AlxeyPnferov

My trading screens were a sea of red on Monday morning, but the Nikkei stood out. A drop of -15% in one session for an index of 225 major stocks is a very rare event, and follows on from a crash the week before. This article looks at why Japanese stocks are blowing up, and why the WisdomTree Japan Hedged Equity Fund ETF (NYSEARCA:DXJ) is still a fund to avoid.

Context

I last wrote about DXJ back in April when I concluded it is “A Great Fund At A Bad Price.”

There were three reasons why I thought this. Firstly, the Nikkei had finally reached its 1989 peak, which was potential resistance.

Secondly, the tailwind provided by a collapsing Yen looked played out as the Bank of Japan slowly normalized its ultra-loose policy.

Thirdly, and not many picked up on this, there had been an increase in retail buying, just like the situation at the 1989 top.

This has been stimulated by an increase in the limits to which Japanese retail investors can invest in a tax-free account – a change aimed at boosting household wealth and encouraging households to invest in riskier assets such as stocks. While this has had a positive effect in the near term, increased retail buying is usually a red flag. Indeed, the Nikkei 1989 top was formed as institutions distributed to speculating retail investors.

Unfortunately, retail investors got trapped again and at Monday’s low, the Nikkei was down 27% from its peak.

It’s Even Worse Than I Thought

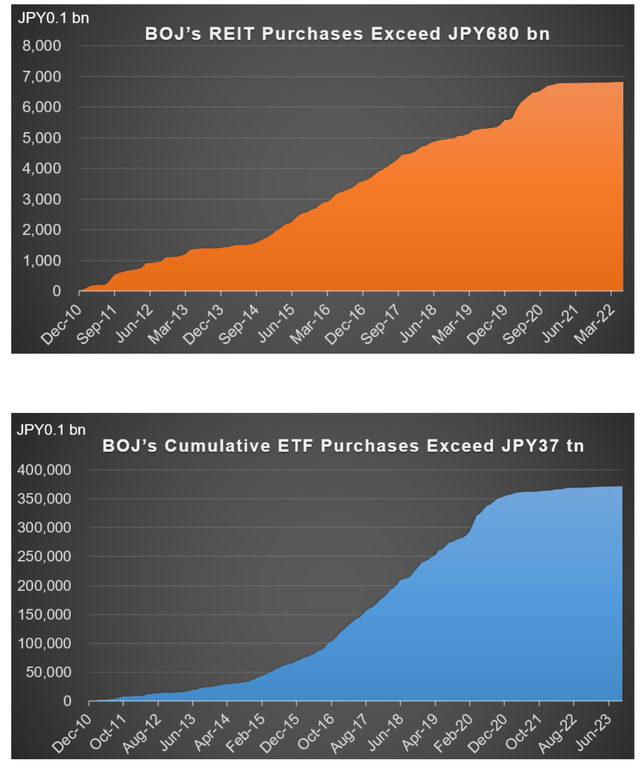

It’s been a lingering fear that the extremely loose and unorthodox policies employed by the BoJ for nearly a decade would lead to problems when they were finally unwound. Rates have been negative since 2016. The BoJ has bought ETFs worth trillions of Yen. Yield curve control led to an unlimited amount of Japanese Government Bond purchases. This was QE on steroids, and it continued while other major central banks were tightening.

These policies are now being slowly reversed. The bank stopped buying ETFs and JREITs in March. Last week’s meeting scaled-down bond buying and crucially raised rates another 15bps to 0.25%.

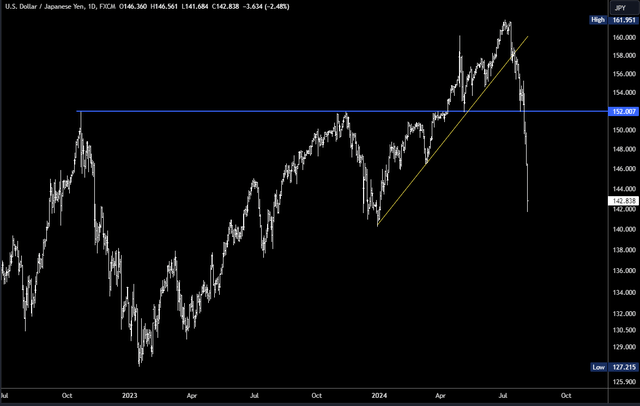

None of this has been a major surprise and the slow process of communicating hawkish changes and implementing them has been happening all year. At first, the yen actually continued to drop and USD/JPY continued to rise to a July peak. The BoJ was forced to directly interfere in currency markets (buying yen) in an attempt to stop its collapse. Perhaps now they wish they didn’t – it has strengthened rapidly and USD/JPY has crashed over -12% in around a month.

USDJPY Daily Chart (TradingView)

This is the USD/JPY carry trade blowing up. A few months back, investors could borrow a weak yen at a low interest rate, convert it into US dollars and buy USTs yields over 5%. But that is not possible anymore, and this is due to US developments as much as those in Japan. Strains in the labour market and concerns about growth have pressured the US 10Y yield from a 2024 high of 4.72% to below 3.7%. Expectations are for the Fed to cut rates much more aggressively than anticipated a month ago. Investors are therefore reversing their carry trades and this is having a significant effect on all assets.

DXJ: Still a Fund to Avoid

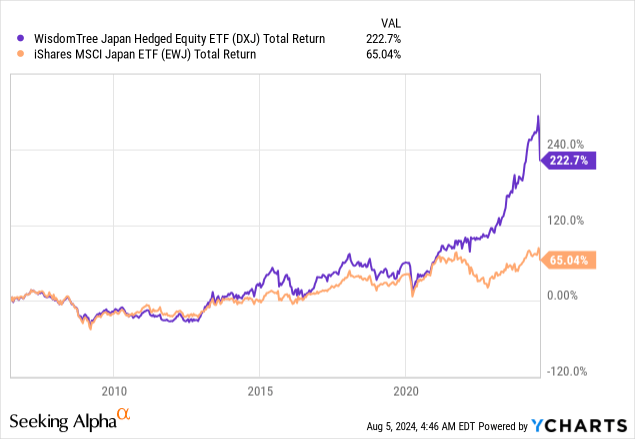

According to the Fund Page, DXJ “seeks to provide exposure to the Japanese equity market while hedging exposure to fluctuations between the U.S. dollar and the yen.” The hedge worked well when the yen was collapsing as it significantly outperformed unhedged funds such as the iShares MSCI Japan ETF (EWJ).

We can see the DXJ and EWJ were well correlated until around 2021 when yields in the US started rising and USD/JPY blasted higher, heaping pressure on EWJ.

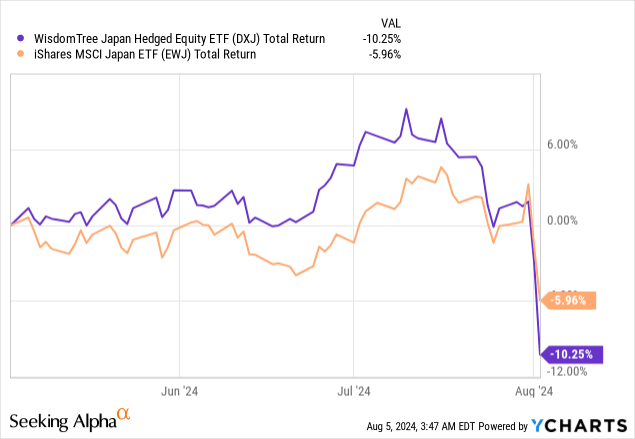

If we zoom into a 3-month view, we can see the opposite is now happening. DXJ outperformed into the July top but has now fallen -10.25% compared to EWJ’s -5.96%. The currency headwind for EWJ has now shifted to a significant tailwind. DXJ is therefore still a fund to avoid as the USD/JPY carry trade unwind likely has more to go. If you really want to invest in Japanese stocks, EWJ is the preferred option.

What Next?

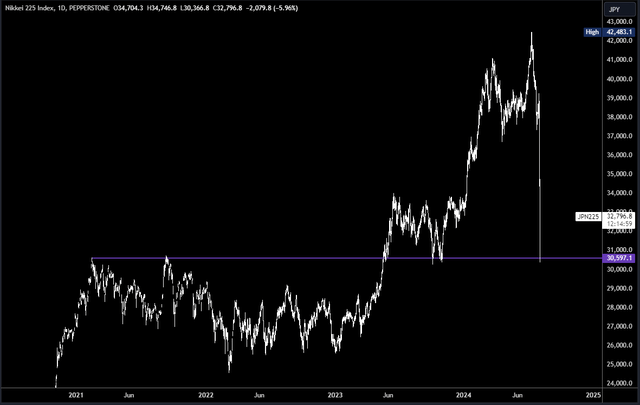

The Nikkei crashed on Monday morning but has bounced over 6% since the Asian close. This looks like a technical move as the 30,366 low was very close to the major level of 30,600.

Nikkei Daily Chart (TradingView)

It looks like the Nikkei can now stabilize above 30,600, and a crash of -27% in a month has made Japanese stocks oversold. This is still a risky space, though, and we may see lower lows into the end of the year as the BoJ and Fed continue to diverge.

Conclusions

A perfect storm has led to the USD/JPY carry trade blowing up. The BoJ is hiking while yields are falling rapidly in the US due to a growth/labour market scare. Japanese stocks are crashing and DXJ is in the eye of the storm.

Due to the large reversal in USD/JPY, unhedged funds like EWJ which have underperformed significantly for years, are starting to outperform. Investing in Japan under the current conditions is risky, but if you are determined to do it, EWJ is preferable over DXJ.