andresr

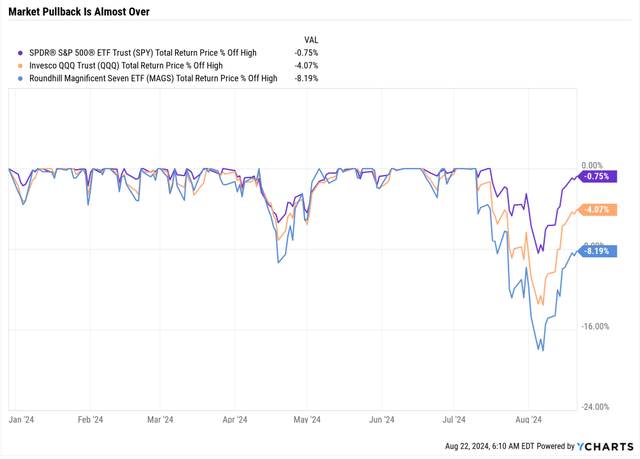

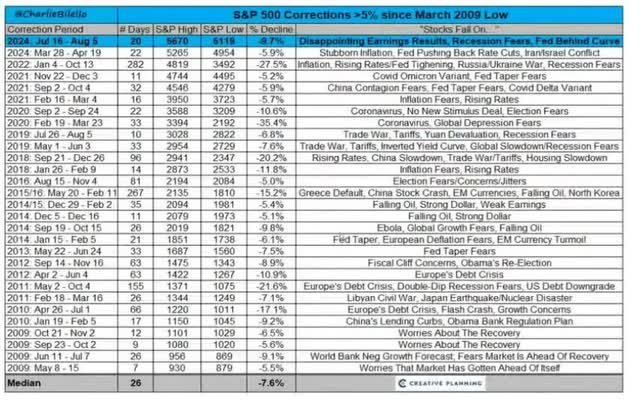

The market pullback appears to be ending.

The market is now less than 1% away from a record high. Good economic news (jobless claims) and Powell’s dovish speech at Jackson Hole on Friday could be enough to end this pullback.

Value investors eagerly waiting for a more substantial correction, like the 14% average intra-year peak declines since 1980, have been disappointed.

Some of the world’s best companies went on sale, but now they’re returning to record highs, and bargain hunters once more are starting to feel left out.

This is why companies trading at 52-week lows can seem so alluring.

However, such lists are often minefields fraught with peril.

Be Careful of Avoiding Value Traps

It’s always and forever a market of stocks, not a stock market.

That means that, even at record highs, there are always wonderful blue-chip bargains to buy.

It also means that plenty of value traps are waiting to trip up investors who try to be like Buffett and “greedy when others are fearful.”

It’s better to buy a wonderful company at a fair price than a fair company at a wonderful price.” – Warren Buffet

Value opportunities are wonderful companies trading at wonderful prices, and value traps are companies that are cheap for a reason.

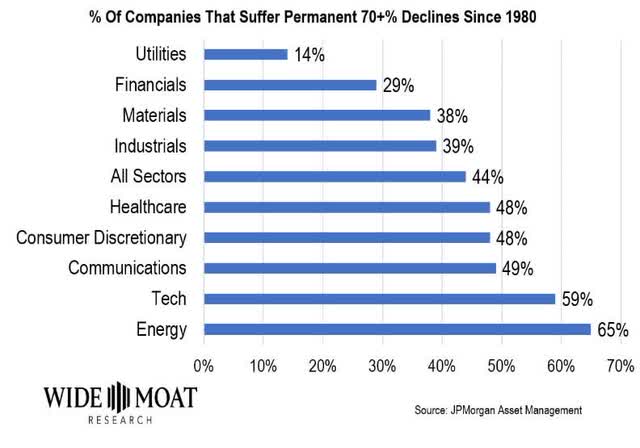

44% of US stocks since 1980 fell 70% or more and never recovered.

But even if you can avoid such landmines, that doesn’t mean that 56% of US stocks are good investments.

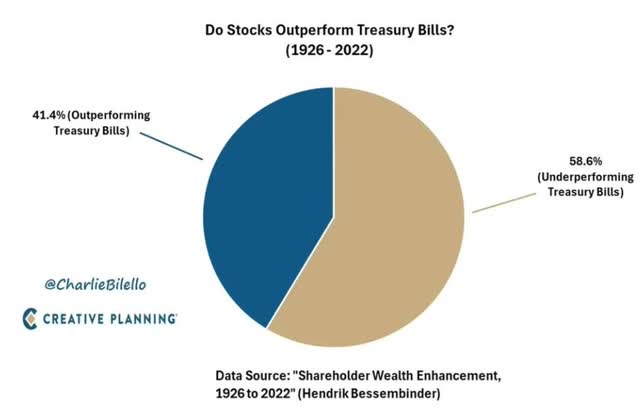

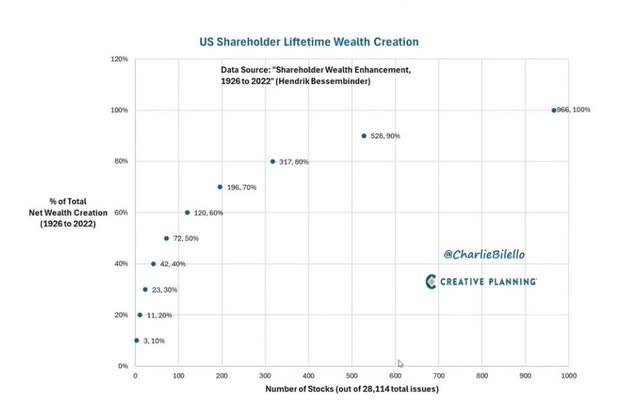

44% of stocks are outright disasters. Since 1926, almost 60% of stocks have underperformed risk-free cash.

Less than 1,000 companies out of 28,000 delivered 100% of the net wealth created for almost 100 years of stock market history.

This shows why stock picking is hard.

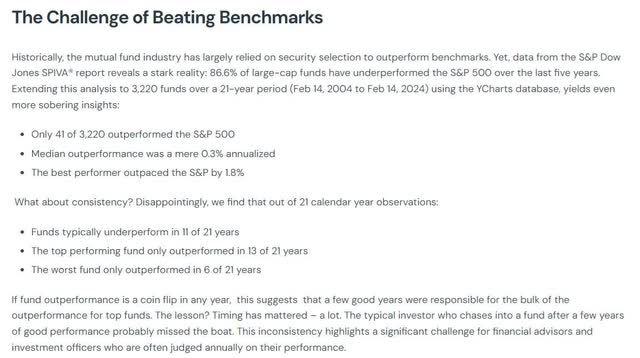

Just 41 out of more than 3,200 mutual funds outperformed the S&P over the last 21 years. And the median outperformance was 0.3% per year, and the best was just 1.8% per year.

Fundamentals Are The Difference Between Value Traps And Hidden Gem Blue Chip Bargains

Can you achieve Buffett-like returns from blue-chip bargains hiding in plain sight?

Yes, but it takes stock picking, which always comes with individual company risk.

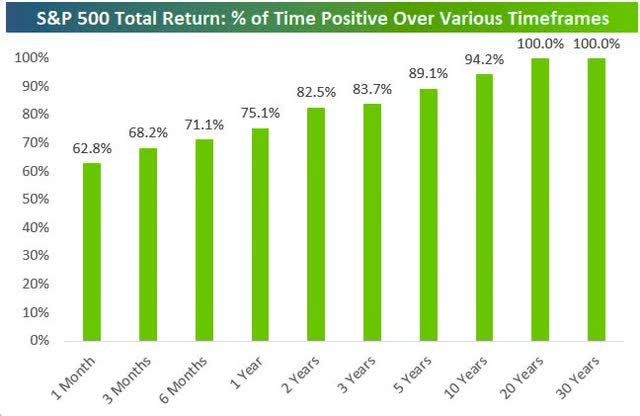

If you own a diversified portfolio, like the S&P 500, you don’t have to worry whether your portfolio will recover. Barring an apocalypse, it eventually will.

When the facts change, I change my mind. What do you do sir?” – John Maynard Keynes

The secret of my success is not some manner of stock market sorcery but a dedication to financial science. A relentless focus on safety and quality first, and prudent valuation and sound risk management always.

So, let me share with you three companies trading at 52-week lows. I’ll show you why two are potentially wonderful bargains potentially set to soar, and one is facing collapsing fundamentals that make it best to avoid.

Albemarle (ALB): The Facts Keep Changing… For The Worse, For This Dividend Aristocrat

Albemarle is the world’s largest (and lowest cost) lithium producer.

While lithium prices are highly cyclical, the company has a 30-year dividend growth streak thanks to a conservative corporate culture and dedication to maintaining a strong and low-risk balance sheet.

Then the Pandemic hit.

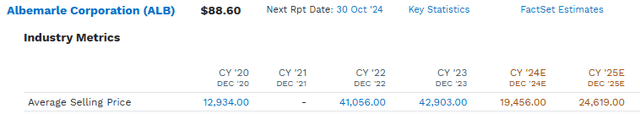

During the COVID-19 pandemic, lithium prices experienced significant fluctuations. In December 2021, the price of battery-grade lithium carbonate in China reached approximately $41,925 per tonne, marking a substantial increase of 485.8% year-over-year.

The highest lithium prices ever occurred in November 2022, when lithium carbonate prices peaked at approximately $81,000 per ton.

Around the world, governments (such as the EU and the US) were planning to have 100% EV vehicle fleets as early as 2035.

The demand for lithium was expected to grow exponentially.

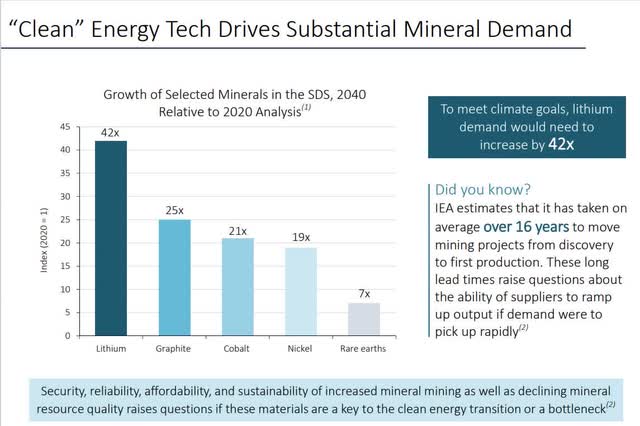

Analysts expected a 42X increase in demand by 2040 if the world adhered to the Paris climate change agreement.

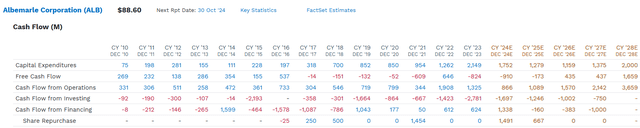

ALB responded by significantly increasing growth spending, from $200 million in 2011 to almost $2.2 billion in 2023.

As of August 2024, the price of lithium carbonate in the United States is approximately $14,800 per metric ton, down 82% from record highs.

ALB’s free cash flow hit a record $646 million in 2022, but then collapsed to -$824 million in 2023 and -$910 million consensus for 2024.

The company plans to cut capex by 50% by 2025, which should stabilize free cash flow. By 2026, free cash flow is expected to return to $435 million, compared to $190 million in annual dividends.

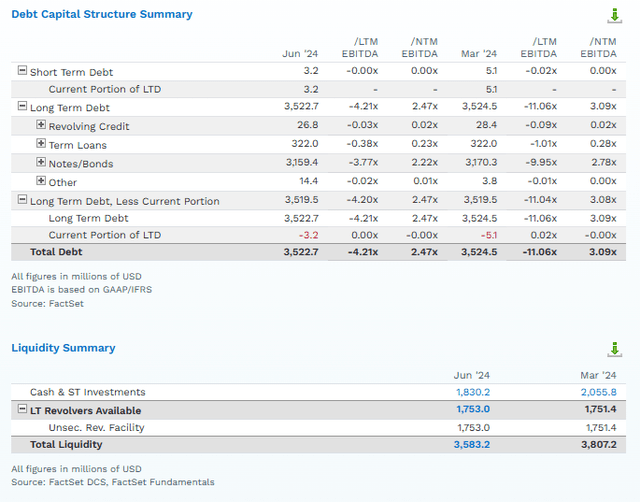

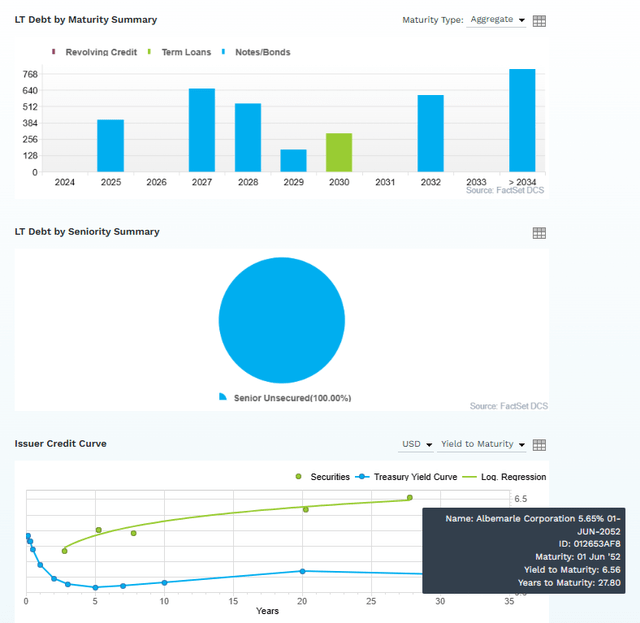

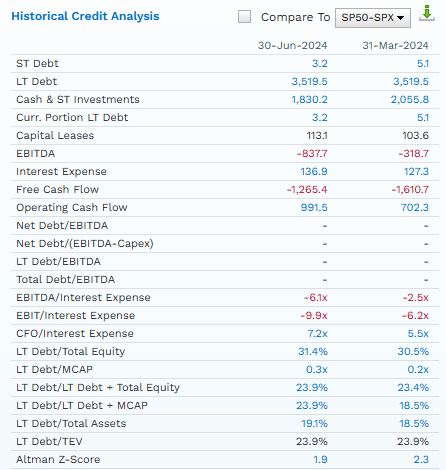

The balance sheet has taken a major shock, with debt/EBITDA -4.21 vs. three or less safe for investment-grade companies in this sector.

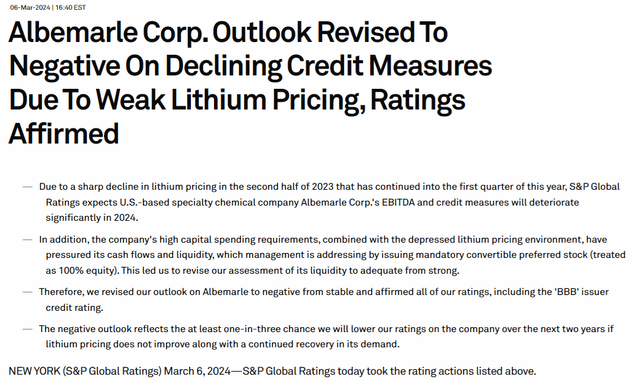

S&P downgraded the outlook on ALB to negative, indicating a 33% chance of a downgrade to BBB- within two years.

These unfavorable supply/demand dynamics add to the uncertainty around the timing of lithium pricing and demand recovery, which has depressed Albemarle’s 2024 credit metrics. We expect lithium prices will gradually improve in the second half of 2024 but remain only slightly above their current trough-like levels. If LCE pricing begins to trend upward, in line with our expectations, we believe the company’s metrics would remain appropriate for the current rating on a weighted-average basis…

The company will continue to focus on its cash flows and liquidity amid the depressed lithium pricing environment.” S&P

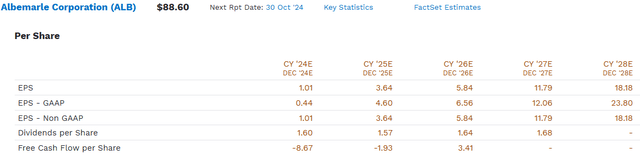

FactSet

ALB’s cash flows have gotten considerably worse in the last three months, though its cost cuts have reduced negative free cash flow from an alarming—$1.6 billion annually to—$1.3 billion.

The dividend was just raised by 1% to keep the streak alive and preserve the dividend aristocrat status.

At $190 million per year, vs. $3.5 billion in total debt, ALB is choosing to borrow to pay the dividend and will have to do this through 2026.

- By definition, any corporation with negative free cash flow paying dividends borrows to fund the dividend.

ALB doesn’t have significant debt maturing next year, not anything that it shouldn’t be able to refinance at reasonable interest rates.

Long-term bond investors remain confident and willing to buy bonds that mature in 2052 at rates consistent with BBB credit ratings.

So why on earth am I recommending not buying ALB right now? Or even potentially trimming and selling it?

Albemarle Is Dead Money For Several Years

It’s not a question of whether lithium prices will recover. Low commodity prices are the cure for low commodity prices.

Lithium at $14,000 per ton is losing much money for the world’s lowest-cost producer. That means that supply will collapse relatively quickly, and prices will rebound.

However, the average lithium price will be about $25K in 2025.

So, what does that mean for the earnings recovery?

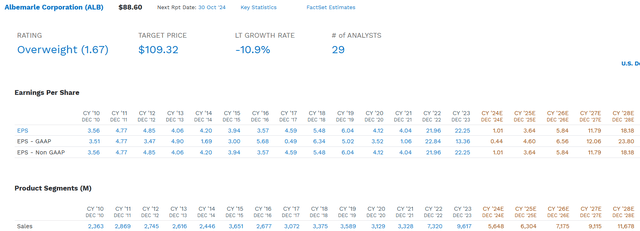

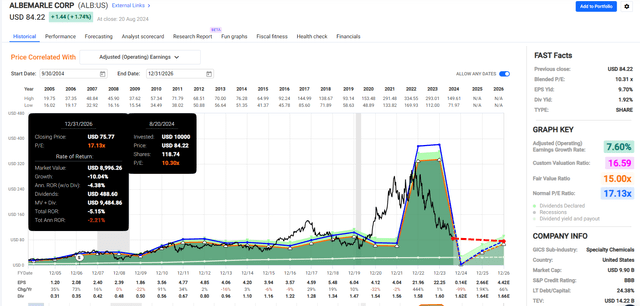

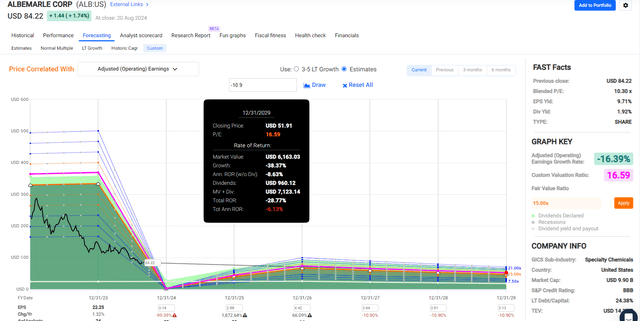

From a peak of $22.25 in earnings last year, a 95% decline in EPS to $1 is expected this year.

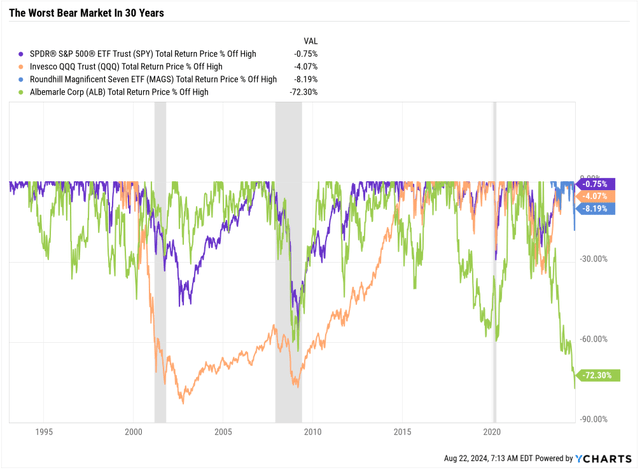

That level of fundamentals collapse explains why ALB is facing the worst bear market in its history.

It also means that even in 2028, with significant improvements in Lithium prices and drastically lower costs, EPS is expected to be around $18, well below the 2023 record.

So, what does that mean for investors buying now?

Negative Return Potential Through 2026

ALB’s fundamentals have collapsed so dramatically that it has negative total return potential, including dividends (the yield is still sub 2%).

Negative Return Potential Through 2029

While the dividend is not likely to be cut (some analysts expect a modest one) with such poor total return potential for the next six years, I can’t recommend ALB now.

Will the growth outlook improve? Yes, likely. But for now, ALB is a speculative, above-average-quality company that is overvalued and a potential trim/sell.

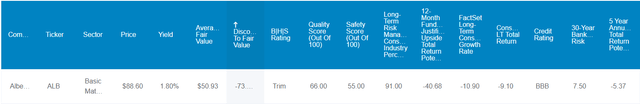

Dividend Kings Zen Research Terminal

ALB’s Dividend Kings safety and quality score has been downgraded to 55% safety, meaning a 2% risk of a cut right now, about 4% risk in a recession, and up to 8% in a severe recession.

My dividend safety scores are calibrated based on historical dividend cuts in every recession since WWII.

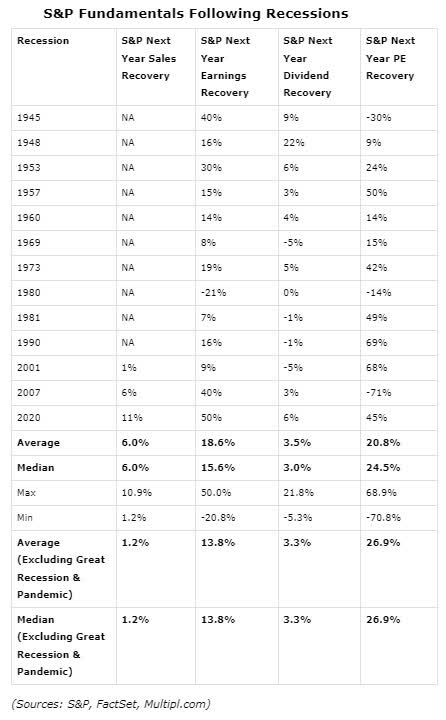

Multipl

That’s not exceptionally high. It’s average for S&P dividend cut risk since WWII. But it’s critical not to ignore prolonged weakness in fundamentals.

ALB appears to be a dividend aristocrat value trap to avoid.

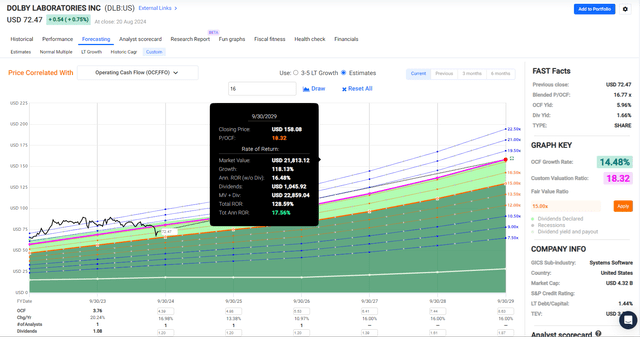

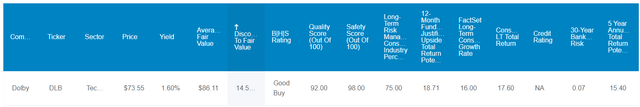

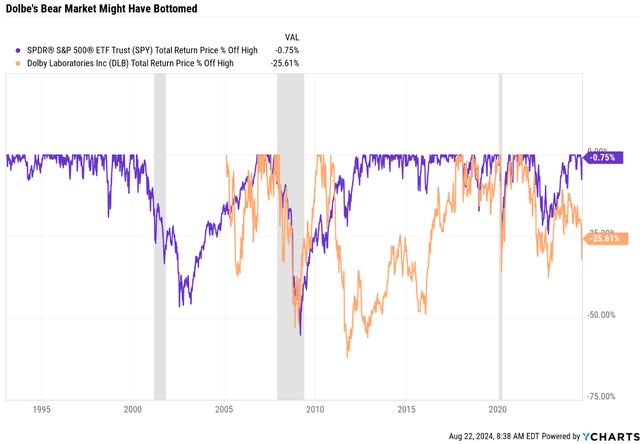

Dolby Laboratories (DLB): A Great Company Whose Valuations Have Returned To Historical Levels

Dividend Kings Zen Research Terminal YCharts

Dolby Laboratories is a renowned company specializing in audio and visual technologies. It’s known for innovations such as Dolby Atmos and Dolby Vision, widely used in various industries, including cinema, home entertainment, and automotive. The company also licenses its technologies and patents, which contributes significantly to its revenue streams.

Dolby has reported a predicted decrease in full-year revenue by 1% to 2%, primarily due to slow global device sales. This slowdown affects the demand for Dolby’s technologies, which are integrated into various consumer electronics.

While Dolby reported a 31% beat on earnings per share expectations, its revenue projections have been slightly revised downward. Analysts now expect slower revenue growth than previous forecasts, indicating a more conservative outlook on the company’s short-term performance.

So, if revenue is flat, and DLB beats expectations by 31%, why is it in a bear market?

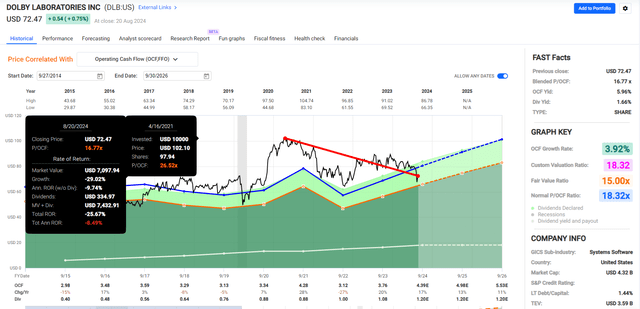

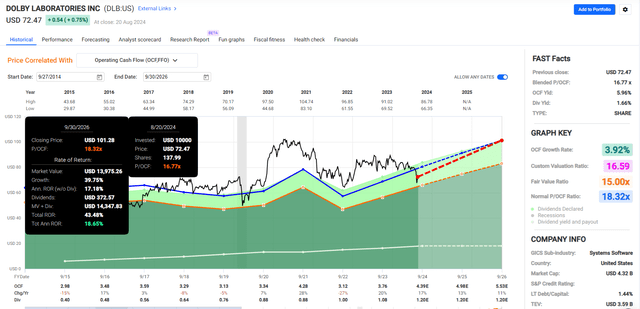

DLB’s historical market-determined fair value is 18X operating cash flow.

It was trading at 27X at the peak in April 2021, when many Pandemic stocks peaked (ARKK peaked in February 2021).

DLB’s fundamentals have remained unchanged. The consensus long-term EPS growth estimate is 16%, and the balance sheet remains strong.

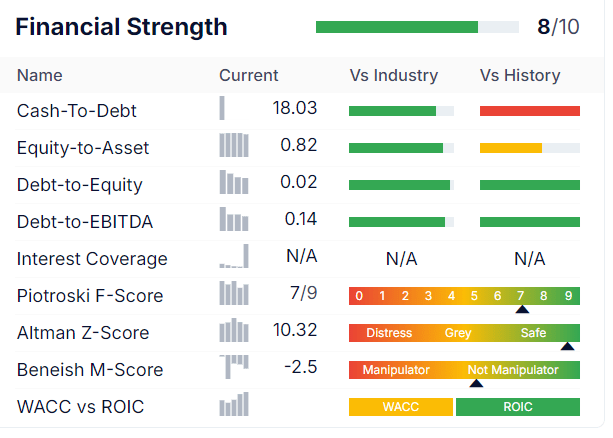

How strong?

GuruFocus

DLB has almost no debt but $906 million in cash.

Altman Z-score, an advanced accounting metric that predicts bankruptcy risk, is over 10, and 3+ is considered very safe.

2026 Consensus Total Return Potential: 44% = 19% annually vs 35% (13%) S&P

2029 Consensus Total Return Potential: 129% = 18% annually vs 85% (13%) S&P

DLB offers attractive short-, medium-, and long-term return potential of 17% to 18% or better, thanks to a modest discount to fair value.

If you’re a dividend growth investor looking for a solid bargain right now, bouncing off 52-week lows, DLB is a potential blue-chip bargain set to soar.

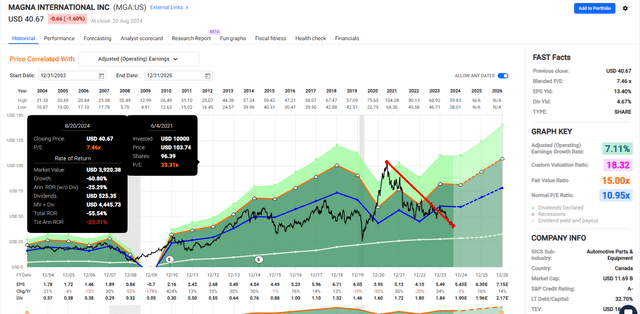

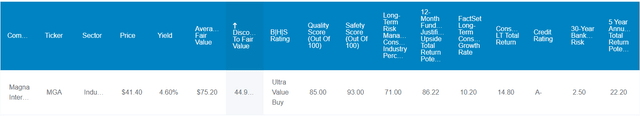

Magna International (MGA): A 4.6% Yielding Beneficiary from Falling Interest Rates

Dividend Kings Zen Research Terminal YCharts

Magna International is a Canadian company founded in 1957 by Frank Stronach. It started as a small tool-and-die shop called Multimatic Investments Ltd. in Toronto.

Over the years, Magna has become one of the largest automotive parts manufacturers in North America and globally. The company provides various products and services, including automotive systems, assemblies, modules, components, and full-vehicle assembly. Magna supplies major automakers such as General Motors, Ford, Stellantis, BMW, Mercedes, Volkswagen, Toyota, Tesla, and Tata Motors.

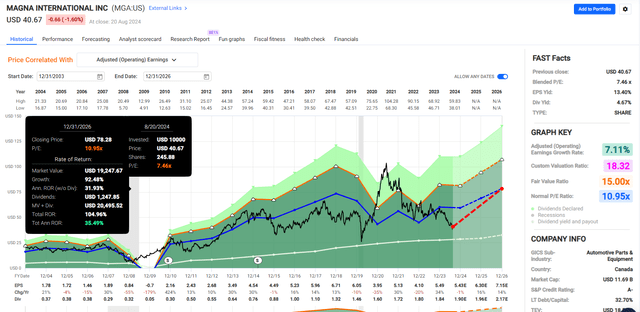

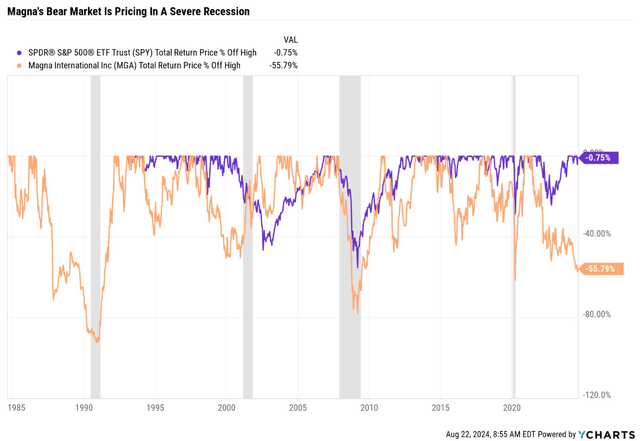

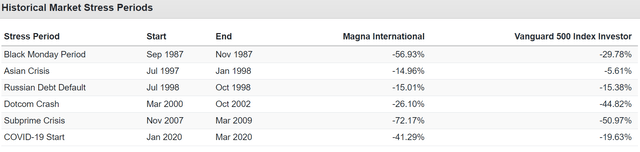

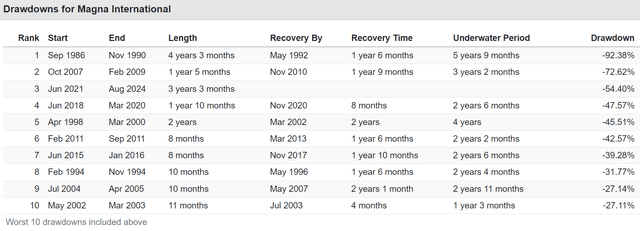

Magna has fallen more than 56%, the most severe bear market since the Pandemic flash crash.

Magna can sometimes be extremely volatile, as you can see in most corrections since 1985.

Portfolio Visualizer Portfolio Visualizer

Like Amazon.com (AMZN), MGA has fallen 92% and spent many years underwater.

This 3.25-year bear market is longer than average, but not unheard of.

MGA flew into an epic bubble, becoming 120% historically overvalued in June 2021.

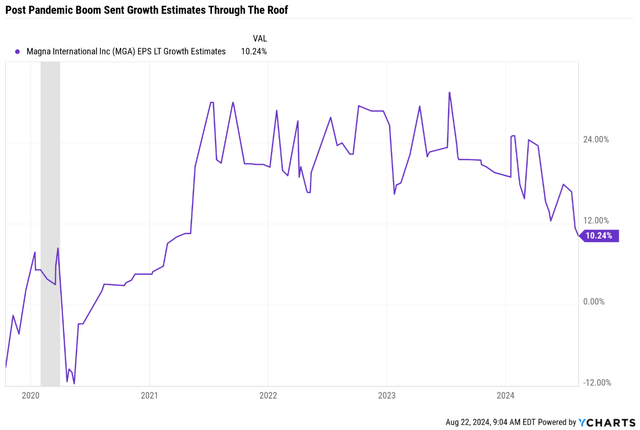

MGA’s growth outlook recovered from the Pandemic crash and hit a record high of almost 30% in June 2021. That year, Tesla was up 10X, and MGA was promoting its plans to become a major OEM supplier for electric cars.

That’s true. MGA is a lower-risk EV play, but its historical growth rate over 20 years has been 7% to 8%.

Delivering sustainable 30% EPS growth in the long term was highly speculative for a cyclical company like this.

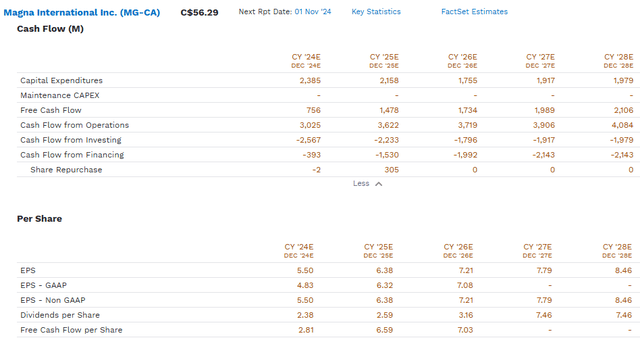

Magna has lowered its full-year 2024 sales outlook, citing issues such as the halted production of the Fisker Ocean vehicle, program delays, and changes in product mix. These factors are expected to impact sales by approximately $400 million.

In the first quarter of 2024, Magna reported a negative free cash flow of $270 million as the company invested heavily in developing advanced technologies. While these investments may create future opportunities, they’re straining near-term cash flows and financials.

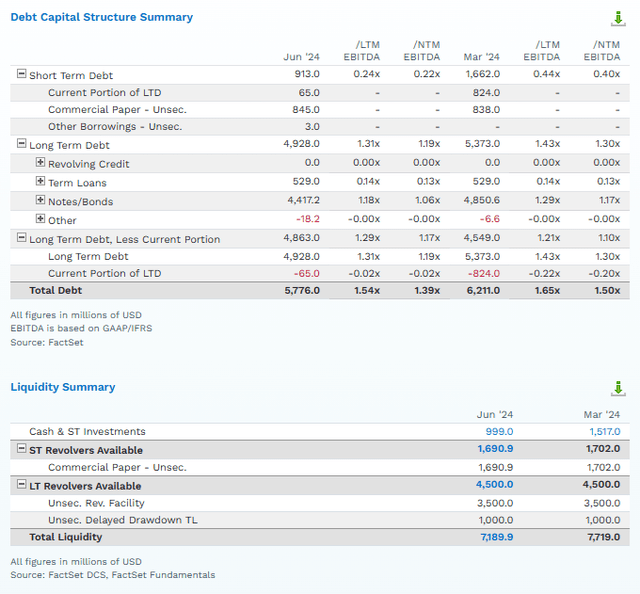

However, the balance sheet is solid, with a stable A-credit rating.

Leverage is falling, and the company has $1 billion in cash or $7.2 billion in liquidity. Free cash flow is expected to recover dramatically next year and keep growing.

The dividend, yielding almost 5%, is expected to grow steadily over time, and the payout ratio is under 50% right now.

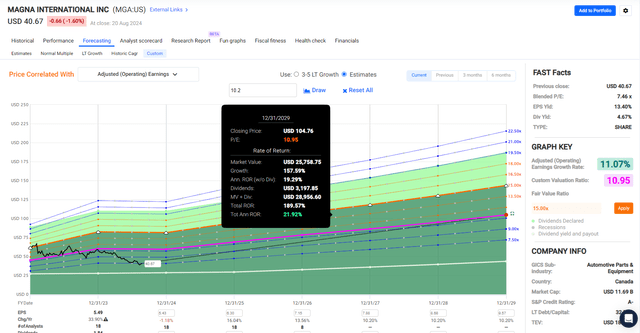

2026 Total Return Potential: 105% = 35% annually (S&P 35%, 13%)

2029 Total Return Potential: 190% = 22% annually (S&P 85%, 13%)

MGA’s balance sheet is strong, its dividends remain very low risk, and its risk management is in the top 28% of global companies.

I can’t tell you whether the bear market has bottomed, but I can tell you that there appears to be no collapse in fundamentals to justify this 55% decline.

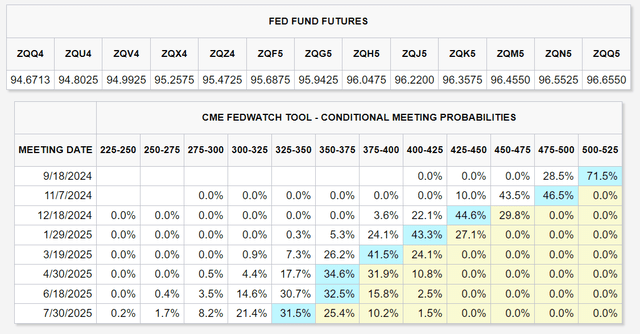

As the Fed cuts interest rates and auto loan rates fall, that should serve as a significant tailwind for OEMs and, thus, MGA with a modest lag.

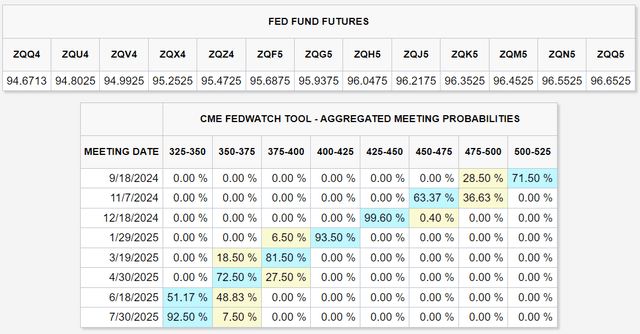

The bond market is now pricing 2% of cuts by July 2025.

I believe this to be an overreaction, However, if true, it could catalyze MGA to soar.

- 86% upside potential justified by fundamentals within 12 months.

- NOT a forecast.

- However, if MGA grows as expected and returns to 11X historical earnings, it could almost double in the next year, which would be 100% justified by fundamentals.

Bottom Line: Blue-Chip Bargains Are Always On Sale… But You Have To Avoid Value Traps

To paraphrase Thomas Jefferson, “The price of financial liberty is eternal vigilance.”

If you want to own individual companies rather than just index funds, you must accept that uncertainty is the only certainty on Wall Street.

Consider the case of GE.

In 2000, it was:

- The most valuable company on earth.

- AAA-credit rating.

- A dividend aristocrat.

- Hadn’t missed earnings in 10 years.

- It was run by Fortune’s “CEO of the Century.”

Five dividend cuts later, what was once the quintessential “widows and orphans” blue chip was split up into three companies after a loss of two decades for investors.

Don’t get me wrong. I’m not saying that ALB will necessarily cut its dividend or that it won’t, at some point, recover and generate some solid returns.

The question is how long it will take for fundamentals to recover. Remember that the PE on ALB is historically 72% above the 20-year average.

While EPS will recover quickly at some point, the stock might not go anywhere for many years.

With superior alternatives available, including MGA and DLB, why take on the speculative risk of an ALB turnaround when blue-chip bargains are firing on all cylinders?