We Are

Dividend investing sits at the heart of REITer’s Digest. We provide a platform for discussion of income producing assets, predominately real estate. However, our love for dividends stretches far and wide. What could be even sweeter than the idea of income is monthly income or “mailbox money” that arrives in your account or mailbox on the same day each month. Income investing is simple and essentially boils down to “a bird in the hand is worth two in the bush.” Put in other words, pay me now!

Looking beyond total return comparisons, there are a variety of reasons why one might seek income. Funding retirement is one of the most common reasons. Funding a mortgage payment could be another reason to select income producing assets.

Income provides several important pieces of a portfolio including predictability, stability, and perhaps more importantly, the opportunity to create an income snowball.

Income or Income Growth?

Income investors have a limited set of goals, which generally boil down to either maximizing current income or maximizing the growth of their income. The differentiation between these two often relies on the time horizon of the investor. Those with a shorter time horizon will emphasize creating more income immediately, maximizing the near term. Investors looking over the longer time frame will often emphasize growth to maximize their future earnings potential. Understanding and differentiating appropriately is a critical piece of the puzzle!

Generally, investments with a higher growth trajectory offer a better opportunity to create future income, even at the expense of near term yield. While the attractiveness of current yield often woos investors away from higher growth potential, they pay the price shortly.

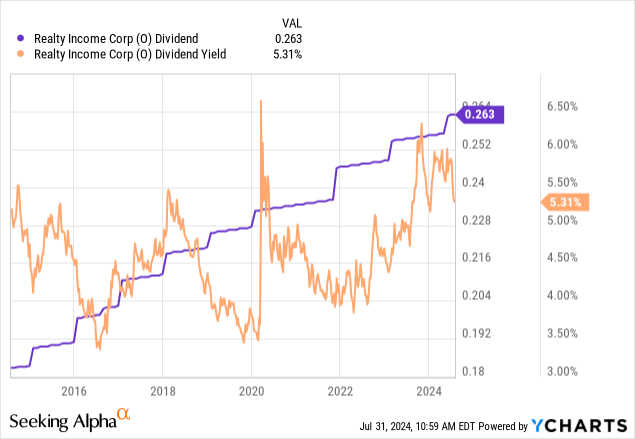

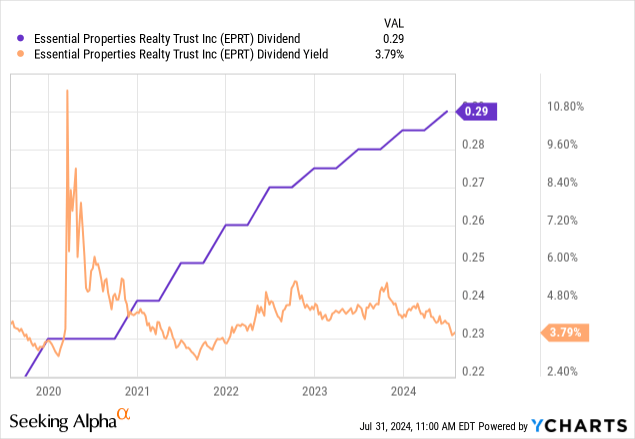

As an illustrative example, take two income-focused net lease REITs, Realty Income (O) and Essential Properties Realty Trust (EPRT). These two companies operate in similar segments, owning and acquiring net leased real estate across the country. Their portfolios and strategies are broadly similar, including their payment of increasing dividends. Each year, both companies pay most of their income to shareholders as a dividend, which grows alongside operations.

Many investors identify O as the superior opportunity based on the higher dividend yield and established track record of dividend increases. After all, O has been increasing the dividend annually for more than five decades, establishing one of the most impressive track records of income growth. However, O’s dividend growth has stagnated over the past decade, as outlined in our recent coverage of the behemoth REIT. In fact, over the past five years, the dividend has grown by just 3.6% per year.

In contrast, EPRT is a much younger company. The portfolio is growing much faster based on per share metrics, which allows EPRT to increase the dividend materially faster than O. EPRT has been active over the past five years, capitalizing on the low rate era to grow at an extraordinary rate. This corresponds directly to growth of the dividend. Over the past five years, EPRT’s dividend has grown by 5.7% annually, exceeding O’s by around 210 basis points.

While both investments have similar yields as competing net lease REITs, some will choose the higher dividend by default. However, if your time horizon is longer than several years, you may choose to reconsider.

Looking at yield on cost, shares of EPRT purchased five years ago have a current yield on cost of 5.6%, when combining the cost basis and the current dividend distribution. Compare this to O, which has a five-year yield on cost of 4.4%. The change stems from a variety of factors. First and foremost, EPRT’s dividend has simply grown faster than O’s. Additionally, O’s valuation has deteriorated as the company grows and slows, causing the yield to increase. O’s yield has historically more aggressive when growth projects were better.

In this case, the growth opportunity won after just several years. With such clear benefit from choosing the dividend growth model, investors should reconsider where they seek opportunities that truly maximize current income. From our perspective, maximizing current income means go big or go home. There is no sense taking large income risk to achieve a 100 basis point yield premium, as was the case between O and EPRT. We must dream bigger.

The 1% Rule

Mental benchmarks can be an important piece of the puzzle for investors looking to rationalize their portfolio. These benchmarks can come in a variety of shapes and sizes. One benchmark for an income producing asset is the 1% rule.

When looking for any investment that maximizes income, I typically look for two main filters. First, I look for a dividend payment equaling 1% per month or 12% on an annual basis. Second, I look for monthly dividend payments. The opportunity to earn 1% or more per month on your investment creates an extraordinary snowball of compounding returns. Compound interest is a fundamental principle of investing and one of the core tenets of any income investors backbone. In fact, Albert Einstein even called compound interest the Eighth Wonder of the World. “He who understands it, earns it…he who doesn’t…pays it.”

A 12% distribution rate creates an extractive mechanism to continuously add cash to a portfolio. This either creates a long term income stream to support spending or provides a compounding opportunity. Assuming dividends are reinvested and share prices remain level, a 12% compound annual growth rate takes less than six years to double your money, based on the Rule of 72.

The two requirements above dramatically limit the investible universe, boiling down all income producing assets to a limited list of funds. In fact, most investments on the list are closed end funds. However, the list remains diverse with a long list of funds from a variety of qualified asset managers.

Today, we explore three funds that meet the criteria. Each fund is unique, investing in a different asset class, with a different style offering three distinct opportunities to earn 1% per month.

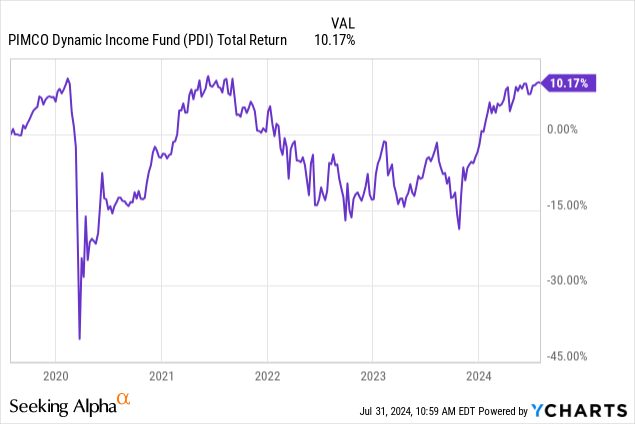

Option #1 PIMCO Dynamic Income Fund – 14.0% Yield

The PIMCO Dynamic Income Fund (PDI) is one of the largest members of the PIMCO closed end fund family, with over $5 billion under management. The fund invests in a highly diversified portfolio of income producing assets which PIMCO actively manages with leverage, derivatives, and other complex strategies.

Like all funds from the manager, PDI actively trades a diverse portfolio of bonds, securitized credit investments, and derivatives from issuers all over the world. The fund is nearly free in their strategy with a flexible mandate. Closed end funds are common vehicles for complex investing with the ability to internally lever and limited liquidity requirements. Like many funds from PIMCO, PDI also partakes in special situations, including bankruptcy proceedings. Most notably, PDI participated in the Carvana (CVNA) bankruptcy.

PDI’s portfolio is diversified across sectors, geographies, and maturities. Nearly half of the portfolio by assets matures within three years. Over the past twelve months, stabilizing interest rates have been a major tailwind for PDI and similar funds. Stable interest rates offer a degree of predictability that aids actively managed investment like PDI.

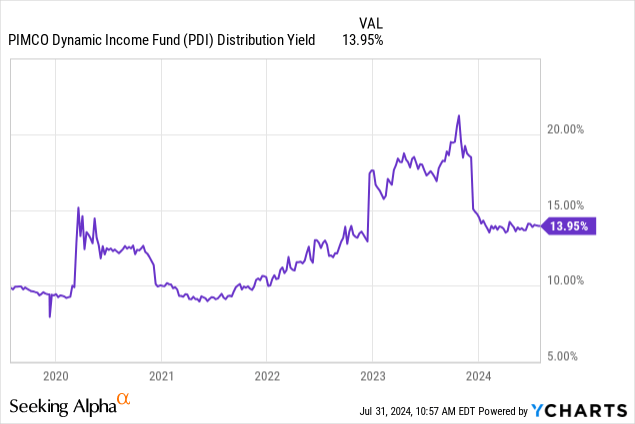

PDI’s monthly dividend corresponds to the highest dividend yield across the fund family. The fund earns its dividend through trading positions and income generated from interest. In fact, there are a variety of complex sources that PDI uses to generate capital, including share issuances.

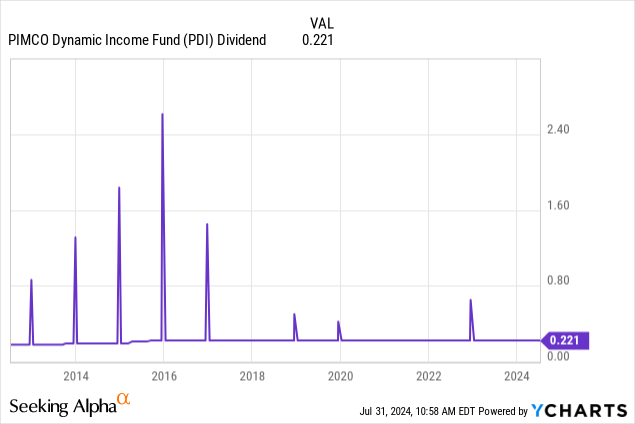

One of the most important pieces of the puzzle for PDI is the consistency of the dividend stream. PDI’s dividend has been level, maintained since an increase in 2015. Maintaining a yield over 12% for over ten years uninterrupted is an impressive feat.

While interest rate volatility has impacted PDI’s share price, the fund’s distribution has remained unchanged.

The monthly dividend corresponds to a current yield of almost 14% based on current share prices.

Option #2: BlackRock Science and Technology Term Trust – 14.0%* Yield

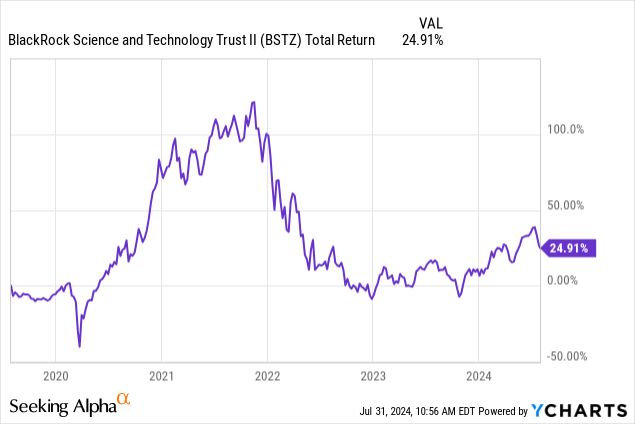

The BlackRock Science and Technology Term Trust (BSTZ) is a closed end fund that invests in the technology sector, both private and public. BSTZ invests in the public tech sector, targeting large capitalization and small capitalization companies. BSTZ juices the equity portfolio with an income-generating covered call options strategy. The remainder of the portfolio is invested in private venture technology investments.

Covered calls are a conservative options strategy designed to generate income in a portfolio. The simple strategy is most successful during stagnant markets and caps the upside of an investment during hot markets.

BSTZ’s largest holding is Nvidia Corporation (NVDA) accounting for more than 10% of assets. This concentration has increased significantly on account of NVDA’s massive run over the past two years.

Within the top ten holdings are privately funded companies including Project Debussy (3.88%), Project Picasso (3.11%), and Project Kafka (2.27%). These private investments are opaque, but investors can find more information through our most recent coverage of BSTZ.

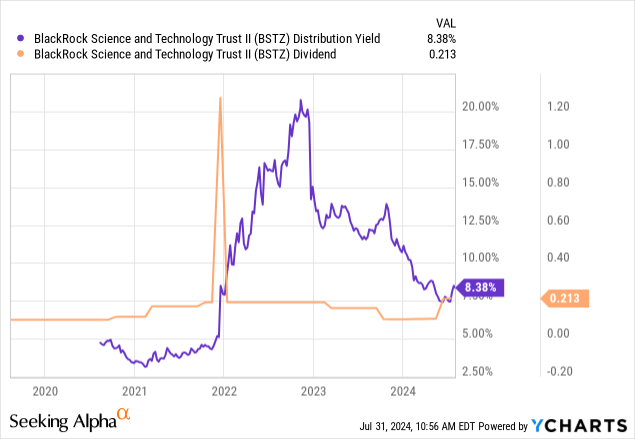

Over the past several years, BSTZ has undergone several critical updates. First, the dividend policy was changed in October 2023 from a flat monthly payment to a floating distribution based on net asset value. The distribution policy was updated subsequently this year, doubling the payment relative to net asset value. As it stands today, BSTZ pays a monthly dividend that corresponds to the average of the fund’s trailing twelve months net asset value. This means that at any time, the fund’s yield is 12%, increasing or decreasing based on the performance of NAV.

The distribution policy means BSTZ’s yield will always be around 12% of NAV, with limited fluctuations based on near term changes in share price.

These changes to the fund come amidst activist pressure from Saba Capital, an activist investor of closed end funds who is looking to takeover BSTZ. While management remains in the hands of BlackRock (BLK) for the time being, the pressure forced some changes at the fund level, including upping the distribution.

Option #3 – Oxford Lane Capital Corporation – 19.4% yield

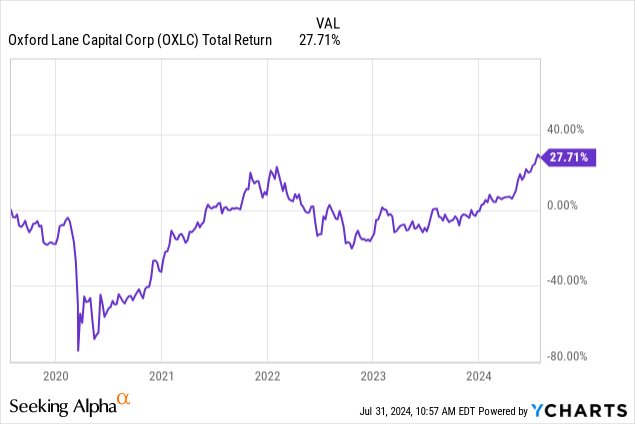

Oxford Lane Capital Corporation (OXLC) is a closed end fund operating in a complex corner of the fixed income universe. Securitized credit is often overlooked by retail investors due to complexity and lack of available investments. Time has reshaped the landscape and there are more publicly available investments than ever. One such opportunity is OXLC.

OXLC is like Eagle Point Credit Company (ECC) as one of few publicly traded companies operating in collateralized loan obligations or CLOs.

Collateralized loan obligations or CLOs are a trillion dollar asset within the broader credit segment. CLOs are actively managed, bundled portfolios of below-investment grade secured loans. The borrowers are typically middle market companies who do not have the creditworthiness to borrow from a bank. To spread risk, these loans are assembled into a risk-managed portfolio. These companies are too small to access traditional capital markets via investment banks.

This portfolio is separated into a vertical structure of cash flows. These “tranches” are prioritized by claim to the cash flow generated by the interest income. Each tranche receives income only after the previous tranche is paid in full.

OXLC focuses on the highest yielding equity tranche which acts as a general cash flow pool to buffer the lower rated debt tranches. Bear in mind, the equity tranche will almost certainly decline over time as loans within the CLO deteriorate. However, the reward more than compensates shareholders for the risk.

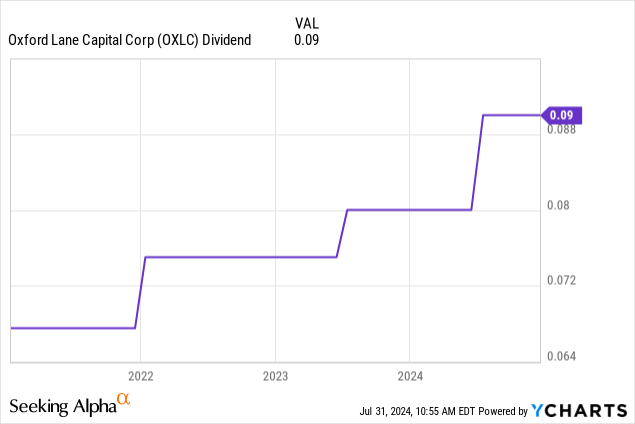

OXLC has continuously disproven naysayers and continued to distribute generous monthly income. Following a recent increase to the fund’s distribution, common shares of OXLC now yield nearly 20%. This makes OXLC one of the highest yielding investments on my radar.

Investor Takeaways

These three investments all meet the criteria of being dividend paying funds that earn more than 1% per month in recurring income. Each presents an opportunity to create an income snowball through reinvested dividends. However, more importantly, with yields above 12%, these investments offer enough income to beat those with more growth potential.

It would take a REIT like EPRT or O decades to reach a double digit yield on cost. Given EPRT is relatively young, shares of the company have never reached a 12% yield on cost. For shareholders of O, the most recent trade with a 12% yield on cost occurred shortly after the Great Financial Crisis.

However, most important is the lack of correlation between these investments. Each fund invests in a completely different sector with a different strategy implemented by a different management team.

PDI is a fixed income fund, investing in a diversified portfolio of bonds and securitized investments. The complex portfolio is a highly leveraged buy managed by one of the top asset managers in the world. BSTZ is a different fund entirely, investing in publicly traded technology companies and venture funded private investments. The fund is unlevered, but a large portion of the portfolio is illiquid. OXLC is once again unique, investing in the equity position of CLOs.

Each company is worth owning and brings a unique area of investing and expertise to the table. Meanwhile, each company also earns more than 1% per month in income, offering an opportunity to add meaningful yield to a portfolio. Don’t sleep on the opportunity to create a massive income snowball, but choose investments which create enough income to compound appropriately.