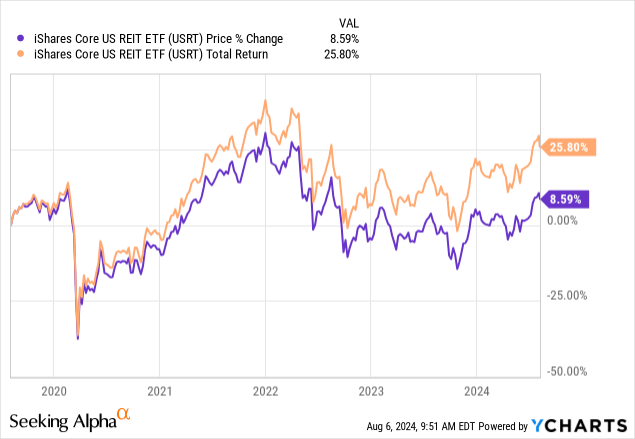

Let us review how USRT performed in the past few years. Like the broader stock market that reached the peak towards the end of 2021, USRT also reached its cyclical peak around that time. Unfortunately, skyrocketed inflation has caused the Federal Reserve to aggressively hike the rate in 2022. As a consequence, USRT’s fund price declined sharply in the same year. Its fund price has rebounded, but still a distance away from the high reached at the beginning of 2022.

YCharts

As can be seen from the chart below, even with dividends, the total return is still negative 10.9% since the beginning of 2022. In contrast, the S&P 500 index has delivered a total return of 13.4% in the same period.

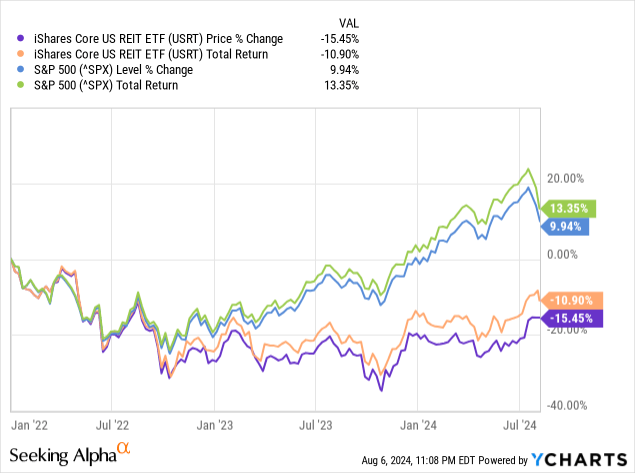

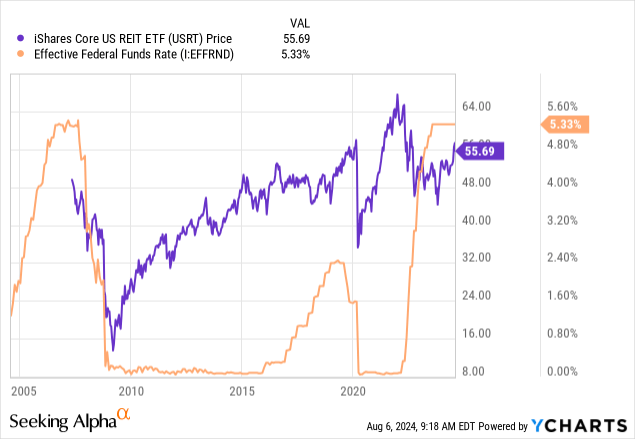

USRT typically has an inverse correlation to change in rate

One primary reason of USRT’s underperformance to the S&P 500 index between 2022 and 2024 is the elevated rate environment. As we know, skyrocketed inflation in 2022 has caused the Federal Reserve to raise the rate aggressively. Since it is quite difficult to tame inflation, the Federal Reserve has kept its rate elevated for quite a some time now. This has caused tremendous pressure on REITs in USRT’s portfolio. As we know, REITs tend to have higher debts and higher rates means higher interest expenses and higher refinancing costs. Therefore, it is not surprising to see USRT’s fund price under pressure in this elevated rate environment.

As can be seen from the chart below, USRT’s fund price tend to have an inverse correlation to the Fed fund rate. In a low rate environment, USRT’s fund price tend to move up, and in a rising rate environment, its fund price can be compressed or even declined. This was the case in 2022.

YCharts

REIT is a cyclical sensitive sector

Besides USRT’s sensitivity to rates, in our previous article, we highlighted that USRT’s fund price is also sensitive to changes in the economy. If the economy is in expansion phase, USRT has typically done well. This is because when the economy is expanding, demand can be very good and REITs can have more room to raise rental rates. However, if the economy is heading for a recession, things will be quite different. Occupancy rates typically decline, and rental income can diminish due to weak demand. Therefore, USRT’s fund price is typically being influenced by these two forces: the strength of the economy, and the rate.

Is the anticipated rate cut good news for USRT?

The market has been speculating that the Federal Reserve will soon begin a new rate cut cycle due to subsiding inflation. This leads to the question: is the anticipated rate cut good news to USRT? Perhaps, a better question to ask is whether the rate cut is due to a weakening economy or simply the result of lower inflation.

It is true that inflation has cooled down considerably, but we also think that the economy is weakening. One important evidence is the rise of unemployment rate. As can be seen from the chart below, the unemployment rate has risen from the low of 3.5% reached in January 2023 to 4.3% in July 2024. The chart also suggests that the rise in unemployment rate appears to be accelerating.

Federal Reserve Bank of St. Louis

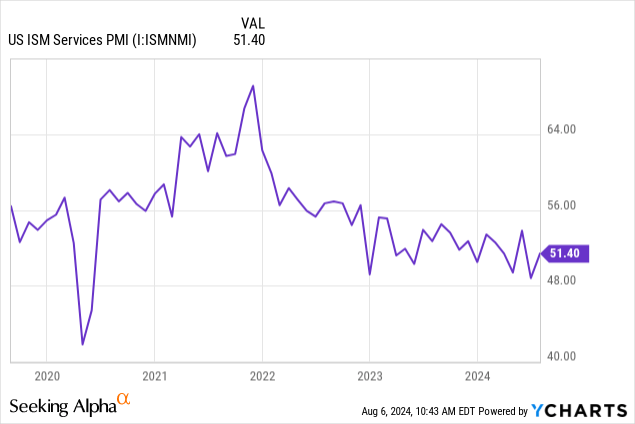

Another evidence of a slowdown in the U.S. economy is the ISM services PMI. For reader’s information, PMI is a forward economic indicator. A figure above 50 usually means the economy is likely to expand, but a figure below 50 suggests the economy may be heading for a recession. As we can see from the chart below, despite the recent rebound, U.S. ISM services PMI is on a declining trend since late 2021. This suggests that an economic recession may be on the horizon.

YCharts

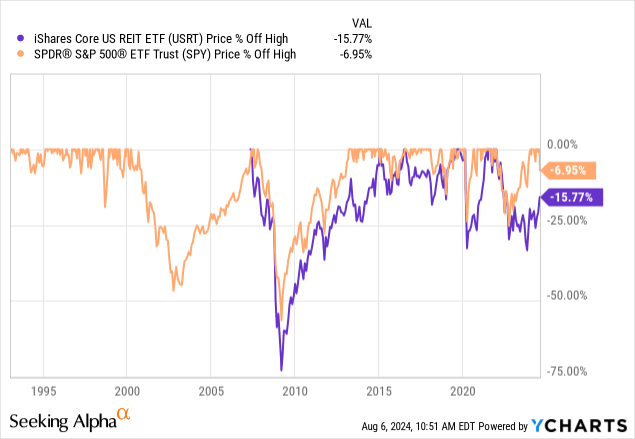

If an economic recession arrives, USRT’s fund price can fall sharply even if the Federal Reserve decides to lower the rate. In fact, the Federal Reserve has usually lowered the rate because of a weak economy. For example, in the rate decline cycle in 2009 and 2020, USRT’s fund price did not rise even though USRT’s fund price is often inversely correlated to the rate. In addition, as can be seen from the chart below, USRT’s fund price typically dropped much harder than the broader market in previous recessions.

YCharts

Investor Takeaway

Since the likelihood of an economic recession is high. We do not think this is the best time to own USRT. We suggest investors to patiently wait on the sidelines.

Additional Disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.