tupungato/iStock via Getty Images

By Min Joo Kang

Industrial production missed market consensus, but strong semiconductor activity provides positive outlook for manufacturing

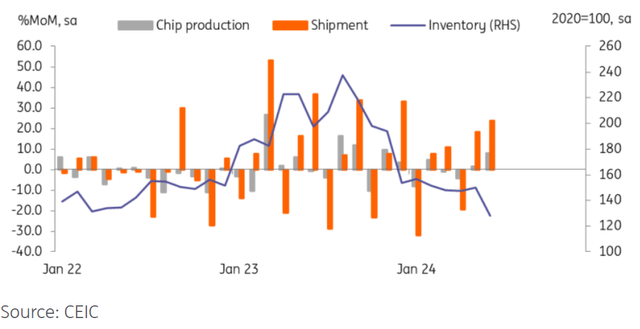

Industrial production rose a weaker-than-expected 0.5% MoM sa in June (vs revised -0.6%, 0.8% market consensus), but semiconductor-related data was outstanding. Semiconductor output rose 8.1% while its shipments were up an even stronger 23.7%.

Robust global demand for memory chips is expected to continue while inventories remain tight, so we see the production cycle of semiconductors remaining positive for some time. Meanwhile, car production fell for a second month while inventories continued to rise, pointing to a moderation in car production in the short term. We have seen strong growth in hybrid models, but export growth in combustion engine models has recently slowed. This is likely to be due to weaker demand from the US and other developed markets.

Shipments overall rebounded 2.3%, mostly due to strong outbound shipments. Domestic shipments declined for a second month, and we see this as a signal for weaker near-term domestic demand.

Semiconductors will lead overall growth

Service sector output rose 0.2% MoM sa in June but with discouraging details

Real estate activity rose 2.4% while services related to leisure, sports, and recreation dropped -5.0%. The recent rebound in house prices is leading the recovery in real estate services. We don’t see this as a good sign, as both the government and the Bank of Korea have warned about a rapid rebound in house prices, which could complicate policy decisions.

Sales of cars and parts services dropped -2.8%, although car sales within the retail sales total rose quite sharply (6.9%). Car sales only measure new car sales, so used car sales must have contracted quite sharply. Thus, we believe total car sales should be weaker than the retail car sales figures show.

Retail sales rose 1.0% sa in June after two months’ decline. Durable goods sales rose solidly (5.2%) on the back of strong car sales (6.9%) as new model launches have boosted car sales over recent months.

Investment is a mixed bag

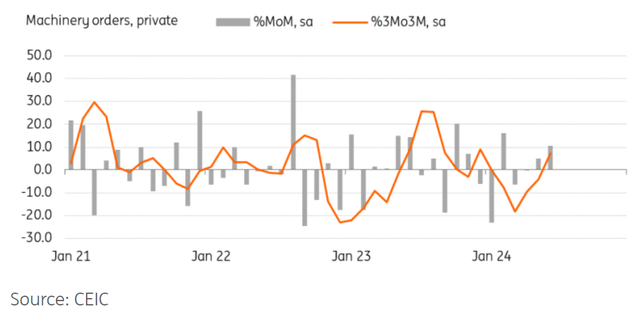

Equipment investment rose 4.3% MoM sa in June. Transportation equipment dropped -2.8%, but was more than offset by strong growth in special machinery (6.5%) including semiconductor manufacturing equipment. Facility investment was weak in 2Q24 GDP, but we think chip makers’ investment will resume in 2H24. Transportation investment was still weak in June, but this was likely related to a delay in importing aircraft, and we think this will pick up in 2H24. More importantly, machinery orders for the private sector continued to rise on a three-month comparison, and we believe facility investment will recover from 3Q24.

Construction contracted for a second month. Construction orders rose but mainly for engineering projects and warehouses, not residential construction, suggesting that sluggish construction will continue to drag on overall growth in 2H24.

Facility investment is expected to recover in 2H24

Content Disclaimer This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more