J Studios

Intro & Thesis

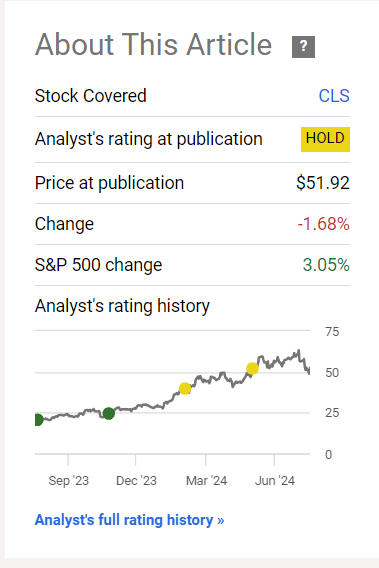

In August 2023, I initiated coverage of Celestica Inc. (NYSE:CLS) stock and then confirmed the “Buy” rating again in November. Since then, the stock has continued to rise, and at some point, its rally made me cautious against the backdrop of valuation ratios that were moving away from historical averages, and I eventually downgraded CLS to “Hold”, confirming that rating 3 months ago. Since my last neutral thesis update, the stock’s price has decreased by almost 1.7%, while the market – the S&P 500 index (SP500) (SPY) – has risen by 3%.

Seeking Alpha, my article on CLS

At that time, my calculations regarding the company’s fair valuation led me to conclude that there was not enough upside to raise CLS’s rating to “Buy” again. However, in light of recent events, such as the company’s Q2 FY2024 report (and other corporate developments), which was released just a week ago, I believe that Celestica stock now deserves a “Buy” rating, as I think its upside potential has increased.

Why Do I Think So?

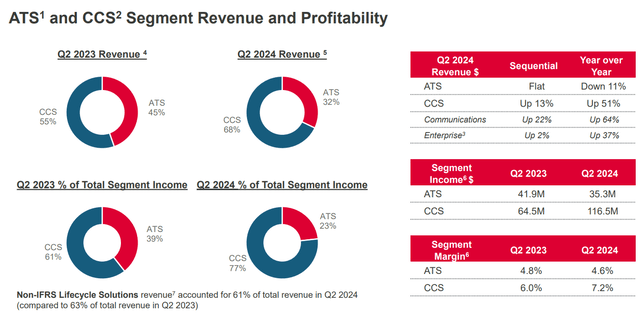

As I often do, let me first begin by describing Celestica’s business structure, with 2 main segments: Connectivity and Cloud Solutions (CCS) and Advanced Technology Solutions (ATS). The CCS segment, which accounts for 55% of Q2 2024 revenue, includes enterprise, communications, telecommunications, server and storage services. The ATS segment, on the other hand, which accounts for 45% of revenue, comprises aerospace and defense (A&D), industrial activities such as energy storage and electric vehicle charging, healthcare technology, and capital goods.

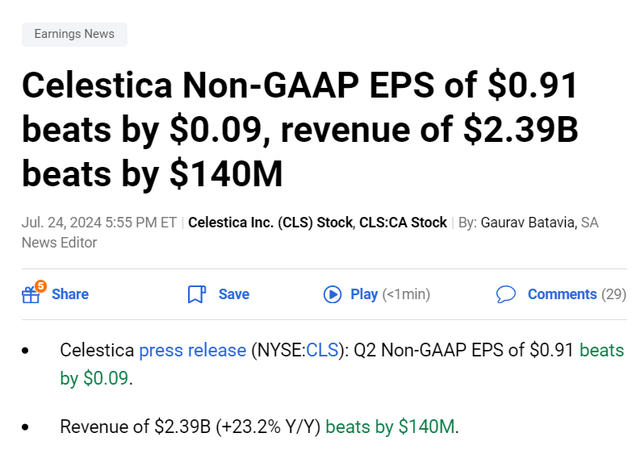

In the 2nd quarter of FY2024, Celestica showed good consolidated performance with total sales amounting to $2.39 billion, a +23% YoY increase from $1.94 billion reported in Q2 2023. After adjusting for IFRS effects, the EBIT margin increased from 5.5% to 6.3% year over year – that’s an improvement of 80 basis points, which looks like a lot to me. As a result, adjusted EPS increased significantly to $0.91 (compared to $0.55 in the second quarter of 2023), i.e. earnings per share increased by 65.45%, which means that operating leverage keeps doing what it should and the company still hasn’t fully reached its peak margins. The consensus expectation regarding both sales and earnings was beaten with a comfortable margin:

Seeking Alpha news

One of the reasons why I initially lowered my rating six months ago was due to concerns that the company might have reached the peak of its margins. This could reduce the positive impact of operating leverage, and as a result, the forecasted growth rates might not be justified in the future.

I’m not sure to what extent this company will be able to continue to have strong financials and benefit from the AI tailwind any more than their peers, but I suspect that the business diversification efforts and still low base should allow the company to grow in the long term. But as for the potential for margin growth in the medium term, I’ve doubts that CLS will continue its rapid growth.

However, as we see from the results of the last two quarters, my concerns were unfounded – Celestica continues to actively grow and increase its operating capacity and leverage, while its margins are still expanding, and the top-line growth prospects, in my opinion, are definitely not diminishing.

Let’s take a look at the Q2 performance of individual business segments:

Celestica’s Q2 numbers, IR presentation

The CCS segment stood out with a sales increase of +51% YoY ($1.62 billion). As the management explained during the earnings call, this growth was “driven by strong demand in both the enterprise and communications end-markets, particularly from hyperscale customers’ investments in data center infrastructure.” Also, the CCS segment’s EBIT margin improved by 120 basis points for just one year (from 6.0% to 7.2%). So CCS’s strength offset the whole negative impact from the ATS segment, which recorded an 11% decline in revenue to $768 million, mainly due to “the continued weakness in the industrial business.” Some of ATS’s end markets, like the Aerospace & Defense and Capital Goods ones recorded double-digit growth increases, but in contrast to CCS, the ATS segment’s EBIT margin decreased slightly from 4.8% in the second quarter of Q2 2023 to 4.6%. In fact, this can even be considered a victory for CLS, as the decline was only 20 basis points, so considering that ATS’s end markets’ segments depend more on classic cyclical industries, I believe that as economic activity in the U.S. and North America as a whole stabilizes, this segment’s margins should also normalize.

As mentioned in previous articles, I believe the main driver of growth will come from the CCS segment, which is directly connected with artificial intelligence and the transition to next-generation computing programs next year. The management itself speaks about it during the latest earnings call, giving us a target top-line growth rate for 2024.

We anticipate incremental growth in networking, driven by healthy demand for our market-leading 400G switch products, and ramping programs in the 800G switch, as well as growth in storage. We expect that this strength will more than offset a slight reduction in AI/ML compute, driven by technology transitions in certain sole-sourced programs. We expect to ramp up new AI/ML next-generation compute programs in 2025. Overall, the demand backdrop for our CCS segment continues to be highly favorable. And as a result, we now expect revenues to be up in the mid-30%s range in 2024.

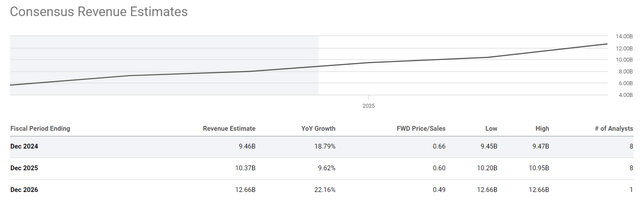

In Q1 we saw approximately 20% revenue growth, and for Q2 we look at about 23% revenue growth; amid that the management projects ending FY2024 with top-line rising by mid-30%s YoY. This indicates a planned acceleration of business expansion in the second half of the year. As far as I can see, the market seems to be not prepared for this, as it’s currently predicting only about 19% YoY revenue growth for FY2024:

Seeking Alpha, CLS

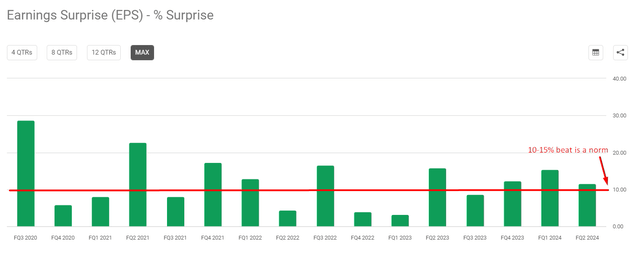

From this, it becomes completely obvious to me where such strong positive earnings surprises come from every quarter: The market systematically underestimates Celestica’s ability to grow, so it just keeps beating consensus and sending its stock higher and higher.

Seeking Alpha, CLS, the author’s notes

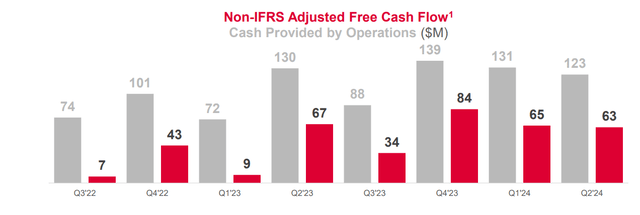

At the same time, speaking about Celestica’s balance sheet, I think it remains healthy with $434 million in cash and equivalents at the end of Q2 (Seeking Alpha Premium data), with total liquidity standing at $1.2 billion (almost 20% of the firm’s market cap). Non-IFRS FCF stays stable at $63 million in Q2 (vs. $69 million last year), while the overall trend speaks for itself.

Celestica’s Q2 numbers, IR presentation

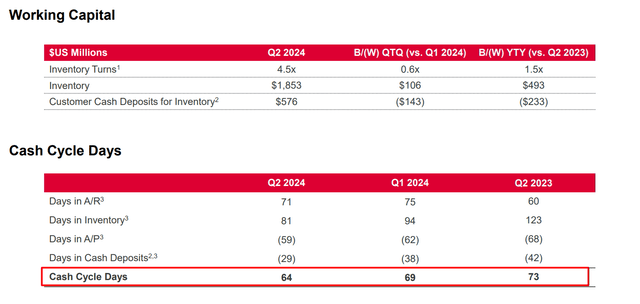

I think the $1.8 billion inventory level should support the company’s continued growth. Also, it’s important to mention here that the overall inventory management system at CLS is working much better now, not only compared to 2023 when the company was still suffering from supply chain issues but also compared to the already good Q1 numbers:

Celestica’s Q2 numbers, IR presentation

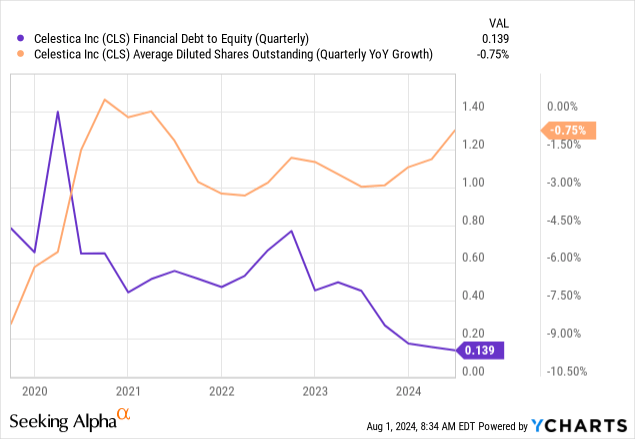

As for the debt load, the company’s debt-to-equity ratio continues to fall and is well below 1, according to YCharts data. In my opinion, Celestica is spending its free cash flow quite skillfully, balancing between deleveraging and share buybacks, which continue to be quite active to this day.

Apparently, the competitive advantages I described back in November 2023 and May 2024 still play a huge role in CLS’s development. Unlike many fast-growing companies that prioritize rapid expansion over profitability and shareholder returns, Celestica has struck a balance between these priorities. At the same time, Celestica’s strategic diversification into higher-margin segments has significantly improved financials, boosting margins and EPS, and setting it apart from its peers. With the company’s competitive advantage in mind, let’s try to evaluate how fairly the stock is traded today.

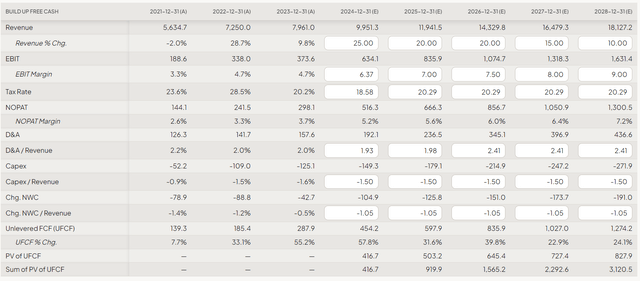

My mistake in the past, when I last did a DCF model, was that I focused on the consensus estimates. Now we see that management expects fairly rapid revenue growth amid no reaction from Wall Street (which is why CLS keeps beating). So I’ll take the management’s expectations into account, with a small correction downward to comply with the principle of conservatism.

I assume in FY2024, the company’s revenue will grow by 25% YoY, and for the next 2 years, it will grow by 20%, then gradually decrease to 10% by FY2028. At the same time, the operating margin will continue to grow, reaching 7% by FY2025 and gradually increasing to 9% by FY2028. For other operational metrics, I’ll assume average historical indicators. I also take into account that the ratio of CapEx to revenue will likely remain at ~1.5%.

FinChat, CLS, the author’s notes added

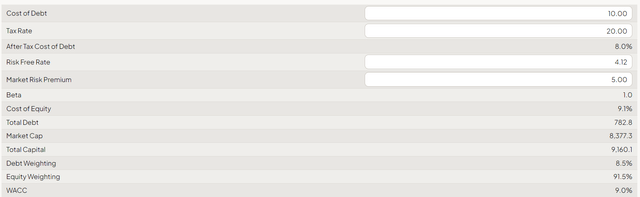

The current value of the risk-free rate as I write these lines is ~4.12%. Assuming a cost of debt of 10%, MRP at 5%, and an effective tax rate of 20%, I arrive at a WACC of 9%:

FinChat, CLS, the author’s notes added

Right now, the stock is trading at a 19.6x multiple of enterprise value to free cash flow, but we can say that the “fair” long-term average is approximately around 12-13x. But even if we assume that by the end of 2028, the stock will be trading at only a 10x EV/FCF multiple, we’ll still get a huge potential upside – around 68.7% from today’s stock price.

FinChat, CLS, the author’s notes added

Thus, in my opinion, I feel like I’m obliged to upgrade my rating based on the calculated undervaluation today.

Where Can I Be Wrong?

Please beware that investing in CLS stock comes with several potential risks. First off, there is industry risk, as the electronics manufacturing services sector is cyclical and sensitive to fluctuations in demand for electronic products. Customer concentration risk is another concern, as a significant portion of Celestica’s revenue is derived from a limited number of clients, making it vulnerable to reductions in business from key customers.

In addition, foreign currency risk arises from operating in various foreign markets, which exposes the company to exchange rate fluctuations that can have a negative impact on earnings. In order to remain competitive in the rapidly evolving EMS industry, continuous technological investment is also required and if the company doesn’t keep pace with advances, it may lead to a loss of market share.

Furthermore, CLS’s stock price action shows that such a strongly one-sided upward movement may not always be sustainable. If we look at the daily chart, we’ll see the structure of an emerging “lower low”, which could potentially indicate a change in medium-term trend:

TrendSpider, CLS daily, author’s notes

The Bottom Line

Despite the aforementioned risks, I still believe that growth in the end markets for both segments of the company is not yet fully realized. Celestica, thanks to its effective business model and ability to continue increasing margins and maintaining its current operating leverage, keeps growing. My concerns from six months ago regarding further margin expansion prospects have been alleviated by CLS’s largest segment in terms of operating profit and revenue – CCS. I believe this very segment will continue to have opportunities for further expansion thanks to AI trends, and management will continue to make efforts to strengthen margins there (and also at ATS as the economic cycle turns). This should, in theory, lead to higher growth rates than the market currently expects.

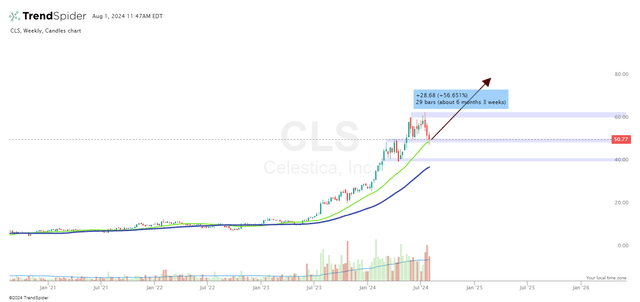

By the way, a few words about technical analysis: if we look at the weekly chart, we see that the current correction is most likely temporary. The CLS stock price is consolidating around the 25-week moving average, and based on the long-term trend, I think we may see a recovery in the next few weeks.

TrendSpider, CLS weekly, author’s notes

In any case, the undervaluation of the company could exceed even the value I indicated above. According to my DCF model – based on realistic input data, in my view – Celestica stock is undervalued by approximately 68.7%. That’s why I’m upgrading it to “Buy” today.

Thank you for reading!