Jonathan Kitchen

Dear readers/followers,

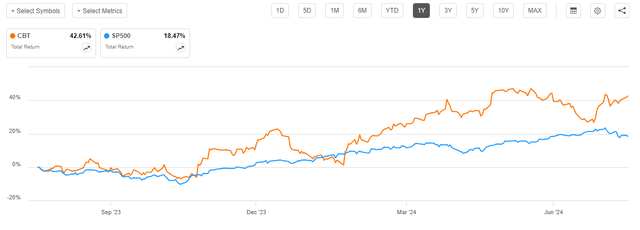

My coverage of Cabot Corporation (NYSE:CBT) has been extensive, and I’ve been a long-time proponent of investment therein. My January 19 article from 2023 is my last coverage, and since then, the company has seen significant positive performance, as it’s up over above index inclusive of dividends. That means that the company has outperformed.

Seeking Alpha CBT RoR (Seeking Alpha CBT RoR)

Together with the positive returns from my previous articles on this business, I would say that Cabot has been a good overall investment with good performance, and this is part of why my overall portfolio has seen significant outperformance compared to most indexes.

In my last article, I clarified why the company was a “Buy” for 2023. This was because of a good performance despite headwinds in the previous year, and expecting a similar level of performance for the coming year, because the company has shown remarkable resilience towards macro when considering the type of company that it is.

My last article on this particular company can be found here.

For this article, we’ll look at the latest published results, the latest forecasts, and see if the company can still be considered anything of a positive “Buy” when the valuation is up 44%+ in about 1.5 years.

As a reminder, I’m using a PT of $115 for the long-term and a short-term PT of around $80/share.

Cabot Corporation – What upside remains after outperformance

Cabot has been through a large number of changes for the past few years. The number of “specialty chemical” businesses out there that can be invested in is too numerous to name here. This one has a 140+ year history with a market cap of over $5B, with 4,300 employees managing 37 locations. The dividend has a 50-year history, but not a history of 50 years of raising the dividend. It’s not a dividend king, but a storied dividend business.

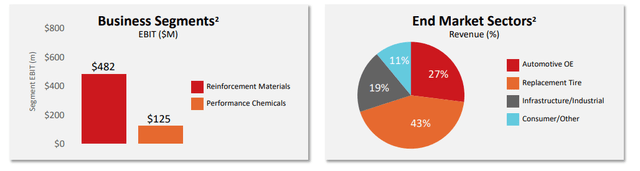

Because of its sales and business mix, it’s fair to call Cabot very exposed to the automotive and general LVP/HVP industries. Because these industries are cyclical, it’s also to be expected that Cabot itself is cyclical. However, Cabot has managed well even in the context of a cyclical industry, with growth in EPS, growth in EBIT, EBITDA, and better ROIC. In short, the company is doing well and has outperformed at a 5-9% CAGR for these KPIs since 2017 and including the FY23 results.

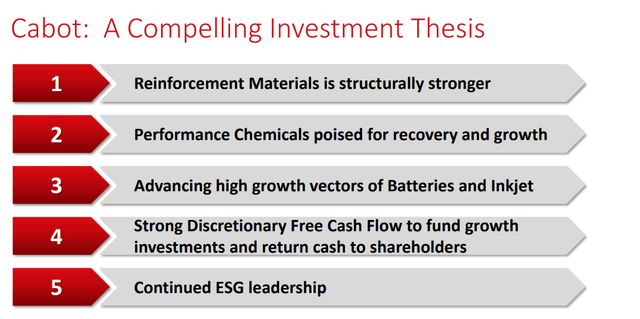

I invest in Cabot because the company is well-managed, with a very good global footprint, has already invested plenty in the “ESG race”, and has exposure to high-growth, high-potential markets (mobility, digital conversion of printing, and lithium-ion). I don’t like investing directly in some of these fields, but Cabot is an ancillary and “close” enough investment to these fields where I am comfortable. When it comes to specialty chemical businesses, I’m not looking to step too far into the “left field” out of my comfort zone.

A word or two on safety as well. The company is rated safe or very safe by Seeking Alpha’s own metrics, scoring B, B+, and A in Safety, growth, and consistency of the dividend. The yield is on the low side, as I have been very clear on before, but it comes at a sub-25% payout ratio, which means the company has ample room to move. If you follow SA’s quant ratings, these also rate the company as a “Strong buy” here, which means I’m looking to also put this into context with my own ratings, because after all the company is up significantly.

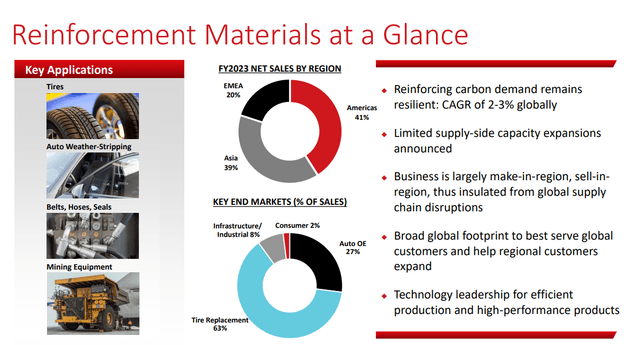

You can summarize Cabot’s operations in mainly a few segments – tires, industrial rubber products, specialty carbons, fumed metals oxides, battery materials, aerogels (the stuff in coatings, insulation, and the like), compounds, and colorants/inks. But as you saw above in the mix, some of these segments – specifically rubber – are far larger than the other.

But like many of the companies I invest in, Cabot is positioned for significant growth in the next decade and more. This has to do with macro trends like mobility shifts, LVP changes, sensor improvements, an increased focus on Sustainability, and the digitization of many things that were previously not digitized.

The appeal of this company specifically is that it does this while having a very resilient fundament and base in legacy, meaning industrial rubber. So even if the shift takes more time, unlike Evonik (OTCPK:EVKIY), this company has more of a grounding in more traditional segments. I consider this to be an advantage.

The company’s low dividend naturally means that I also expect more growth out of the business. It’s only logical – more dividends, less money for growth – less dividends, more money for growth. And while the dividend has been growing at 7% CAGR since -15, the company has also added to this with opportunistic share repurchases. The company’s conservative capital allocation strategies are also fully reflected in a lower-than-average for the sector. It’s now at 1.7x to adjusted EBITDA, with a cash balance of over $200M versus a gross debt of just south of $1.1B, with less than $100M of maturities in 2024, and none beyond that until 2026. This is reflected, despite a size of only about $5B in market cap, in a full investment-grade credit rating.

We have 2Q24 reported at this time, and the results are “worth seeing”. EPS was up to almost $1.8 on an adjusted basis, with both segments performing at double-digit rates of growth over the previous year. Cash flow was over $170M on the operational side, and the company bumped the dividend by 8% – a very fair increase. Also remember, that because I bought the company cheaply, my yield for Cabot is above 2% here.

The company’s 2Q24 results were so good that the company increased guidance, up to a 25% growth at the midpoint year-over-year, with a continued strong outlook, and the company’s various segments seeing signs of improvement.

To not just “parrot” the management points here, I can say that there is proof for these trend improvements over the past 5 years and that the company’s transformation is working. This is due to both margin and earnings increase – and not small ones. The company has managed to average 10%+ adjusted EPS growth since 2017, but due to the volatility in its valuation, has not been “rewarded” for those trends unless you knew where to invest and at what value. I’ve always kept well below the 12-13x P/E line – such as when I started writing on the company and invested nearly at single digits. There were several times, in fact, that you could do that. Doing so if you look at the company’s valuation today, you’d have always “gotten away” with a lot of positives.

Let’s say for instance that you, like me, got your eyes opened for CBT during COVID-19 and the crash we saw – that would have resulted, in investing at sub-7x P/E, in annualized RoR of 44% or TSR of almost 400% since then. (Source: paywalled F.A.S.T graphs link).

It’s an argument for why valuation investing, in the end, and with all the patience, does, in fact, work.

Let’s look at valuation.

Valuation for Cabot Corporation

The valuation for Cabot is unfortunately more tricky than you might believe. This has to do with, as usual, valuation for the company. Cabot typically trades between a 12-14x P/E, not 15x. It’s currently trading at 15.05x, which means that the company is trading at a slight premium.

We also need to take into account that Cabot is expected to grow here. But even with the 25-26% EPS growth this year, which I expect to materialize, and the 10-11% the years after, which I again expect to materialize, the company does not produce a 15% annualized RoR with the yield at a 2026E basis – that’s on a 12.5x P/E basis by the way. But you can also raise that to around 14, in fact, even 15x, and you’d still not get 15% annualized. At most, you’d get something like 13% annualized under these estimates.

This also fails to take into account the risk of volatility and downturns for the stock. Because the risk of this is non-trivial, I argue that you should not forecast this company above 13.5x, which comes, once again, to $112-115/share.

So as you can see, my long-term thesis and PT for the company are still intact. I’m not changing it. It’s beaten my short-term PT, so I’m removing that. But I always expected the company to beat my short-term PT, and I also expected it to reach my long-term PT, which is still annualized above 10%. So I’m willing to ride this one out unless it bounces up to over $110/share again. I missed selling a few months back. If the stock does a repeat performance in May 2024, I’ll reconsider deploying that capital elsewhere.

But for now?

This company may be a good “Hold”, but I can no longer consider it a “Buy”, because it doesn’t fulfill my basic targets anymore. 10-11% isn’t good enough for “fresh” capital.

I say “Hold”.

Here is a clarification of the company risks.

Risks for the Thesis

The main risk to a company like this is earnings volatility due to macro volatility and end-market volatility. Given the company’s low leverage and the maturity of its operations, I don’t see many risks of the fundamental sort for the business. Its operations are largely technology-agnostic. Tires, for instance, are needed regardless of how your vehicle is powered. The company’s focus works towards interchangeability, regardless of how the development goes, as long as it goes in a digital direction. I believe this is what will largely happen.

Beyond that, risks are valuation-based. As I said before, I take a different stance to the quant view here – I’m actually changing my thesis and rating on the company. While there is an upside that could result in a “Buy” here, I believe 10-12% annualized not to be enough when there are better options available. For that relatively simple reason, I’m at a “Hold” here, and I’m downgrading Cabot Corporation.

Thesis for Cabot Corporation

- This is an excellent play on necessary commodity chemicals at the right valuation. Cabot is a world market leader in key raw materials and technologies that are required by the modern world. The recent annual results have confirmed the upside in battery materials, and I believe this will grow going forward – but it can only be bought if the upside is appealing enough.

- This is no longer the case, and I am changing my rating to “Hold”, due to viewing the company with an upside to a target of 13-14X 2024E P/E, a long-term PT in the triple digits close to $115. This only results in a moderate upside, and not enough for me.

- Cabot is therefore a “Hold”.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

The company is no longer cheap, and I don’t see the upside as good enough – it’s now a “Hold” because of this.