J Studios/DigitalVision via Getty Images

Passive Aggressive – July 2024

Dear Partners,

July was a volatile month. Not only because of the condensed reporting season but also due to upheavals in both size and momentum factors at a time when most local fund managers pay less attention to markets. The de-grossing and rotations were violent at times, and challenging to navigate.

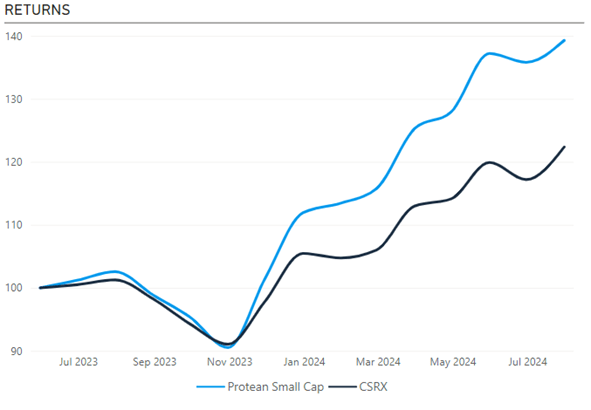

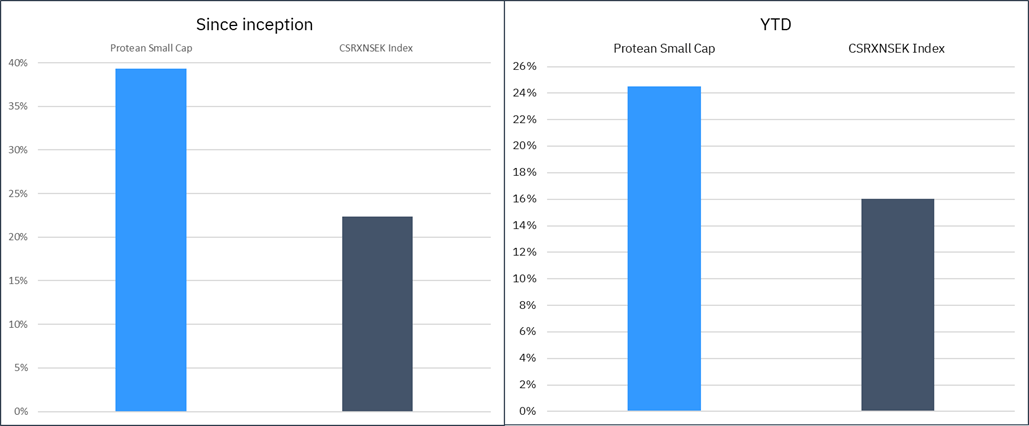

Protean Small Cap. The fund returned +2.6% in July, which is 1.8% behind the CSXRN (SEK) benchmark index for the month. Performance since inception in June 2023 stands at 39.4%, outperforming the index by 17% in a little over a year.

Our top contributors in July were Acast (OTCPK:ACASF), Netel and Getinge (OTCPK:GNGBF). Detractors include Lindex, Maven Wireless, and RTX.

Protean Select returned +0.3%. That’s 9.5% YTD and 24.3% since inception. The volatility in the strategy remains below 7%, which can be interpreted as about a third of the risk of the overall market.

Top contributors were Acast, Getinge, and Netel.

Notable detractors were our small cap short basket, Lindex, and Evolution (OTCPK:EVVTY).

This month’s letter elaborates on how passive investors are actually the most aggressive, and why investing in artificial intelligence taken to extremes results in authentic stupidity. We also explain our thesis in the imploded Finnish refinery star Neste (OTCPK:NTOIF).

Thank you for being an investor!

Team Protean

Passive investors are the most aggressive

Entirely without scientific evidence, I’m going to postulate it anyway: we are starting to see the price discovery function in equity markets struggle due to the increased size of passive funds. We at Protean pride ourselves in being active, quick, and eager to engage in a trade if we see prices being out of whack due to uneconomic selling or buying. Truth be told: it’s getting harder. When a stock is (or: is remotely speculated to be) picked for inclusion in an international index, there is no limit to how much money comes crashing in.

With more indexing and ETF-ing, plus marginal price setters like hedge funds turning increasingly to market-neutral and growth systematic quant funds (where price is more important than fundamentals), the second-order effects of increased correlations and single stock volatility on reporting are upon us. Scanning order flow, it is becoming increasingly clear that passive investors are by far the most aggressive.

Sooner or later – one could argue – equities return to a fair price justified by fundamentals. Therefore, the most obvious price distortions from passive investing should be terrific alpha opportunities for active investors. Is this true? Yes, it probably is. But – and this is an important but – over what time horizon? In a modification of the old adage: stocks can be bought by passive funds for longer than you can stay solvent. With continued inflows to silly non-fundamental products, there’s no saying when this “technicality” will fade.

We regularly observe irrational price action, and often act on it. But if we catch the whiff of impeding index changes, we take a step back and regroup. When your counterparty in the market is price insensitive, has unlimited capital, and a time horizon that mechanically follows the Excel spreadsheet of some index-quant at MSCI, there’s no arguing with that.

Watch what happened to Swedish small cap VBG that rose 60% in a few months helped by passive buying, only to drop 20% on a result that saw estimates trimmed by merely 2-3%. Or the significant and price-insensitive buyers in Addtech (OTCPK:ADDHY), likely driven by speculation it is due to be included in a global index.

We shake our heads at the madness… and sharpen our knives.

Authentic stupidity

With all the hype around AI, it is fruitful to ask: what if? What if it’s not a massive game changer? With investments going into AI knick-knacks to the tune of 1trn USD in the coming years (more, if you look at most bullish Nvidia-analyst forecasts), there surely must be a massive pot of automation gold at the end of the proverbial rainbow? In just the past few days Meta (META) raised capex guidance to 37-40bn USD and MSFT saw a similar picture. There’s no end to the current spending in this investment-war.

What is AI impacting in the near term? Chatbots and customer service, sure. LLMs are no doubt suitable for low-level automation of standardized troubleshooting. Image generation yes, but – let’s be honest, they’re not inspiring are they, and it’s not like it’s a massive productivity gain a handful of stock photographers have less to do. AI does seem to have a knack for writing code, increasing the productivity of programmers.

These are valid applications. But are they going to bring above-WACC returns to the 1 trn USD investment program? No they’re not. The real boon comes when AI can solve complex problems. Scientific discovery, innovation, material testing. But this is quite a bit away.

Like MIT professor Daron Acemoglu put it in a recent interview from GS:

“Many tasks that humans currently perform, for example in the areas of transportation, manufacturing, mining, etc., are multifaceted and require real-world interaction, which AI won’t be able to materially improve anytime soon. So the largest impacts of the technology in the coming years will most likely revolve around pure mental tasks, which are non-trivial in number and size but not huge, either.”

The most optimistic forecasts also seem to assume AI itself improves on an almost exponential scale. It is not obvious, from first principles, why doubling the data or the GPU capacity, would double the capability of the AI models. Sure, there is probably some correlation, but complexity and capacity are not the same units.

AI-capacity isn’t cheap. Yet the assumption seems to be costs will fall over time. Given the complexity of the supply chain (it’s not EASY to develop and manufacture a GPU!), one certainly could ask when exactly that’s about to happen.

Reflexivity is an interesting concept: our perception of the market influences the market itself. Our ebbing and flowing convictions influence actual outcomes. It goes hand in hand with the question “What’s priced in?”. Taking the other side of consensus at extremes is often profitable. I venture that positioning in AI is extreme. As an example, there are now more small and micro-cap companies trying to associate their equity story with the concept than one can shake a stick at. What is the opposite of artificial intelligence? Authentic stupidity?

Protean Select – Pontus’ update for July

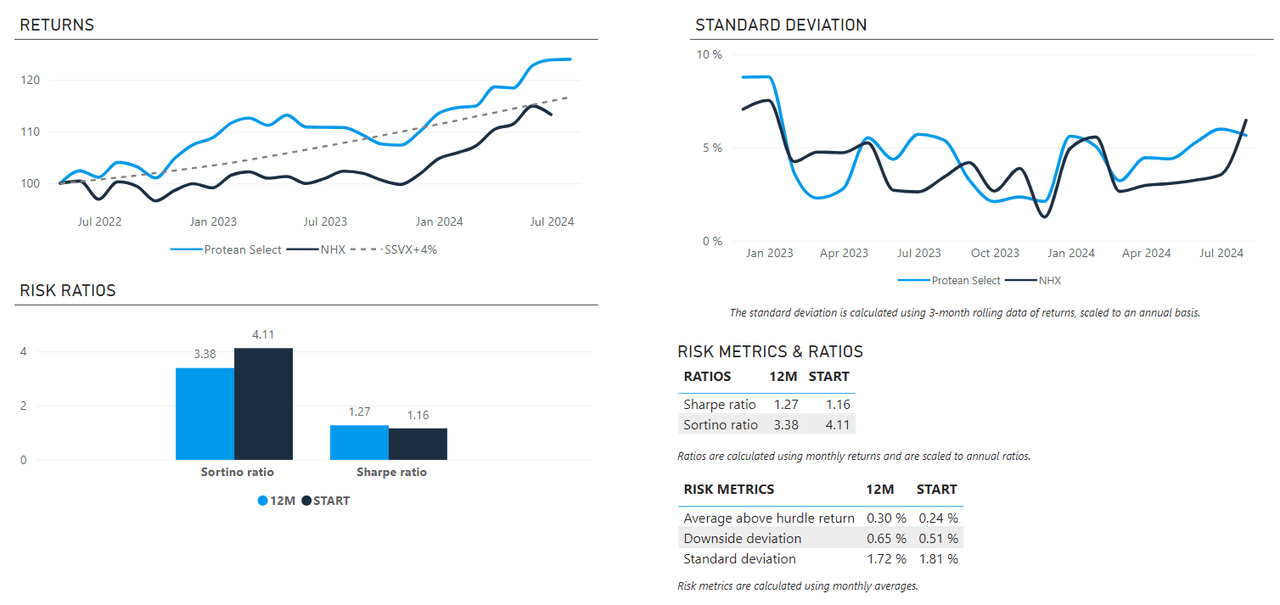

For this month we introduce new performance and risk metrics for Protean Select, courtesy of our excellent summer grad Filip Orestav. Filip is a data science major at the Royal Institute of Technology and is helping us automate and analyze the vast amounts of data our business generates.

In the graphics above we show our return vs the NHX index and vs our hurdle rate. The NHX is an index constructed from the performance of 54 Nordic hedge funds focusing on equity strategies. NHX is published after our Partner Letter, so updates with one-month lag in the chart above. Our hurdle rate is 7.7% annualized (4% + 90-day Swedish T-bills). All figures are net of fees.

We also introduce a handful of other ratios to help understand the nature of our returns:

The sharpe ratio measures the performance of a portfolio compared to the risk-free rate, adjusting for its risk. It is the additional amount of return that an investor receives per unit of increase in risk. If the sharpe ratio is 1, it means that the excess return is equal to the risk taken, whereas if the sharpe ratio is above 1 the excess return is greater than the risk taken.

The Sortino ratio measures the performance of a portfolio compared to the risk-free rate, after adjusting for its risk. It is identical to the sharpe ratio, but only penalizes downside deviation and not upside volatility.

The measure “Downside deviation” Quantifies the risk of negative returns relative to a minimum acceptable return (MAR/hurdle rate), in our case 90-day Swedish treasury-bills + 4%, converted to monthly returns. It focuses solely on the returns that fall below the hurdle rate, providing a targeted measure of downside risk.

Protean Select posted +0.3% return in July. That’s +9.5% YTD and +24.3% since inception. The volatility remains below 7%. During the month we have been actively adjusting the cautious net we were running going into July. A few days ahead of month end we covered most of our index-hedges, and hence exited July with 47% beta-adjusted net long exposure and 107% gross exposure.

Top contributor was Acast, which continued its impressive run of growth and again proved the investments in US scale is bearing fruit. There are very few ways globally to get exposure to the momentum of the podcast medium, and we anticipate Acast will generate significant interest as they continue relentlessly on the path to profitability.

Getinge was a strong contributor to returns. The set-up going into the quarterly report was unusual: plagued by long-standing quality issues and under scrutiny by the FDA, Getinge’s BoD and management saw fit to throw bathwater, baby and tub through the window and offer very modest guidance for the year, citing it is “too early to have a firm opinion on the extent” to which the FDA concerns would impact the underlying business. After listening to actual practitioners using the affected products, we concluded the impact was likely to be slim – if any. At the same time investors were abandoning the stock, analysts were competing on downgrading estimates and ratings. Suffice to say: expectations were low. The quarterly report proved us right: Getinge beat lowered expectations by 22% on Adj. EBITA and had decent order intake across all divisions. On the first day of August the market saw fit to sell Getinge for the nth time on the same piece of news of the IABP issues, as competitor Teleflex mentioned increased tendering activity in the wake of said FDA-letter. As a reminder, the IABP-business is around 5% of Getinge’s annual EBITA, and a slowdown has been discounted several times over already.

Netel is a service provider in telecom, power and infrastructure. It rose 22% in July as the Q2 report showed continued progress on both growth and margins. This is a case of rebuilding confidence in a project business plagued by a few historical mistakes. The company is well-positioned to capitalize on structural growth trends, and despite the stock doubling over a few months, it still trades on MSD multiples.

Our by far biggest detractor was our relatively sizeable position in Lindex, where – in typical over-cautious Finnish style – the company saw fit to issue a “profit warning” adjusting the guided revenue growth by a mere 1%-point, but keeping the profit guidance unchanged (they could just as well have issued a statement saying they anticipate higher margins!). The report itself was largely in line with expectations, and we keep believing the stock is undervalued and overlooked due to the ongoing restructuring and strategic review.

Evolution, where we detailed our thesis in the June Partner Letter, was a negative contributor during the month. We have re-doubled our research efforts and must admit conviction has faded somewhat, as we see a risk of a prolonged period of shareholder churn and controversies, further weighing on multiples.

Other notable detractors were Stora Enso and our basket of small cap shorts.

Neste

Everything moves in cycles. Neste was once a sleeping Finnish refinery company that by accident (or foresight) stumbled into the business of refining waste products to a fully functioning diesel (HVO). Since the feedstock is “waste” and not fossil oil, it is considered CO2 neutral and hence labeled “renewable diesel”. Buoyed by endless demand, ESG hype, benign policy actions and tax treatments, their early mover advantage allowed them to earn super-profits.

Then it all went pear-shaped thanks to a classic capital cycle: jealous of super profits, other refinery companies started building HVO facilities and capacity has crept upwards. This, in turn, led to increased competition for feedstock, impacting margins. Furthermore, Chinese refineries, seeing their own luke-warm market saturated (and increasingly electrified!) went on an export spree, exacerbating the glut.

If that wasn’t enough, the backlash to various climate policies has diluted incentives. Sweden – a big and super-profitable near-monopoly market for Neste – scrapped their generous tax treatment and abruptly reduced the mandatory blending target ambition. This has led to significant volumes being diverted to other, less profitable markets. The policy momentum has simply cooled dramatically in the wake of the energy crisis that followed the Ukraine war.

To top things off, Neste has scored several own goals by providing too optimistic forecasts (and promptly missed them) and operational delays in ramp-up of new capacity.

You will not be surprised the stock has absolutely cratered. It is flat over 7 years. But first went up 300%, then down 70%. Things are really – REALLY – bleak. However – and this is why it’s starting to get interesting – there are emerging signs the cycle is turning, and the market is discounting nothing will ever change.

Applying a longer-term perspective, the underlying problem Neste solves is not going away. Not a day goes by without a handful of headlines of volatile weather and warmer climates. It is getting worse. As the policy pendulum swung violently in one direction during the energy crisis, it might well start to swing back again: as Sweden (and Finland) caved to populist demands, other countries are progressing. Countries as diverse as Brazil, Japan, South Korea, and Argentina, are all mulling SAF- or renewable diesel mandates. The Netherlands has implemented an aggressive scheme, and Germany is not far behind. Around the corner in 2025 is a mandatory 5% SAF blending scheme in the EU for air travel.

The influx of Chinese biofuels to the European and American markets has also helped tilt the balance. Some estimate up to 20% of market volumes are Chinese exports. In a recent turn of fate, the EU is now (July) imposing anti-dumping measures, and chances are the US will follow. This suggests the balance might improve ahead.

While the short-term picture is blurred and marred with overcapacity and uncertainty, the direction of travel, looking years out, seems unchanged. The capital cycle is in full swing, with Neste competitors mothballing planned capacity. BP, Shell, UPM and Chevron have all canceled or delayed biodiesel refinery investments in the past months. US competitor Vertex has even converted their renewable plant back to fossil diesel!

With all the recent volatility in prices and profits, it is easy to forget that what Neste has built is impressive: it is the only truly global renewable fuel company. They are fully integrated all the way from sourcing the variety of waste raw materials, pre-treatment and state-of-the-art refineries on four continents, to sales and logistics networks. Our work on Neste, including conversations with industry experts and government officials, suggests Neste is uniquely positioned and one of a kind. Unless the world turns 100% CO2 YOLO, Neste has an important function to fill. This is not reflected in current valuation, where the market is myopically focused on the downward slope of near-term RP-margins and the 6-month uncertainty.

We might be a quarter or two early, and there is a non-zero risk they miss the guidance again in H2, but we have started building a position. Ramp-up problems don’t last forever, and the capital cycle plus demand growth from air travel will eventually sort out the overcapacity issue. The stock is trading in line with other (fossil) global refining peers, despite being a biofuel growth play. The risk-reward looks increasingly attractive with potentially tightening markets in 2025 and hopefully operational improvements ahead.

Protean Small Cap – Carl’s update for July

Protean Small Cap gained 2.6% in July. That is 1.8%-points behind the CSXRN (SEK) benchmark index for the month, breaking the 8-month streak of index beating returns. This puts the fund 17%-points ahead of our index (CSRXN SEK) since inception and 8.5%-points ahead so far this year.

The fund now manages just north of 400m SEK. Thank you for your trust.

Our top contributors in July were Acast, Netel and Getinge. These winners were shared with Select, so see that segment for our reasoning. Detractors include Lindex, Maven Wireless and RTX.

You’ve already read about the top contributors in the Select updatebut the suffering in the Danish wireless chipset provider RTX was isolated to Small Cap and the Swedish Maven Wireless decline was more pronounced in Protean Small Cap.

RTX is in the midst of a business transformation, where they want to go from being a ‘developer for hire’ to being able to capitalize fully on their know-how. This means that they must take more costs upfront by themselves to justify capturing the full upside, a cost increase which in the longer-term is fully feasible because they have a very strong balance sheet. However, this made them vulnerable to the post-pandemic slowdown in many of their key segments, as well as the realization that customers had overstocked their product. We remain believers in the long-term story.

Maven has shown a spectacular growth track-record since they joined the portfolio at inception, but Q2 didn’t do them any favors: growth went from +200% to -20% on a very difficult top-line comparable, and as they have added costs ahead of the launch of their new Nimbus product for in-door coverage, this hit hard on the EBIT line.

The ten biggest positions in Protean Small Cap as we enter August are:

| Acast | 5.1% |

| Ambea | 4.1% |

| Devyser | 3.4% |

| Lindex | 3.3% |

| Rejlers | 2.9% |

| Getinge | 2.8% |

| Fagerhult | 2.7% |

| Valmet | 2.7% |

| Cargotec | 2.6% |

| Kemira | 2.6% |

The monthly reminder

We optimize for performance, not for convenience, size, or marketing.

You can withdraw money only quarterly (monthly in Small Cap).

We will tell you very little about our holdings.

Our strategy is tricky to describe as we aim to be versatile.

A hedge fund can lose money even if markets are up.

We charge a performance fee if we do well.

You do not get a discount if you have a larger sum to invest.

We do not have a long track record.

Thank you for being an investor.

Pontus Dackmo

CEO & Investment Manager, Protean Funds Scandinavia AB

|

DISCLAIMER: Investments in a fund can both increase and decrease in value. You are not guaranteed preservation of invested capital. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.