hapabapa

My last Micron (NASDAQ:MU) article was published in February 2024 when the stock was trading for $86. In June, Micron shares surged to nearly $160 per share, which was close to a double in value; however, this stock has since seen a sharp pullback which, I believe, is another ideal buying opportunity. I still see all the strong trends and positive industry fundamentals as being intact, so I am using the current weakness in AI chip stocks to increase my positions in select stocks, including Micron. I believe the future for Micron has never been better and that many investors continue to underestimate Micron in terms of future earnings power and upside potential. Many investors are holding on to their views that Micron is a highly cyclical chip company in what is already a highly cyclical industry, and this has been true in the past. However, thanks to AI and Micron’s HBM chips, and also due to a number of other factors, I believe Micron will be far less cyclical. I also believe that many investors are underestimating how powerful and how long the next chip cycle will be.

I believe my bullish thesis remains intact, and I see the recent pullback in Micron as another major buying opportunity. Micron reported Q3 results after my article was published, and these results and management commentary also serve to confirm how bullish I am about this company. This stock is now oversold, and I believe it is due to rebound sooner or later. But I am mostly focused on the long-term upside for Micron, which I think is possibly even better than what investors expect for AI chip favorites such as NVIDIA (NVDA).

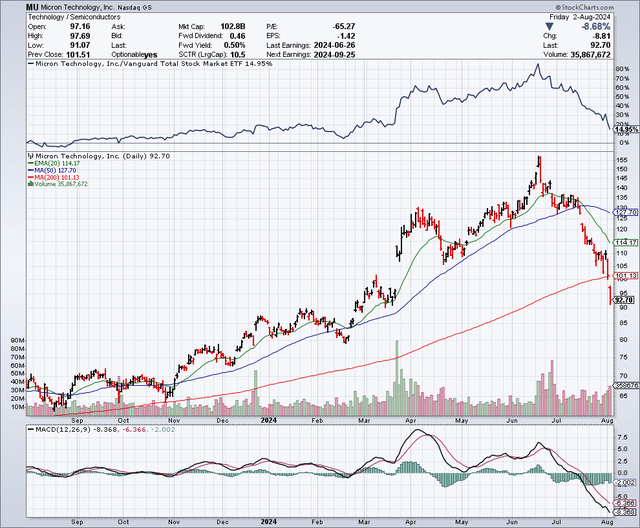

The Chart

As the chart below shows, Micron shares have been rising and in a powerful uptrend, and the stock had doubled in value in the past few months when it went to nearly $160 per share in June. However, it has experienced a sharp pullback in recent weeks, along with many other chip and tech stocks. Micron shares are now trading at $92, which is well below the peak it hit in June. The 50-day moving average is about $127, and the 200-day moving average is just over $101. Look at this chart, and it is clear that until recently, buying every pullback over the past several months has resulted in gains within just a few weeks, and I believe that could be true this time as well.

Q3 Results And Management Commentary Confirm My Bullish Views On Micron

On June 26, Micron reported Q3 earnings of $0.62 per share (non-GAAP), which was a beat by $0.09. Revenues came in at $6.81 billion, which was a beat by $140 million, and this represents a huge year-over-year growth rate of 81.6%. For Q4, the company is guiding earnings to come in at $1.08 per share and revenues of $7.6 billion. The market might have wanted more optimistic guidance for Q4, but I like that management appears to be acting conservatively, and this could lead to another earnings and revenue beat going forward.

When reading the Q3 earnings call transcript, it is pretty hard to not be excited about the future for Micron. It is clear that demand is very strong for Micron’s products, and it is likely to get even stronger going forward. Micron said its HBM production is sold out for calendar 2024 and 2025. Management sees Micron as one of the biggest AI beneficiaries, and it stated:

“Now turning to our end markets. We are in the early innings of a multi-year race to enable artificial general intelligence, or AGI, which will revolutionize all aspects of life. Enabling AGI will require training ever-increasing model sizes with trillions of parameters and sophisticated servers for inferencing. AI will also permeate to the edge via AI PCs and AI smartphones, as well as smart automobiles and intelligent industrial systems. These trends will drive significant growth in the demand for DRAM and NAND, and we believe that Micron will be one of the biggest beneficiaries in the semiconductor industry of the multi-year growth opportunity driven by AI.”

Trade Tensions And Export Restrictions

There are plenty of geopolitical and other issues that could pose a risk to chipmakers. Just recently, a Bloomberg report came out that suggested the Biden Administration is considering restrictions on the sale of memory chips to China that could be used for AI. This could impact some companies, but China already banned the use of Micron’s memory chips in critical infrastructure back in 2023. There are other restrictions that could be impacting sales to China for some companies and if President Trump is elected, the trade tensions could get worse as he has proposed major tariff increases on China.

One major concern is the possibility that China could invade Taiwan in order to unify it, and this could cause havoc on the global economy since so many chips are made in Taiwan. While this move would be very risky for China, another potential concern is that China simply surrounds Taiwan with its Navy and by doing so, it could create a partial or complete quarantine. This could effectively shut down exports in an attempt to force unification without firing weapons or invading. Fortunately, Micron manufactures much of its production right here in the U.S. But, I believe just about every major company and the global economy will be significantly impacted if Taiwan tensions go towards some of these potential worst-case scenarios.

Micron’s HBM Supply Deal With NVIDIA

Micron’s High Bandwidth Memory chips or “HBM” appear to be game changers for the company and the AI industry. HBM3e chips from Micron appear to stand out from others because these chips use 30% less power. Given the already significant amount of energy that AI consumes, many companies are looking to find more efficient solutions. Micron started producing HBM3e chips in February and has sold out all of its production for these chips through 2025. This high demand is pushing up prices and boosting profit margins for Micron.

I think the market is underestimating Micron as an AI beneficiary. I see significant potential and multi-year demand for Micron’s DRAM chips when it comes to building AI data centers. In addition, Micron’s HBM3e chips are being used by NVIDIA for their H200 Tensor Core GPU, which is a top pick for AI applications. When I see the level of disparity in how Micron is valued when compared to NVIDIA, it shows me that there is a lot of upside potential for Micron. I believe this valuation gap could narrow in the next year or two. Not long ago, NVIDIA hit a $3 trillion valuation level, and some analysts believe it will be worth $10 trillion by 2030. Meanwhile, Micron is currently just around $114 billion.

Let’s Compare Micron And NVIDIA

As shown below, consensus estimates provided by Seeking Alpha suggest that Micron is just about to experience explosive earnings and revenue growth. These estimates suggest that Micron is trading for less than 10 times earnings estimates for 2025 and for just about 7 times earnings for 2026. That appears deeply undervalued when you consider that the S&P 500 Index (SPY) is trading for well over 20 times earnings, and also when you consider that Micron’s earnings and revenues are growing at a much faster pace than the average stock in the market.

Earnings Estimates

|

FY |

EPS |

YoY |

PE |

Sales |

YoY |

|---|---|---|---|---|---|

| 2024 |

1.18 |

NM |

78.73 |

$25.04B |

+61.12% |

| 2025 |

9.58 |

+713.89% |

9.67 |

$38.28B |

+52.87% |

| 2026 |

12.97 |

+35.37% |

7.15 |

$44.36B |

+15.90% |

The consensus earnings estimates below are for NVIDIA, and it is also expected to see explosive growth. But, what I think is notable is that Micron is currently trading at around $92 per share, which is less than what NVIDIA shares are trading for, which is currently around $107. What is stunning is that Micron is expected to earn triple of what NVIDIA is expected to earn in 2026. In fact, Micron is expected to earn more in just 2026 than what NVIDIA will potentially earn in 2025, 2026, and 2027, combined. That’s a massive disparity in valuation and one that suggests Micron is very undervalued. These estimates suggest that Micron can outearn NVIDIA by a wide margin and due to this, I believe Micron shares could outperform NVIDIA shares going forward.

Earnings Estimates

|

FY |

EPS |

YoY |

PE |

Sales |

YoY |

|---|---|---|---|---|---|

| 2025 |

2.74 |

+111.25% |

39.18 |

$120.37B |

+97.59% |

| 2026 |

3.72 |

+35.87% |

28.84 |

$163.49B |

+35.82% |

| 2027 |

4.32 |

+16.13% |

24.83 |

$188.53B |

+15.31% |

Micron Is An Apple Supplier And Could Benefit From The AI iPhone Upgrade Cycle

Not only does Micron supply NVIDIA, but it also supplies Apple (AAPL) with memory chips. Apple is expected to roll out “Apple Intelligence” enabled products such as the iPhone later this year, and this is expected to help fuel a major new upgrade cycle for Apple. Of course, this will benefit Apple suppliers like Micron.

Many PCs were purchased during the initial months of the Covid outbreak, for use in work-at-home purposes and these are now getting older and are in need of an upgrade, especially as AI-enabled computers are now being introduced. In addition to this, Microsoft (MSFT) has announced it would retire Windows 10 on October 14, 2025 and the end of support for Windows 11 on November 11, 2025. Because of this and for other reasons, analysts believe the PC market will grow by 7% in 2024, and 10% in 2025. This could benefit Micron since computers require memory chips and even more so as complexity increases with AI-enabled features.

I Think The Recent Selloff In Micron Is Way Overdone

It is still so early in terms of AI and how it could change so many aspects of life. AI is widely considered to be the Fourth Industrial Revolution, and I believe this could drive a supercycle for chipmakers. According to a Bank of America (BAC) analyst, Vivek Arya, the current upcycle for the chip industry is only in quarter 3 of what is typically a 10 quarter semiconductor upturn.

There has obviously been a big pullback in tech stocks recently, and that has put pressure on Micron. Even NVIDIA is now down about 30% from the highs of about $140 which it hit in June. The market in general just took a hit on fears that the Fed waited too long to lower rates and that is raising recession fears. Intel (INTC) just reported very disappointing earnings and that stock dropped about 30%, and created a negative mood for chip and tech stock investors. However, I do not see these factors as causing a significant change in terms of the fundamental outlook for Micron. As we know, their HBMe3 chips appear to be sold out for the next couple of years, and it has many tailwinds from an Apple upgrade cycle. It also has the potential PC upgrade cycle that is also likely to just be getting underway due to AI-enabled PC’s launching and because of support ending for older versions of Microsoft’s Windows.

Chip stocks are now deeply oversold, and the market could be poised for a big up day or up week very soon. So I believe there could be a rebound for technical reasons. I also think earnings from NVIDIA could be what the chip stocks need to get back on track. NVIDIA is expected to report Q2 2024 earnings of $0.59 per share on August 28, and since this company is taking market share from companies like Intel, the results could be better than expected. With the stock down so much lately, this could be the ideal setup for some positive earnings beats that take the chip stocks back up from oversold levels.

Potential Downside Risks

I’ve been concerned that the Fed has already waited too long to cut rates and I believe we could be in for a recession, which I wrote about in this past article. In the article, I point out that the Fed has often missed the mark in terms of policy decisions in the past. If we do see a recession in the coming months, this would likely impact chip demand and create downside risks for the stock market in general. We just learned, on August 2, that unemployment is rising, and I believe these numbers will get worse in the coming months. This concern about the economy has led me to raise cash, and it keeps me from being too bullish on the stock market for now.

The potential of rising tension between China and Taiwan is a risk factor for chip companies and all major companies, as well as the stock market. A potential invasion or quarantine of Taiwan would have major consequences for the global economy. Rising trade tensions between the U.S. and China are yet another concern that could directly impact Micron, and other chipmakers.

In Summary

I believe the risk to reward ratio in Micron shares is very favorable for shareholders right now, in terms of the upside greatly outweighing the potential downside. Valuation comparisons to NVIDIA and other chipmakers suggest that Micron is deeply undervalued and therefore, I believe it could outperform. I believe the market is underestimating Micron, and I see its HBM chips as creating a more powerful and longer-lasting chip upcycle. For all these reasons, I view Micron as a strong buy on this dip candidate.

No guarantees or representations are made. Hawkinvest is not a registered investment advisor and does not provide specific investment advice. The information is for informational purposes only. You should always consult a financial advisor.