Nathan Howard/Getty Images News

Written by Sam Kovacs.

Introduction

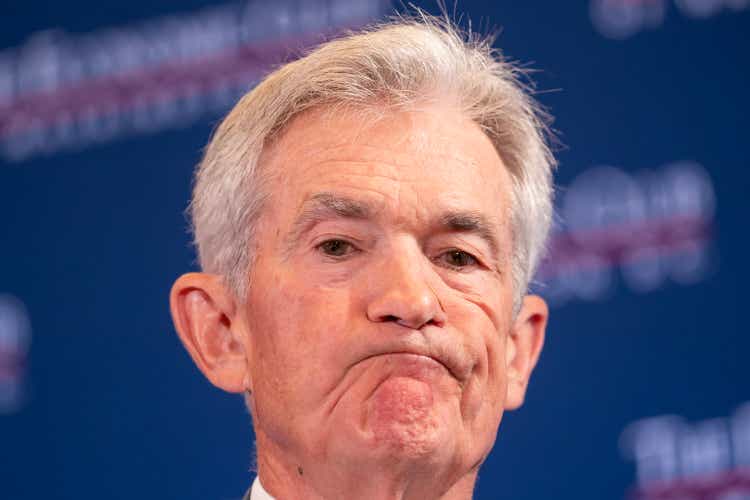

If we were to see inflation moving down … more or less in line with expectations, growth remains reasonably strong, and the labor market remains consistent with current conditions, then I think a rate cut could be on the table at the September meeting – Jerome Powell.

It has been 6 years since Powell became Fed Chair, and he is finally saying something which is pleasing to me. While I do believe the Fed’s timing on rate cuts to be slightly off, and that all the elements necessary for a rate cut have been in place for months, it pleases me that the Fed chairman’s most dovish comments in a long time set us up for a September cut.

Powell’s remarks reinforced investors’ expectations that the Fed is poised to pivot in September from an era of restrictive interest rates to a more accommodative stance. This shift aims to guide inflation to the 2% target without significantly harming the labor market.

Powell expressed confidence in achieving a soft landing, noting that the data does not suggest a weakening or overheating economy.

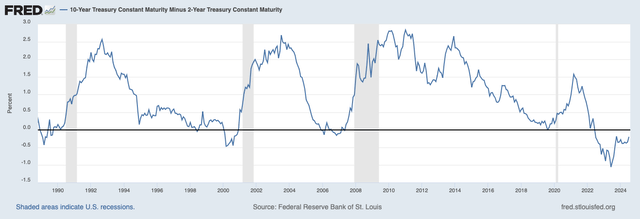

As inflation has continued to trend towards 2%, and anyone capable of basic arithmetic can see that it will continue to do so. (For more on this, you can read this article I wrote in February.)

Figure 1: Rates and Inflation (Reuters)

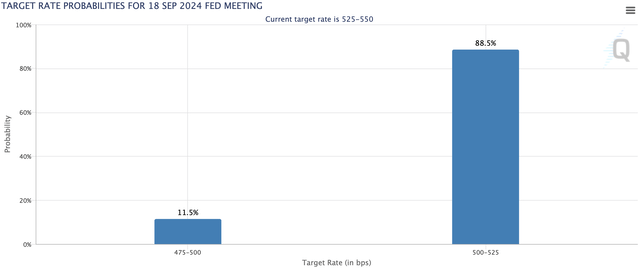

Following Powell’s remarks, interest rate futures, stocks, and Treasury bonds rallied, with the probability of a significant rate cut in September increasing according to CME Group’s FedWatch tool. Powell, however, indicated that a 50-basis-point cut was not currently under consideration, despite the FedWatch tool now marking an 11.5% probability of a 50 bips cut.

Figure 2: Target Rate Probabilities September (CME FedWatch)

Now let’s be clear, I’d much rather see a 25 basis point cut, followed by another, rather than having to cut aggressively, as this would be a reactionary event to worsening economic contraction.

The steady decline in inflation has finally fostered a consensus among Fed members that the inflation battle is nearing its end.

The Fed’s statement, approved unanimously, downgraded the description of inflation to “somewhat elevated” moving away from the term “elevated” used for the past three years.

It also shifted from being “highly attentive to inflation risks” to a broader focus on “the risks to both sides of its dual mandate” of maximum employment and stable prices. Let’s hope that the rate cuts come early enough to not hurt employment too bad.

Economic trouble ahead?

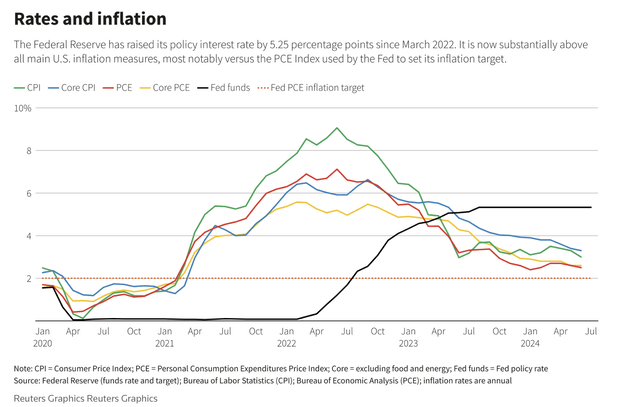

As the rates are moving towards being cut in September, the yield curve as measured as the difference between the 10 and 2 year treasuries is reverting and nearing positive.

In the past 4 recessions which are charted above: 1990, 2001, 2009 and 2020, the yield curve had turned positive by the time the recession hit.

This explains why everyone who called for a recession in 2023 got it wrong. This is something I foresaw and wrote about in January 2023 in an article titled “The 2023 recession, why so certain?” I concluded:

But it seems to me, that once again, the men in the suits and ties, in their business districts in London and New York, have failed to look beyond their office’s glass window.

Only a massive slowdown in jobs could crush the health of the US consumer.

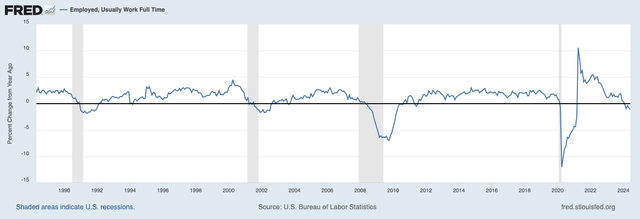

Fast-forward 18 months, and I have a very concerning chart to share with you below.

The amount of Americans who are employed, and usually work full-time is down from a year ago.

Figure 4: Employed, Usually work full time (FRED)

In each of the past 4 recessions, this metric declined at the same time a recession happened.

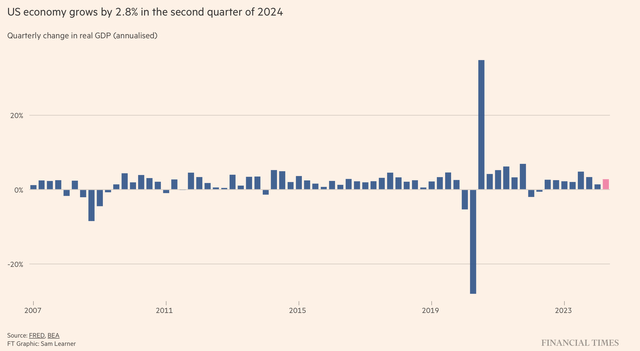

Unfortunately, this doesn’t line up in the current environment. Last week, the US GDP for the second quarter was reported as growing at a 2.8% real rate.

Figure 5: US real GDP growth (Financial Times)

Is it possible that we will reach a soft landing then? Yes, it is, of course, very possible. Is it possible we enter a recession? Yes, of course it is very possible.

Let’s buy stocks which should do well regardless of how the economic situation plays out, knowing that rates will be cut in September. This will commence a rate cut cycle which is expected to continue for at least a whole year.

Understanding Bonds in a reducing rate cut environment

Before we take a look at which dividend stocks to buy, it is informative to look at what types of bonds tend to do best when rates are cut.

This is of value because bonds are more simple instruments than equities. They have predetermined cashflows and their yields are based on the credit rating and the maturity.

When rates are cut and yields go down, bond prices naturally go up to reflect the lower yields. There are certain types of bonds that do particularly well when rates are cut:

- Zero coupon bonds: Zero coupon bonds do not pay interest. Rather, they trade discounted to face value, and as yields go down, the discount rate used to calculate the current price of the bond goes down too. This in turn makes the zero coupon bond’s price go up. Because the only cashflow from this bond is at the very end of its life, for two bonds of similar maturity, the zero coupon bond will be more interest rate sensitive.

- Long-term bonds: Bonds with longer maturities have the bulk of their cashflows further in the future. A decline in discount rates used to calculate their price leads to an increase in their price. The longer the “duration” of a bond, the more interest rate sensitive it is.

Then there are some behavioral impacts. Rate cuts usually come with bumpy economic conditions, or at least risky economic conditions, as we have assessed in the section above.

This leads to a boost in performance in investment grade corporate bonds, due to two factors: yield chasing from funds that were in government bonds and now need more yield, and security chasing from those who were in high-yield bonds and now feel unsafe with these.

Investment grade bonds are more interest rate sensitive than junk bonds, as junk bonds depend more on their credit safety than their interest rates in pricing.

Using this basic understanding of bonds in a rate cut cycle will give us a good way to approach stocks, as we’re about to see.

What stocks to buy for rate cuts.

From the section above, we have derived that buying bonds which exhibited these characteristics would be beneficial in the current environment:

- long term

- zero-coupon

- investment grade.

If we can find stocks which have at least two of these qualities, then we would be likely looking at stocks which could do well in a rate cut environment.

Zero coupon stocks?

The zero-coupon thing is important to note. Stock’s whose cashflows are mostly projected to be in the future (such as with high-growth stocks) are likely to do very well in an environment where rates are cut.

This is why in one day we saw Broadcom (AVGO) increase 11% from $143 to $160, amid the Fed signalling. Even though AVGO pays a dividend, it is such a minimal part of its FCF each year, and the market is assigning massive future cashflows to this stock.

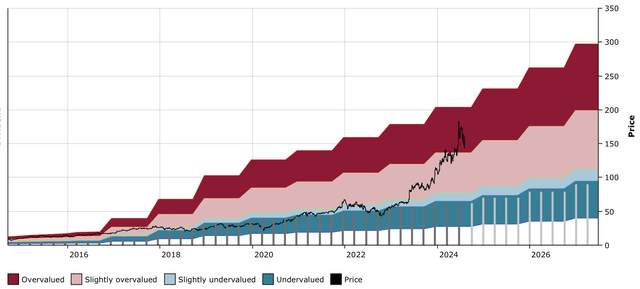

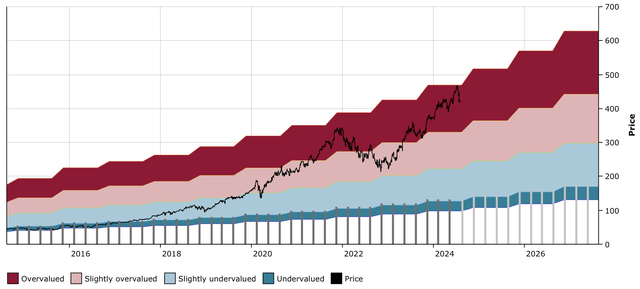

Figure 6: AVGO DFT Chart (Dividend Freedom Tribe)

Now, this doesn’t mean that we want to buy Broadcom at these prices. We’re actually exiting our Broadcom position after having made it the largest position in our portfolios. In fact, it remained so even after having sold half of it, as it just kept going up. In January 2023, we identified it as a strong dividend stock to buy when we called the AI bull market, saying: ChatGPT marks a turning point in the AI Revolution.

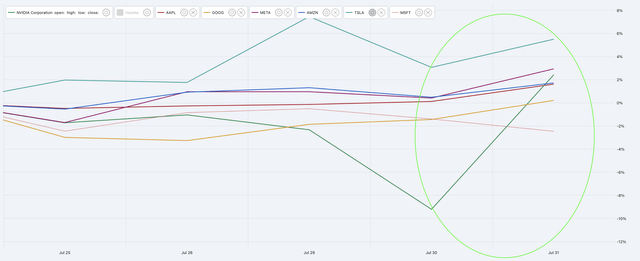

Unsurprisingly then, most of the Mag 7 stocks were up on Wednesday, with Nvidia (NVDA), Amazon (AMZN), Tesla (TSLA), Alphabet (GOOG), Meta (META), Apple (AAPL) all up for the day. Microsoft (MSFT) was the only outlier.

Figure 7: Magnificent 7 1 week returns (Dividend Freedom Tribe)

But do I feel safe buying these stocks at current prices? No way.

This is a season to be selling these stocks, not buying them, as they are historically overvalued, and moving towards a peak.

Figure 8: MSFT DFT Chart (Dividend Freedom Tribe)

What I wanted to point out, is that despite their overvaluation, because of their “zero-coupon” bond like nature of large expected cashflows in the future, they might initially respond well to the anticipation of rate cuts.

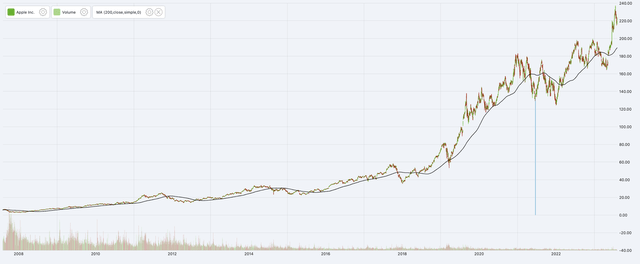

Nonetheless, investors should be lightening their exposure to these stocks, and considering exiting altogether once they breach their 200-day SMA and indicate they are moving into a downward cycle.

Figure 9: AAPL price and 200D SMA (Dividend Freedom Tribe)

Doing this would allow investors to harvest gains on the way up, and bail having retained most of the gains of the cycle.

But this is not where I see value and the biggest gains in the current cycle of rate cuts.

Rather, I’m looking for stocks which look like long-term investment grade bonds.

Stocks which look like long-term investment grade bonds

If there are stocks which are perceived to have the characteristics of long-term investment grade bonds, we can expect these to do well in a rate cut environment.

One clear element which makes something “bond like” is the dividend, which replicates the coupon payment.

Here, we’d expect to see cash from the sidelines come into these stocks from the yield chasers.

So dividend stocks are where we’re looking. But it is the blue-chip dividend stocks which we should favor, as to be bond-like we need to be able to depend on this cashflow.

The safest dividends, then, will exhibit investment grade bond like attributes. Those with the longest track record of dividends will also be viewed as the most likely to pay dividends for longer. There is a clear “Lindy effect” going on in the market regarding these.

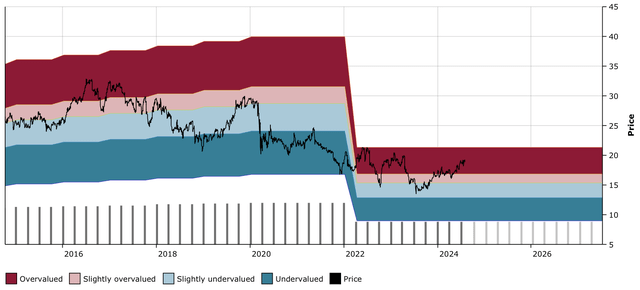

However, smart analysis of fundamentals is essential because this alone cannot be a proxy for dividend safety. AT&T (T), Walgreens (WBA), and 3M (MMM) are all reminders of this.

The DFT charts of these stocks, shown below, demonstrate the erosion of value which happens when a dividend is cut and why we want to avoid these situations at all cost.

Figure 10: T DFT Chart (Dividend Freedom Tribe) Figure 11: MMM DFT Chart (Dividend Freedom Tribe) Figure 12: WBA DFT Chart (Dividend Freedom Tribe)

Stocks which are in what are usually referred to as “defensive” sectors would also have investment grade-like attributes.

Here are 3 which, I believe, are fantastic buys with this in mind. It also helps that they have a quite high level of debt, which should see lower interest payments because of lower rates.

Buy Pfizer

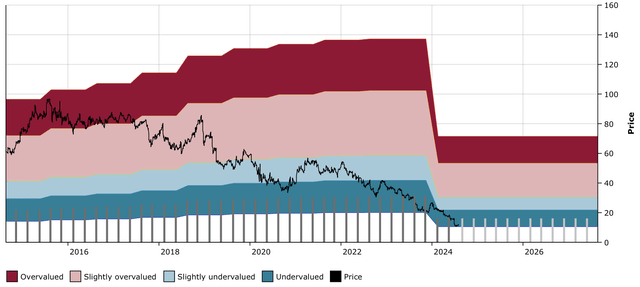

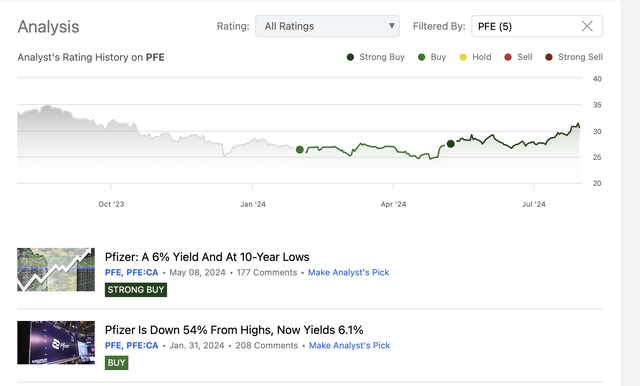

I have written about Pfizer (PFE) twice so far this year.

Figure 13: Author’s PFE Coverage (Seeking Alpha)

The stock has outpaced the S&P 500 (SP500) since both of those calls, with a 16% return since the first one.

The stock still yields a solid 5.5% and is trending upwards.

Figure 14: PFE DFT Chart (Dividend Freedom Tribe)

Healthcare stocks have been doing quite well, and are generally considered a defensive sector.

In a previous article, I noted the high presence of debt. Lower rates would certainly help Pfizer:

The Seagen acquisition added a considerable amount of debt, bringing debt to EBITDA to about 6x, well above the 3.25x objectives. Let’s say they need to cut debt in half, to go back to where they were at the beginning of 2023, at around $30bn. If they continue paying down debt at a $6bn per year pace (my estimate of this year’s pace), it could take 5 years. Of course, they could likely accelerate this as they plan to do selling their $10bn or so stake in Haleon, which would free up cash. The consequence is that, let’s say for at least the next 2–3 years, debt holders will be the masters.

Pfizer is exhibiting good momentum as the stock has crossed its 200-day SMA.

In the past, this has usually led to some mean reverting of the stock, but should also mark now a clear change in trend in upcoming months.

Figure 15: Pfizer Price and 200D SMA (Dividend Freedom Tribe)

The company posted a good second quarter in which it raised its revenue guidance by $1bn, indicating that it was going to grow revenues at a 9-11% pace this year.

I believe the market has overexaggerated the risk of revenue falling off, and underestimated PFE’s ability to pump out new drugs from its pipeline.

I’m bullish on Pfizer.

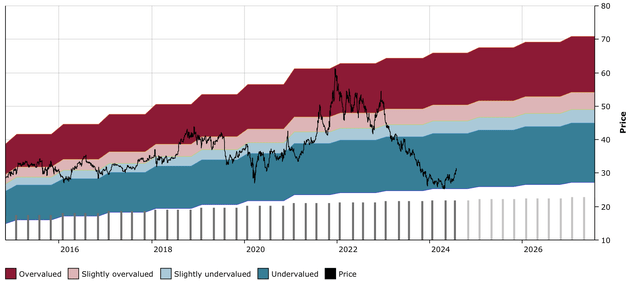

Buy British American Tobacco

I wrote about British American Tobacco (BTI) on Seeking Alpha recently here. In 3 weeks, BTI has increased by 12% from $31.7 to $35.6. However, I believe it is still a buy and that the current environment will shed a positive light on the stock.

It recently reported earnings, which highlighted the company’s resilience and cashflow generating abilities, even in an environment which is marked by particularly high competition from illegal vapes.

Figure 16: BTI DFT Chart (Dividend Freedom Tribe)

In the past couple of months, the stock has blitzed through its 200-day moving average, broken out from its 1-year-high, and is now looking to go higher.

Figure 17: BTI price and 200D SMA (Dividend Freedom Tribe)

The tobacco industry is as “consumer staple” as possible, making it a very defensive industry, which makes it a great dividend paying stock. It currently yields 8.34%, but it generates enough free cashflow to pay the dividend twice!

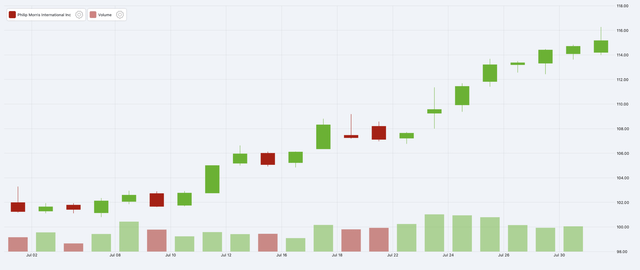

There has been a clear change in the tides for tobacco stocks. Philip Morris (PM) which was one of the DFT’s top 10 stock picks for July, is up 14% for the month.

Figure 18: PM 1M price chart (Dividend Freedom Tribe)

In the process, it has moved to our watch list.

Now, BTI will be part of our top 10 picks for August.

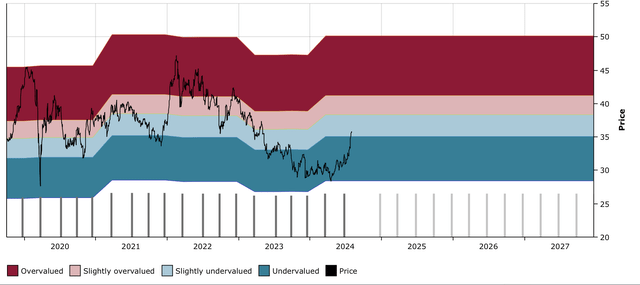

Buy Verizon

The third and final stock on this list is a telecom behemoth: Verizon Communications (VZ).

This short list has been designed intentionally to provide 3 stocks which are in defensive sectors, pay safe, predictable dividends, and will benefit from rate cuts due to resembling long-term investment grade bonds in many ways.

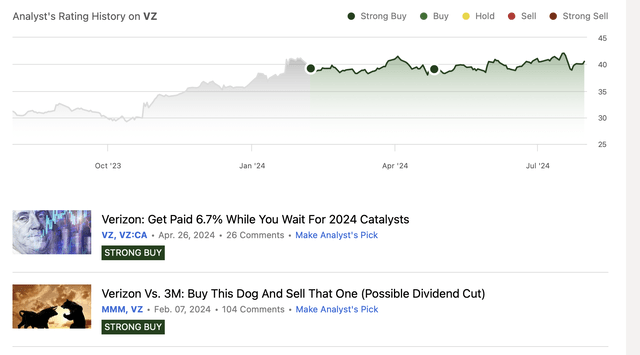

Just like Pfizer, I’ve written about VZ twice this year on Seeking Alpha.

Figure 19: Author’s VZ Coverage (Dividend Freedom Tribe)

Unlike Pfizer, we haven’t yet seen the same traction in the stock price.

In my article “get paid 6.7% while you wait for 2024 catalysts,” I explained at length the bond analogy for VZ.

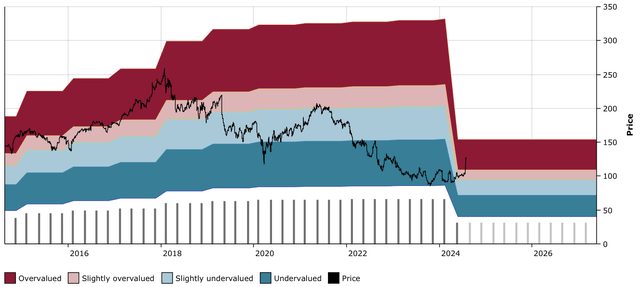

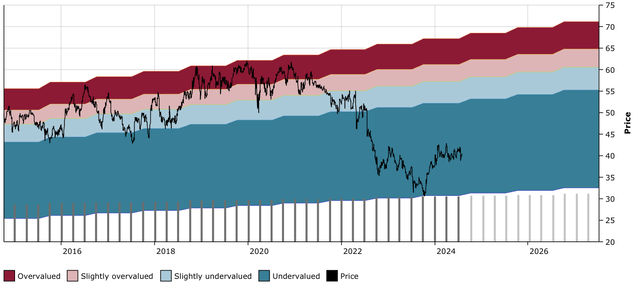

And you see, this will be a big catalyst for VZ. Yes, because it means interest expense will be lower in the future. But more because the stock is trading as a bond proxy, because of its stable dividend, high cash flow and steady eddy nature. As you can see on VZ’s DFT chart below, the stock fell hard in 2022, outside of its historical range, as higher rates drove the stock lower.

How can we explain this? Two obvious ways. The first is that as rates go higher, investors expect more yield from equities because they can get a high risk-free yield. The second is that as rates go higher, the risk of the stock goes up because of the higher interest payments, and therefore investors sell it.

The consequence of all of these viewpoints are the same: As long as rates remain higher, and that the opinion is that rates will remain higher, VZ will fail to make a comeback.

If rates remain higher for longer, and in a worst-case scenario where they are not cut, we will not see any resumption of bullishness regarding VZ’s share price. The dividend is not at risk as the lower CapEx spending in upcoming years frees up a lot of cash even despite the higher rates.

However given that I believe that we will see rate cuts this year, that will be our catalyst for VZ’s stock to bounce back. I believe $50 to $55 to be very fair share price targets.

The stock has returned 5% since then. It currently yields 6.56% and trades at $40.5, which I believe makes it still very attractive.

Figure 20: VZ DFT Chart (Dividend Freedom Tribe)

A further bullish sign is that we are now seeing the 200D SMA serve as support for VZ’s stock price.

The one-year chart shows that nicely. VZ crossed the 200D SMA in October last year, which debuted a bullish uprise for the stock.

Figure 21: VZ 1 year chart and 200D SMA (Dividend Freedom Tribe)

However, in late July, the mixed earnings report saw the stock gap below it, only to quickly recover and return above the 200-day SMA.

I believe that VZ’s interest rate sensitivity outweighs any operational results right now, as the firm generates plenty enough cashflow to continue paying its dividend.

Because of this, I’m bullish on VZ.

Conclusion

Of course, there is an elephant in the room which hasn’t been addressed here: REITs and utilities. I have written extensively about these in the recent past, and would point you to my recent article: If I had to retire today with 12 REITS.

I, personally, believe the rate cuts are inevitable now. And I also believe these 3 stocks will do very well now.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.