Monty Rakusen/DigitalVision via Getty Images

LKQ Corporation (NASDAQ:LKQ) noted in the last quarterly report that it intends to redesign the business model in Europe. Besides, the company appears to benefit from recent M&A transactions. In my view, LKQ will most likely intend to accelerate inorganic growth in the coming years. Previous free cash flow growth seen in the last decade, decrease in the share count, ongoing stock repurchase agreements, and increases in the book value per share indicate undervaluation. The results of my discounted cash flow model indicated that the fair price could be around $103 per share. Other analysts also noted that the stock appears cheap.

Business Overview, Recent Earnings, And Growth Review

LKQ presented itself in the last quarterly report as a global distributor of vehicle products. The company sells replacement parts, systems used in the repair and maintenance of vehicles, and specialty aftermarket products.

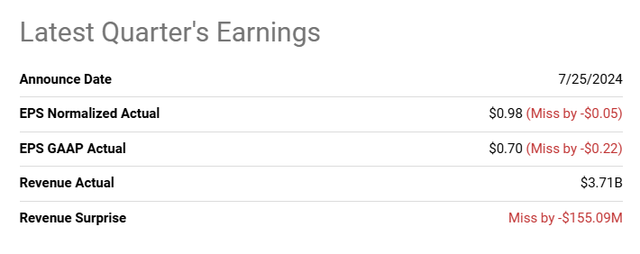

In the last quarterly report, the company noted lower than expected EPS GAAP of $0.98, and lower revenue than expected close to $3.71 billion. I did not like the earnings reported.

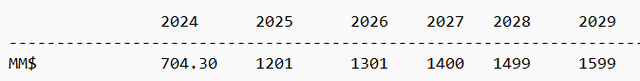

In the six months ended June 30, 2024, LKQ noted FCF of $320 million, which is lower than what the company reported in the same period in 2023.

Source: 10-Q

With that about recent FCF, and EPS, in my view, investors may want to have a look at the company’s long-term performance.

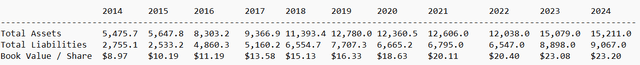

In order to detect long-term growth, I reviewed the increase in the total amount of assets and liabilities from 2014 to 2024. It turns out that the total amount of assets multiplied by close to 2.77x in the last ten years. Total liabilities also increased, however, the book value per share multiplied by about 2.58x. In sum, I think that LKQ is definitely growing in the long term.

It is also worth noting that the price to book value is at close to 1.7x. As shown in the chart below, 1.7x is a long-term minimum. In my view, LKQ appears cheap.

In my view, the expectations of analysts may change, and the price could change, but the last ten years were beneficial for LKQ. Given these details, I think that we can expect long-term growth in the coming years.

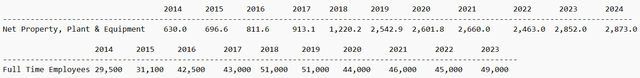

It is also worth noting that the total amount of property and equipment increased from $630 million in 2014 to about $2.8 billion in 2024. Directors seem to be increasing the total amount of capacity. Higher capacity will most likely lead to higher net sales growth in the coming years. LKQ also reported higher headcount in the last decade, which, in my view, indicates confidence about the future.

Income Statement Review, Net Debt/EBITDA, And WACC

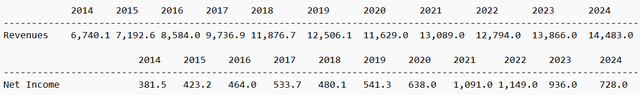

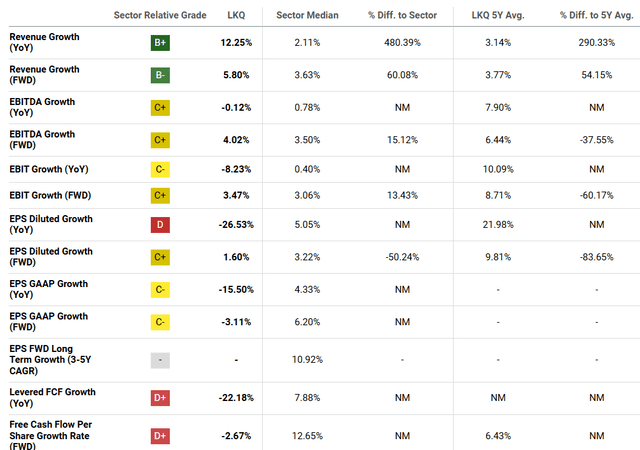

The review of previous income statements indicates healthy growth. From 2014 to 2024, total revenue increased by close to 114%, and net income growth stood at about 91%. With these figures, I am really not concerned about the recent decline in net sales growth reported in 2024 and 2023. The business model was proven for more than ten years. I think investors should not only look at the numbers reported in 2023 and 2024.

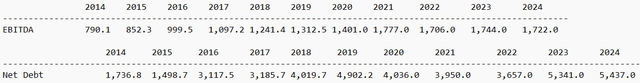

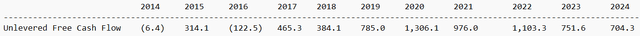

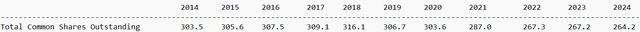

EBITDA figures also increased significantly from 2014 to 2024. The net debt/EBITDA is close to 3x. However, I would really not be concerned about the total amount of debt. The company grows and generates positive and growing EBITDA. Debt holders will most likely offer new financing when it is necessary.

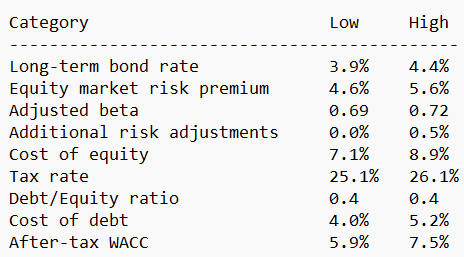

In the last quarterly report, the company noted term loan payable with interest rate close to 6.8% and U.S. Notes including interest rate of 5.75% and 6.25%. In addition, the company reported Euro notes including interest rate of about 4.13%. With these numbers in mind, I think that assuming a WACC of about 6.2% makes a lot of sense, and appears conservative. Other analysts out there reported a WACC that is not far from mine.

Source: Valueinvesting.io

Cash Flow Review, And Decline In The Total Share Count

Previous FCF includes 2014 FCF of -$6 million and 2023 FCF of $751 million. Like the company’s net income, net sales, and EBITDA, the company’s FCF grows. Investors did not receive negative FCF results since 2017. In 2020, total FCF stood at close to $1.3 billion.

I think that directors inside LKQ know well that the company is undervalued. With this in mind, shareholders enjoyed a significant decrease in the total number of shares from 303 million to about 264 million in 2024. In my view, further decrease in the total number of shares could bring increases in the fair price per share. As a result, demand for the stock could increase, which may lead to stock price increases.

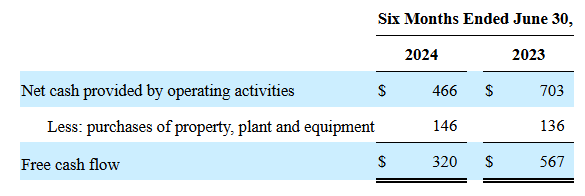

DCF Model: $103

My financial model includes conservative assumptions with regard to future FCF growth, net income growth, and debt levels. My numbers are conservative, and are in line with results delivered by the company in the past.

I also took into account the ongoing structural centralization and standardization in Europe, which was noted in the last quarterly report. In my view, successful operations in Europe could bring increase in the FCF margin growth and the EBITDA margin. The following lines were taken from the most recent quarterly report. Note that the project is expected to be completed by the end of 2027.

We have undertaken the 1 LKQ Europe plan to create structural centralization and standardization of key functions to facilitate the operation of the Europe segment as a single business. Source: 10-Q

We are executing on the various projects associated with the 1 LKQ Europe plan and expect to be completed by the end of 2027. During the three and six months ended June 30, 2024, we incurred $11 million and $19 million, respectively, in costs across all three categories noted above. We expect that costs of the plan, reflecting all three categories noted above, will range between $125 million to $155 million for 2024 through the projected plan completion date in 2027. Source: Q2 2024 Earnings Report

In addition, I think that we could expect further increase in net sales and FCF growth from inorganic growth. In the last quarterly report, the company noted that acquisitions and divestitures enhanced significantly the results for the six months ended June 30, 2024. In my view, given the recent success, LKQ will most likely try to bring new inorganic FCF growth.

The increase in parts and services revenue of 10.5% represented increases in segment revenue of 24.3% in Wholesale – North America, 5.9% in Specialty, and 2.8% in Europe, partially offset by a decrease of 10.8% in Self Service. This overall increase was driven by an 11.7% increase due to the net impact ofacquisitions and divestitures and a 0.1% increase due to fluctuations in foreign exchange rates, partially offset by an organic parts and services revenue decrease of 1.2%. Source: Q2 2024 Earnings Report

My discounted cash flow model also included a further increase in the number of shares acquired by LKQ. It is worth noting that the company reported a program that includes the potential purchase of $3.5 billion. Stock repurchases could bring demand for the stock, lower WACC, and stock price increases.

Our Board of Directors has authorized a stock repurchase program under which we are able to purchase up to $3,500 million of our common stock from time to time through the scheduled duration of the program on October 25, 2025. Repurchases under the program may be made in the open market or in privately negotiated transactions, with the amount and timing of repurchases depending on market conditions and corporate needs. Source: Q2 2024 Earnings Report

My DCF model includes expectations in line with previous FCF growth, a WACC of 6.2%, and long-term growth of 2%. The results would include a total valuation of $33 billion, an equity valuation of $27 billion, and a target price of $103 per share.

- NPV: $6,139.18 million

- NPV of TV: $27,061.91 million

- Total Value: $33,201.09 million

- Net Debt: $5,437.00 million

- Total Equity: $27,764.09 million

- Share Count: $267.50 million

- Target Price: $103.79

Other Analysts Gave An Average Price Target Of $54 Per Share

I think that it is worth having a look at the expectations and forecasts of other analysts. According to Seeking Alpha, the average price target from analysts is close to $54 per share.

It means that they mostly see a significant amount of upside potential in the stock price. Out of 10 analysts, three mentioned a strong buy mark, six think that the company is a buy, and 1 mentioned a hold note. None of the analysts reviewed gave a sell mark.

Risks

General economic conditions in North America or Europe may affect the company’s bottom line, and may lower future net income growth. However, there are specific factors that are applicable to the company’s business model. They represent relevant risks. For instance, a decrease in the number of vehicles on the road may diminish future FCF growth. Besides, changes in used vehicle pricing or inflation could also destroy future economic prospects.

I would also expect a deterioration in the company’s FCF expectations as a result of online transactions and business executed on online marketplaces. The company provided some information about these risks in the last annual report.

Business transacted on online marketplaces continues to increase, which presents additional competitive pressures on us; in addition, the owners of these online marketplaces control access to their platforms and may prohibit us from participating. Source: 10-k

LKQ may also suffer from OEMs efforts to restrict the access to the aftermarket parts markets. In this regard, LKQ noted that OEMs include software in some vehicle parts that prevent them from being recycled. There are also repair shop certification programs, and other efforts that may damage LKQ’s business model. The following lines are from the most recent 10-k.

From time to time, the OEMs have engaged in efforts seeking to increase OEM market share and to restrict consumers’ choice to use recycled or aftermarket parts to repair consumers’ vehicles. Examples of these efforts include blocking the use of vehicle telematics by the independent repair industry, demanding that suppliers provide certain parts exclusively to the OEMs, embedding software in certain vehicle parts that prevents them from being recycled and used to repair other vehicles, repair shop certification programs that, in some cases, require the repair shops to use only OEM parts, refusing to sell certain OEM parts unless the buyer is an OEM-certified shop, obtaining patents and trademarks on various subcomponents of vehicles to prohibit the use of an aftermarket part alternative, and price matching and rebate programs on certain aftermarket products. Source: 10-k

LKQ appears to have good relationships with insurance companies, which encourage vehicle repair facilities to work with the company. If LKQ fails to maintain these agreements, I think that future net sales growth may be lower than expected, and FCF could decrease. If a sufficient number of analysts detect a decline in the company’s net income growth, in my view, demand for the stock could decline.

These insurance companies encourage vehicle repair facilities to use products we provide. Our arrangements with these companies may be terminated by them at any time, including in connection with their own business concerns relating to the offering, availability, standards or operations of the aftermarket quality and service assurance programs. We rely on these relationships for sales to some repair shops, and a modification or termination of these relationships may result in a loss of sales, which could adversely affect our results of operations. Source: 10-k

With regard to the total amount of debt, in my view, unexpected increases in the interest rates may push the company’s cost of capital or WACC, which may lower the company’s implied valuation. Under certain conditions, the net debt/EBITDA may increase significantly, and some shareholders may decide to dump their shares. As a result, I think that we could expect a decline in the demand for the stock and a decrease in the stock price.

Conclusion

LKQ recently reported efforts to redesign the business segment in Europe, expected to be completed in 2027. In addition, recent M&A efforts and divestitures seem to enhance the company’s net sales. Considering the company’s free cash flow in the last decade, increase in the book value per share, and ongoing stock repurchases, I think that the company appears significantly undervalued. Designed with conservative assumptions, my discounted cash flow model offered a fair price valuation that implied significant upside potential in the stock price. Other analysts also offered an average target price that is above the current stock price.