dszc

On Friday, April 26, 2024, oil and gas supermajor Chevron Corporation (NYSE:CVX) announced its first-quarter 2024 earnings results. At first glance, these results were mixed as the company failed to meet analysts’ earnings expectations but still posted an earnings beat. However, a closer look at these results reveals that there were quite a few things that investors should be able to appreciate.

In particular, Chevron managed to achieve pretty strong performance from its enormous project in Kazakhstan, as well as from various projects in the Permian Basin in North America. As has been the case with most oil and gas companies that have reported so far, though, the company was adversely impacted by lower natural gas prices. However, Chevron is not as impacted by natural gas prices as some of its peers, such as Exxon Mobil (XOM).

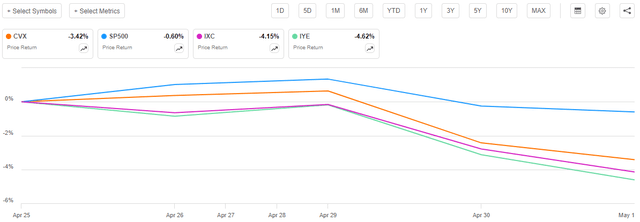

Overall, the market seems to have been somewhat disappointed by Chevron’s results. This chart shows the company’s stock performance from April 25, 2024, until today:

As we can see, Chevron’s shares are down 3.42% over the one-week period. This is a much worse performance than the 0.60% decline of the S&P 500 Index (SP500) over the same period. However, Chevron did manage to outperform both the domestic and international energy indices, as represented by the iShares U.S. Energy ETF (IYE) and the iShares Global Energy ETF (IXC). This might be a sign that the market views Chevron better than many other energy companies in light of its earnings.

We can see that much of the one-week decline in Chevron’s stock price came on Tuesday, though. That was a day in which just about everything was sold off, so the fact that this company’s share price was pummeled is not really surprising. In addition, oil prices (CL1:COM) fell significantly on Tuesday and Wednesday due to hopes of peace in the Middle East as well as a report from the American Petroleum Industry that shows that domestic oil supplies increased substantially over the past week:

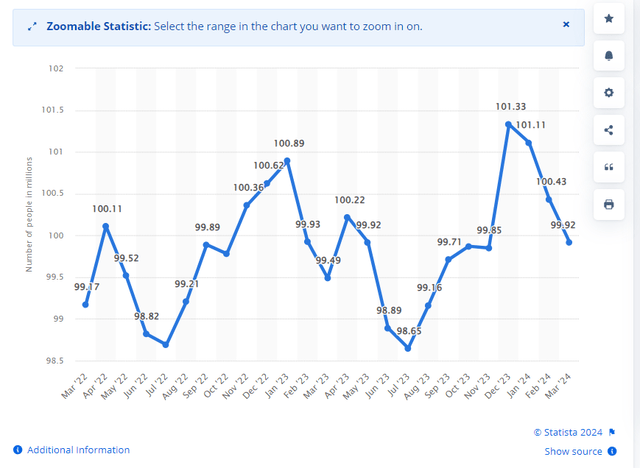

The American Petroleum Institute gave no reason for the massive increase in private crude oil stockpiles, but my guess is that consumers have been cutting back on their driving. There are 99.92 million people in the United States of working age who do not have jobs right now (and are not counted in the official unemployment figures):

Monthly Size of Inactive Labor Force in the United States (Trading Economics)

When we combine this with the official unemployment figure (6.429 million), we arrive at a total of 106.349 million Americans of working age who are not currently employed. It stands to reason that many of these people will be cutting back on their driving activity to survive in the face of rising inflation, and that reduction in demand could cause oil supplies to increase. Admittedly, this is just a theory on my part, as I can find no information from official sources that provides a reason for the substantial weekly increase in oil supplies.

Chevron’s revenues and profits depend a great deal on oil prices, as most followers of the company are well aware. As such, an increase in oil supplies or a reduction in oil prices will normally cause the stock price to decline. This has probably been the biggest driver in the poor one-week performance of the company’s stock price, rather than perceived weakness in the first-quarter results.

Earnings Results Analysis

As I stated in a recent article:

It is my usual practice to share the highlights from a company’s earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis.

Here are the highlights from Chevron’s first-quarter 2024 earnings report:

- Chevron brought in total revenue of $48.716 million in the first quarter of 2024. This represents a 4.09% decline over the $50.793 million that the company reported in the prior year quarter.

- The company reported an operating income of $6.5990 billion for the reporting period. This represents an 18.00% decline over the $8.0480 billion that the company reported in the year-ago quarter.

- Chevron produced an average of 3.346 million barrels of oil equivalent per day in the current quarter. This represents a massive 12.32% increase over the 2.979 million barrels of oil equivalent per day that the company produced on average in the corresponding quarter of last year.

- The company’s Tengizchevroil affiliate safely commenced operations at its Wellhead Pressure Management Project at the massive Tengiz field in Kazakhstan.

- Chevron reported a net income of $5.5010 billion in the first quarter of 2024. This represents a 16.32% decline over the $6.5740 billion that the company reported in the first quarter of 2023.

It seems quite certain that the first thing that anyone reading these highlights will notice is that Chevron experienced declines in just about every measure of financial performance. With that said, though, the company did manage to limit the year-over-year decline by quite a bit as the reported declines are much less than ExxonMobil reported.

Chevron provides a reason for this decline in its earnings press release:

First quarter 2024 earnings decreased compared to last year primarily due to lower margins on refined product sales and lower natural gas realizations, partly offset by higher upstream sales volumes in the U.S.

As I pointed out in a few recent articles, the price of natural gas at Henry Hub was significantly lower in the first quarter of 2024 than it was in the first quarter of 2023:

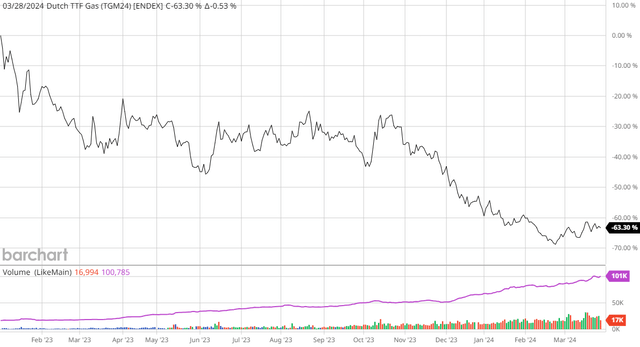

Barchart

That chart shows that natural gas prices were down 55.87% over the January 1, 2023, to March 31, 2024, period. The price of natural gas in Europe was also down over the period, to a much larger degree:

Thus, it seems pretty obvious that Chevron would receive less money for each unit of natural gas that it sold in the first quarter of this year compared to the first quarter of 2023. This is indeed the case, which we can clearly see by looking at the company’s realized prices:

|

Q1 2024 |

Q1 2023 |

|

|

U.S. Natural Gas Realizations ($/mcf) |

$1.24 |

$2.58 |

|

U.S. Liquids Realizations ($/bbl) |

$57.37 |

$59.06 |

|

International Natural Gas Realizations ($/mcf) |

$7.25 |

$9.00 |

|

International Liquids Realizations ($/bbl) |

$72.52 |

$68.89 |

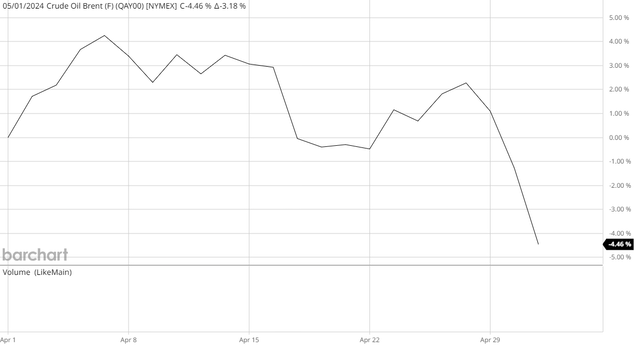

We can also see that the average price that Chevron received for each barrel of oil that it sold in the most recent quarter in the United States was a bit lower than the company had a year ago. This is also in line with what we have seen from some of the other upstream companies that have reported their results so far. For the most part, though, crude oil prices are holding up much better than natural gas prices and started to rise following the end of the first quarter. In fact, for most of the month of April, Brent crude oil prices were actually a bit higher than they were in March:

That chart shows the spot price of a barrel of Brent crude oil from March 31, 2024, until today. As we can see, until its steep declines this week, Brent crude oil was generally up from its March levels. This may benefit Chevron in the second quarter if oil prices manage to recover from this week’s losses. There could be a near-term catalyst for this, as Ukrainian drones hit a major Rosneft (OTC:RNFTF) refinery in Russia yesterday. This naturally took some of the global production of refined products offline, reducing the supply side of the supply demand balance. On the demand side, though, there are signs that the American consumer has started to buckle and reduce consumption of gasoline, as we discussed in the introduction.

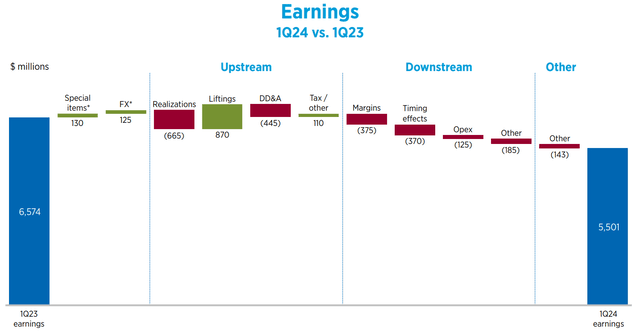

A few moments ago, we saw that Chevron’s international liquids realizations actually increased somewhat year-over-year. However, this was not as helpful for the company as we might expect because the majority of Chevron’s liquids production and sales are in the United States. In the first quarter of 2024, the company reported that its American oil production totaled 1.130 million barrels per day on average. The average production of its international oil operations came in at an average of 838,000 barrels of oil per day. Thus, the decline in American liquids realizations offset the gain that it experienced in international liquids realizations, but the impact of crude oil prices was very slight. Chevron stated that lower energy prices were responsible for a $665 million decline in its earnings from the first quarter of 2023:

It appears almost certain that the majority of the $665 million adverse impact was due to lower natural gas prices in both the United States and internationally. The impact from crude oil prices was probably only a tiny proportion of this.

Chevron was able to offset a significant proportion of the lower price realizations by increasing its production. As the company points out in its earnings press release:

Worldwide production was up 12 percent from a year ago primarily due to the acquisition of PDC and strong operational performance in the Permian and DJ Basins in the U.S. and the Tengizchevroil affiliate, partially offset by planned downtime in Nigeria.

The PDC acquisition referred to in the quote was Chevron’s $7.6 billion acquisition of PDC Energy last summer. The acquisition made Chevron the largest energy producer in Colorado and a major presence in the Denver-Julesburg Basin. This acquisition brought the company’s production in Colorado up to about 400,000 barrels of oil equivalent per day. It should be obvious how this would boost the company’s production by quite a bit.

Tengiz Oil Field Operations

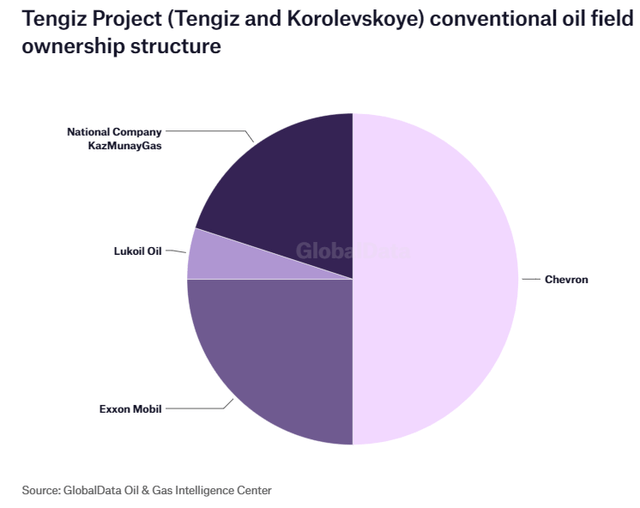

The Tengiz oil field in Kazakhstan is one that we do not hear very much about in the Western media. However, it is one of the largest fields in the world, boasting estimated reserves of about 25 billion barrels of crude oil. Offshore Technology provides a great deal of information about this field and the development project surrounding it, which is 50%-owned by Chevron:

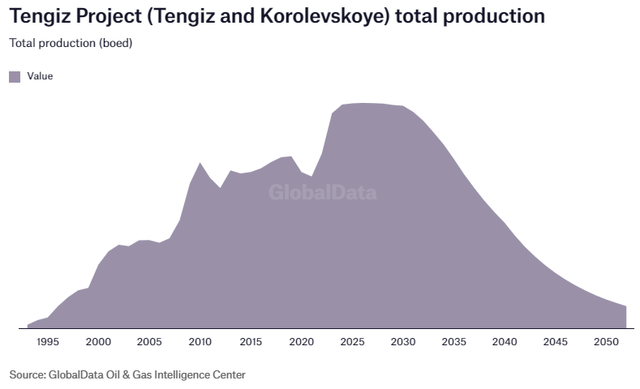

More precisely, Chevron owns 50% of Tengizchevroil, which operates the field and sells the output from it. The output from the field is enormous, as it produced roughly 540,000 barrels of oil per day before Chevron announced a major expansion in 2012 that was expected to boost the field’s output by about 250,000 to 300,000 barrels per day. Last week, Chevron announced that the first phase of this expansion program is complete. From the announcement:

Chevron launched its first production at its Tengiz oilfield expansion project on Thursday, with completion of the final phase of the expansion set for the first half of next year, enabling an additional 260,000 barrels per day of crude oil output, or an additional 12 million tons per year.

The company will naturally see the early results of the completion of this expansion project over the remainder of this year and into next year as this new production comes online and ramps up.

The production from this field is expected to peak in 2026, after which it should be able to operate at close to peak levels for just under ten years:

As such, the company’s announcement about the first phase of the expansion project being completed last week and its plans to grow production through the end of 2025 should provide a source of growth for the company over the near- to medium-term. Obviously, this will turn out to be a benefit to investors going forward.

Financial Considerations

As I stated in a few previous articles (such as this one):

It is always important to analyze the way that a company finances its operations before making an investment in it. This is because debt is a riskier way to finance a company than equity because debt must be repaid at maturity. The repayment of this debt is usually accomplished by issuing new debt and using the proceeds to repay the maturing debt because very few companies have sufficient cash on hand to completely repay all of their debt as it matures. This process can cause a company’s interest expenses to increase following the rollover in certain market conditions.

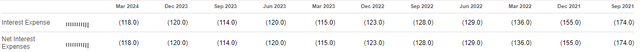

Fortunately, Chevron has not been significantly affected by the rising interest-rate environment that has existed in most developed markets over the past two years. In fact, the company’s total and net interest expenses have been declining rapidly since 2021:

This is almost certainly going to be surprising, considering that interest rates in general are far higher today than they were in mid-2021. However, Chevron has been following the same path as many other energy companies and reducing its debt aggressively over the past few years. On September 30, 2021, Chevron’s earnings press release stated that the company had a total debt of $37.347 billion. The earnings press release for the first quarter of 2024 states that the company has a total debt of $21.835 billion. That reduction in debt was more than sufficient to offset the impact of rising interest rates. Thus, Chevron seems to be relatively insulated from interest rates and there is clearly nothing to worry about here.

Valuation

According to Zacks Investment Research, Chevron has a forward price-to-earnings ratio of 11.80. Here is how that compares to some of the company’s peers:

|

Company |

Forward P/E Ratio |

|

Chevron Corporation |

11.80 |

|

ExxonMobil |

12.09 |

|

ConocoPhillips (COP) |

13.65 |

|

BP (BP) |

7.61 |

|

Shell (SHEL) |

8.69 |

|

TotalEnergies (TTE) |

7.81 |

(All figures from Zacks Investment Research.)

As we can see, Chevron is currently trading at a more attractive valuation than its American peers. However, the company is more expensive than European energy companies. This may be justified, though, as Chevron is also expected to grow its earnings a bit more rapidly. Let us take a look at the price-to-earnings growth ratios for each of these companies:

|

Company |

PEG Ratio |

|

Chevron Corporation |

2.36 |

|

ExxonMobil |

4.03 |

|

ConocoPhillips |

2.73 |

|

BP |

2.62 |

|

Shell |

1.68 |

|

TotalEnergies |

1.78 |

(All figures from Zacks Investment Research.)

Here we can see that Chevron Corporation’s valuation appears pretty reasonable when compared to its peers when we consider the company’s projected earnings per share growth. Admittedly, Shell and TotalEnergies do appear somewhat cheaper on both a forward price-to-earnings ratio and a price-to-earnings growth ratio basis, but there are many investors out there who wish to avoid European energy majors right now due to the well-publicized problems in the “green energy” industry. Shell and TotalEnergies both have somewhat more exposure to that segment than Chevron.

As of right now, the S&P 500 Index has a forward price-to-earnings ratio of 22.60, so Chevron appears to be remarkably cheap compared to the market in aggregate. Overall, the company might be worth considering right now.

Conclusion

In conclusion, Chevron’s first quarter 2024 earnings results were reasonably solid. The company did suffer a bit due to lower energy prices than a year ago, but its enormous production growth largely offset this. The company is also well-positioned for growth as the Tengiz field production is likely to increase over the next year or two, plus the company still has significant operations in the Permian Basin and Colorado that could be ramped up further. Chevron also boasts a very strong balance sheet and an attractive valuation.

The biggest risk here is that consumers will remain weak and reduce their vacation activities this summer, causing oil supplies to increase. That is likely to be a near-term problem, though, and overall Chevron looks like a good long-term holding to buy on any weakness.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.